Phynart Studio

Investment Thesis

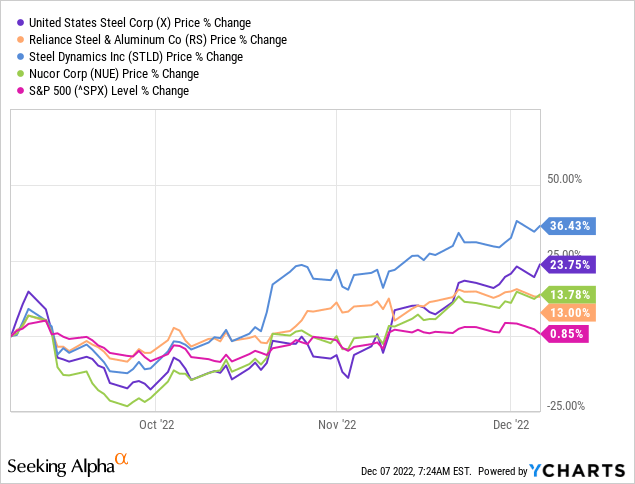

Nucor (NYSE:NUE) is a boring steel company. And for all its boring appeal, its performance is on fire compared with the rest of the S&P 500 (SPY).

That being said, past performance isn’t indicative of future returns. And Nucor isn’t even the best performer in the steel sector these past few months.

And what I believe is crucial to understand about Nucor is this. It did have a sizzling 2022. And its free cash flows will probably reach +$7 billion in 2022.

Furthermore, nobody expects anything even close to this figure in 2023. However, this is my core argument. Steel isn’t going away after 2022. If anything, steel demand is going to go up and global supply is going to be restricted.

There’s a lot to be excited about being a value investor. Let’s get to it.

Something is Happening With Steel

The graphic that follows doesn’t require much interpretation.

I’ve selected a few names within the steel industry. And you can see that all names selected in the past three months have beaten the S&P 500. I’ve not gone through and cherry-picked any names.

What I have done is selected the names that have one key advantage. These companies are predominantly US-based steel companies. And you may say, so what?

You see, these companies have a moat around them. And a moat in a way that isn’t immediately obvious. Allow me to describe both the demand side and the supply side.

The Green Agenda is Going to See Huge Demand for Steel Products

In the first case, I’ll tackle the demand side of the equation.

Around the developed world, there’s a huge demand for cheap, reliable, green energy sources. One green energy renewable source is offshore windmills. Another is the stainless steel for solar panels. Both of these are going to require an unimaginable amount of steel.

Here’s a quote from ArcelorMittal (MT) CEO Johannes De Schrijver:

Steel is required by each of these markets. Without steel, none of the renewable energy sources would be possible. Every renewable energy structure – a wind turbine, a solar panel – requires steel.

For the world to move on the green agenda, it will have to first massively ramp up its steel usage, to build the needed infrastructure to support the green transition.

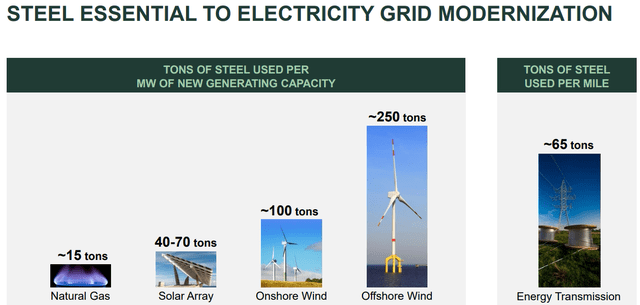

NUE presentation

If the world is serious about going green and starts to seriously consider offshore wind as a viable alternative to burning natural gas, we can expect a large increase in the use of steel.

For instance, an increase in offshore wind, which uses 250 tons of steel per megawatt versus the current baseload of 15 tons per megawatt used with natural gas.

One way or another, the demand for steel isn’t going anywhere but up.

What about the re-shoring of the manufacturing of the semi-industry?

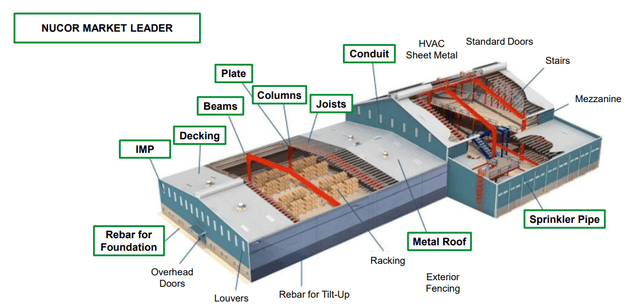

NUE presentation

If the US is serious about reducing its dependence on China and re-shoring its multi-billion semiconductor factoring in the US, we can just see in the graphic above how much steel demand is going to be needed.

Next, we’ll discuss the supply side.

But What About This Moat You Mention?

Here’s the real kicker to this whole story.

At the same time as demand for steel is going to be trickling higher over the next several years, countries that normally manufacture steel are facing an insurmountable problem.

Here’s my point, steel is extremely energy intensive. And if energy outside the US costs around 5x more than the US, that means that US-based steel manufacturers can be profitable at significantly lower steel prices than their overseas competitors.

So, not only is demand going to go up. But also, supply will be limited, because the input feedstock to make steel can end up higher than the actual end product.

But What About China?

I’ll admit that this is an unknown for me.

On the one hand, the Chinese government has moved to support real estate groups. As a reminder, China’s real estate sector is the biggest importer of steel.

And for the bulk of 2022, not only has China’s real estate market been in a slump, but with China’s COVID restrictions, it was a double whammy on the steel industry.

Trading Economics

On the other hand, I’m inclined to believe that since China ”notified” that it would send a $35 billion stimulus package to its slumping real estate sector, the steel price on the spot market appears to have found a floor.

As you can see above, steel prices have moved higher in the past several weeks. And the market is always attempting to move six months quicker than where we are now.

Something to think about. Something positive. How positive, that’s another question altogether. But overall, I’m confident you’ll agree, it’s positive.

The Bottom Line

NUE is cheaply valued. And if steel prices remain stable in 2023, this stock is poised to do well in the coming 12 months. By my estimates, NUE is priced around 7x next year’s free cash flow. For this figure, I’ve assumed that free cash flow in 2023 gets cut by 60% relative to 2022. I’ve done this to leave myself a large margin of error.

This is how I think about it. Outside of cyclical commodities, the rest of the market, particularly in tech, continues to be priced as if we’ll have a shallow recession. While in commodities, the worst is priced in.

Whenever everyone agrees on the worst outcome, that insight is typically already reflected in the stock.

Be the first to comment