CHUNYIP WONG/E+ via Getty Images

Thesis

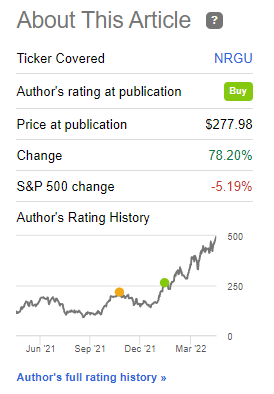

The BMO MicroSectors U.S. Big Oil Index 3X Leveraged ETN (NYSEARCA:NRGU) is an exchange-traded note that has as its objective giving an investor three times the daily performance of the Solactive MicroSectors U.S. Big Oil Index. In January, we wrote an article where we were bullish on NRGU given the incipient structural bull market in commodities. NRGU is a leveraged product, thus catered to sophisticated investors generally, and not suitable for buy-and-hold portfolios. When buying a leveraged product, an investor needs to set clear profit targets and exit the trade when those targets are met. A look at the historic performance for NRGU showcases that the product can have very deep drawdowns that can exceed -50%.

While we do not think oil prices and implicitly oil equities are going to collapse in the near future, we do nonetheless feel that after a +78% return in three months, we would like to take profit on the NRGU product and wait for a market pull-back to re-enter the trade. We are therefore happy to record our 78% profit for the trade and move to Hold on NRGU, eying an oil market pullback driven by the ceasing of the Ukraine conflict as a good re-entry point for the ETN.

Performance

Our proposed trade for NRGU is up more than +78% since our Buy rating.

Author January 2022 Rating (Seeking Alpha)

An investor who would have purchased NRGU after our article in January would have almost doubled their money. This outstanding result stems from a rally in energy companies’ equities and the 3x leverage embedded in the product. Leveraged ETNs are tools generally geared towards sophisticated investors since they magnify both gains and losses. To that end, we can see the tremendous pull-back for NRGU in December 2021 after being up more than +50% for the year.

NRGU 1-Year Performance (Seeking Alpha)

NRGU is a great trading tool, but do not think of it as an instrument that you can hold forever and that can generate tremendous returns. Commodities and commodity equities are cyclical instruments, and when looking at long term results for NRGU, we can clearly see why 3x leveraged products should only be used as trading tools.

5-Year Total Return (Seeking Alpha)

During the Covid crisis, the vehicle lost almost all of its value due to the leveraged return profile.

Holdings

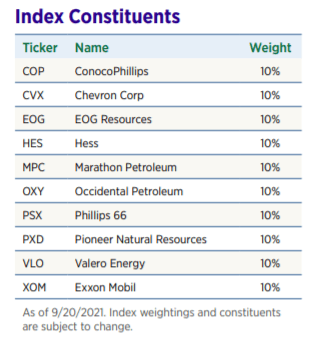

The fund mirrors the Solactive MicroSectors U.S. Big Oil Index, which has the following composition.

Index Composition (BMO)

The portfolio is currently composed of the largest North American Oil & Gas majors, with both integrated operations as well as more specialized players. Note that no European Oil & Gas majors are present in this portfolio, meaning that the returns for the product have been insulated from the Ukraine/Russia conflict and the significant write-downs we have seen for the likes of Shell (SHEL) and BP (BP) on the back of their Russia business.

We also like the equal weight 10% allocation for each name. This type of portfolio build ensures that the product constantly captures the upside for the laggards, rather than being overweight the best-performing momentum names. We feel that in the energy space the balance sheet mend and longer term performance is a two-horse race, where some of the better managed companies having already reached extremely robust valuations, while some of the laggards will catch up via performance as oil prices stay at elevated levels.

Composition Risk Factors

A) Yield – the fund does not offer any dividend yield, hence it is very different than holding a portfolio of the above ten names outright.

B) Financing Charges – given its 3x leverage, the fund has to pay certain financing charges to Bank of Montreal. Absent any moves in the underlying portfolio, an investor will lose money given price erosion from those charges.

C) Zero Recovery – given 3x leverage on daily index move, the ETN can lose its entire value, unlike holding the stocks outright.

D) Call Right – Bank of Montreal can call the notes prior to maturity date, which would mean that if an investor is underwater from a total return perspective, that loss would suddenly become realized.

Conclusion

NRGU is an ETN from the leveraged product suite. The vehicle offers 3x the daily return of ten large North American Oil & Gas companies. NRGU has had an outstanding performance in 2022, being up more than +78% since our Buy rating in January 2022.

As with any leveraged product, NRGU is not a buy and hold instrument but a trading tool to be used for shorter time-frames. We are therefore happy to record our 78% profit for the trade and move to Hold on NRGU, eying an oil market pullback driven by the ceasing of the Ukraine conflict as a good re-entry point for the ETN.

Be the first to comment