SilverV

Thesis

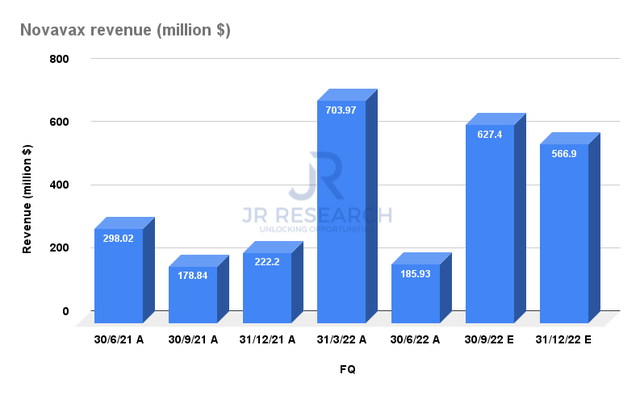

Novavax, Inc. (NASDAQ:NVAX) Q2 card stunned the market with a print that came in well below expectations. The company also revised its FY22 guidance to $2.15B (midpoint), down significantly from its previous $4.5B (midpoint) guidance. We posited in our earlier articles that Novavax could face significant hurdles in meeting its revenue estimates, given the falling demand for COVID vaccines.

The hammering post-Q2 has also sent NVAX close to its June lows, which saw robust buying support that led to a remarkable rally. While we think the sentiments over NVAX remain highly pessimistic given its weak execution, there are reasons to be optimistic at the current valuation.

Despite its late entry into the COVID vaccines market, it has delivered 73M doses globally, including 23M since the start of Q3’22. The company also highlighted that it recorded $400M of revenue since July 1, which flowed over to Q3 from Q2’s delays. Therefore, we are confident that H2’22 should turn out much better for Novavax than H1, helping lift investors’ sentiments further.

NVAX’s valuation of 0.95x NTM revenue is also attractive compared to its peers. Therefore, we believe the current opportunity is attractive, with $1.38B in cash and equivalents, representing 42.5% of its market cap.

Accordingly, we revise our rating on NVAX from Sell to Speculative Buy.

Novavax Q2 Earnings – Disastrous, But Look Ahead

Novavax posted revenue of $185.93M in FQ2, which came in well below the company’s expectations. CEO Stan Erck articulated:

Our revenue for the quarter came in well below anyone’s projections. And with respect to all of 2022, we’re expecting to fall short of our earlier projections. The shortfall was a result of a couple of issues, one of which is short-term, the timing of our shipments to Europe. The other is a broader issue and will take some time to work through, and this is our changes in expectations from 2 major markets, the US and the COVAX Facility. (Novavax’s FQ2’22 earnings call)

The company clarified in the call that it has already recognized $400M in revenue since July 1, which it failed to deliver before June 30 for its Europe distribution. Therefore, the disaster seen in its Q2 print should not be repeated moving forward.

However, waning demand from the US and COVAX led to the significant revision of its FY22 guidance to $2.15B (midpoint), down from its prior guidance of $4.5B (midpoint). The challenges were partly due to Novavax’s late entry and the surge in supply, coupled with the difficulties faced by COVAX in its distribution to lower-income countries. Erck accentuated:

Globally, and particularly with respect to COVAX, there was a surge in supply. And when coupled with challenges COVAX had with the distribution into low- and middle-income countries, this limited the need for them to order contracted product from us and other vaccine manufacturers. In the case of the U.S., I believe we were late to the market, and US vaccination was driven by what was available and shown to work, mRNA vaccines. We are now projecting that we will have no new revenues in ’22 from the US and from COVAX. Originally, we had planned to have revenue from these 2 markets arising from the sale of 110 million and 350 million doses, respectively. (Novavax earnings)

Therefore, we are confident the issue of waning demand and oversupply has been addressed sufficiently by Novavax. Furthermore, the revision in guidance has de-risked the market expectations significantly, which is constructive to help lift sentiment subsequently if Novavax executes well.

Novavax reported revenue of $889.9M in H1’22. Based on its revised guidance, the company expects to deliver $1.26B in H2, including the $400M recognized since July 1. The revised consensus estimates suggest revenue of $1.19B, coming in below the company’s guidance. Therefore, we believe the bar has been set lower by the Street, which also helps Novavax to outperform.

Investors should also note that Novavax remains confident in meeting its contracted demand, even though unforeseen delays have clouded the visibility into their delivery schedules. Management highlighted:

It’s important to note that while some of our delivery schedules have been shifted into 2023, total demand under most APAs remains unchanged. When coupled with global oversupply, this drove a shift in demand for our vaccine from the second quarter into the second half of the year and into 2023. It is important to note that our total contracted demand remains mostly unchanged. (Novavax earnings)

Is NVAX Stock A Buy, Sell, Or Hold?

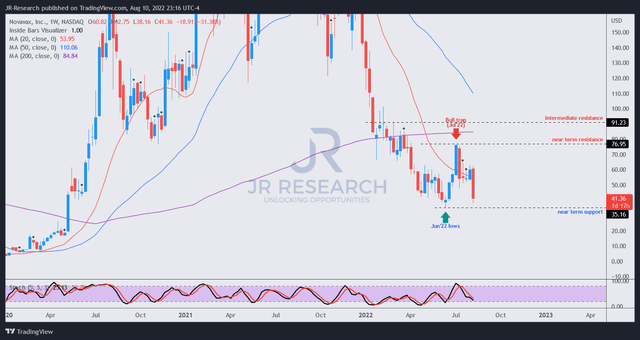

NVAX price chart (weekly) (TradingView)

We urged investors in our previous article to avoid buying into the surge in July, as we observed a potential bull trap could form, even as Novavax secured its EUA.

The resulting bull trap formed the following week, and NVAX has tumbled about 44% since our warning.

However, we believe the current sell-off should be supported by its June lows, which should help the stock form a constructive base. Furthermore, the market sentiments in biotech stocks have improved markedly, which should also undergird NVAX’s recovery momentum.

NVAX last traded at an NTM revenue multiple of 0.95x. Coupled with $1.375B in cash and equivalents accounting for 42.5% of its market cap, we are confident its June lows should hold.

As a result, we revise our rating on NVAX from Sell to Speculative Buy, with a price target of $60 (implied upside of 45%).

Be the first to comment