Prostock-Studio/iStock via Getty Images

Citigroup (NYSE:C) recently provided bullish guidance on Nu Skin’s (NYSE:NUS) stock based on the premise that the asset is part of a group of household good securities that have been oversold in 2022’s bear market. We disagree with the premise and feel that Nu Skin is a potential value trap due to various growth concerns and its cyclical profile.

Our previous article assigned a buy rating to Nu Skin’s stock because of its lean business model that presents robust income statement prospects. However, we now change our stance to a strong sell as we believe the skincare space is about to get crowded, and Nu Skin could suffer in the current stock market climate as it’s a highly cyclical instrument.

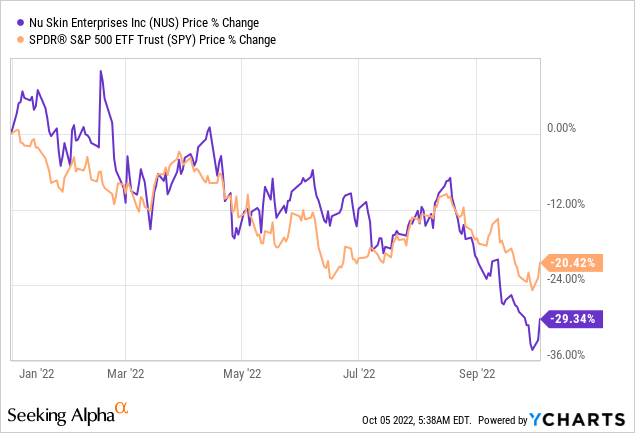

Recent Performance Explained

Nu Skin’s weak year-to-date performance is due to a culmination of factors that stem from both systemic and idiosyncratic events. Firstly, Nu Skin was never going to hold up well in a bear market, in our view, because it is a consumer discretionary stock.

Discretionary stocks exhibit excess sensitivity to the economic cycle as they retail goods that are “wants” instead of “needs”. In essence, Nu Skin missed its second-quarter earnings target (EPS miss of 10 cents) due to economic headwinds, which also contributed to poor stock performance. In addition, secondary effects related to 2022’s bear market exacerbated Nu Skin’s stock performance.

Let’s run through Nu Skin’s latest earnings report to gather a better understanding of its recent operating performance.

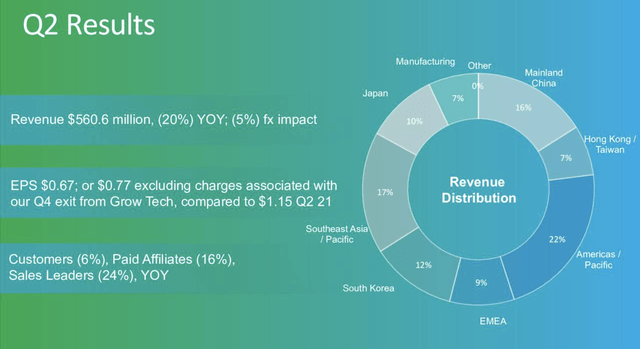

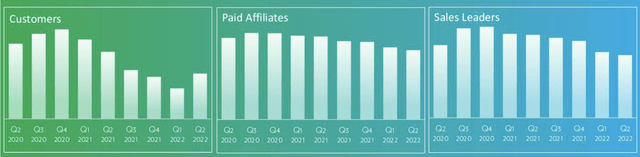

On the positive side of things, Nu Skin did table 20% in year-over-year revenue growth with 5% assistance from functional currency benefits. The company also grew its customer base and its sales affiliates by 6% and 16%, respectively.

However, Nu Skin’s long-term performance is waning. For example, the company’s 5-year CAGR (compound annual growth rate) is at a mere 2.57%, which barely meets the long-term GDP growth trend. I think this is very underwhelming for a growth-stage company.

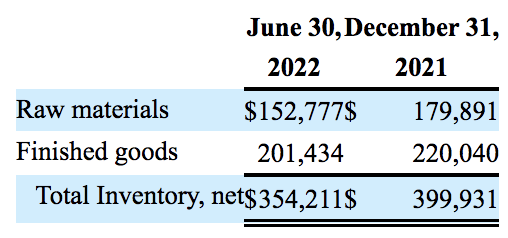

Furthermore, Nu Skin has tapered its inventory. The big concern here is the significant decline in raw materials, which is usually a sign that a company anticipates softer demand. Additionally, Nu Skin’s CapEx has dropped off by 28.34% in the past year, indicating that the company’s investing less aggressively, ultimately denting its expansionary potential. In fact, Nu Skin’s actually scaled down recently by exiting its Grow Tech business activities.

Nu Skin’s 10-Q

Lastly, Nu Skin operates in an industry with low barriers to entry. The affiliate sales business model is being leveraged by many of its rivals (such as Mary Kay and Beautycounter) these days, meaning that crowdedness and broad-based industry price depletion could arise. Therefore, Nu Skin’s competitive advantage could wane soon.

Potential Value Trap

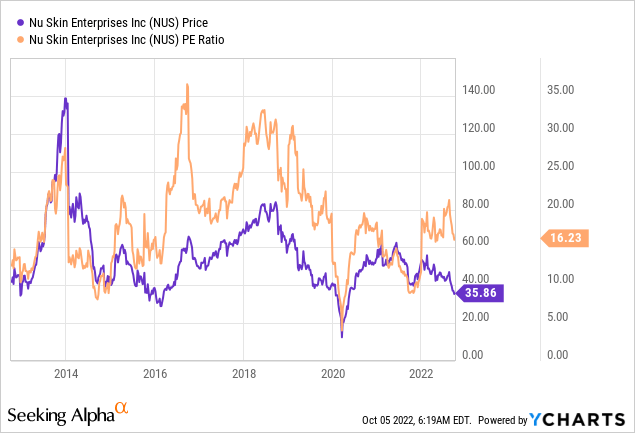

At face value, we could easily conclude that Nu Skin is undervalued. For example, the stock’s trading at only 0.72x its sales, and its price-earnings ratio is at a 16.21% normalized discount. Nonetheless, we must examine a value trap here as Nu Skin’s growth metrics are in dire straits.

| Price-Earnings | 16.16x |

| Price-Sales | 0.72x |

| Price-Cash Flow | 9.32x |

| 3Y CAGR | -1.63% |

| 5Y CAGR | 2.57% |

Source: Seeking Alpha

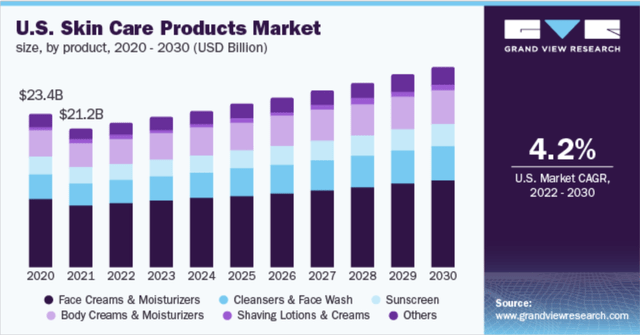

As shown in the table above, Nu Skin’s struggling to scale its business, which could see its market share wane. Nu Skin’s struggling growth is partially due to the slowing skincare market, which is forecasted to proliferate at only 4.2% annually until 2030.

Nu Skin’s recent disconnect between its price-earnings ratio and stock price action adds to the argument. It seems as though the market anticipates the company’s earnings to fade; therefore, price-multiple compression could be possible. In fact, Seeking Alpha’s sampled analyst estimate suggests that Nu Skin’s earnings-per-share could recede by 13.76% by December this year.

A Fair Counterargument

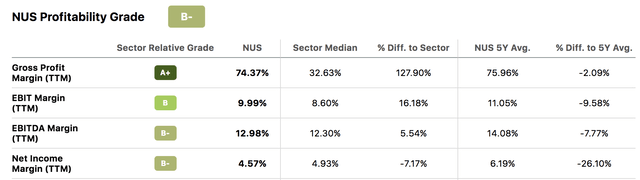

On the flip side, there’s no arguing the fact that Nu Skin’s independent affiliate sales program allows the company to operate with sumptuous profit margins. I mean, a gross profit margin of 74.37% is surreal. In addition, the company holds down a robust EBITDA margin, meaning its intrinsic company value is quite solid.

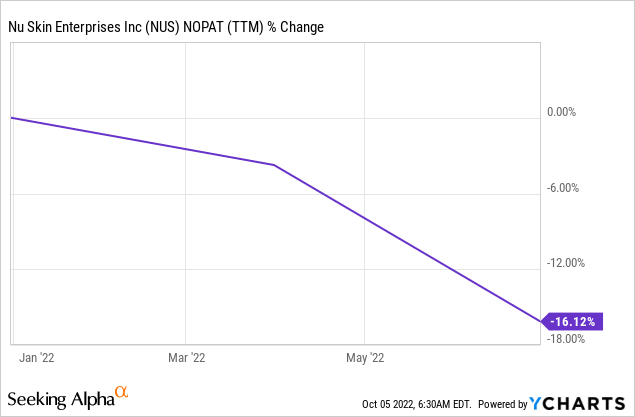

However, there’s clear compression in the firm’s net income. This is due to the aggressive re-investment rates required to stay ahead in an industry with low barriers to entry. The argument can be backed up quantitatively by observing the company’s negative draw on NOPAT, which measures the monetization of working capital.

Another aspect that could act in Nu Skin stock’s favor is its high dividend yield, which is partially due to the stock’s enormous year-to-date downturn. Nevertheless, Nu Skin still pays a great dividend, which is well covered by safety ratios and cash on its balance sheet.

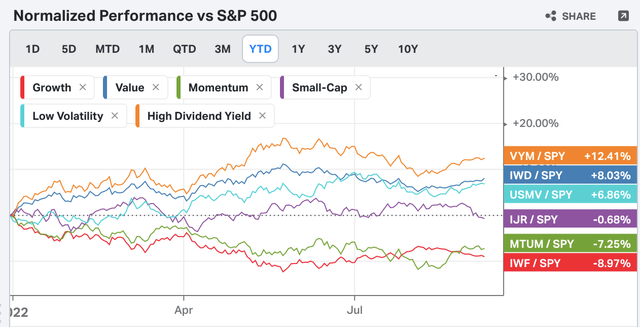

The current risk-off market climate demands high-yielding assets (see the succeeding diagram), possibly presenting a tailwind to NuSkin stock.

| Dividend Yield (fwd) | 4.29% |

| Dividend Coverage | 2.21x |

| Cash Per Share | 7.18x |

Source: Seeking Alpha

Concluding Thoughts

We urge investors to be careful with Nu Skin stock as it’s a potential value trap. There’s no denying the business’s robust profit margins; however, the skincare industry’s slowing growth, and rising competition in the affiliate sales space could devalue Nu Skin’s stock. Furthermore, the company’s re-investment rate has slowed, presenting a risk to future market share. Lastly, Nu Skin’s dividend is appealing and well-covered. Nevertheless, investors must ask themselves if a high dividend yield could outweigh potential price-based losses.

Be the first to comment