PonyWang

All eyes will be on NVIDIA Corporation (NASDAQ:NVDA) when it reports its Q3 results after markets close tomorrow, 11/16/2022. Semiconductor companies across the globe have been adversely impacted by dampened consumer demand, and investors will be closely watching how Nvidia’s revenue has been hit during the quarter. But in addition to just tracking its headline financial figures, investors may also want to watch its inventory purchase obligations, segment financials, its management’s take on channel inventory normalization, and their revenue outlook for the quarter ahead. These items will provide us insights about where Nvidia and its shares may be headed next. Let’s take a closer look at it all.

Gauging Demand Momentum

Let me start by saying that Nvidia’s top brass has remained at the forefront of innovation, and they’ve aggressively rolled out industry-leading products time and again. As a result, they’ve disrupted various segments of the computing space and grown their business at a stellar pace over the past decade. But this time around, there’s a lot of uncertainty about how strong consumer demand really is, given that inflationary pressures and rising interest rates are eating into the disposable incomes of consumers across the globe. So, the first order of business for investors should be to assess Nvidia’s inventory planning in its upcoming earnings report.

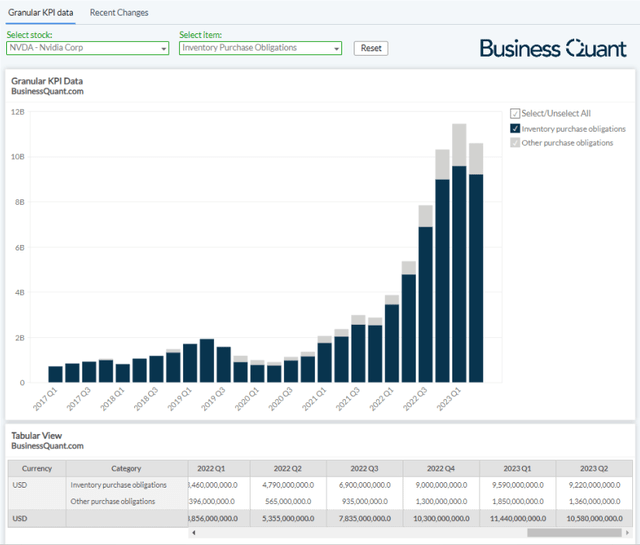

We can do this by monitoring Nvidia’s purchase obligations. This is the dollar value of all the cancellable as well as non-cancellable contracts that the company has placed with its suppliers. If Nvidia’s management is anticipating a quick demand resumption, then they might not cancel or defer their existing purchase obligations. However, if the company’s top brass is experiencing a significant sales slump, then they’re likely to cancel or defer some of these obligations in order to be financially frugal and to avoid an unprecedented inventory build-up. So, this metric essentially indicates the amount of financial risk that Nvidia’s management is undertaking.

See, the general demand for computing products and peripherals has been weak for other similar companies. Intel (INTC) and Advanced Micro Devices (AMD), for instance, have cautioned investors about weak sales momentum. AMD has even slashed prices of its Ryzen 7000 Series CPUs by up to 27% that were released just a few weeks ago, to reinvigorate demand. So, it’s only natural that Nvidia will also encounter similar headwinds in its Q3 and Q4 and prompt its management to cut back on purchase commitments. However, if the purchase obligations figure remains steady, or rises, then it’ll be a matter of concern, as it would present the possibility of oversupply in the coming months.

There was also an unconfirmed report that said Nvidia was looking to cut orders with its chip fabrication partner, Taiwan Semiconductor (TSM). This makes sense – if the demand momentum is slowing down, then it’s financially prudent to cut back on cancellable contracts and reduce the risk of an unnecessary inventory build-up. I think it’s needless to say, but a decline in its inventory purchase obligations will confirm the sales slump is intensifying, and shareholder returns will remain muted for the foreseeable future at the very least. So, pay close attention to Nvidia’s inventory purchase obligations.

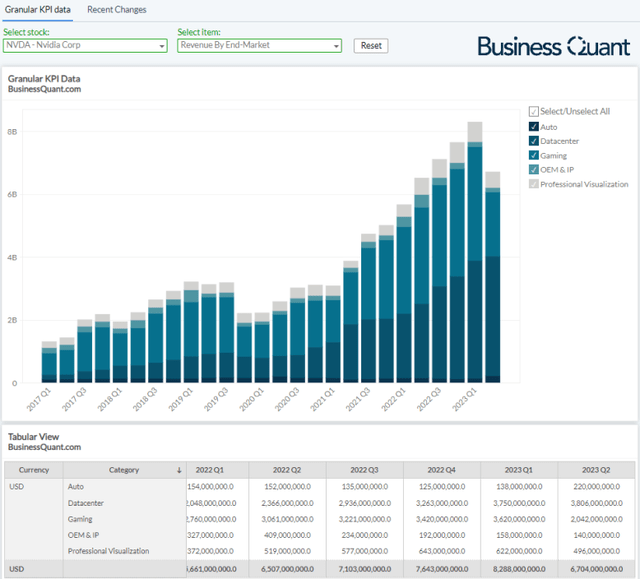

Bifurcated Revenue Impact

Having said that, let’s now shift attention to Nvidia’s financials. The chipmaker classifies its revenue into 5 reporting segments, namely Datacenter, Auto, Gaming, Professional Visualization, and OEM/IP. Out of these, the datacenter business is its largest revenue driver, accounting for nearly 57% of the company’s total sales last quarter. What’s even more interesting is that this revenue stream has sequentially increased in 14 quarters straight, which is a commendable feat and an enviable position to be in for any mature company.

But this time around, I’m expecting a minor pullback in Nvidia’s datacenter revenue. I say this because enterprises across the globe have been cutting back on their discretionary spending and deferring expansion plans until we’re out of the recessionary phase. So, naturally, Nvidia will be experiencing order cuts from its customers during these challenging macroeconomic times. At the same time, there’s a growth catalyst to mitigate this decline.

A few weeks ago, U.S. regulators imposed a ban on the export of certain China-bound datacenter chips from Nvidia and AMD. I’ve been arguing that both chipmakers would find a way to cater to these anxious datacenter customers in China, as these foreign entities would look to quickly build an inventory buffer and be willing to pay top dollar, until they find a way out of this predicament. This scenario seems to be playing out exactly as I predicted.

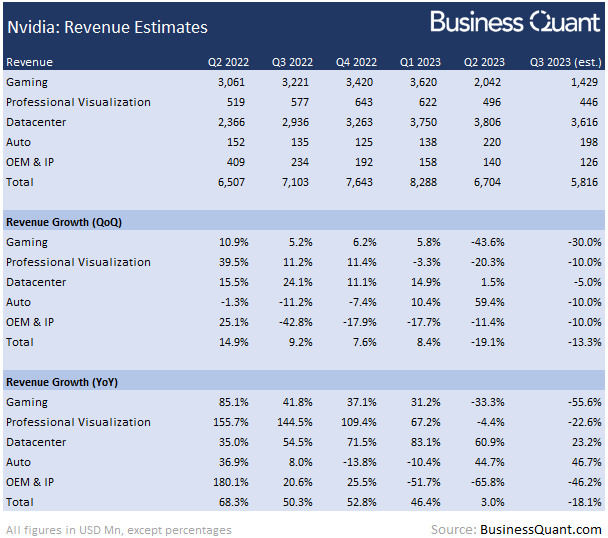

Nvidia artificially reduced the data throughput of its impacted A100 chips by 33%, rebadged it as A800, to bypass U.S. export restrictions and continue on with its sales to Chinese enterprises. So, I expect the emergence of this new growth catalyst to mitigate the decline in sales brought along by the general macroeconomic weakness across the globe. As far as guesstimates go, I’m estimating Nvidia’s datacenter revenue to decline 5% sequentially and amounted to $3.61 billion during Q3.

Moving on, Nvidia’s gaming division is its second-largest revenue driver, as it amounted to roughly 30% of the company’s total sales in Q2. With the crypto crash intensifying, consumer disposable incomes plummeting across the globe, and new budget GPU offerings from Nvidia just a few weeks away, there isn’t any prominent catalyst to mitigate the downside impact to this business. So, I’m anticipating Nvidia’s gaming revenue to be down 30% sequentially in Q3, with the actual figure coming in around $1.4 billion.

Lastly, its remaining three segments – Auto, OEM/IP, and Professional Visualization – are immaterial to the company’s total sales as they, on average, amounted to just around 4% of Nvidia’s total sales last quarter. There aren’t any material catalysts that would change the status quo and/or cause a major inflection in either of these revenue streams anytime soon. So, I anticipate each of these segments to post a 10% sequential revenue decline during Q3.

This brings us to a company-wide revenue estimate of around $5.81 billion in Q3, which would mark a year-over-year decline of 18.1% and a sequential decline of 13.3% Coincidentally, my estimate falls within the Street’s consensus revenue estimates that are spanning from $5.5 billion to $6 billion.

BusinessQuant.com

But having said that, we must also pay close attention to Nvidia management’s revenue outlook, consumer demand projections, and their product strategy for Q4. Specifically speaking, look for clues on:

- how they plan to prioritize production across different product lines, to mitigate the sales slump,

- do they plan on cutting back production until channel inventories of older stock are cleared,

- do they plan on slashing cutting prices, like AMD did, to reignite consumer demand.

Final Thoughts

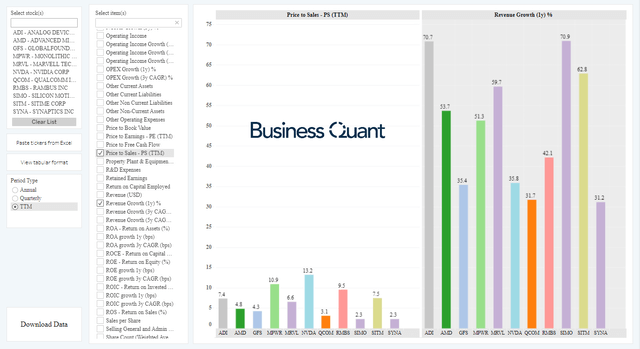

Nvidia’s shares are trading at over 13-times their trailing twelve months. This is an exorbitantly high figure on a standalone as well as on a relative basis. There are several other semiconductor companies that are growing revenue faster than Nvidia but are trading at much lower Price-to-Sales multiples. So, I contend that Nvidia’s Q3 earnings report and the accompanying sales slump will encourage investors to ask why the stock deserves such a stark premium and also trigger a selloff in the stock.

But as far as key items are concerned, investors may want to keep a close eye on Nvidia’s purchase obligations, its segment financials, and its management’s outlook for the quarter ahead, in the Q3 report. These items will better highlight how Nvidia is being affected by the global macroeconomic turmoil, and they are likely to influence where NVDA shares head next. Good Luck!

Be the first to comment