FatCamera

In the course of my life, I have often had to eat my words, and I must confess that I have always found it a wholesome diet.”― Winston Churchill

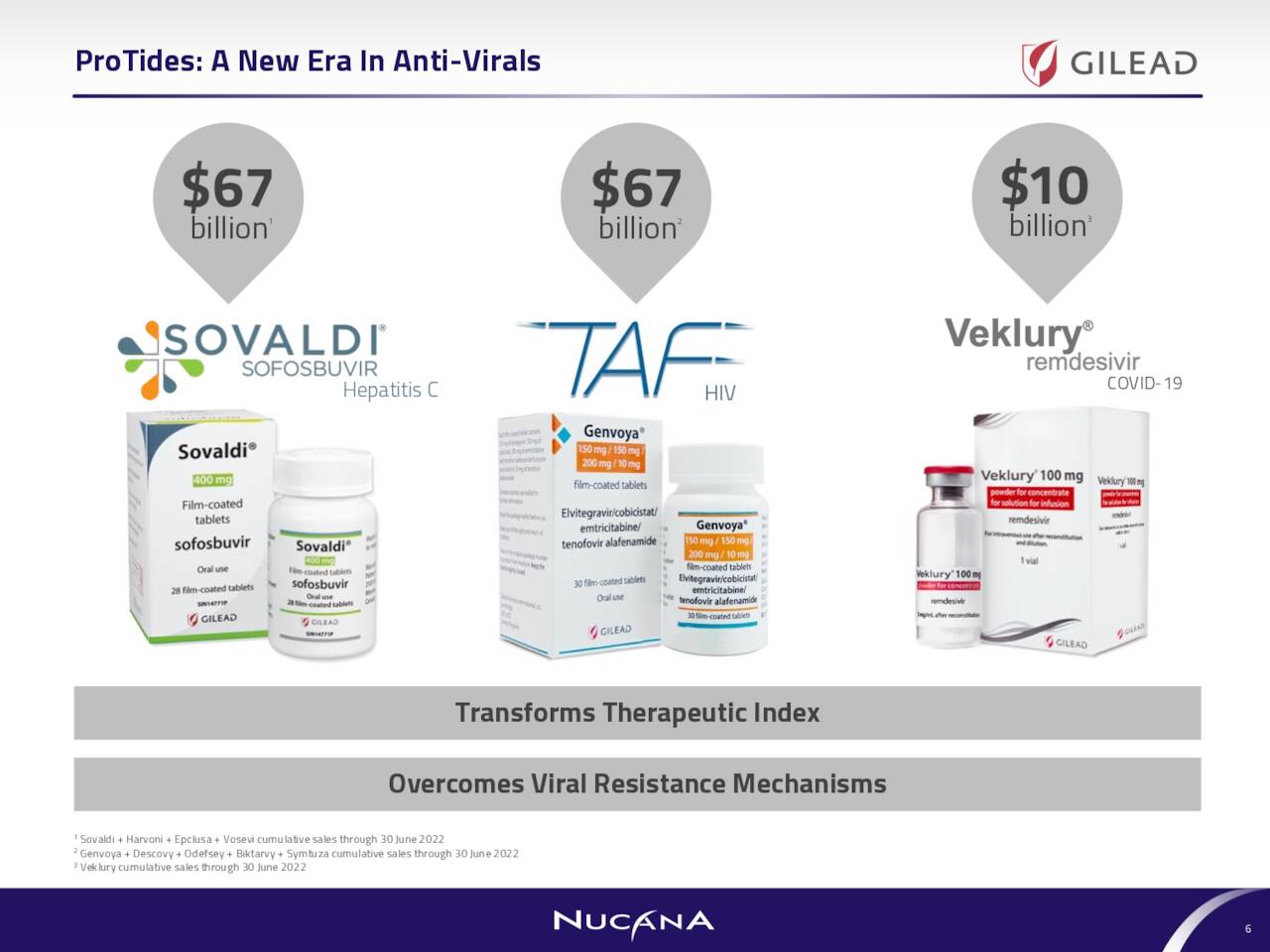

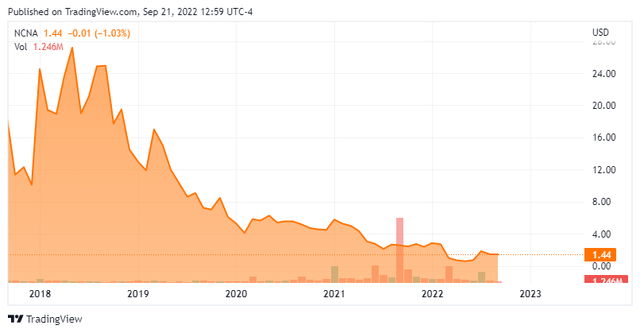

Today, we are circling back on NuCana plc (NASDAQ:NCNA) for the first time in 18 months. There is big legal wildcard around this company. A German court recently upheld a key patent it holds and ruled that Gilead Sciences (GILD) infringed this patent via commercialization of Sovaldi, Harvoni, Vosevi and Epclusa in Germany.

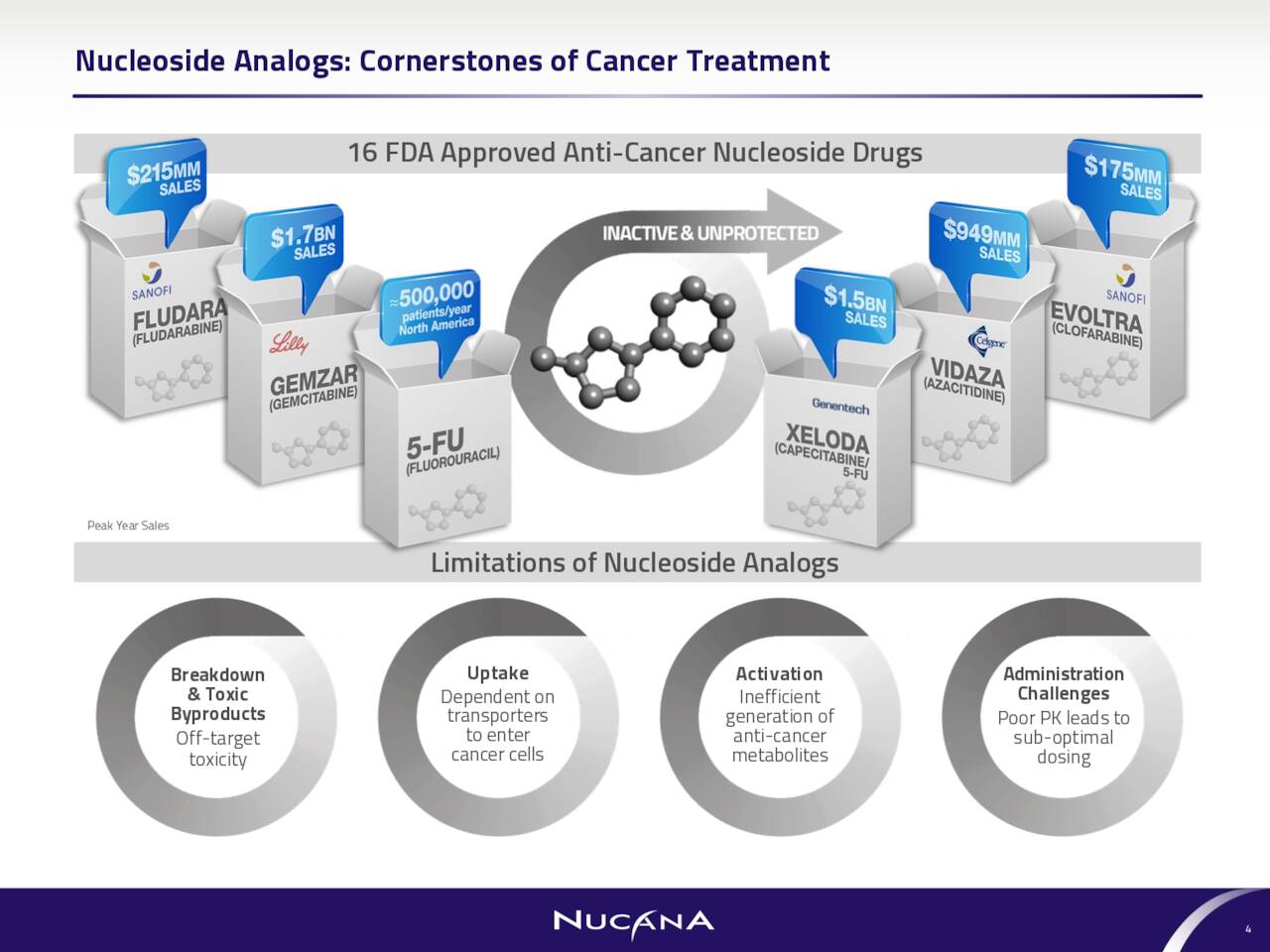

Cumulative Sales (September Company Presentation)

Obviously, this is not a legal forum and potential ramifications of this ruling/litigation were discussed at length at the end of a recent article here on Seeking Alpha. Therefore, our analysis below will be around the company’s pipeline and potential. However, potential investors in NuCana should be aware of this litigation.

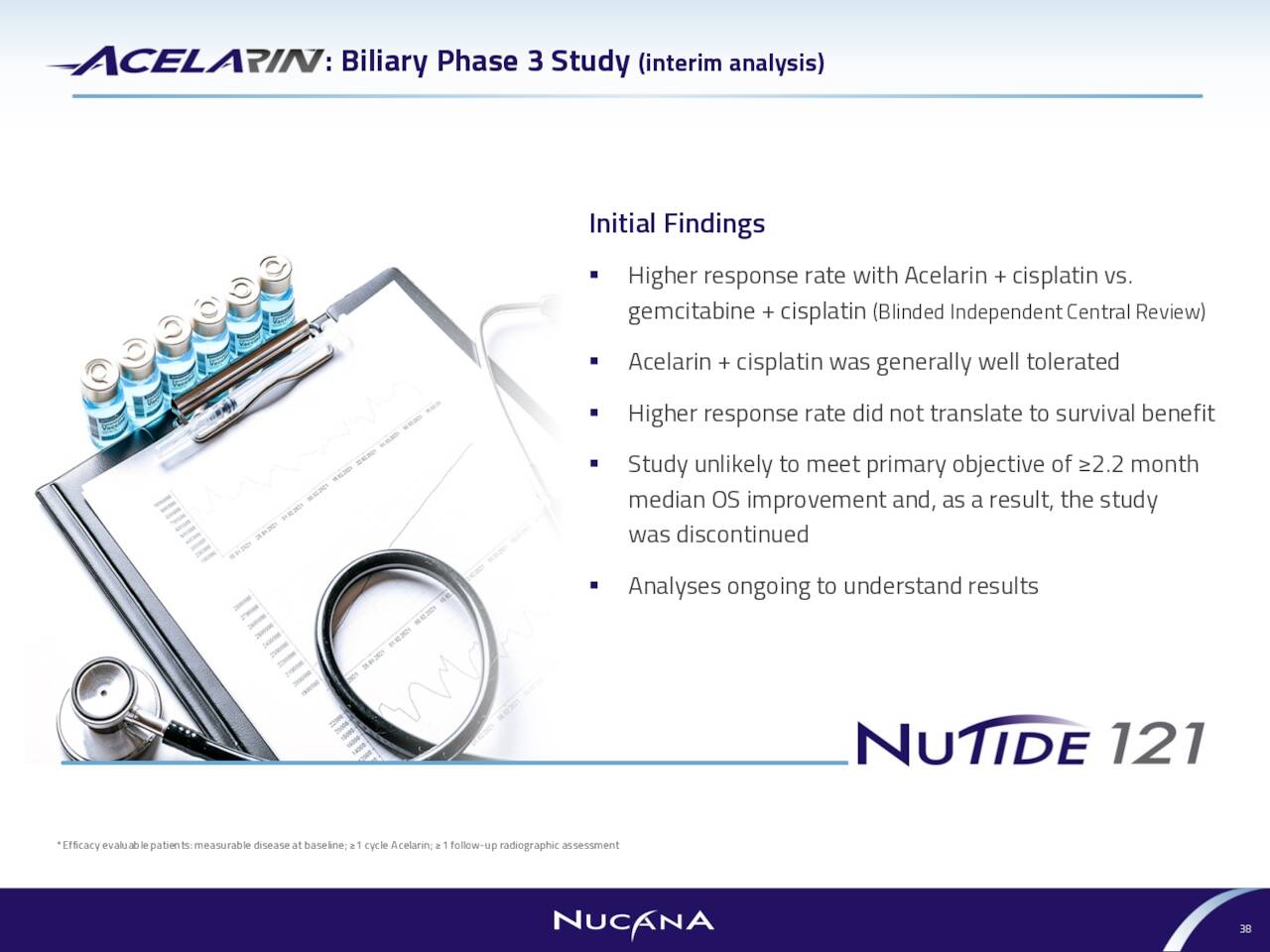

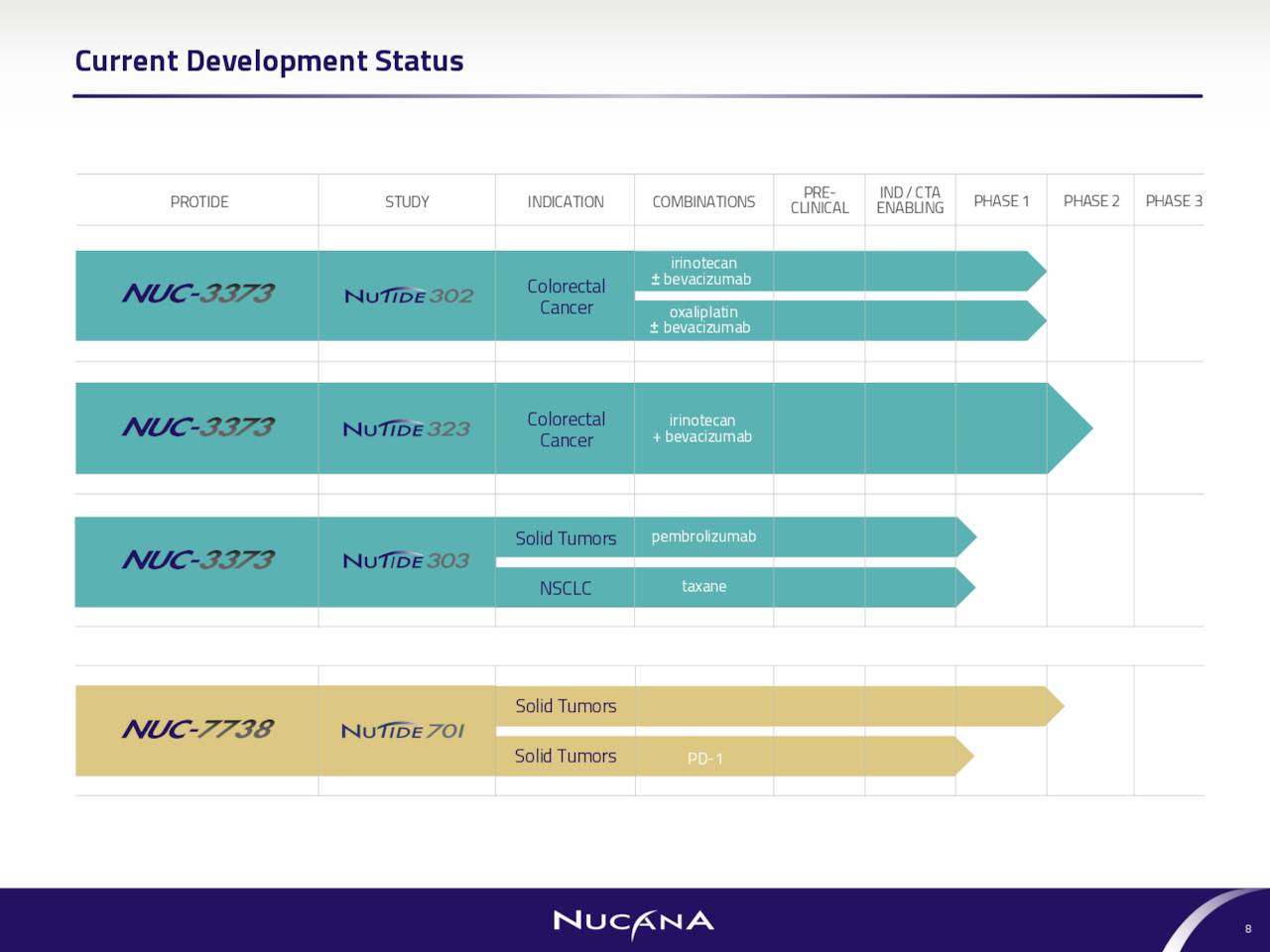

September Company Presentation

NuCana plc stock was hit hard in the first quarter of this year after the company announced it would discontinue a Phase 3 trial for its most advanced candidate Acelarin in biliary tract cancer. Despite a higher objective response rate, a decision to halt the trial was based on a pre-planned futility analysis conducted by the study’s Independent Data Monitoring Committee.

Company Overview:

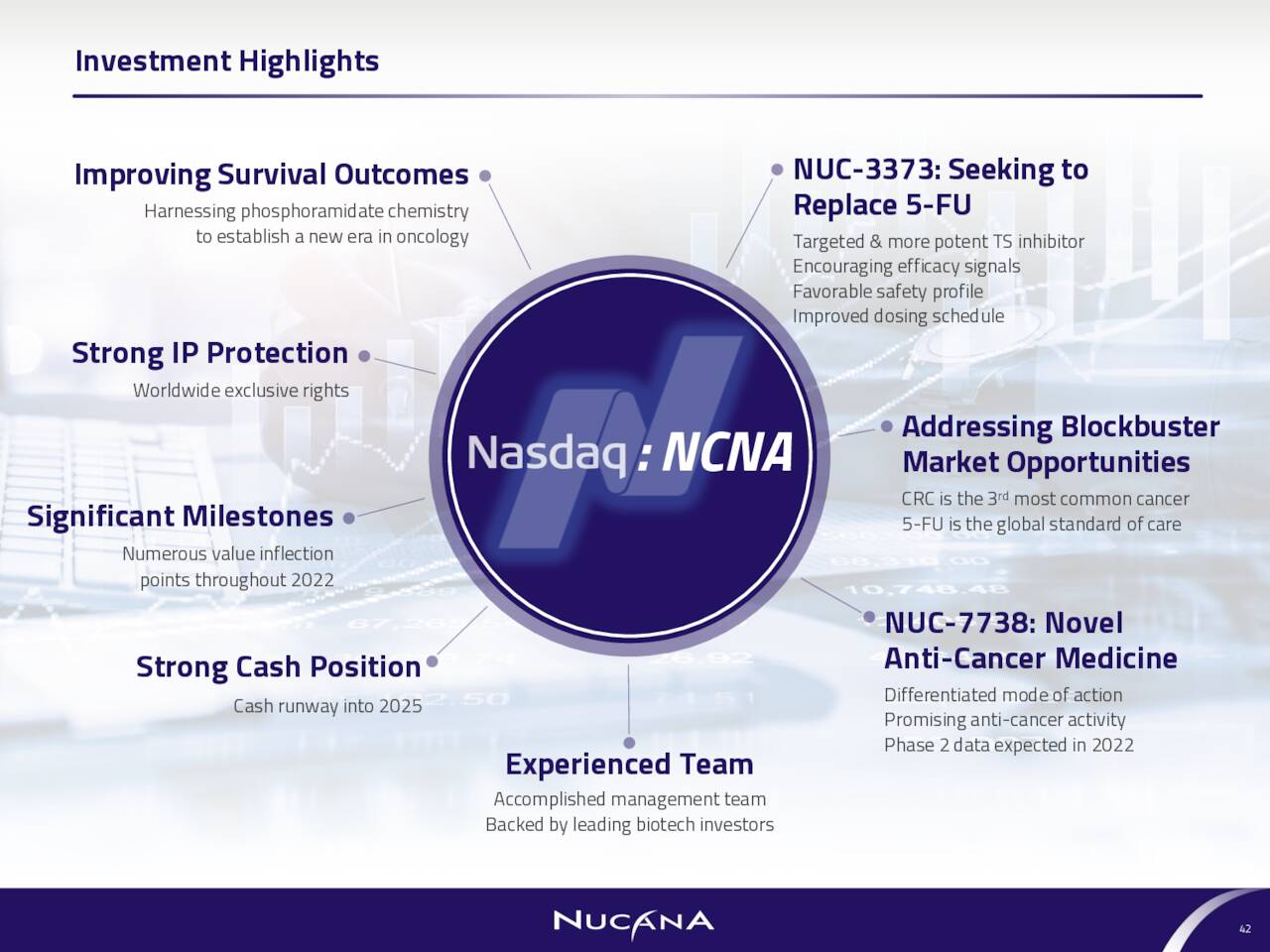

September Company Presentation

This clinical stage biopharma concern is headquartered in Edinburgh, United Kingdom. This oncology-focused company has several products in its pipeline that were created off its proprietary ProTide technology platform. NuCana plc shares currently trade just under $1.50 a share and sport an approximate market cap of $75 million.

Nucleoside Molecule (Company website)

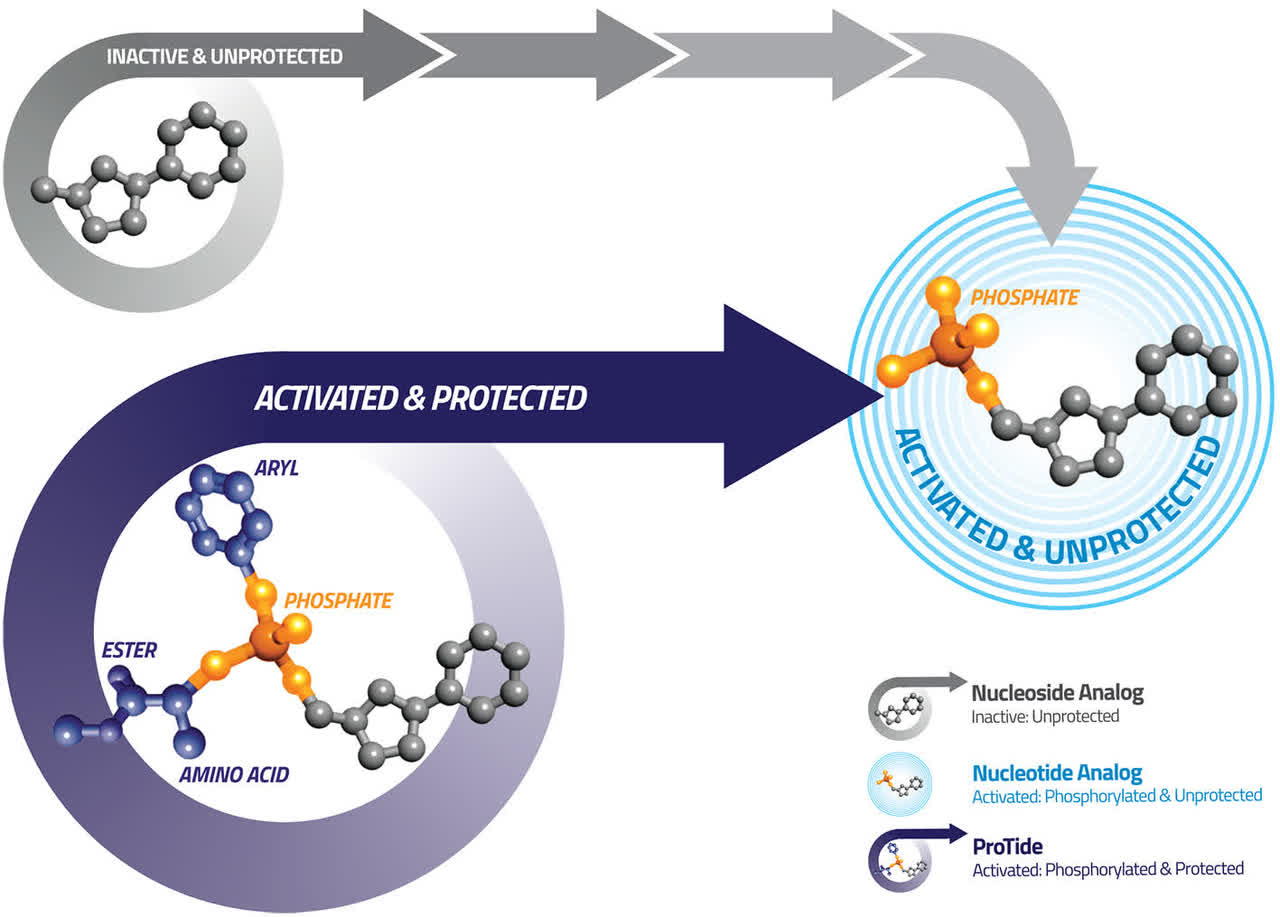

The company is using its proprietary ProTides developmental platform to create drug candidates. These ProTides are designed to overcome the limitations of nucleoside analogs.

September Investor Presentation

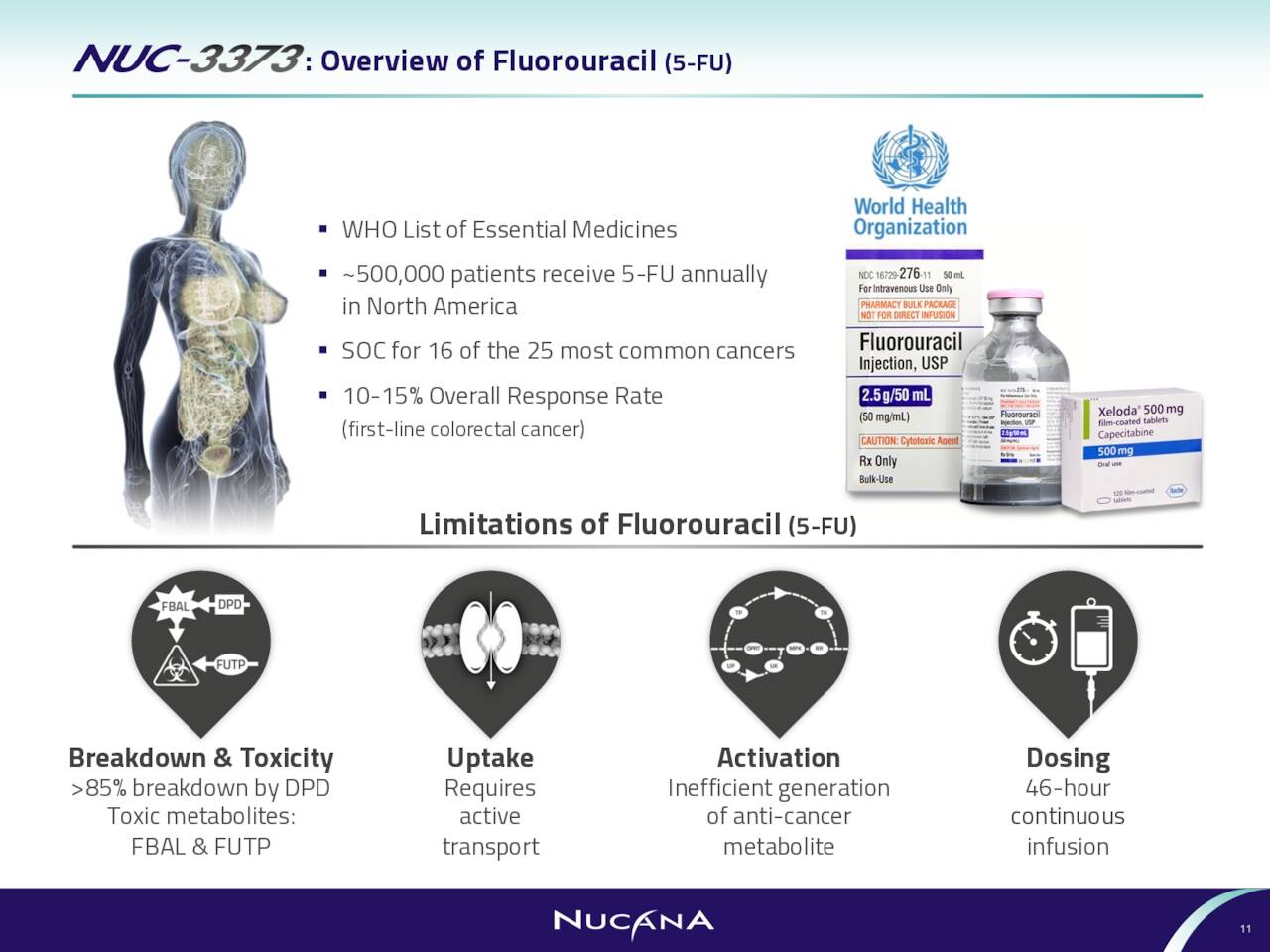

These analogs are widely prescribed chemotherapy agents and work by blocking the replication of cancer cells by supplying faulty DNA and RNA building blocks during the cell division process, thus leading to cell death, or apoptosis. However, there are several major shortcomings with these analogs that limit the efficacy of their use.

Company Website

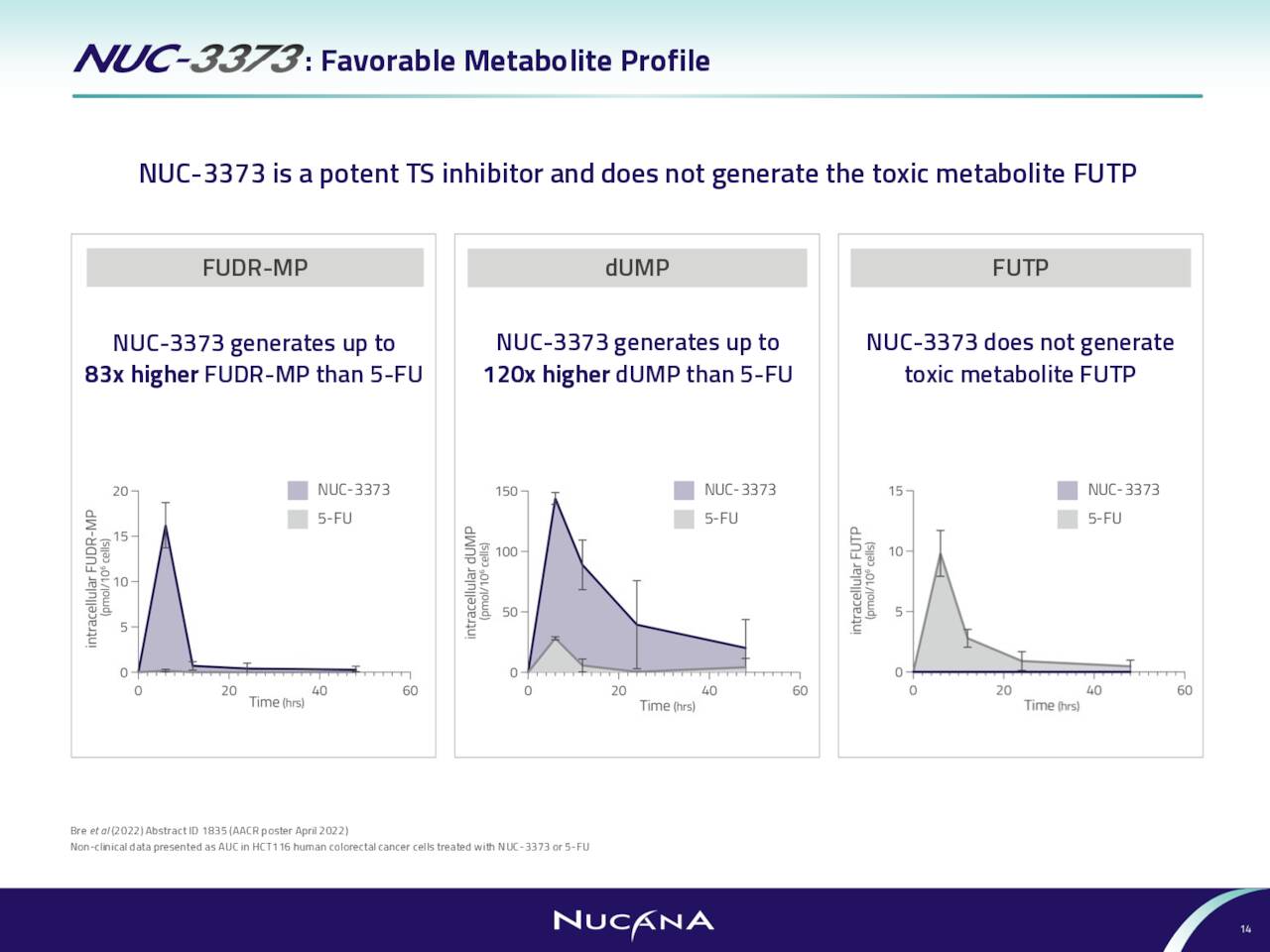

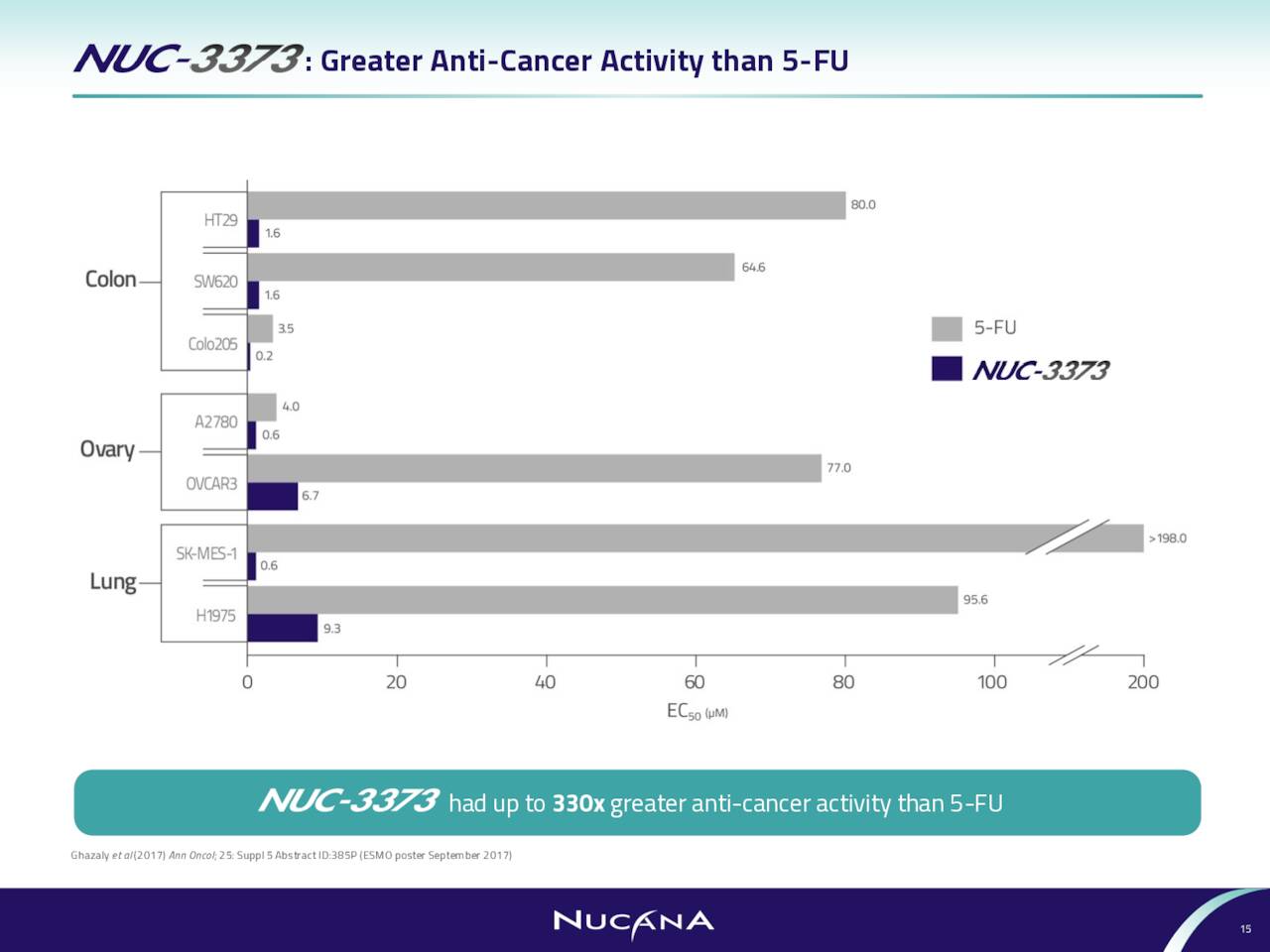

ProTides generate significantly higher levels of the active anti-cancer metabolites inside tumor cells compared to nucleoside analogs. Nucana’s ProTides aim at reducing the generation of toxic byproducts that result from the breakdown of nucleoside analogs like 5-FU and capecitabine. Each ProTide candidate contains parent nucleoside analogs, different ProTide structures, different modes of action, and different target indications.

September Company Presentation

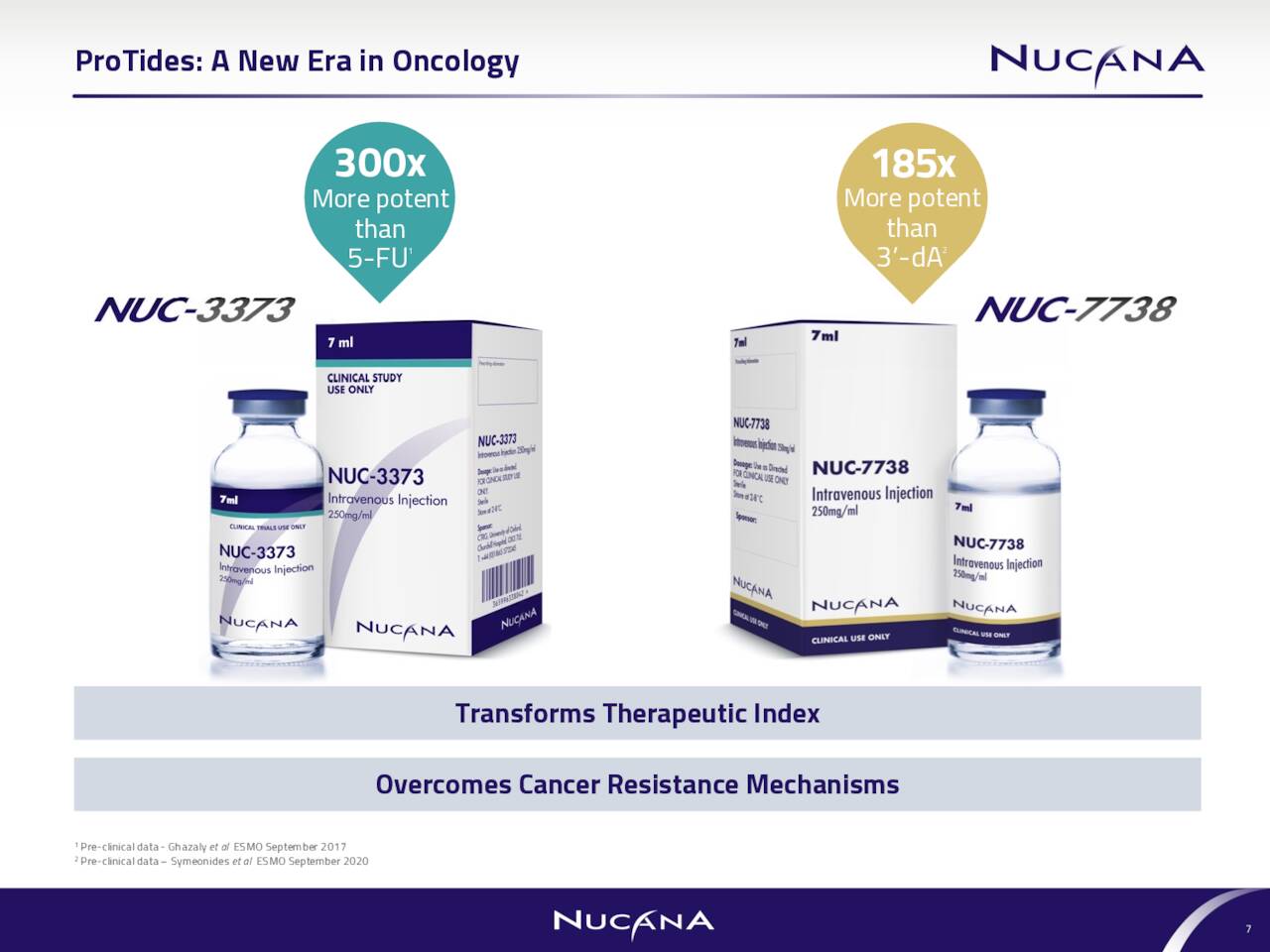

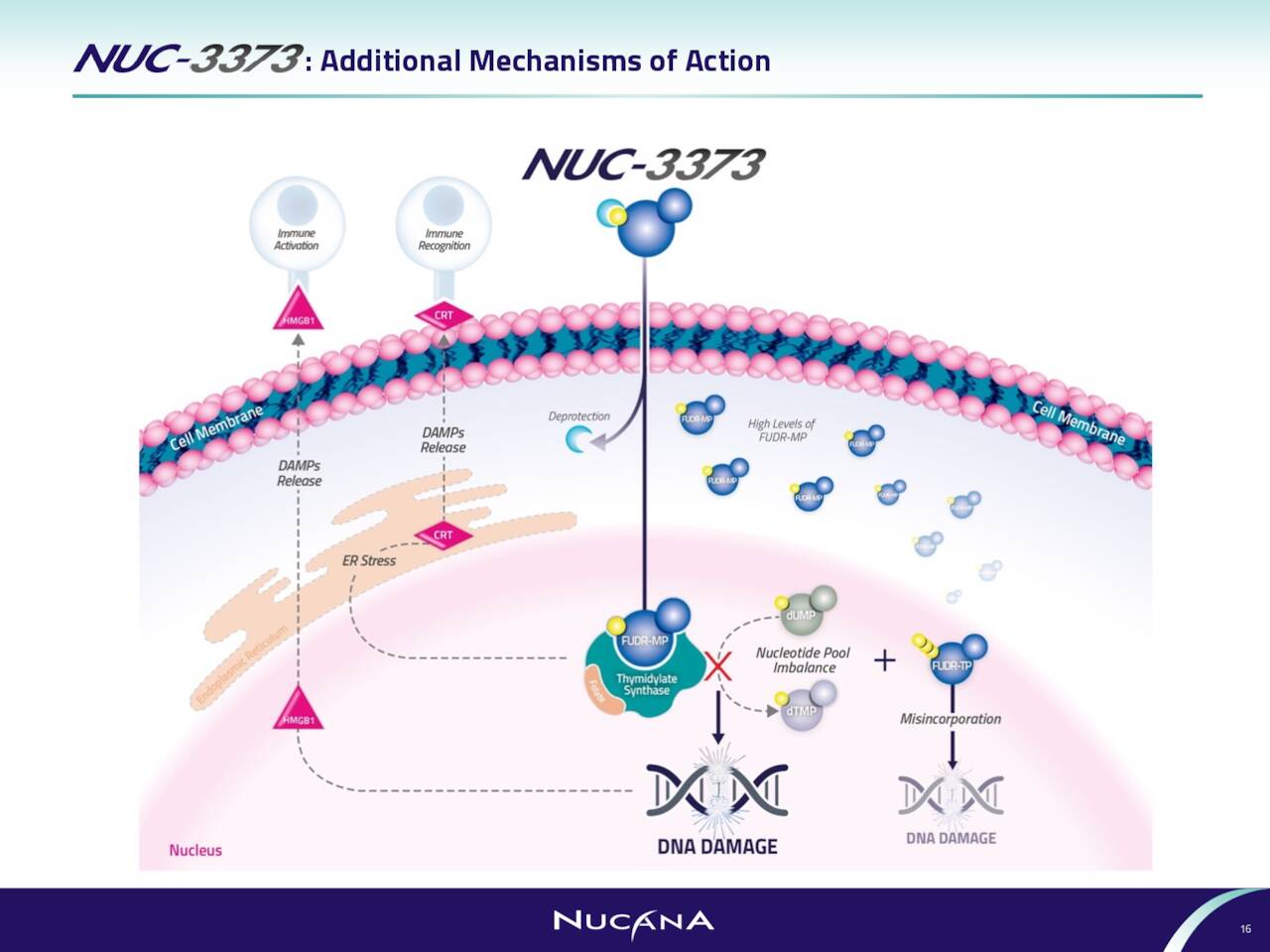

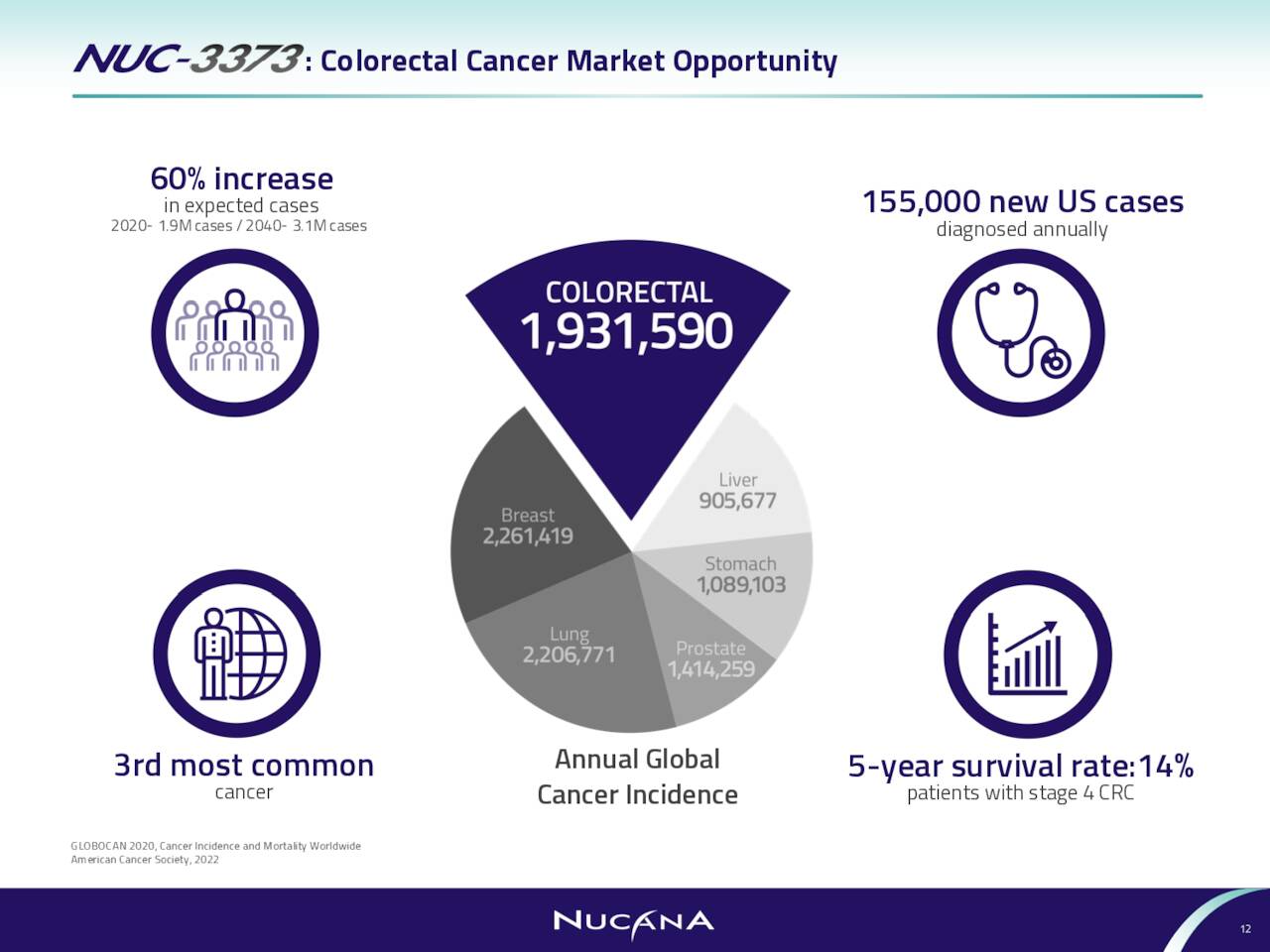

The company currently has two primary compounds in development. The first of which is a compound called NUC-3373. This is a new chemical entity derived from the widely used chemotherapy agent 5-FU.

September Company Presentation

The second key candidate in NuCana’s pipeline is NUC-7738, which is a new chemical entity derived from 3’-deoxyadenosine.

September Company Presentation

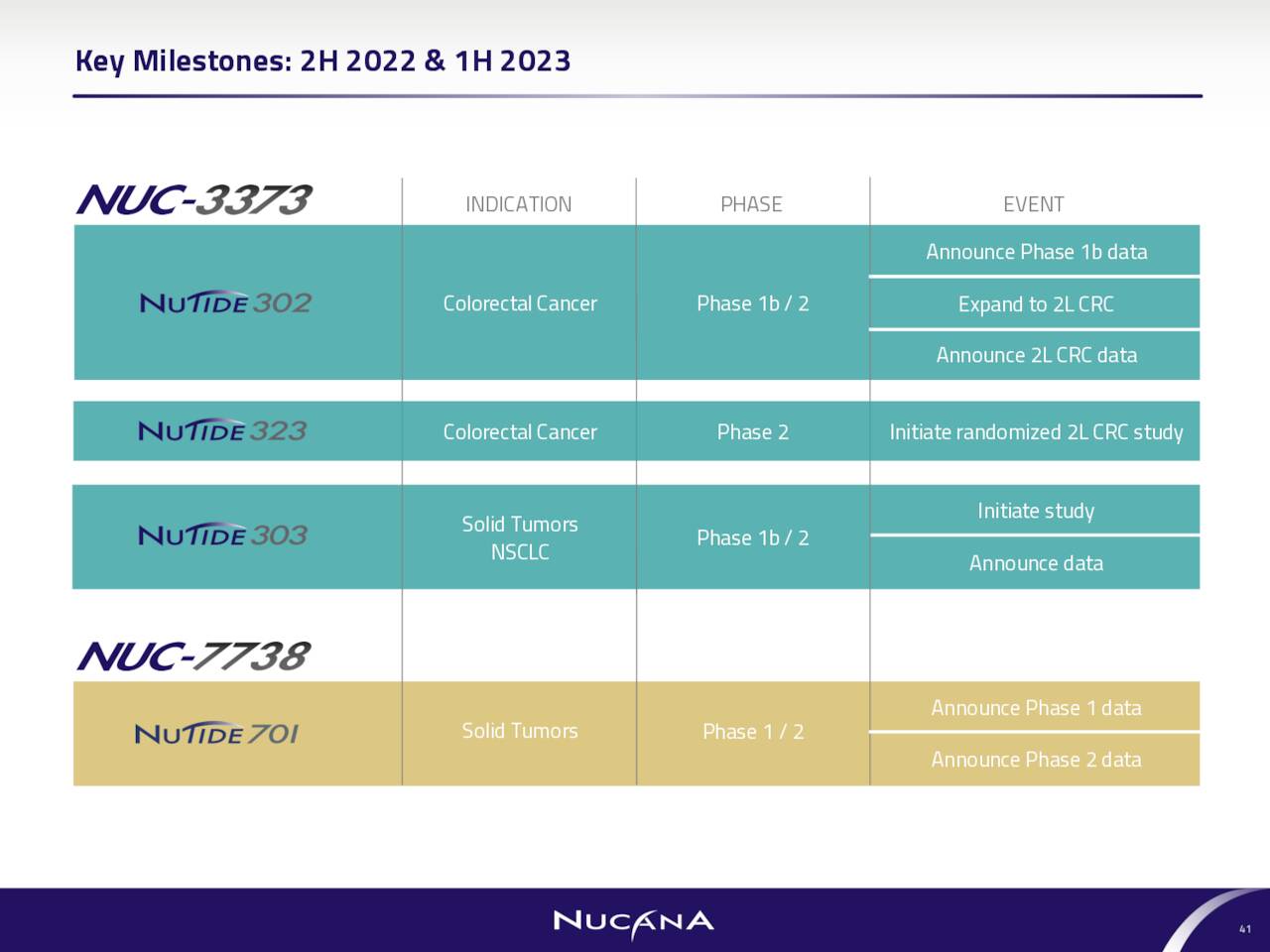

NUC-7738 has recently completed a Phase 1 study in advanced solid tumors. The candidate is currently being investigated in the Phase 2 part of this study. Currently, NUC-3373 is completing a Phase 1 study in advanced solid tumors as well. It is also currently being investigated in a Phase 1b/2 study in advanced colorectal cancer.

September Company Presentation

September Company Presentation

In addition, management to initiate a randomized Phase 2 study in second-line patients with advanced colorectal cancer. They also are planning a Phase 1b/2 study of novel combinations in patients with solid tumors. Early results around NUC-3373 have been promising (above).

Analyst Commentary & Balance Sheet:

NuCana was downgraded to Market Perform from Outperform by Cowen & Co. at the beginning of March. Since then, William Blair, Citigroup ($5 price target, down from $7 previously), Truist Financial ($6 price target, down from $22 previously) and Oppenheimer ($5 price target) have all reissued Buy or Outperform ratings on NCNA.

Less than one percent of the outstanding float is current short. The company ended the first half of 2022 with £46.5 million in cash and marketable securities on its balance sheet. The company’s cash burn rate is approximately £6 million to £7 million a quarter. NuCana has no long term debt.

Verdict:

September Company Presentation

NuCana plc’s developmental platform is targeting potential huge markets if its ProTides technology turns out to be successful. 5-FU has been in existence for decades and still is widely used despite its limitations.

September Company Presentation

Obviously, the company is in the early stages of development but does have some trial milestones on the horizon. Just the potential in colorectal cancer could turn out to be a very large opportunity.

September Company Presentation

All in all, at current trading levels, NuCana seems to be a speculative but compelling “sum of the parts” story. The majority of the stock’s market cap is represented by the net cash on the balance sheet. Add in two intriguing early/mid-stage assets as well as the chance of a significant litigation settlement at some point; NuCana plc would seem to merit at least a small “watch item” position in diversified biotech portfolio.

Life is a long lesson in humility.”― J.M. Barrie

Be the first to comment