Richard Drury

Nu Holdings (NYSE:NU) just reported its earnings. While there is a modicum of pressure from macro conditions, the strategy is not hitting roadblocks and all metrics point to the fact that Nu is leveraging their positioning to a very substantial degree. In particular, the Nu multiproduct strategy is working well, and is structurally improving their profile for cash generation and their marketing economics. Customer growth continues and is driving revenue together with growing average revenues per user or ARPAC. An impressive quarter.

Q3 Breakdown

Let’s focus on the most salient points for the quarter that point to great theoretical economics once Nu achieves its scale up.

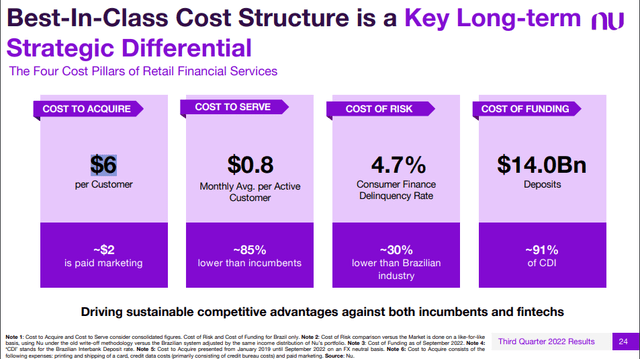

Marketing economics are scaling well. Customer acquisition costs or CACs typically grow as you need to acquire more customers and reach deeper into the barrel for the incremental user. This is not really happening for Nu despite very substantial customer growth. CACs remains around the $5-$6 per customer level, and it implies a very high ROI on marketing where the average monthly ARPAC is almost $8.

CACs (Q3 2022 Pres)

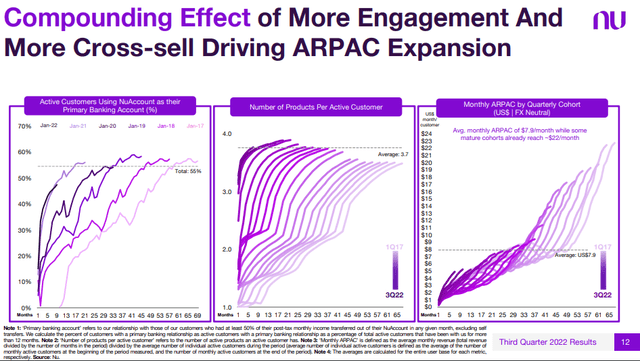

With ARPACs growing for customers as they age, the run-rate ROI just keeps growing. Older customers have ARPACs in excess of $22, and this has not been hampered by macro conditions. Therefore, as long as there is limited or no churn, customers appreciate in their run-rate value and yield on marketing investment.

ARPAC (Q3 2022 Pres)

If that weren’t enough to show the value of the product, and the value capture into very high customers long-term values or LTV, the economics of acquisition has been improved even further by multiproduct strategy. Not only do adding more products grow the potential cap for value capture per customer, it appears that new customers are now joining with a larger number of Nu services engaged. In fact, newer customer are generally using more products than older customers, although older customers are still showing trends of adopting new products too. With more value coming upfront, and the potential for customers to start maturing on more products at once, should increase ARPAC starting points and improve the LTVs purely from discounting effects with more value coming upfront. We are already seeing that in the data with more gradient in ARPAC at earlier stages for newer customers in exchange for a quicker taper later which is fine, since upfront is better. The acquisitions of EasyInvest and the adopting of a suite of products is really paying off and we should be encouraged if Nu continues to leverage inorganic growth like that.

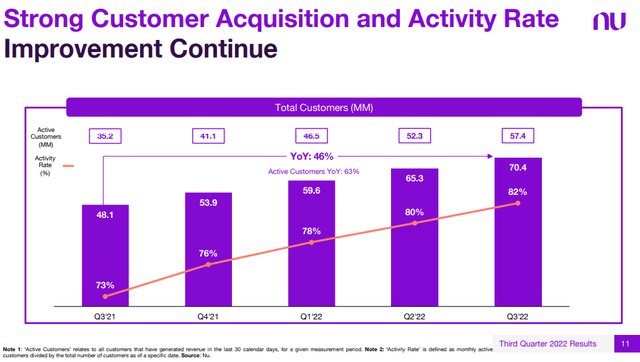

Total customers also continues to grow, which is essential, although it is tapering slightly.

Customer Growth (Q3 2022 Pres)

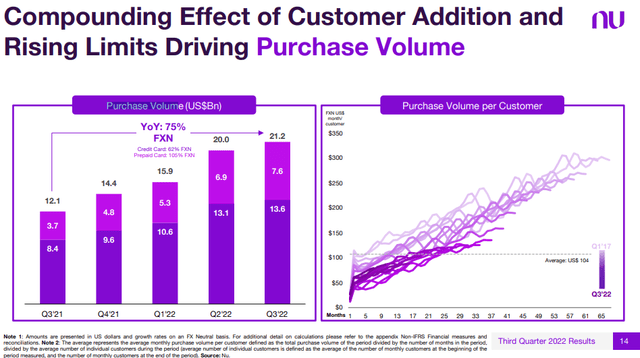

Indeed, this is where we’re perhaps seeing some macro pressure, with younger cohorts scaling purchase volumes a little slower than and later cohorts also tapering. General spending may be seeing some pressure and this is appearing in these metrics.

Macro Pressure? (Q3 2022 Pres)

Bottom Line

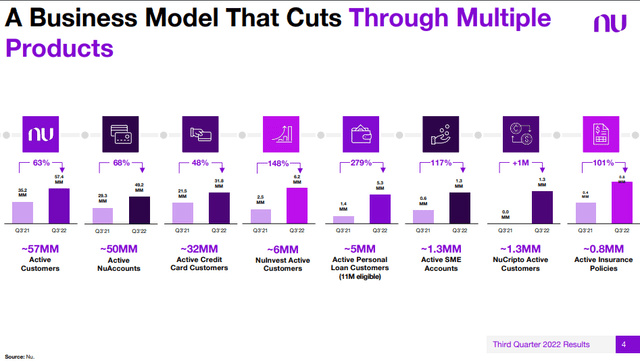

Adjusted net income continues to improve thanks to cost-cutting measures, but it doesn’t matter to us, we are mainly concerned about how much wallet share Nu can get from customers and how good the unit economics are from a marketing perspective, which is their main investment lever. Growth in customers and ARPAC growth is coming despite credit tightening. Despite that even credit-based products are still seeing growth.

Multiproduct (Q3 2022 Pres)

Nu is still low in price since the rotation out of tech this year as higher discount rates put more pressure on tech multiples. But Nu has millions of customers and growing, they’re each becoming increasingly valuable. Customer growth can continue for a while as their markets are still quite unbanked and are all populous nations. Brazil alone is 214 million people, Colombia 51 million and Mexico 130 million. There’s other LatAm markets too. There is still a lot of scope for growth here with excellent unit economics. A buy.

If you thought our angle on this company was interesting, you may want to check out our idea room, The Value Lab. We focus on long-only value ideas of interest to us, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our gang could help broaden your horizons and give some inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment