Ivan Zhaborovskiy/iStock via Getty Images

Introduction

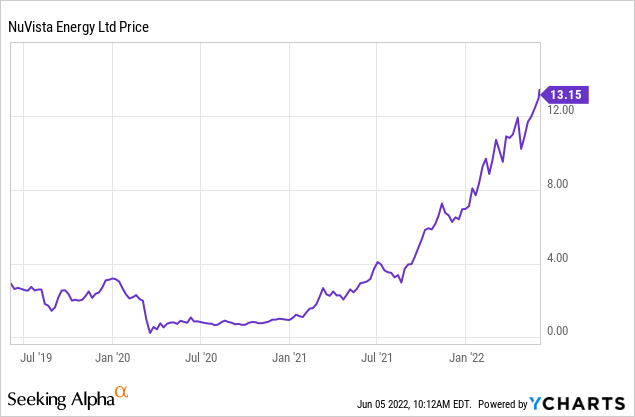

Three months ago, I discussed NuVista Energy (OTCPK:NUVSF), a Canadian natural gas producer which is still flying under the radar. Back in March, I liked the company’s focus on reducing the net debt and strengthening its balance sheet, and thanks to the high natural gas price the balance sheet is now improving very fast. NuVista expects the net debt to drop toward C$200-250M by the end of this year and the board of directors has approved a share repurchase plan which should help to create more value down the line.

NuVista’s primary listing is on the Toronto Stock Exchange, where it’s trading with NVA as ticker symbol. The average daily volume exceeds 1.5 million shares.

The High Natural Gas Price Is Fueling NuVista’s Financial Results

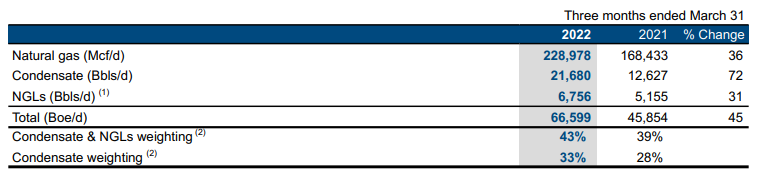

In the first quarter of this year, NuVista saw its oil-equivalent production rate increase by approximately 45% to just over 66,000 boe/day. The production of natural gas increased by 36% while the condensate production increased by more than 70%. And although NuVista obviously predominantly is a natural gas producer, the contribution from condensate sales offers a nice by-product revenue as not only did the production increase by over 70%, the condensate price jumped by 69% while the natural gas price increased by ‘just’ 53% to a realized price of C$5.79/mcf.

NuVista Energy Investor Relations

The higher received price was also caused by the strong natgas price in Chicago, where the natural gas price was almost US$6/mcf in the quarter. Meanwhile, NuVista is also able to sell its natural gas in Canada at a premium to the AECO benchmark price, as its products have a higher heat content.

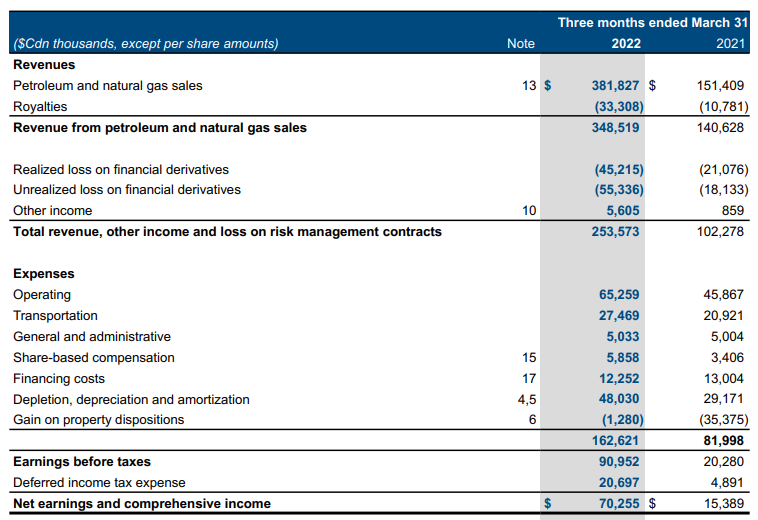

The combination of a higher production rate and higher prices caused the total revenue to increase by 150% to in excess of C$380M and after taking the royalty payments and the realized and unrealized losses on hedges into account, the net revenue was approximately C$253M (which still is almost 150% higher than in Q1 2021).

NuVista Energy Investor Relations

As you can see in the image above, NuVista still is a low-cost producer and this helped the company to report a pre-tax income of almost C$91M and a net income of just over C$70M for an EPS of C$0.31/share. That’s quite impressive, as the pre-tax income was actually slashed by more than 50% due to the realized and unrealized hedging losses.

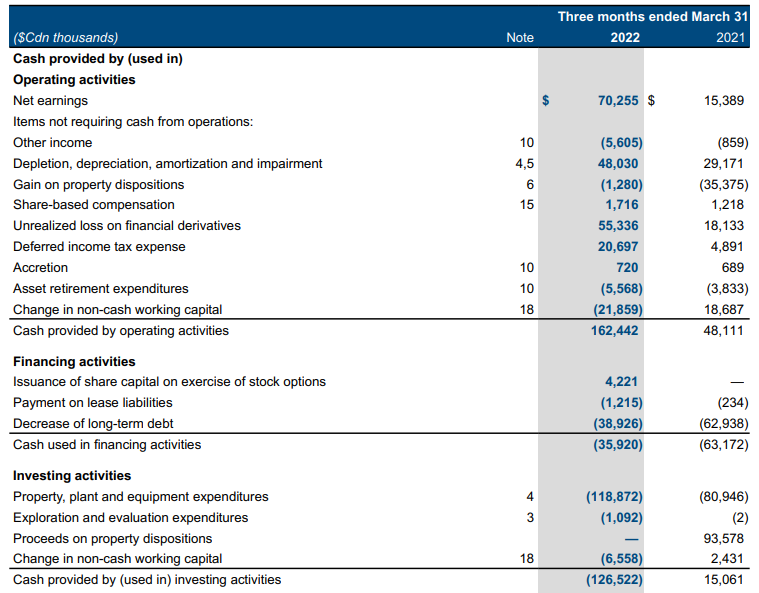

The cash flow statement provides a good overview of the cash generated by NuVista including the realized hedging losses but excluding the unrealized hedging losses (which will obviously be realized over the next few months and quarters). The operating cash flow, adjusted for changes in the working capital position and lease payments, was $183M (including about C$45M in realized hedging losses).

NuVista Energy Investor Relations

The reported capex was approximately C$120M, as you can see above, resulting in a free cash flow result of C$63M. This is including a deferred tax payment to the tune of just over C$20M, so if we would include a normalized tax payment, the adjusted operating cash flow was C$163M while the reported free cash flow was C$43M.

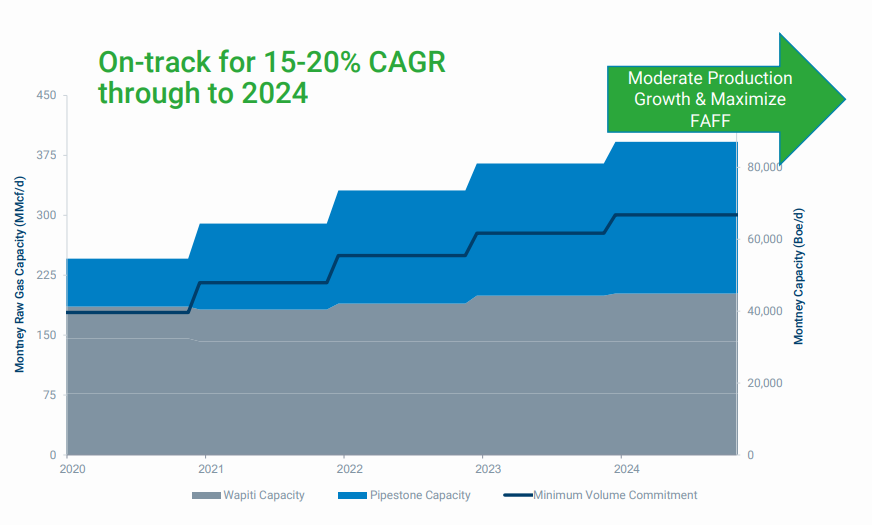

That doesn’t sound very exciting, but keep in mind NuVista is investing in growth as it wants to increase its production rate toward the total capacity of its processing facilities of about 90,000 boe/day. NuVista originally anticipated to spend around C$300M on capital expenditures but on the back of the current tailwinds, the company has hiked its capex guidance to C$365M. This increased guidance represents an average quarterly capex spending of just over C$90M, so it’s pretty clear the company has been front-loading its capex.

NuVista Energy Investor Relations

The Net Debt Level Target Has Been Reached – What’s Next?

NuVista was planning on launching a share buyback program as soon as it reached its desired net debt level. That level was calculated based on maintaining a debt to adjusted funds flow ratio of less than 1 using $45 WTI and $2 NYMEX natgas.

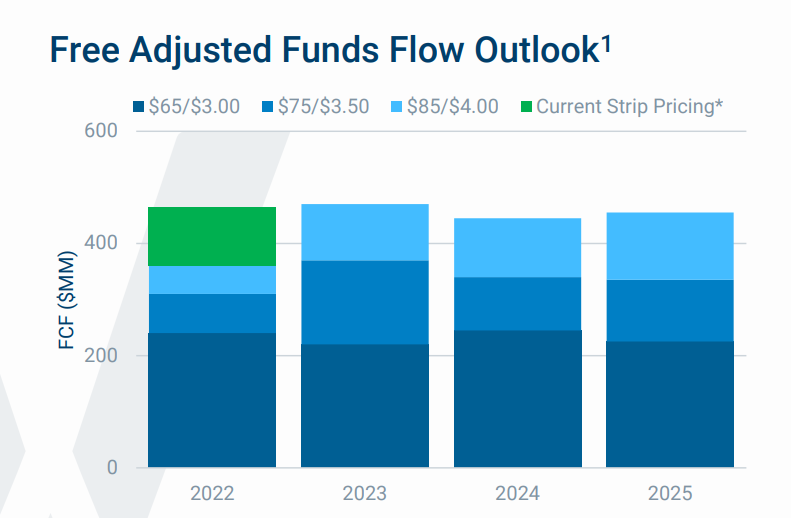

That long-term sustainable base net debt level of C$200-250M has now been reached, and NuVista is dedicating to spend 25%-50% of its quarterly free adjusted funds flow on share repurchases. Unfortunately, NuVista isn’t mentioning a dividend, so the (intangible) share buybacks will be the only thing the company will spend its cash on. NuVista has filed an application to repurchase up to 10% of its float, and it expects to be in a position to commence buybacks in the second half of this month.

NuVista Energy Investor Relations

And as the net debt continues to decrease while the free adjusted funds flow will remain relatively stable with an anticipated C$450M in 2023 based on $85 WTI and US$4 natural gas, NuVista is in a good position to step up its share buybacks. Assuming it will indeed spend C$225M on buying back stock next year, the company would be able to repurchase and cancel approximately 17 million shares, or almost 8% of the share count.

Investment Thesis

NuVista is taking advantage of the high natural gas prices to rapidly clean up its balance sheet, and this paves the way to start rewarding its shareholders. It’s perhaps a little bit unfortunate the company isn’t considering paying a dividend yet as even just a symbolic dividend of 10 cents per quarter would result in a dividend yield of just over 3% while it would cost the company less than C$90M per year.

That being said, if the natural gas prices remain high it makes sense for NuVista to try to buy back its shares now, in anticipation of a higher production rate (and cash flows) further down the road as the company plans to gradually increase the production rate towards 90,000 boe/day. Once that production platform will be reached and the natural gas price remains relatively high at US$4 on a NYMEX basis, the free cash flow per share could easily exceed C$2/share (depending on how many shares NuVista is able to repurchase and cancel by the end of 2024).

I currently have no position in NuVista Energy as I’m exposed to the natural gas price through positions in other companies, but NuVista is executing its growth plans well, and its share price should continue to do well.

Be the first to comment