hapabapa/iStock Editorial via Getty Images

Last August, I wrote a popular SA article (GM Is Undervalued If You Consider Cruise) describing the unique opportunity to invest in General Motors (NYSE:GM) because of the value of its Cruise subsidiary. Since then, Cruise has made significant progress, which has improved the value of Cruise for GM even more.

- The US National Highway Traffic Safety Administration recently issued final rules eliminating the requirement for highly automated and self-driving vehicles to need driver controls. This ruling was crucial to Cruise because of its strategy of a custom-built Cruise Origin without any driver controls.

- Several months ago, GM presented its timeline for Cruise, which is the basis of some exciting financial projections. These show the potential for Cruise that, if realized, can increase the value of GM stock 3X to 5X in the next few years.

- Finally, GM acquired Softbank’s share of Cruise, increasing its ownership to 80%. Cruise also changed its leadership last December, replacing its CEO. These two changes indicate that GM does not intend to spin-off Cruise, enabling GM to capture more value from Cruise.

In this article, I will explain the implications of these, and I will also translate GM’s timeline for Cruise into financial projections. Let’s start with a brief update on autonomous ride services.

Autonomous Ride Services (ARS)

I’ve written about autonomous vehicles in previous Seeking Alpha articles with much reader interest, discussion, and disagreement, including an introduction and overview of AVs: Autonomous Vehicle Investment Roadmap – Part 1: Investment Opportunity Overview. As I said before, autonomous vehicles will redefine transportation as we know it today, just as online shopping redefined retail. If you can correctly anticipate how transportation will be redefined, you can achieve a significant investment advantage.

Here is a brief update on autonomous ride services:

- The technology behind autonomous ride services is proven. Now it’s being perfected. Waymo (GOOG) (GOOGL) has been providing paid passenger rides using driverless cars in Chandler Arizona for more than a year. Cruise has started to offer free driverless passenger rides in San Francisco.

- ARS follows a proven technology/capital-intensive business strategy replacing a labor-intensive business (ridesharing). It will cost less than half per trip of current ridesharing, and the lower price is expected to expand the market.

- It now appears that ARS will initially compete with ridesharing services like Uber (UBER) and Lyft (LYFT), and it will be initially introduced in major cities.

- Importantly, it now looks like Cruise has caught up with Waymo, which was previously the clear leader in this new market.

- There are seven expected competitors in this new market: Waymo, Cruise (GM), Argo (F), Motional, Aurora/Uber (UBER), Zoox (AMZN), and potentially Apple (AAPL).

- Next year, 2023, now looks like the year for the initial roll-out of ARS, and San Francisco now looks like the first market, which will have two major competitors. San Francisco is one of the largest ridesharing markets.

Cruise vs. Waymo Strategies

Cruise and Waymo are the leaders in this market, but their strategies are different. Waymo was the first company to launch its autonomous ride service successfully, Waymo One, by retrofitting Fiat Chrysler Pacifica hybrid minivans and, subsequently, Jaguar I-Pace electric vehicles. This enabled it to get to market faster and refine its self-driving technology. It launched its service in Chandler, Arizona, which has a more accessible road system.

Waymo is now using driverless autonomous vehicles to provide rides in San Francisco to its employees. The pathway for launching ARS tends to be: autonomous rides with safety driver present, then driverless rides for employees, followed by free driverless rides to the public, and finally, the launch of a paid driverless service to the public. Waymo will be the first company to provide ARS in two significant markets.

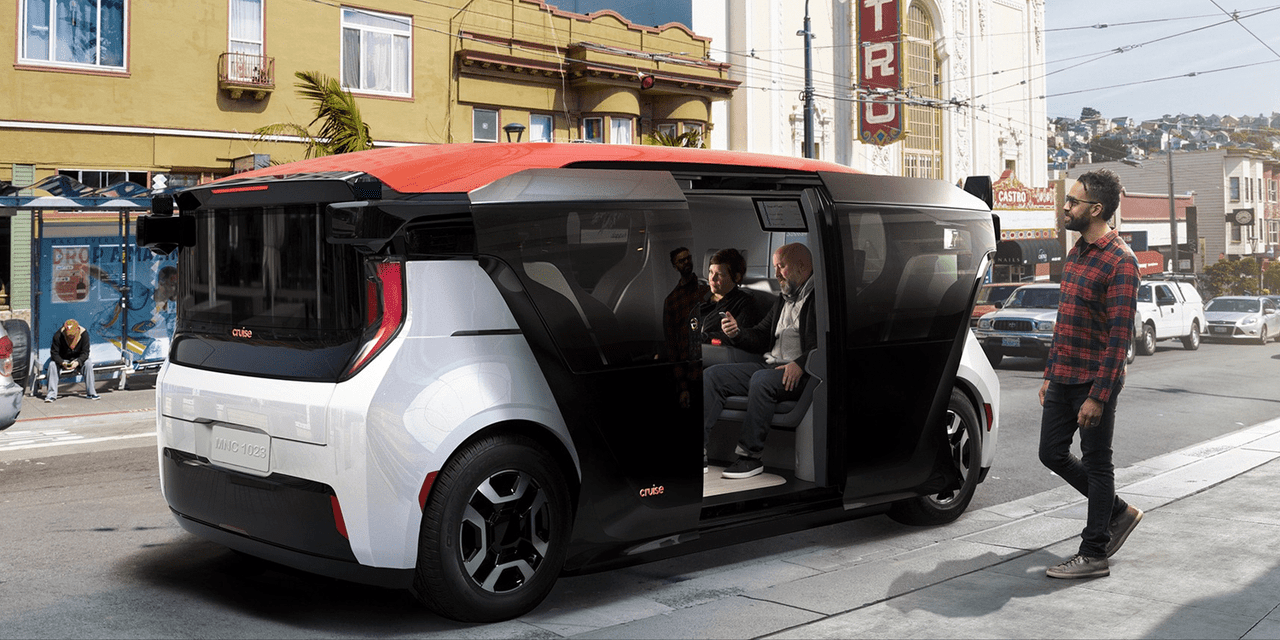

On the other hand, Cruise targeted San Francisco as its initial market, with much more complicated road systems, although lower speeds. The notable strategic difference from Waymo is that Cruise invested in developing a custom-built vehicle for autonomous ride services, the Cruise Origin. This delayed Cruise’s market entry but played to GM’s traditional strengths in designing and manufacturing vehicles. A custom-built vehicle provides many advantages, including lower cost because it doesn’t need driver controls, increased room for passengers since there is no driver, lower operating costs because it is designed for higher mile usage and a distinct design that can be attractive to passengers.

The Cruise Origin (Cruise)

Cruise also has a version of the Origin for use in autonomous delivery, although that opportunity is not discussed here.

Although Waymo had a significant time-to-market advantage, it didn’t develop a custom build ARS vehicle, and now it appears that it may need to do that. It also found that major cities provide the best initial markets for ARS, not suburban areas like Chandler.

In December, Waymo announced that it would collaborate with Geely to integrate the Waymo Driver into a version of the new mobility-focused, all-electric Zeekr vehicle, designed in Sweden specially for autonomous ride-hailing.

Waymo Zeekr (Waymo)

The Zeekr vehicle’s design prioritizes the comfort, convenience, and preferences of Waymo One riders. This rider-first vehicle features a flat floor for more accessible entry, easy ingress/egress thanks to a B-pillarless design, low step-in height, generous head and legroom, and fully adjustable seats. In many ways, it’s similar to the Cruise Origin.

Waymo disclosed that it will begin to introduce these fully autonomous Zeekr vehicles on US roads within the Waymo One fleet in the years to come. This implies that it will be a couple of years behind Cruise with custom-designed ARS vehicles.

Cruise Timeline

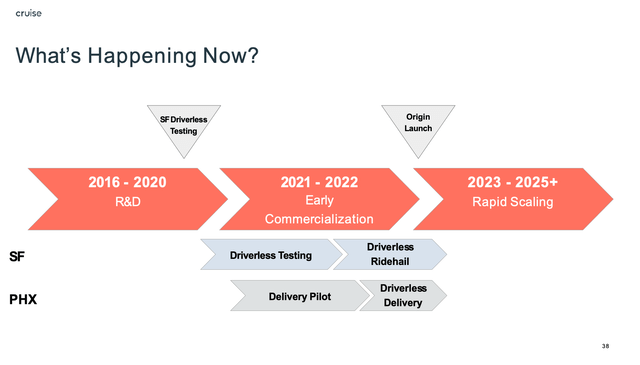

GM disclosed its expected timeline for Cruise in an investor presentation. GM made three notable points: where it is now in its launch of ARS, the expected ramp-up of its Cruise fleet, and its expectations for market size based on different price points.

Three-Phase Development & Launch

GM provided guidance on where Cruise was in the launch of its ARS. As the chart below shows, Cruise completed most upfront R&D and is in the Early Commercialization phase of three phases for its roll-out of autonomous ride services and autonomous delivery. San Francisco is its initial market for ARS, while Phoenix is for autonomous delivery.

Cruise Launch Phases (GM Investor Presentation)

It intends to start offering ARS in San Francisco later this year and then start ramping up its service when it introduces Origin in the next year. It expects to manufacture thousands of Origins in 2023.

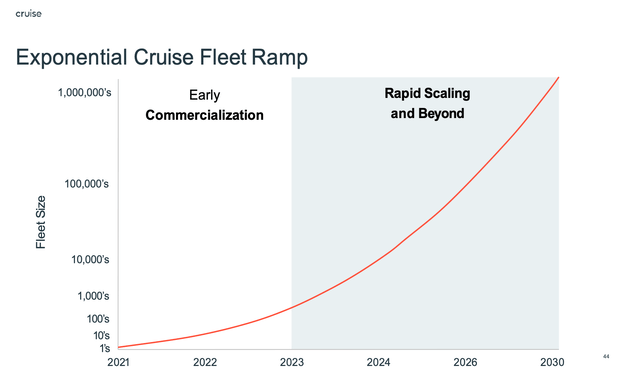

Fleet Forecast

Cruise intends to increase the size of its fleet exponentially, as can be seen in the chart below. It projects tens of thousands of vehicles by 2024-2025 and more than 200,000 by 2026 or 2027. It goes on to estimate more than 1 million by 2030. This roll-out requires a significant investment in Origin AVs, but Cruise already has the financing for this. It received a $5 billion line of credit from GM’s financing business to purchase these vehicles from GM. This funding should be enough to fund the cost of 50,000 to 70,000 Origin vehicles. After this point, additional vehicles should be self-financing.

Cruise Fleet Forecast (GM Investor Presentation)

This chart provides a crucial forecast since the number of ARS vehicles will be the critical metric for revenue projections. I’ll translate this forecast to potential revenue and profit in the next section.

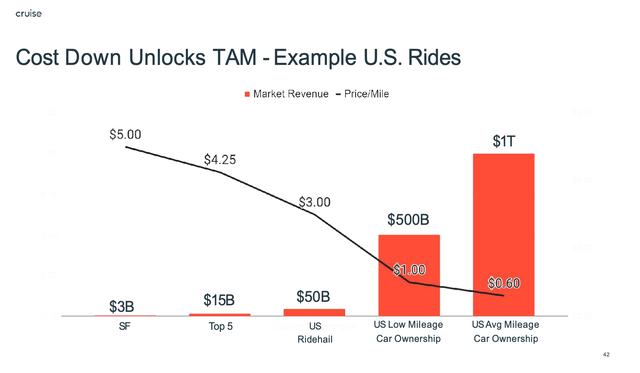

Market Expansion and Price Sensitivity

GM expects continued cost reduction will be critical to its market expansion. It uses $5 per mile as the current estimate for ridesharing in San Francisco but claims significant cost advantages of $1.50 per mile in the early days of the Origin. This is similar to my previous cost estimates. It estimates a market opportunity in San Francisco alone of $3 billion.

Cruise TAM Estimate (GM Investor Presentation)

Cruise intends to lower prices as it expands. It will grow into the top 5 cities, expanding the market to $15 billion, and then more broadly throughout the US for a $50 billion market. At $1 per mile (which is feasible at higher volumes), ARS begins to displace some car ownership for those who don’t drive very much, and the market expands to $500 billion. Eventually, it sees the US ARS market growing to $1 trillion.

Translating GM’s Cruise Fleet Estimates to Revenue and Profit Projections

How do GM’s forecasts translate into potential revenue and profit for Cruise? This requires projections using a possible business model for autonomous ride services. There are always skeptics of any business model projections, but it’s the only way to try to look at the future for a new business. It’s also the same way companies like Cruise develop their internal plans.

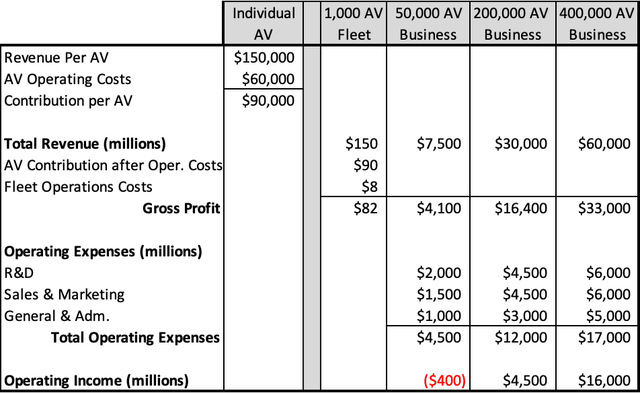

The following chart projects the potential business model for an ARS business. It has three levels: revenue and cost per AV, the additional fleet management costs, and overall business costs.

Based on projections from Autonomous Vehicles: Opportunities, Strategies, and Disruptions, the typically expected revenue per ARS vehicle will be approximately $150,000 per year. This estimate comes from averaging various alternative utilization and pricing assumptions with an average price of $1.81 per mile, much lower than most ridesharing prices. Annual operating costs are estimated at $60,000, including fuel (electric), maintenance, insurance, and depreciation.

Additionally, there will be costs for managing the fleet, including dispatch staff, fleet facility costs, support costs, local marketing, etc. For 1,000 vehicles, fleet operations costs compute to be $8 million on fleet revenue of $150 million and a contribution of $90 million after the vehicle costs. Estimated Gross profit for 1,000 AVs is $82 million, increasing proportionately with the size of the fleet.

ARS Model Projections (Autonomous Vehicles: Opportunities, Strategies, and Disruptions)

The third level of the business model adds the overall operating expenses for R&D, Sales & Marketing, and General & Administrative costs. These are projected based on typical operating expense ratios but are considered conservative.

Overall, the business model projects revenue of $30 billion with a $4.5 billion operating income at 200,000 ARS vehicles, increasing to $60 billion and $16 billion at 400,000 ARS vehicles.

Translating this to GM’s projections for Cruise Fleet Ramp-up achieves the following approximations:

| 2025/26 | 2026/27 | 2028 | 2030 | |

| AV Fleet | 50,000 | 200,000 | 400,000 | 1 million |

| Revenue | $7.5 billion | $30 billion | $60 billion | $150 billion |

| Oper. Income | (0.4) billion | $4.5 billion | $16 billion | $40 billion |

So, what would be the implied value of a highly profitable $30 billion business projected to almost double every two years? It would probably be a few hundred billion dollars, or 4-5 times GM’s market value today.

Is this projection realistic? Here are a couple of checkpoints. GM’s TAM projection estimates the market at $50 billion for the US ride-hail market, increasing to $500 billion with the migration of low-mileage car owners. This is projected when the price per mile reduces to $1 per mile from $3 per mile. Uber projects a $1 trillion (25X growth) in the US market when the price per mile from autonomous ride services goes to $1 with autonomous ride services. The current US market for ridesharing is approximately $150 billion. ARK Invests projects a $990 billion global market at prices above $1 per mile, eventually increasing to $5 trillion at much lower prices.

GM’s 2025 estimate of 50,000 ARS vehicles would equate to approximately 4.2 billion miles, which would only be a small percentage of the estimated US ridesharing market of more than 200 billion miles.

NHTSA Final Rules On Driver Controls

As mentioned, Cruise decided to design and build a unique autonomous vehicle for ride services. If successful, it gives Cruise some critical competitive advantages. Vehicle costs are significantly lower because it will eliminate driver controls (steering wheel, pedals, the systems for linking driver controls, mirrors, etc.). It also provides much more passenger space and comfort. Finally, it has a uniquely attractive design difference. However, the risk in this strategy was that it required federal approval to eliminate driver controls.

This risk is now removed. Federal vehicle safety regulators have cleared the way to produce and deploy truly driverless vehicles that do not include manual controls such as steering wheels or pedals. Here is a summary of that rule:

SUMMARY: This final rule amends the occupant protection Federal motor vehicle safety standards (FMVSSs) to account for future vehicles that do not have the traditional manual controls associated with a human driver because they are equipped with Automated Driving Systems (ADS). This final rule makes clear that, despite their innovative designs, vehicles with ADS technology must continue to provide the same high levels of occupant protection that current passenger vehicles provide. The occupant protection standards are currently written for traditionally designed vehicles and use terms such as “driver’s seat” and “steering wheel,” that are not meaningful to vehicle designs that, for example, lack a steering wheel or other driver controls. This final rule updates the standards in a manner that clarifies existing terminology while avoiding unnecessary terminology, and, in doing so, resolves ambiguities in applying the standards to ADS-equipped vehicles without traditional manual controls. In addition, this final rule amends the standards in a manner that maintains the existing regulatory text whenever possible, to make clear that this rule maintains the level of crash protection currently provided occupants in more traditionally designed vehicles. This final rule is limited to the crashworthiness standards to provide a unified set of regulatory text applicable to vehicles with and without ADS functionality.

The only minor change GM may need to make is to its seat configuration. The ruling further states:

This final rule only applies to ADS-equipped vehicles that have seating configurations similar to non-ADS vehicles, i.e., forward-facing front seating positions (conventional seating). Thus, NHTSA focused on conventional seating in this rulemaking, noting that additional research is necessary to understand and address different safety risks posed by vehicles with unconventional seating arrangements (e.g., rear-facing seats or campfire seating).

The initial Cruise Origin design has a rear-facing front seat, enabling passengers to face each other. If it needs to adjust this seating layout, it should be a small change. And in my opinion, some early riders on autonomous vehicles may be uncomfortable riding backward anyway.

Change in Ownership & Leadership

GM sold equity in Cruise in 2018 to Softbank for $2.25 billion, with an additional $1.35 billion due upon commercial deployment. It later sold another $2.75 billion to Microsoft (MSFT), institutional investors, and Walmart. With outside ownership, it was likely that Cruise would be spun off from GM earlier rather than later to provide the upside gains and liquidity that outside investors expected.

This changed recently, though. GM acquired Softbank’s equity ownership stake in Cruise for $2.1 billion. GM will now pay the additional $1.35 billion. GM’s ownership in Cruise will now be increased to approximately 80%. While there is some concern that GM bought out Softbank at the initial investment value, 80% ownership is important. Mary Barra said in a statement. “Our increased investment position not only simplifies Cruise’s shareholder structure but also provides GM and Cruise maximum flexibility to pursue the most value-accretive path to commercializing and unlocking the full potential of AV technology.”

This change in ownership follows Cruise CEO Dan Ammann’s abrupt departure from the company in December. Reportedly, this had to do with disagreements in strategy, including when to take the company public. Ammann’s successor, the founder of Cruise, tweeted that an IPO would be a “major distraction, especially right now” as the company is scaling up its newly-launched driverless ride-hailing service in San Francisco.

Cruise also announced the launch of a “Recurring Liquidity Opportunity Program,” in which Cruise employees with vested stock options will be able to sell them to GM.

These moves indicated that GM does not intend to spin-off Cruise soon, although it has not ruled out a future IPO of Cruise. While this is a disappointment for those hoping to invest in an early Cruise IPO, it is good news for GM investors. While a spin-off could create early increased value, holding onto Cruise until it proves the enormous potential of this new market will accrue much more to GM investors.

Summary

The progress made by Cruise is significant, making it even more valuable and less risky. It has not only caught up with Waymo, but it has the strategic advantage of building a custom-designed ARS vehicle. This strategy leverages GM’s expertise in vehicle design and manufacturing. Waymo now needs to catch up with that. A recent National Highway Traffic Safety Administration rule allowing the elimination of driver controls from autonomous vehicles removed a significant risk of GM’s strategy.

GM has disclosed an aggressive timeline for Cruise. It will launch its ARS in San Francisco this year and then ramp it up quickly when the Origin is available next year. From there, it plans to expand this service to other major cities. Extrapolating this to revenue and profit projection illustrates the significant potential value of Cruise to GM. And on top of this, GM has increased its ownership of Cruise and indicated that it plans to delay any spin-off until it can capture more value for GM shareholders.

GM’s current price of about $44 per share is based entirely on its traditional auto business. Cruise has the potential, which is much clearer now, that it can be worth many times more than that. This presents a unique investment opportunity for those who see the potential for the transformation of transportation.

Be the first to comment