imaginima

NuStar Energy L.P. (NYSE:NS) is a large, crude oil-focused midstream master limited partnership with operations spanning much of the central United States and extending down into Mexico. This company has admittedly been one of the more troubled midstream firms over the past few years due to the severity of the commodity’s collapse compared to natural gas. It has also not been one of my sector favorites either due to its near-exclusive focus on crude oil and refined products. This is mostly due to the fact that the fundamentals for crude oil are somewhat weaker than the fundamentals for natural gas. With that said though, NuStar Energy has been strengthening over the past year as the demand for crude oil and refined products has largely recovered from the effects of the pandemic with the reopening of the economy and the production of crude oil has improved somewhat in response to today’s high energy prices. The company’s unit price reflects this as NuStar Energy’s common units are essentially flat over the past year, which is not impressive but it is still better than the losses that a few other partnerships have delivered. NuStar Energy also boasts a fairly impressive 9.82% yield so even a flat unit price will deliver a respectable return. The company’s second-quarter earnings results were not particularly impressive either, but let us investigate and see if NuStar Energy could be a decent investment for the right kind of person.

About NuStar Energy

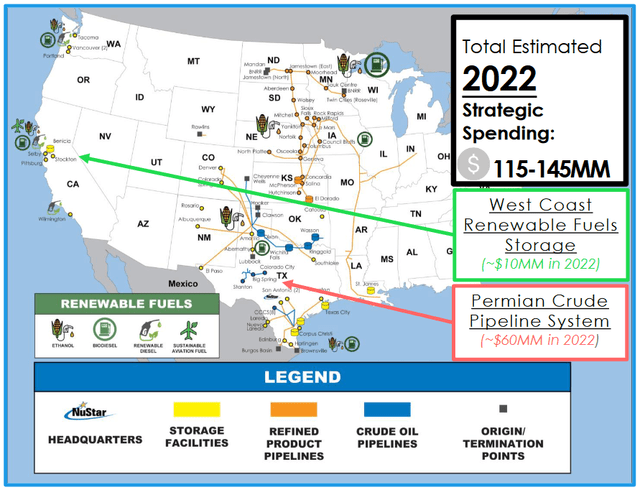

As stated in the introduction, NuStar Energy is a large crude oil and refined products-focused midstream company that has operations stretching across much of the central United States and down into Mexico:

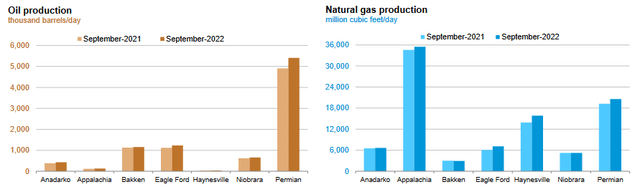

The fact that the company’s operations are almost entirely confined to the central part of the country is no big surprise. Nearly all of the nation’s hydrocarbon-producing basins are in that area and all of the ones that produce crude oil are. In addition, many of the nation’s refineries are in the central parts of the country as they are frequently close to the crude oil-producing basins. While all of the basins that NuStar Energy serves are primarily producers of crude oil, they do have some different dynamics. For example, it is much cheaper to produce crude oil in the Permian Basin than in the Bakken Shale due to the geologies of the two areas. This is one of the reasons why production in the Bakken Shale fell much more in 2020 in response to the fall in crude oil than production in the Permian Basin did. The production in the Permian Basin has increased much more than the production in the Bakken Shale over the past year in response to the steep increase in crude oil prices that we have seen over the past year:

U.S. Energy Information Administration

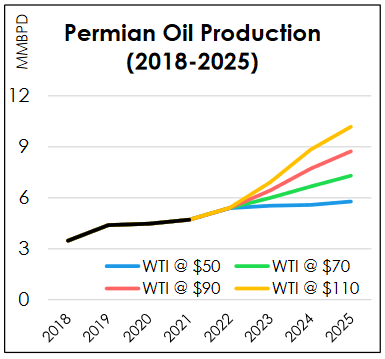

The Permian Basin is expected to see further production growth over the coming years as the various producers in the United States move to take advantage of the current high price environment, which is likely to persist for quite some time. This is in spite of the fact that some major Permian producers like Diamondback Energy (FANG) are planning to hold production steady. We can see this here:

NuStar Energy/Data from Rystad and ESAI

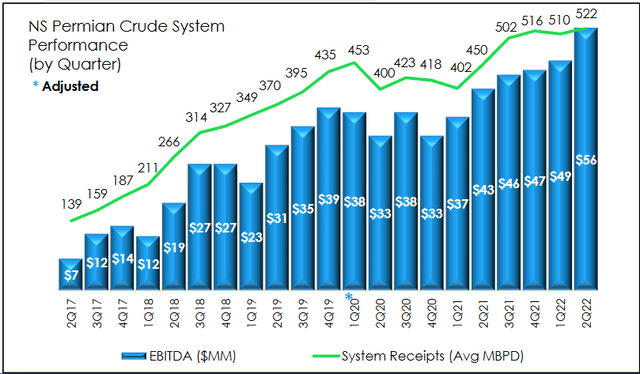

This is important because one of NuStar Energy’s largest and most important assets is its Permian gathering, transportation, and storage system. This system includes 993 miles of pipelines capable of handling 700,000 barrels of crude oil per day. The system also includes 1.6 million barrels of crude oil storage capacity. The reason why growing upstream production benefits this system is because of the business model that the company uses. NuStar Energy basically enters into long-term (typically five to ten years in length) contracts to move crude oil through its system in exchange for volume-based compensation. This provides NuStar Energy with a great deal of insulation against fluctuations in energy prices and causes the company’s revenues and cash flows to increase when volumes do. This has overall proven to be a very good business model over the past several years as the American energy industry has seen tremendous production growth:

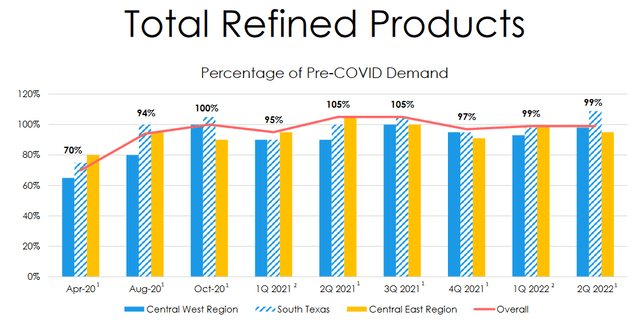

Unfortunately, one of the flaws with this business model was revealed following the COVID-19 outbreak, although NuStar Energy held up much better than upstream companies did. As everyone reading this likely knows, the lockdowns that were imposed following the outbreak of the virus caused the demand for refined products to collapse as people stayed in their homes and generally avoided travel. Even today, many companies have still not returned to business as usual and are sticking with a virtual office model. Thus, there is much less travel going on now than prior to the pandemic due to fewer people traveling for work. Overall though, demand has mostly recovered:

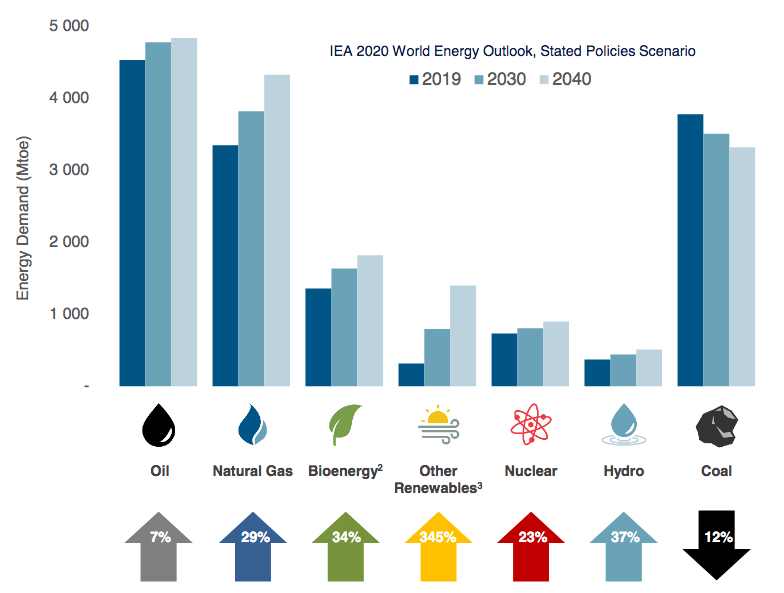

The fact that demand is still slightly lower now than pre-pandemic is a drag on NuStar Energy’s refined products business since there is no point in transporting products that nobody wants to buy. This is in sharp contrast to midstream companies focusing on natural gas like The Williams Companies (WMB). As I pointed out in a recent article, the demand for natural gas is growing dramatically due to the utility sector. However, the growing popularity of things like electric cars and increasing fuel efficiency is likely to keep crude oil and refined products demand down. This is one reason why the International Energy Agency is projecting that the global demand for natural gas will increase by 29% but the global demand for crude oil will only increase by 7% by 2040:

Pembina Pipeline/Data from IEA 2021 World Energy Outlook

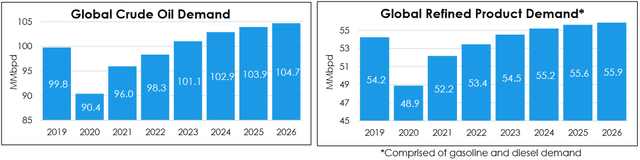

This differential between the projected demand growth of the two products will, unfortunately, be a drag on NuStar Energy’s forward growth relative to its more diversified or natural gas-focused peers. This is one of the reasons why NuStar Energy is not one of my favorite companies in the midstream space. It appears that even NuStar Energy’s management is well aware of this problem as the company has no traditional growth projects under construction (it has a few renewable projects, but those are much smaller than its traditional businesses) and the company itself even projects relatively tepid demand growth for the products that it transports, especially as we approach the middle of the decade:

NuStar Energy/Data from RBN Energy and ESAI

This, unfortunately, could render NuStar Energy to being an income play as opposed to an income and growth play. This conclusion is reinforced by the fact that the share price has been almost completely flat over the past year. Thus, the only return that investors have been receiving over the trailing twelve-month period has been the distribution.

Financial Considerations

The fact that NuStar Energy appears to have limited growth potential does not necessarily mean that the company will be unable to deliver distribution growth. This is because one of the company’s current areas of focus is debt reduction. Thus, it is addressing one of the biggest concerns that I expressed during my last article on the company. Fortunately, the company has made some significant progress in this area.

One metric that we can use to evaluate the company’s debt load is the leverage ratio, which is also known as the debt-to-EBITDA ratio. This ratio essentially tells us how long it would take the company to completely pay off its debt if it were to devote all its pre-tax cash flow to that task. As of June 30, 2022, NuStar Energy had a leverage ratio of 3.93x based on the company’s trailing twelve-month EBITDA. This is a very nice improvement over the 4.27x that the company had at the end of the second quarter of 2021. Analysts generally consider anything under 5.0x to be reasonable but I like to see this ratio under 4.0x to add a bit of a safety margin in the event of a cash flow decline. The management of many midstream firms seems to agree as most of these firms have been actively trying to get their leverage ratios down under 4.0x.

The reason why this could lead to distribution growth is that the less cash the company has to spend on debt service, the more money that it has available to do other things such as distributions to the limited partners. It is important to note though that management has not made any statements to this effect. It is simply something that might be worth considering when formulating an investment thesis.

Distribution Thesis

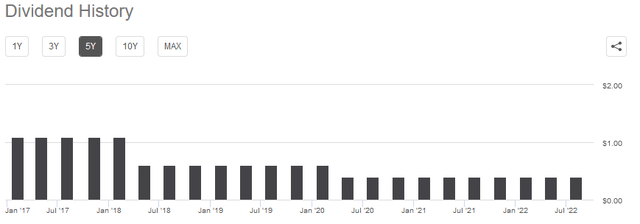

As we have seen over the course of this article, NuStar Energy’s distribution is likely to be the only return investors will receive for quite some time. Fortunately, it is a very attractive distribution as the 9.82% yield is higher than just about anything else in the market. NuStar Energy does not exactly have the best track record when it comes to the distribution though as the company has cut its payout twice in the past five years:

Admittedly, many midstream companies had to cut their distributions back in 2020 due to the unprecedented conditions that year so this can be forgiven but it is much harder to overlook the distribution cut in 2018. However, new money will be receiving the current distribution and the current yield so the company’s concerning past is not necessarily something that we have to worry about when considering whether or not to buy the common units today. The most important thing for us is to determine if the company can actually afford the current payout. After all, we do not want to be the victims of a distribution cut that reduces our incomes and almost certainly causes the unit price to decline.

The usual way that we analyze a midstream partnership’s ability to carry its distribution is by looking at its distributable cash flow. This is a non-GAAP metric that theoretically tells us the amount of cash that was generated by the company’s ordinary operations and is available to be distributed to the shareholders. During the second quarter of 2022, NuStar Energy reported a distributable cash flow of $83.002 million, which was a significant decline over the $97.375 million that the company reported in the prior-year quarter. However, the company’s distributable cash flow was still enough to cover the distribution 1.88 times over. This is a reasonable ratio. Analysts usually consider anything over 1.20x to be sustainable but I like to see the ratio over 1.30x in order to add a margin of safety to the position. As we can clearly see, NuStar Energy easily beats both of these requirements so the distribution is likely to be quite safe at the current level. This is nice since it may be the only return that investors receive as we have already discussed.

Conclusion

In conclusion, NuStar Energy is not the best investment in the midstream space due to its lack of significant growth potential. However, the company may make sense for someone that simply wants to collect a high level of income. The company’s 9.82% yield appears to be quite sustainable so investors can rest easy and simply collect their quarterly checks. It is nice that the yield is so high given the lack of growth potential. This is one of only a few companies that I would not recommend reinvesting the distributions into though as you would be better off taking them and putting them into something with greater growth potential. Overall, NuStar Energy is not a bad investment since the yield alone does provide an adequate return, but there are better energy companies out there.

Be the first to comment