JackF/iStock via Getty Images

Nutrien Investment Thesis

Nutrien (NYSE:NTR) has been shunned by investors that wanted to see ”action” in 2022. However, recent evidence shows that the moment that investors waited for is starting to emerge.

Not only are potash prices staying high, but nitrogen prices too, have found a bottom and are ticking slightly higher.

Meanwhile, nitrogen’s input feedstock, natural gas, has retraced lower in the past few weeks.

Altogether I believe this will lead to Nutrien beating its 2022 EBITDA guidance.

There’s new dawn about to break for Nutrien. And at 5x EPS, the downside here is relatively muted.

Background to Key Needle Drivers

Nutrien’s EBITDA profitability is made up of roughly speaking as 50% coming from potash, and over 20% of its EBITDA comes from its retail business (where Nutrien has retail operations aimed at selling farming solutions and products across retail stores, predominantly in North America, Australia, and Canada), and over 20% from its nitrogen business. The remainder comes from its phosphate business.

Thus, unlike Mosaic (MOS), Nutrien’s phosphate business does not move the needle on its operations. The core thesis drivers for Nutrien are potash and nitrogen since Nutrien’s retail business is not a needle mover, it’s a source of earnings diversification, but to a certain extent, it’s ”immune” to crop prices. There’s a slight exaggeration on my part here, but I wish to simplify the story.

The bulk of Nutrien’s investment thesis comes from its potash and nitrogen segments. Simply put, what happens with potash and nitrogen moves the investment thesis, either positively or negatively.

In fact, looking back to the guidance that Nutrien offered investors back at the start of August, nitrogen could end up reaching nearly 30% of Nutrien’s total EBITDA, while potash would continue contributing around 50% to Nutrien’s total EBITDA.

Next, let’s get some context.

Why Capital Flowed Out?

On the back of the Russian invasion, investors moved rapidly to reprice fertilizer companies. Indeed, investors understood that there would be fertilizer shortages, and so the whole sector moved up quickly, pushing up many peers across the board.

However, that trade died out during the summer because of two reasons. Firstly, investors come to realize that the shortage of fertilizer wouldn’t be so imminent. Furthermore, farmers had started pushing back against elevated fertilizer prices and sought to defer their fertilizer purchases.

Secondly, there was an exogenous factor taking place. It appeared that tech had found its bottom, so investors were only too eager to buy the dip in tech and return to the same playbook that was the winning trade of the past decade.

That of ”asset-light” businesses with undisturbed secular growth stories. I put ”asset-light” in quotes, because while they are asset-light since there are not enough tangible assets, they are not high ROE businesses, because managements are overpaid. Alas, that’s perhaps a discussion for another day.

In any case, investors simply didn’t buy into enough this ”whole food crisis” narrative and capital flowed out from the fertilizer trade.

Why Capital Will Flow In?

However, some interesting news has now started to emerge.

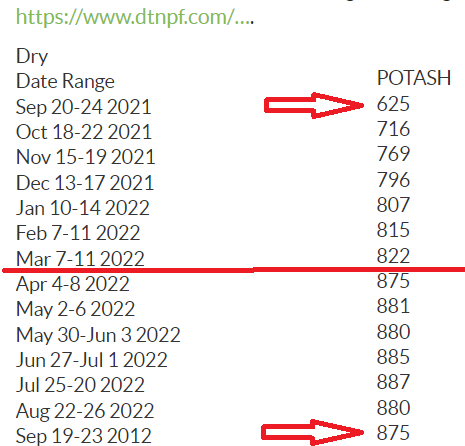

DTNPF.com

What you see above is that potash prices appear to have remained fairly sticky. A lot of investors thought that the potash trade was dead or at least that prices would roll over, as farmers would be unwilling to pay for elevated potash prices.

That would have meant that rather than there being shortages, there would be oversupply. At least in 2022. Well, as you can see above, that’s evidently not the case.

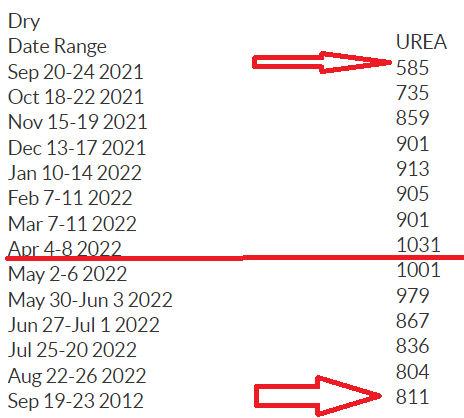

Within Nutrien’s nitrogen segment, I’ve put a spotlight on urea. But it’s largely the same for ammonia and the other products.

DTNPF.com

What you see here is that April saw a peak in urea prices, before prices rolled lower. And that coincided with investors coming to the conclusion that the fertilizer trade was done, at least in the near term.

However, what you now see in the table above is that urea prices have not only found a floor but have actually ticked higher.

Clearly, the facts show that irrespective of any narrative about farmers pushing back against elevated fertilizer prices, the facts don’t echo that narrative.

NTR Stock Valuation – 5x EPS

We are about to enter Q3 2022 earning season. And the best I can do at this juncture is take Nutrien’s guidance. Although, I’m reasonably confident that they’ll beat the high end of their guidance for 2022. Why?

Firstly, as I’ve discussed above, urea and other nitrogen products have firmed up. Secondly, and this important, natural gas prices have come down substantially in the past few weeks.

Both aspects together will improve Nutrien’s margins. Nevertheless, even taking Nutrien’s full-year guidance at face value, the stock trades for 5x EPS.

The Bottom Line

There’s a confluence of factors coming together that will drive Nutrien’s profitability higher. Natural gas prices have come down in the past few weeks. That’s an input cost for nitrogen production. Also, nitrogen fertilizer prices are remaining high and sticky. Both together will drive strong operating leverage.

Investors came to believe that fertilizer stocks were going to soar ”to the moon” in 2022. When that turned out not to be the case, investors got bored and moved on.

Meanwhile, all that’s happened is that the bull case got pushed back temporarily. There’s a lot to be excited about in fertilizer stocks in the coming weeks.

Be the first to comment