PixelsEffect/E+ via Getty Images

Intro

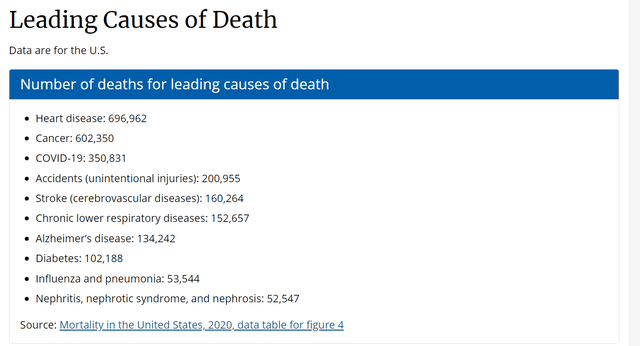

Medical attention has been focused on the coronavirus since the first infections were discovered in December 2019. It has caused many deaths and many disruptions to lives worldwide. Chronic diseases are flying under the radar and receive much less attention from health care providers and patients, although they have been the silent killers. Diabetes, the most prevalent chronic disease, affects more than 400 million people globally and directly caused 1.5 million deaths, according to the World Health Organization’s data for 2019. Both Type 1 and Type 2 diabetes require daily or weekly insulin injections to keep the blood sugar level in check. Novo Nordisk (NYSE:NVO), the world’s leading producer of diabetes therapies that owns nearly 50% of the insulin market, is constantly trying to find new and effective treatments and, eventually, a cure.

NVO is also an expert in obesity. Globally, more than 1.9 billion adults are overweight, and over 650 million are obese. NVO is gaining important ground in the obesity treatment market with their new drugs, originally developed to treat type 2 diabetes, which have recently been shown to be effective for weight loss in non-diabetic patients. In addition, obese patients tend to develop type 2 diabetes and other comorbidities, such as atherosclerotic cardiovascular and inflammatory liver disease, for which NOVOB DC has a few treatments in the pipeline.

Thesis

Looking forward, Novo Nordisk is in a position to capitalize as the leading provider of insulin and a robust pipeline for obesity and its comorbidities. Below is the detailed analysis.

#1 Strong progress in Obesity

Obesity is the epidemic of the modern world. Once considered a high-income country problem, overweight and obesity are now rising in low- and middle-income countries, particularly in urban settings. The World Health Organization (W.H.O) estimated that the number of obese adults and children has nearly tripled since 1975. More than 39% of adults over 18 years old were overweight, and 13% of them were categorized as obese. This will likely continue at least into the near future, with younger people being serious victims of the disease. 39 million children under 5 are overweight and obese, as are 340 million people between 5 and 19.

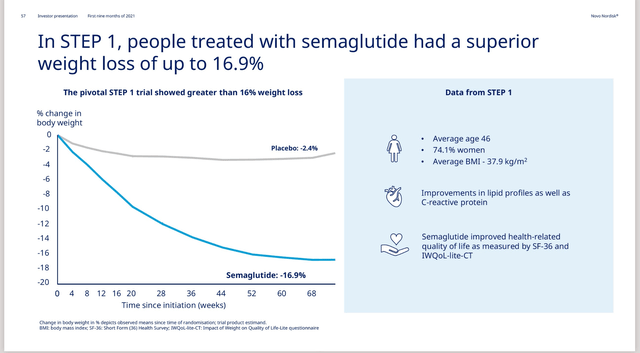

Obesity treatments are the key to Novo’s long-term growth. The company should receive approval for European marketing of the highly anticipated obesity drug Wegovy in early 2022. Results for Wegovy are extremely significant and promising.

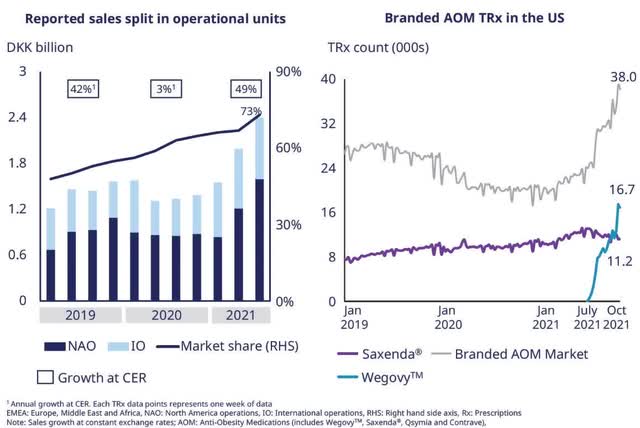

Wegovy was approved by the FDA in 2Q 2021 and is expected to continue growing as it is still new to the market. It has already dramatically overshadowed Saxenda, NVO’s previous weight loss drug.

A Firm leader in Diabetic therapies

The number of people with diabetes quadrupled between 1980 and 2014, from 108 million to 422 million worldwide. New patients are now emerging from low and middle-income countries more rapidly than from high-income ones. Diabetes was the eighth leading cause of death in 2020.

Of the total diabetic population, greater than 90% suffer from type 2 diabetes, primarily caused by excess body weight and physical inactivity. Type two diabetes was formerly known as an adult disease but is increasingly found in children.

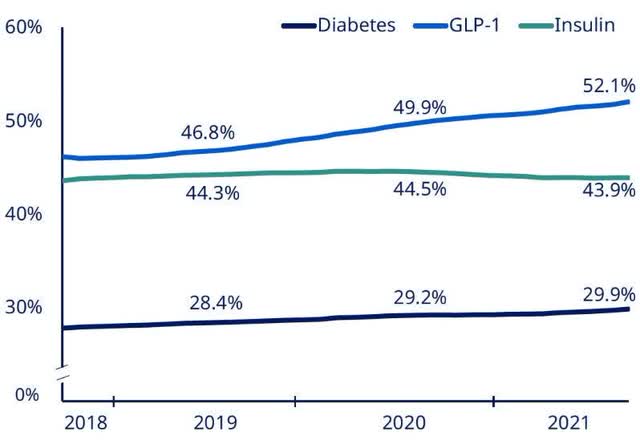

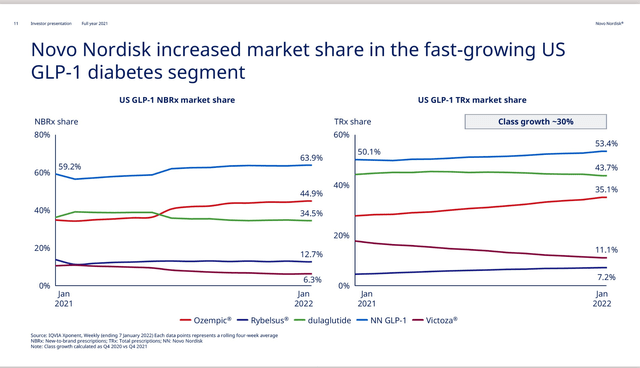

NVO is a leader in the diabetic treatment market with several medications, here is a chart of their market share as of Q3 2021.

More promising news is seen if you look at their market share in fast-growing markets.

Special attention should be paid to Ozempic, which in both cases gained ~5% market share YoY.

Ozempic

Insulin icodec (a long-lasting form of insulin administered as an injection once a week) is central to Novo’s 2022 clinical news flow. Ozempic is a once-weekly noninsulin medication that mimics the action of a hormone called glucagon-like peptide 1, activating the GLP-1 receptor and prompting your body to generate insulin.

Ozempic only works in people with type two diabetes, as those with type one lack the ability to produce their own insulin altogether. It has been shown to help the body naturally regulate blood glucose levels.

Ozempic carries an upside potential and helps the drug maker reassert its dominance amid the challenge from Eli Lilly’s Trulicity, the primary competitor to semaglutide. The results appear promising as Ozempic performed better in phase 3b at improving blood sugar and promoting weight loss.

Since Ozempic was just recently granted the approval for the 2mg dose, there is no thoroughly convincing evidence it will do better than what is already on the market. Early results are a good place to look though, and investors should keep an eye on relevant news.

Tresiba

Unlike Ozempic, Tresiba is a form of insulin rather than a GLP-1 agonist.

Novo’s Tresiba has the best profile in the basal (long-lasting) insulin class, showing benefits in head-to-head trials versus Sanofi’s Lantus and Toujeo. Tresiba showed both a larger decrease in blood sugar levels as well as a decreased risk of hypoglycemia. Tresiba attained FDA approval in 2015 but was more recently launched in China in 2018. Thanks to its strong label as well as high and immediate demand, it has secured a place on the national drug reimbursement list, which could result in higher sales for the region.

While not new like Ozempic, the relative strength over its competitors displayed here provides a moat.

#3 Robust Pipeline for diabetes comorbidities

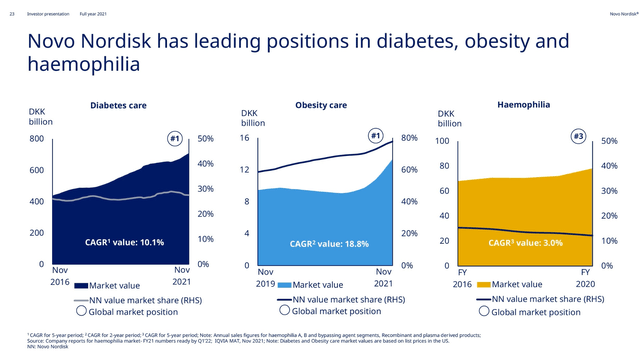

Recent studies of more than 1.3 million people show that 98% of adults with diabetes type 2 have at least one comorbid chronic disease, and almost 90% have at least two. Researchers found the most common comorbid conditions were hypertension (82.1%), overweight or obesity (78.2%), hyperlipidemia (77.2%), chronic kidney disease (24.1%), and cardiovascular disease (21.6%). The trend does not appear to be slowing down either, with the market value exploding across the board.

Another important thing to note when reading this chart is that the NVO value is not in dollars but in market share, so, particularly in obesity, NVO is getting a larger piece of a growing pie.

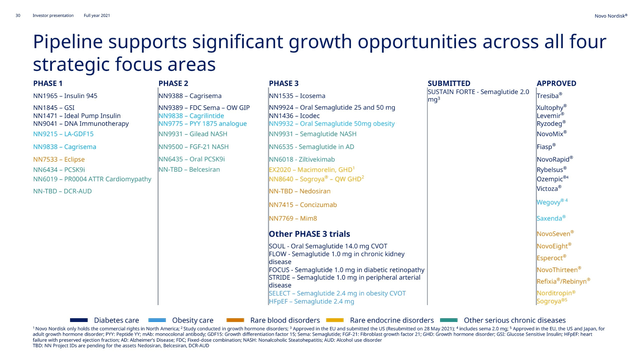

That just encompasses drugs already on the market, let’s look at their pipeline.

Many of their drugs are in late-stage clinical trials and have shown promising results in the earlier stages.

Those considering a position should closely watch for important approval dates, especially those in “other serious chronic disorders,” as the application of semaglutide could be further than the market has currently priced in.

Conclusion

Novo’s expertise in diabetes treatment provides a large amount of cash flow and aids the expansion into the treatment of obesity and other related conditions. The company is likely to continue to expand its market share in diabetes with Ozempic, and the other potential applications for semaglutide are worth getting excited about. Sales continue to grow while the future looks more and more exciting, and for that reason, NVO is worth buying.

Be the first to comment