imaginima/iStock via Getty Images

When Nu Holdings Ltd. (NYSE:NU) first listed in December of 2021, I noticed that the group of investors that were investing in Nu was of a rather high quality. High caliber, long-term investors. Of course, amongst them was Warren Buffett’s Berkshire Hathaway. As such, I decided to do a fundamental deep dive into the company to find out what it is about, and why is it that these institutional investors are putting money into Nu.

Investment thesis

I am initiating Nu Holdings with a strong buy rating based on the following investment thesis:

- Nu is disrupting the financial services sector in Latin America (“LatAm”), providing a strong value add to customers and SMEs (small and medium enterprises) that have fallen through the cracks as traditional banks do not service them at all or do not service them well. This provides a huge market opportunity for Nu that is for the taking, providing a long-run growth opportunity for Nu.

- Nu is currently one of the world’s largest digital banking platforms, but it is one that is still growing its customer base very quickly at a low customer acquisition cost. It has among the highest customer satisfaction and engagement in the industry.

- Nu is one of the rare high-growth fintech companies that have the ability as well as visibility to achieve profitability as it scales up its customer base, grows ARPAU, and reduces the costs associated with the business. There is compelling evidence that there are incremental improvements.

- Nu’s strong credit portfolio growth, including its credit card and personal loans business, comes with strong credit quality despite the huge growth in volumes. In addition, management is prudent in ensuring a proactive coverage ratio over 90+ NPL to ensure high stability and liquidity in the business across different market cycles.

With that, my target price for Nu, as elaborated below, is $12, implying a 70% upside potential from current levels.

Overview

In 2013, due to his frustration with the banking services he experienced in Brazil, David Vélez, co-founder and CEO of Nu Holdings, decided to partner with Cristina Junqueira and Edward Wible to co-found Nubank. The goal: tackling complexity while empowering people.

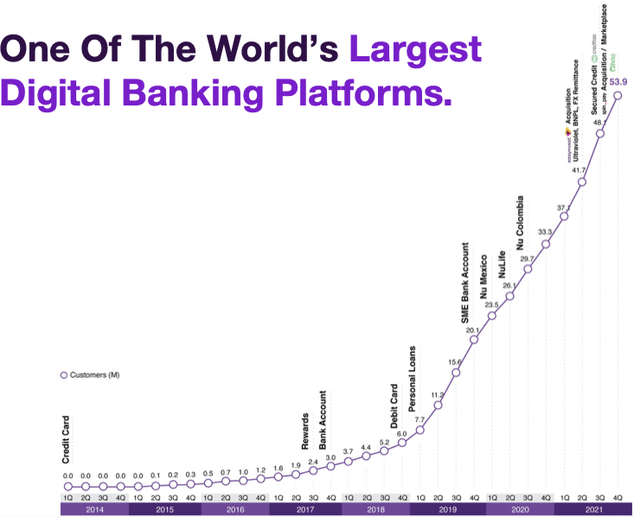

About a year later, in 2014, it launched its first product, Nubank credit card. As can be seen in the picture below, Nu has since added many new products and services and also expanded into the Mexican and Colombian markets. More importantly, as a testament to Nu’s goal, it has seen some serious traction in customer growth, to about 53.9 million customers, including both consumers and SMEs.

Growth of Nu Holdings over the years (Nu PPT)

Huge market opportunity for disruption in LatAm’s financial services sector

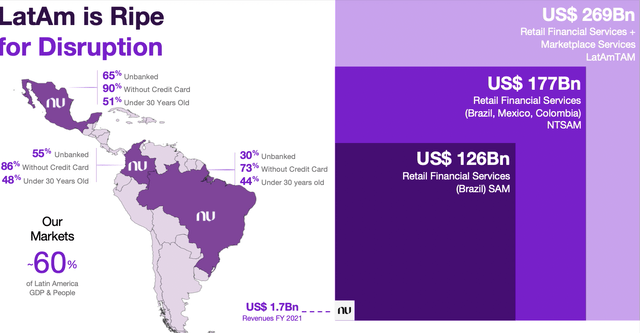

Nu’s core markets are in Brazil, Mexico and Columbia, which make up 60% of the LatAm’s GDP. Within these markets, the proportion of young customers below 30 years old, the age group growing up in the world of fintech, is between 44% to 51%. In addition, the proportion of unbanked consumers that have been left to fall through the cracks in the traditional financial services sector represents somewhere between 30% to 65% of the population.

In addition, consumers without credit cards make up between 73% and 90% of these markets. As such, I think that there is no doubt that Nu could bridge the gap and provide these underserved or even unserved populations in LatAm with the financial services that they need.

Disruption opportunity in LatAm financial services (Nu PPT)

As such, there is an addressable market of $126 billion in the retail financial services sector in Brazil, while its core markets of Brazil, Mexico, and Colombia has an addressable market of $177 billion. This will be where Nu will be focusing its expansion efforts on. The addressable market in LatAm for retail financial services and marketplace makes up $269 billion in an expanded market outlook.

A customer base that is growing and engaged

Nu ended 2021 with a record 53.9 million customers, both consumers and SMEs. Of these, 41.1 million are monthly active customers.

As highlighted earlier, based on Nu’s 4Q21 results, it reported a record number of 53.9 million customers, both comprising of consumers and SMEs.

To break it down further, we see that its core market of Brazil continues to grow decently, with 58% growth in customer growth year-on-year, to 52.4 million customers based on its 4Q21 results. Based on Brazil’s adult population of approximately 168 million people, this means that about 30% of the country’s adult population currently are Nu’s customers. The implication of this to me is that there is still a significant runway for customer growth in Brazil despite the exponential growth in customers since 2014.

Furthermore, as reported by Nu, over 55% of these monthly active customers with at least a year of being a Nu customer have actually made Nu their primary banking account. This is huge for Nu.

In its other markets, Nu has also seen stellar customer growth. Nu Mexico customers as of 4Q21 were 1.4 million customers, which was up 1243% year over year. Based on an earlier 2Q21 Nu Mexico results, it showed that Nu was already the second-largest issuer of new credit cards in Mexico. As such, with the strong showing in customer growth in Mexico in 4Q21, Nu management said that this might suggest that as of 4Q21, it has already achieved the status of being the largest issuer of new credit cards in Mexico.

In Colombia, Nu reached 114,000 customers only 15 months after launching in the country.

To evaluate the quality of its customer base, we look towards Nu’s Net Promoter Score (NPS). In fact, Nu just reported in its 4Q21 results that it has achieved NPS levels of at least 90 for the markets it operates in, Brazil, Mexico and Colombia. NPS, to me, is regarded as the gold standard metric for evaluating and measuring customer experience. It measures the loyalty of customers to a particular company. With a maximum score of 100, the higher the score, the higher the quality of customer experience that was achieved.

For Nu to achieve a score of 90 is a remarkable feat in my view and demonstrates the very positive customer experience it brings relative to traditional banking experiences. More importantly, with a score of 90, this implies that Nu’s customers are loyal and likely to be promoters of the company who will continue to use the products and services offered by Nu and even refer it to others.

A business model poised for substantial earnings generation

As with all high-growth fintech companies these days, the ability to make the business a profitable one, or at least the visibility of it, is crucial. Without any ability to generate profits, these high-growth companies are in effect cash burning machines that might likely question the going concern assumptions of most financial models in the future. As such, I place a strong emphasis on earnings ability. If a high-growth company shows that it is capable of achieving this, it should be deserving of a premium on its valuations.

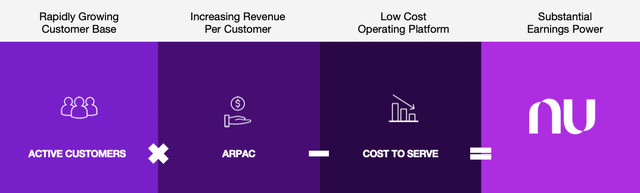

Nu’s strategy to profitability is rather straightforward. To achieve substantial earnings power, it will need to grow its revenues whilst reducing its costs. To increase its revenues, this comes from growing active customers and also increasing the Average Revenue Per Active Customer (ARPAC). To decrease its costs, Nu focuses on lowering the cost to serve, and thus, ultimately operates a low-cost platform.

Nu’s business model to generate substantial earnings power (Nu PPT)

Active customer and ARPAC growth

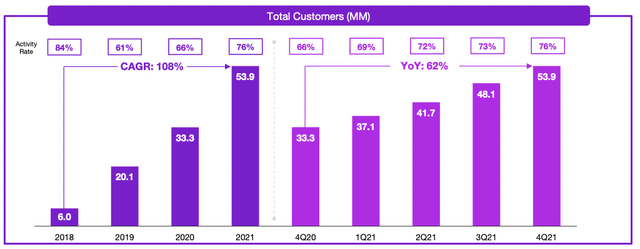

Nu’s customer growth has been excellent over the past 4 years, with a 108% CAGR over the period. Even in the most recent quarter, the 62% growth in customers shows Nu’s continued momentum in acquiring new customers.

Nu’s strong customer acquisition momentum (Nu PPT)

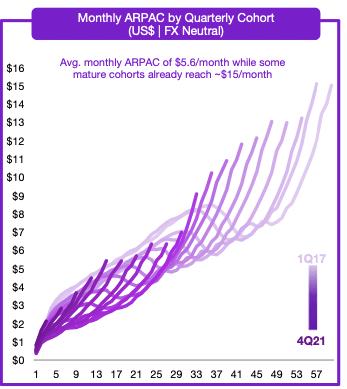

In addition, we can see that Nu is successful in increasing monthly ARPAC for each cohort, with the average ARPAC achieving $5.6 per month while the most mature cohorts have achieved about $15 per month. This was largely driven by the increase in products used by each active customer over the years as Nu rolled out more products, like bank accounts in 2017, debit cards in 2018, personal loans in 2019 and NuLife in 2020.

Increase in Nu’s ARPAC (Nu PPT)

Lowering costs

Nu’s strategy to improve operating leverage and unleashing its operating leverage potential comes from 4 cost advantages it can leverage on:

- Low customer acquisition cost

- Low cost to serve

- Low cost of risk

- Low cost of funding

With its NPS of more than 90, Nu has an enviable position of having one of the lowest customer acquisition costs in the industry as most of the customer growth comes organically, through word of mouth. As such, Nu has an advantage over peers in terms of having a lower customer acquisition cost.

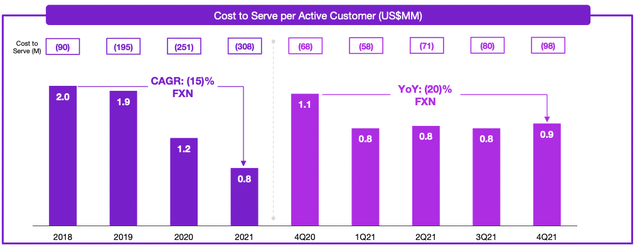

In addition, Nu has been able to decrease its cost to serve over time. This is evident from its ability to lower the cost of serve per customer by 20% YOY in 4Q21. As such, its operating leverage potential can easily be increased with the increasing customer growth we are seeing in its core markets. Over the longer run, Nu saw its cost to serve per customer drop by 15% CAGR from 2018 to 2021.

Nu’s cost to serve continues to decline (Nu PPT)

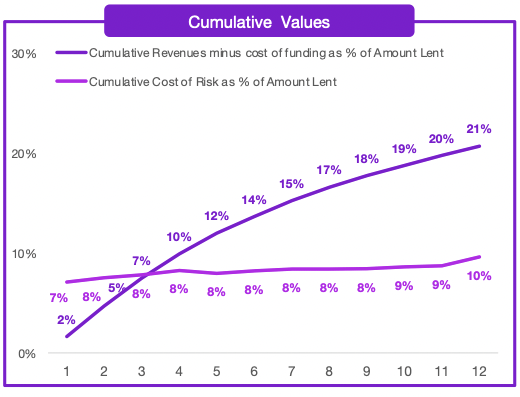

Lastly, Nu also targets a lower cost of funding and cost of risk. As illustrated below, we can see that the cost of funding and cost of risk has been kept low even as the number of customers and amount of lending has increased.

Nu’s declining cost of funding and cost of risk (Nu PPT)

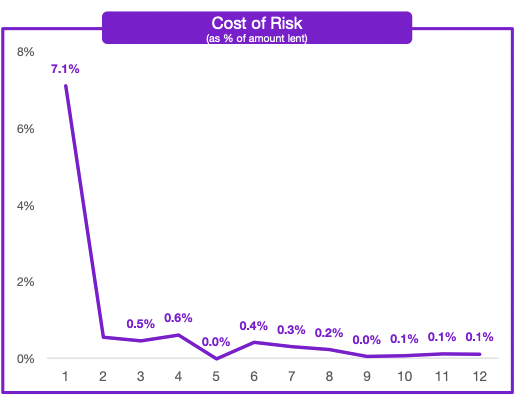

Zooming into the cost of risk, we can see that the cost of risk has decreased even as the amount of lending business has increased.

Nu’s declining cost of risk (Nu PPT)

Strong growth with an emphasis on strong asset quality

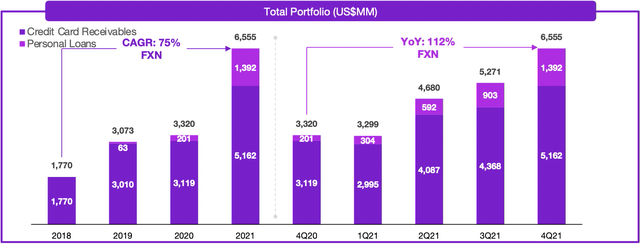

Nu’s credit portfolio has grown considerably, at a CAGR of 75% from 2018 to 2021. The large bulk of it comprises of credit card receivables, but personal loans, which was launched in 2019 is increasingly driving the growth of the portfolio as it makes up a larger mix in the credit portfolio.

Strong growth in Nu’s credit portfolio (Nu PPT)

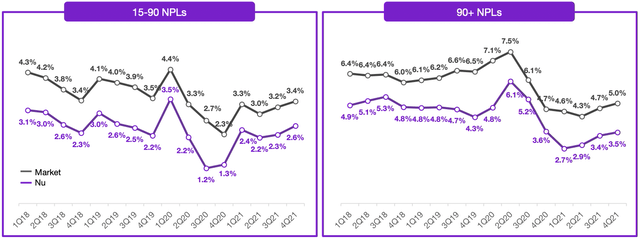

That said, there is always the risk that this strong growth in the credit portfolio and personal loans might come at the expense of increasing delinquencies, measured by NPLs. As can be seen by the 90+ NPLs, there is a spread of 1.5% between the market and Nu as of 1Q18, and that spread has been maintained at 1.5% as of 4Q21. This is despite the fact that the credit portfolio has grown from $1,770 million as of Dec-18 to $6,555 million as of Dec-21, as shown above. I look at the 90+ NPL mainly because these are the non-performing loans that are more than 90 days past due and represent loans that are probably unlikely to be collected.

Strong growth not at the expense of asset quality (Nu PPT)

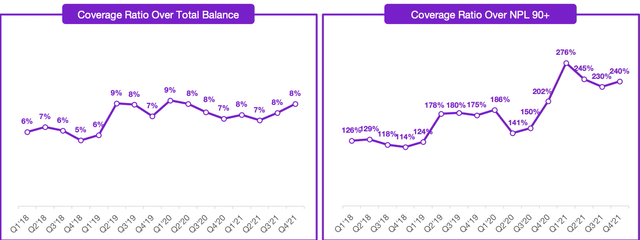

Furthermore, Nu maintains a rather prudent coverage ratio across cycles, in my view. In 1Q18, the coverage ratios over NPL of 90+ was at 126%, while as of 4Q21, this coverage ratio over NPL of 90+ was doubled to 240%. This represents ample prudence to cover for the 90+ NPLs. Similarly, its coverage ratios over its total balance have steadily increased from 6% in 1Q18 to 8% in 4Q21.

Nu’s prudent coverage ratios across cycles (Nu PPT)

As highlighted in the 4Q21 results, management said a higher coverage ratio was warranted given, firstly, how fast the loan portfolio is increasing relative to the credit portfolio, and secondly, the continued normalization of NPLs to the pre-Covid levels. In my opinion, the fact that management is proactive in increasing the coverage ratios over the 90+ NPLs in anticipation for these two issues highlighted above indicates to me that the management takes a calibrated prudent approach to risk and asset quality. This is an important advantage for Nu, in my view, especially across credit cycles.

Valuation

My target price for Nu is $12. This implies a 70% upside to current price levels. This is based on a mix of DCF methodology and comparable-based methodology. Specifically, on the comparable method, this group recently traded between a range of 6x to 12x 2022F revenues, and since Nu’s revenue growth is significantly higher than most competitors in the group, and with Nu’s ability to be profitable, I think that it warrants a premium in the multiples.

Nu is currently trading at 17.9x 2025F P/E, with a growth adjusted P/E ratio, or PEG ratio of 0.24x. In the nearer term, as I expect Nu to turn to profitability in FY2023, the P/E ratio for 2023F and 2024F are 109x and 31x respectively, while EPS growth for 2024F is expected to be around 250%.

Risks

Brazil macroeconomic environment

Going into the Brazil presidential election this year, there are many uncertainties plaguing the Brazilian macroeconomic environment as the fiscal scenario in Brazil continues to be challenging, along with rising inflation (10% increase in 2022) as well as rising interest rates. A weaker economic environment causes a potential slowdown in growth and/or a worsening of asset quality.

Competition

Competition to Nu comes in several fronts, both from emerging fintech players in Brazil each with advantages in certain segments of the financial industry, while large incumbent banks may also adapt to the new digital environment and create digital platforms that can effectively compete with Nu.

Conclusion

I conclude with a strong buy rating on Nu, with a target price of $12, representing about a 70% upside from current levels. Nu is likely to be a leading fintech in LatAm with a long-term compounding opportunity as it continues to grow. As highlighted, Nu has a large addressable market opportunity in its core markets of Brazil, Mexico and Colombia, a rapidly growing customers base that is highly engaged and satisfied, a business model that is poised for significant earnings potential, and resilient asset quality as it continues to grow its credit portfolio.

Be the first to comment