jiefeng jiang

The market liked what NVE Corporation (NASDAQ:NVEC) had to say in its most recent fiscal Q2 earnings report. The report helped NVE Corporation stock soar higher, pulling the stock out of the hole it was in for much of 2022 and coming close to erasing all losses for the year. NVEC, a manufacturer of products utilizing spintronics, has thus outperformed in what has been a tough year for most semis. In addition, it looks like NVEC is not done yet and the stock could go higher. However, some may still want to lock in profits and take some chips off the table. Why will be covered next.

NVEC stock has recovered

Many semiconductor stocks have suffered major losses in 2022, but NVEC is an outlier with YTD losses of just 3% – and that’s with a 3% drop last Friday or the stock would be flat for the year. In comparison, many semis have done much worse. For instance, the iShares PHLX Semiconductor ETF (SOXX) is down 31% YTD. The chart below shows how NVEC has recovered after being down for much of 2022.

NVEC can be said to have outperformed in 2022. However, for much of 2022 NVEC was not doing all that well. The stock lost as much as 36% by late June, and as recently as October 19 the stock was still down 29% for the year. Things have changed since then, with NVEC soaring higher in the last two months, but for much of 2022, the stock was sitting on major losses.

Why NVEC was able to turn it around

The stock went from being worth $48.23 on October 19 to being worth $66.61 on October 26. It’s no coincidence the stock gained 18% the day after and 38% a week after October 19, which happens to be the day the company released its most recent earnings report. The report stood out in a number of ways. NVEC has long struggled with tepid growth, which has weighed on investor sentiment towards NVEC, but growth accelerated in a big way in the latest report and the outlook suggests this accelerated pace in growth is here to stay.

Q2 FY2023 revenue increased by 46% QoQ and 57.1% YoY to $10.7M, a new record high. Yet despite the 57.1% YoY increase in the top line, operating expenses declined 6.7% YoY. This helped power a 740 basis points YoY increase in operating margin to 67.3%, helping push the bottom line to new heights. EPS increased by 46.5% QoQ and 68% YoY to $1.26, making it the first time NEVC has earned more than the $1 it paid out in quarterly dividends for the last seven years. Q2 FY2023 was a milestone in that regard. The table below shows the numbers for Q2 FY2023.

|

(GAAP) |

Q2 FY2023 |

Q1 FY2023 |

Q2 FY2022 |

QoQ |

YoY |

|

Revenue |

$10.72M |

$7.34M |

$6.82M |

46.0% |

57.1% |

|

Gross margin |

77.6% |

77.5% |

77.4% |

10bps |

20bps |

|

Operating margin |

67.3% |

64.2% |

59.9% |

310bps |

740bps |

|

Operating expenses |

$1.11M |

$0.97M |

$1.19M |

14.4% |

(6.7%) |

|

Income from operations |

$7.21M |

$4.71M |

$4.09M |

53.1% |

76.3% |

|

Net income |

$6.09M |

$4.14M |

$3.65M |

47.1% |

67.0% |

|

EPS |

$1.26 |

$0.86 |

$0.75 |

46.5% |

68.0% |

Source: NVEC.

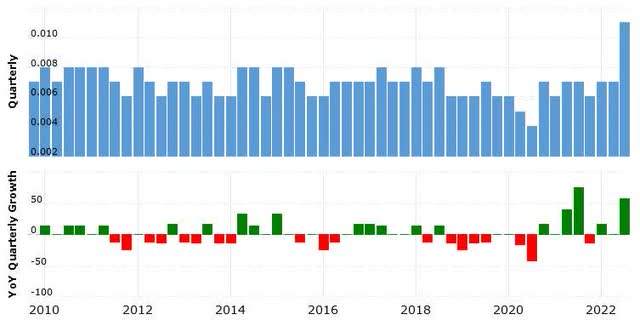

NVEC grew much faster than what the market had come accustomed to. If there was one thing the market had come to expect from NVEC, then it is that quarterly revenue will most likely be somewhere in the $5-8M range. The chart below shows how quarterly revenue has not changed all that much in the last decade, that is until the most recent quarter. Still, growth has been hard to come by for NVEC.

NVEC does not have a good track record when it comes to growth. Still, management believes Q2 FY2023 will not turn out to be an isolated event. Growth is expected to remain strong and not regress in the coming quarters. From the Q2 earnings call:

“So, we see increased business and increased potential and we’re currently expecting to continue strong year-over-year revenue growth. As Joe mentioned, we had some business that is — can be lumpy, specifically the anti-tamper products, but then also we had some business that was relatively weak in the medical sector. So, those offset a little bit and our interest in our catalog products was very strong.

And as Joe mentioned, our order flow remains strong. So, we’re optimistic that we can continue strong year-over-year revenue growth. Now there are some risks of course and there’s caveats that we face the supply chain headwinds. But we’re optimistic that this is business that, that much of this business is business that we can retain, the business that we’ve won from competitors and that we can continue our growth trajectory.”

A transcript of the Q2 FY2023 earnings call can be found here.

On the other hand, management did acknowledge the Q2 FY2023 numbers benefited from demand being pulled forward to a certain extent.

“I would say that the anti-tamper product, I would say some of that was absolutely full ahead. We had a vendor who or a customer who wanted some expedited delivery on some products. So I will say we did pull ahead some revenue there.”

The concern people might have here is that the pulling forward of demand could have adverse consequences down the road. Growth has accelerated, but it may have come at the expense of future demand and growth by extension.

Valuations are up, but still within reason

NVEC has appreciated by 51% since the June lows, a rally which has pushed up valuations as well. For instance, NVEC has an enterprise value of $267M, which is equal to 13 times EBITDA on a trailing basis. In comparison, the median for the sector is 13x, which is not that different from NVEC. NVEC also has a P/E ratio of 18, which is less than the sector median of 24x. On the other hand, NVEC looks worse in other metrics. The stock is valued at 5 times book value, more than the median of 2.9x. The table below shows some of the multiples NVEC trades at.

|

NVEC |

|

|

Market cap |

$319.99M |

|

Enterprise value |

$267.10M |

|

Revenue (“ttm”) |

$31.1M |

|

EBITDA |

$20.4M |

|

Trailing GAAP P/E |

18.28 |

|

Forward GAAP P/E |

N/A |

|

PEG ratio |

0.80 |

|

P/S |

10.30 |

|

P/B |

5.02 |

|

EV/sales |

8.60 |

|

Trailing EV/EBITDA |

13.12 |

|

Forward EV/EBITDA |

N/A |

Source: SeekingAlpha

Investor takeaways

NVEC has long been held back by the lack of sustained growth, although it has attempted to make up for it somewhere else. NVEC has, for instance, paid a $1 quarterly dividend for years, which translates into a dividend yield of about 6% with the stock priced at $66.24. Keep in mind that the yield was more like 8+% before the stock’s recent rally.

However, this level of payout was above what NVEC actually earned, raising doubts as to the long-term sustainability of this dividend. This is why the most recent earnings report was potentially a gamechanger. NVEC earned $1.26 a share, which is more than enough to cover the dividend. NVEC’s dividend yield looks more sustainable with the latest numbers, assuming of course EPS does not regress.

More importantly, growth has shifted to a higher gear. Stagnant growth was arguably NVEC’s biggest flaw, but the latest updates suggest NVEC has found a solution to this issue. At least, the market seems to think so, which is why the stock has pretty much erased all losses for the year after being down big. NVEC is now in a position to trade in positive territory, which is not something most semis can say.

It’s a tough call, but unlike the previous article from June, I am now neutral on NVEC. There is certainly a case to be made to stay long after the recent developments. NVEC has long had growth potential and the Q2 report suggests NVEC may have finally cracked the code to get growth going. A dividend yield of 6% is nothing to sneeze at, certainly if it is sustainable in the long run. The charts also leave room for the stock to go higher, although not at the pace seen in recent months.

Long NVEC has certainly paid off in the last couple of months, especially if someone got in at the June lows. It’s also possible NVEC may be in the starting blocks of a sustained growth phase. Jumping ship means to potentially miss out, which could make it hard to let go of NVEC.

On the other hand, there is reason to be cautious. It remains to be seen whether NVE Corporation stock can keep up the pace in growth seen in fiscal Q2 or whether growth will return to what it has historically been. NVEC seems to have benefited from the pulling forward of orders. If not for this, growth would likely have been less.

NVEC has not done a good job in terms of growth for many years and it would be premature to assume its growth challenges are gone after just one good quarter. It’s true longs can still count on a generous dividend, but it’s not the draw it used to be. Not only is the yield lower than it used to be at 6%, but we are no longer in a low interest rates environment.

Yield is not as hard to find these days, especially if one is willing to dip into the corporate bond market where yields higher than 6% are available. While multiples for NVEC are not excessive by any means, they are not so low that people would have no choice but to get in or risk missing out.

Bottom line, the prudent move would be to at least consider locking in profits with NVE Corporation stock by taking some or all chips off the table, especially after the big move up in a short amount of time. Anyone who got in at the June lows should now be sitting on major gains, but it’s worth keeping in mind that these are all paper profits, especially if the stock proceeds to give it all back.

There’s the risk the recent numbers were temporarily inflated. The stock could reverse course if it turns out that NVEC has yet to solve its growth issues. There are no guarantees NVEC will keep on growing like it did in Q2. If it does, the stock could go higher. But if it does not, the stock goes down and all the recent gains will be lost.

One can always get back in at a later time, but with the way the cards are laid out at the moment, playing it safe by locking in profits with NVE Corporation stock is probably best. In the end, a bird in the hand is worth two in the bush.

Be the first to comment