Justin Sullivan/Getty Images News

Nvidia’s (NASDAQ:NVDA) shares have plunged 43% over the last 6 months alone but the shareholders’ pain may be ending soon. Latest data released yesterday reveals that the chipmaker’s short interest dropped by 5.5% in the last reporting cycle. Its short interest has declined to insignificant levels, well below the industry average and median, thereby suggesting that the stock may be bottoming out. This should reassure Nvidia’s shareholders that their investment has limited downside, but ample upside potential from current levels. Let’s take a closer look to gain a better understand of it all.

Dismal Shorting Activity

For the uninitiated, short interest is basically the aggregate number of short positions that are open and are yet to be covered. A sharp rise in the metric indicates that market participants are actively shorting a given stock in the hopes of its value significantly declining in the near future. Conversely, a sharp decline in the metric indicates that traders are actively covering their short positions as, perhaps, they see limited downside potential from current levels. So, the short interest metric is essentially a handy tool to gauge the Street’s ever-evolving sentiment pertaining to any given stock.

Coming back to Nvidia, its short interest at the end of the last cycle amounted to 31.73 million. This figure may seem like a lot in isolation but it’s actually minuscule. The company has around 2.4 billion shares in public float which means that just about 1.3% of the chipmaker’s tradeable shares had been shorted at the end of the last cycle. Also, this short interest figure dropped 5.5% sequentially which points to rapid short covering even still. This suggests that market participants are really uncomfortable at holding even small amounts of short positions against the chipmaker.

As a reminder, the short interest data being referenced here is from the cycle spanning the first half of June. The data was publicly released only yesterday which means its fresh and relevant to our discussion here.

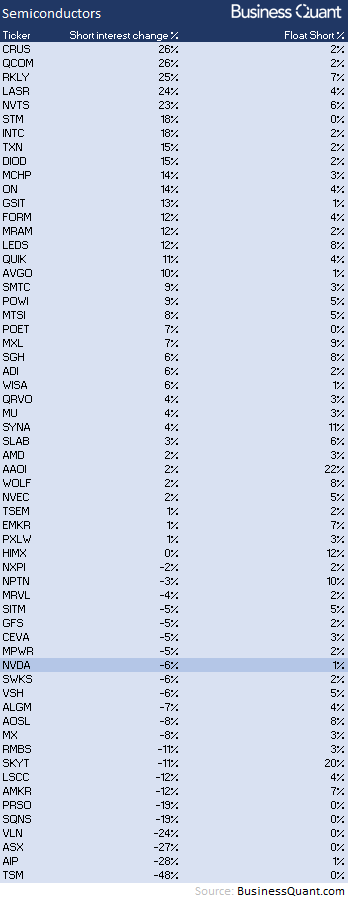

Having said that, I wanted to see if we can compare the shorting activity in Nvidia with other semiconductor stocks in general. After all, if the short interest levels and its overall declines in Nvidia are in-line with industry levels, then we can just call it an industry tailwind and move on. So, I pulled the short interest data for 60 other semiconductor stocks trading on US bourses to get a holistic view of the ground reality. The results turned out to be rather interesting.

As it turns out, Nvidia’s short interest as a percentage of its total float is much lower than a broad swath of its peers. Also, note in the table below how only 38% of the stocks saw short interest declines in the last cycle like Nvidia, whereas the remining 62% stocks experienced a short interest buildup. In fact, Nvidia’s two popular peers, Intel and AMD, saw their short interest figures rising by 18% and 2% respectively instead. This suggests that there isn’t any unanimous sector-wide tailwind at play here — market participants are comfortable shorting semiconductor stocks, just not Nvidia.

BusinessQuant.com

This begs the question – why are market participants uncomfortable when it comes to shorting Nvidia, even when fears of a full-flown recession are looming large?

Reasons for Caution

See, growth stocks are being pummeled due to recession and inflation-related concerns. Managements and analysts across the board have been slashing their financial forecasts for companies that are on the verge of business deterioration and/or don’t have the pricing power to pass the inflationary pressures to customers. But these criteria don’t necessarily apply to Nvidia.

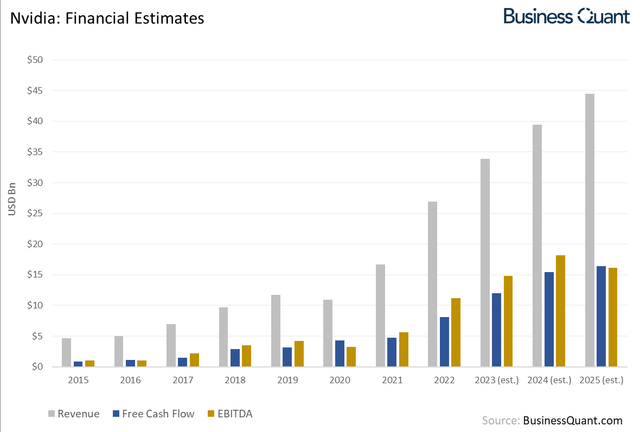

In fact, analysts have rather bullish expectations from the chipmaker and estimate its growth momentum to remain at elevated levels for the next few years at least, even during times of macroeconomic uncertainty. This prospect of continued growth makes Nvidia a risky stock to short in the first place and suggests that short-side market participants would be better off if they instead targeted businesses that are overvalued and on the verge of deterioration.

Secondly, note how Nvidia’s free cash flow is expected to continue growing over the coming years. This suggests that if the broader markets were to tank further, the chipmaker would have ample cash flow buffer to carry out strategic acquisitions at discounted prices. Depending on the situation then, these buyouts may variably strengthen Nvidia’s bull case by ensuring that the company maintains its growth momentum.

Third, Nvidia’s RTX 30-series GPUs launched about 20 months ago were pretty much a washout generation for mainstream gamers. Scalpers and crypto miners scooped every bit of supply, and GPU prices have remained well over MSRPs across the world. But Nvidia is just a few months away from releasing its highly anticipated RTX 40-series GPUs. The demand for crypto-mining GPUs may have cooled down but, this time, mainstream gamers will finally get a chance to upgrade their systems after several years. So, I anticipate mainstream GPU demand to more than offset the declining crypto GPU demand, which implies that Nvidia’s gaming business will continue to grow rapidly in 2023 at least.

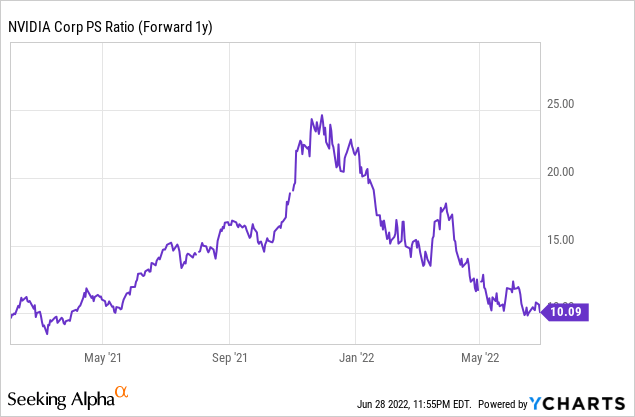

Lastly, Nvidia’s shares are down nearly 50% over the last 6 months and its shares are now trading at around 10-times their forward sales forecast. This forward Price-to-Sales multiple has dropped considerably from around 25-times merely a few months ago and is now hovering close to its 52-week lows. This means Nvidia’s shares may have little downside potential from current levels. These factors, in my opinion, are why market participants aren’t actively shorting Nvidia but are targeting other flailing businesses instead.

Final Thoughts

It’s important to note that short interest data is based on trades that have already taken place in the past, based on prior news flow and expectations. Also, fresh news flow and fundamentals-altering events can cause a reversal in shorting activity and induce changes in broader shorting trends. This data isn’t always a good leading indicator for future price action and should, at best, be used to confirm if the trade direction is in-line with the Street’s money flows.

Having said that, if there was anything fundamentally flawed with Nvidia’s growth prospects, its valuations were obscenely stretched and its price correction was certain, a broad swath of market participants would have initiated short positions in the name to profit off of this high-probability correction. But that evidently did not happen — market participants wound up their already minuscule short positions in Nvidia and shorted other semiconductor names instead.

This should reassure the chipmaker’s shareholders that their investment doesn’t have much downside potential left from the current levels. So, I believe that investors with a long-term horizon may want to accumulate Nvidia’s shares on potential price corrections, in multiple tranches, while the broader market indices try to find a bottom. Nvidia is a fundamentally strong stock and is likely to outperform the Street over multi-year time frames. Good Luck!

Be the first to comment