Gwengoat/E+ via Getty Images

Introduction

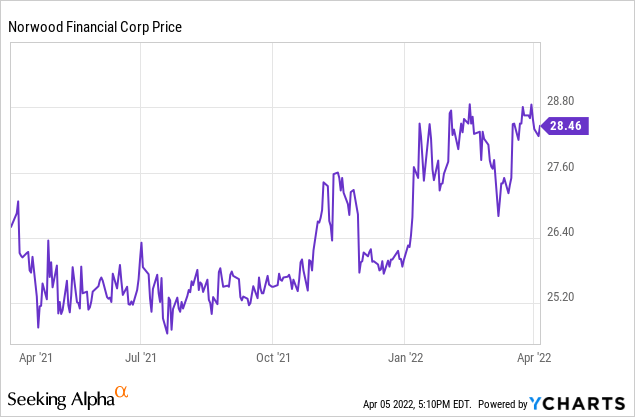

It has been about 16 months since I last looked at Norwood Financial (NASDAQ:NWFL) but although I was charmed by the bank’s performance in January 2021, the bank’s share price has barely moved despite posting good results in 2021 and the strengthening balance sheet. Perhaps this is an opportunity, but I first wanted to have a closer look at the bank’s assets. Norwood Financial is the name of the holding company for Wayne Bank.

A strong result in 2021 thanks to the low loan loss provisions

Norwood Financial is active in both Pennsylvania as well as New York, and in my previous article I noticed the loan book was quite real estate heavy so one could consider a long position in this bank a bet on the real estate situation in those two states. The real estate value doesn’t have to go up, as long as the borrowers are able to make their payments, Norwood’s loan book performance should be fine.

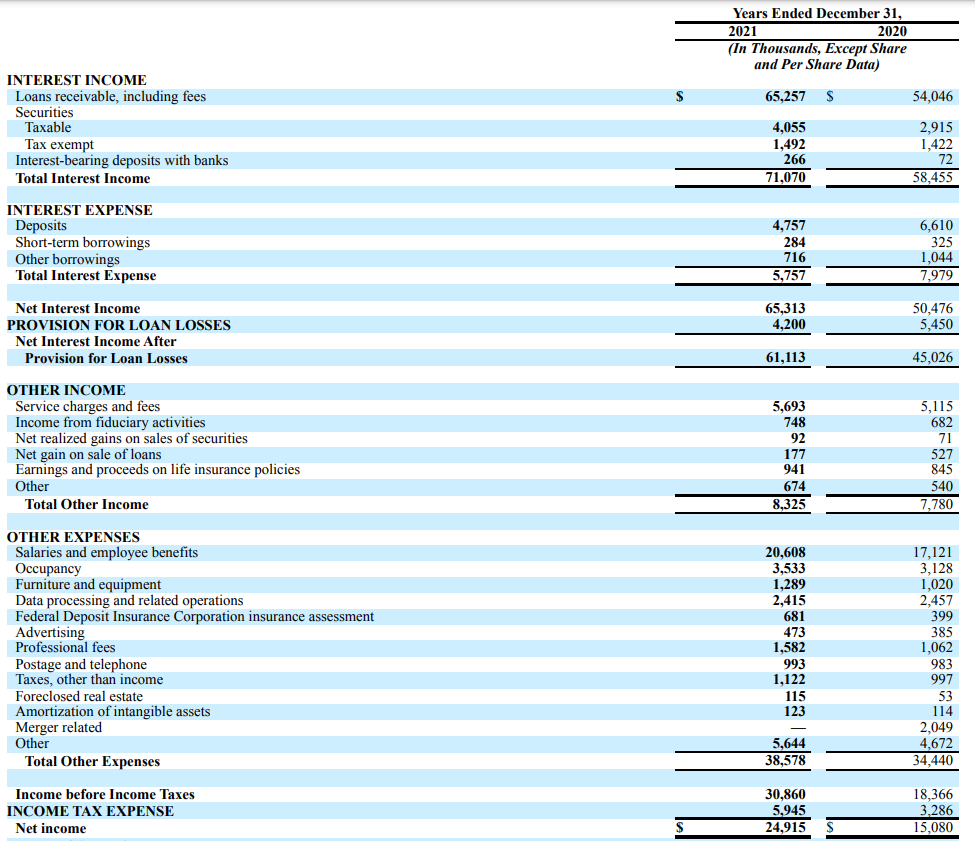

In 2021, the bank benefited from a higher interest income in combination with a lower interest expense and the combination of both pushed the net interest income approximately 30% higher to in excess of $65M.

Norwood Financial Investor Relations

That’s a good result as the higher net interest income will help to mitigate the impact of the higher net non-interest expense during the year which increased from less than $27M to in excess of $30M. The pre-loan loss provision and pre-tax income was approximately $35M. Unlike other banks which were able to recoup a substantial portion of the loan loss provisions they recorded, Norwood kept its loan loss provisions rather high at $4.2M which is just over 20% below the level recorded in 2020. This rather high loan loss provision level it why I wanted to have a closer look at the loan book and the status of the loans and I’ll discuss this in a separate section in this article.

After taking the loan loss provision into account, the net income was approximately $24.9M resulting in an EPS of $3.05 which indicates the bank’s stock is currently trading at less than 10 times the earnings, knowing those earnings were not inflated by taking back some of the historical provisions.

Norwood has recently hiked its dividend to $0.28 per quarter and the annualized dividend of $1.12 represents a dividend yield of approximately 4%. The payout ratio is just under 40% so the dividend is well covered.

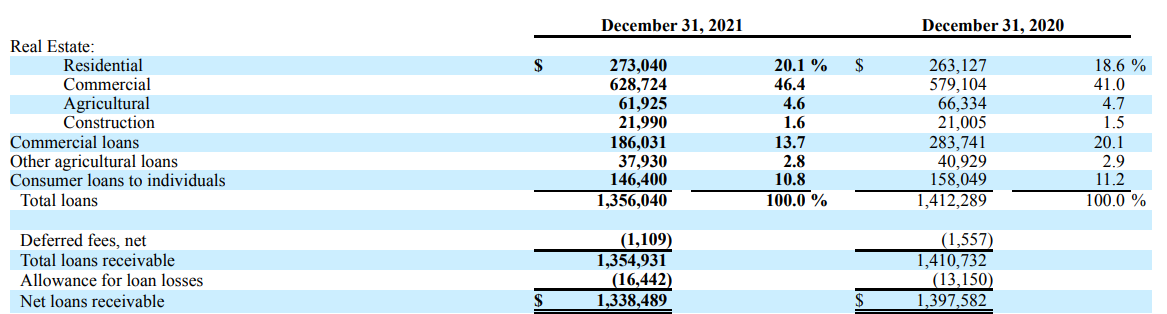

The loan book is still very real estate heavy

As the loan loss provisions remained rather high, I wanted to have a closer look at Norwood’s loan book. Perhaps there’s no reason to be alarmed as the provisions in 2020 were relatively low and it would make sense if Norwood tried to soften the blow by spreading the provisions over several years, but I still wanted to dig a bit deeper into this.

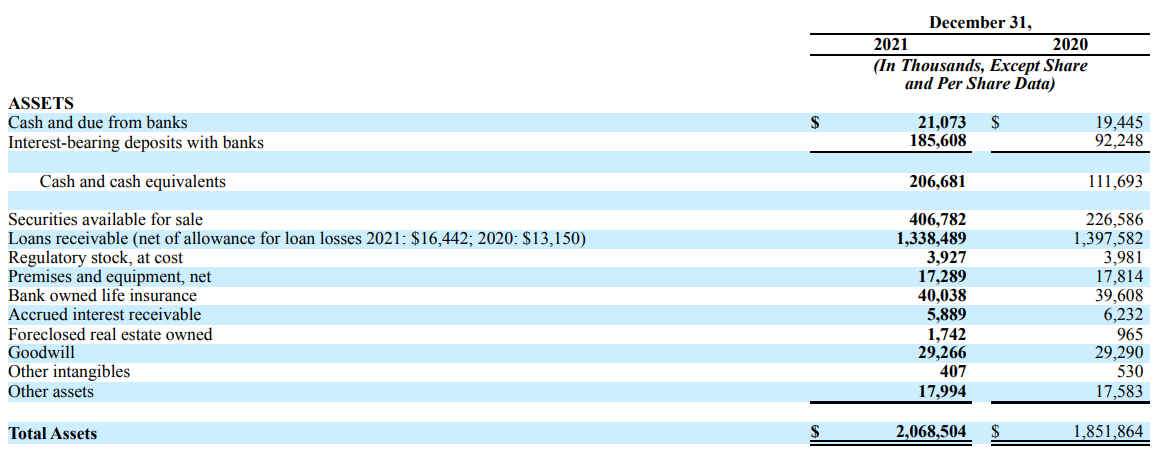

The balance sheet contains a total of $2.07B in assets, and as you can see in the image below, about $207M is held in cash and cash-equivalents with an additional $407M in securities of which the majority should be as good as cash.

Norwood Financial Investor Relations

The total size of the loan book was $1.34B, which actually is a decrease of about 4% compared to the previous year. And that’s a first interesting element: The balance sheet size increased by in excess of $200M but the size of the loan book decreased as Norwood increased its cash-equivalent balance and almost doubled its investment in debt securities.

As explained in my article last year, the loan book of Norwood Financial is very much geared towards real estate as it makes up about 72% of the total loan book. The majority is related to commercial real estate but there’s a good chunk of residential real estate as well.

Norwood Financial Investor Relations

The image above already explains why the loan loss provisions remained relatively high: even after adding the additional provisions, the total allowance for loan losses is just around 1.2% of the loan book, compared to less than 1% about a year ago.

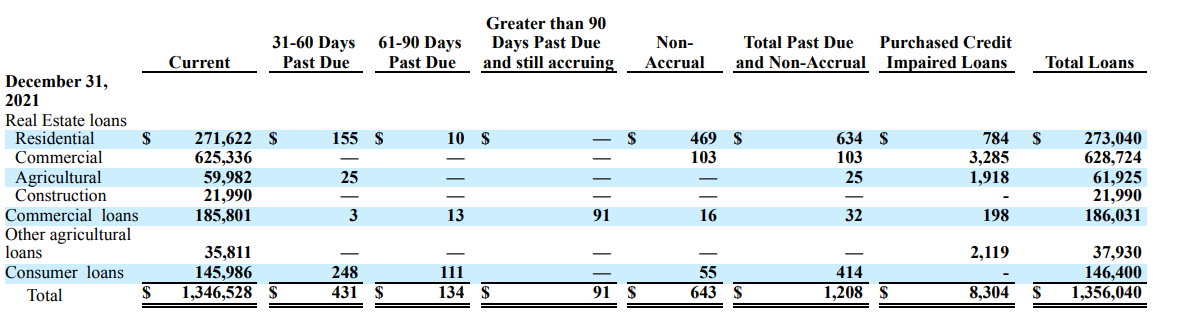

The next logical step is to check what percentage of the loans is currently past due. And that situation looks quite OK. The total amount of loans past due that aren’t accruing was $1.2M and with a total amount of $8.3M in purchased credit impaired loans, it looks like Norwood Financial should be fine. Especially because the impaired and non-accruing loans are mainly backed by real estate so losses should remain relatively limited.

Norwood Financial Investor Relations

Investment thesis

I currently don’t have a long position in Norwood Financial but I am a bit surprised the bank’s share price has barely moved since my previous article in January last year. The stock is currently trading at less than 10 times the 2021 earnings (which were not inflated by adding back previously recorded loan loss provisions) and as the stock is trading at a P/TBV of approximately 1.35, the shares aren’t overly expensive either. The dividend yield is acceptable (4%) but by keeping the payout ratio low, Norwood Financial is actually increasing its tangible book value by in excess of $1.5/share per year, so the current premium on the tangible book value is decreasing.

I don’t think I’ll initiate a long position anytime soon as I need to keep an eye on my cash position, but Norwood Financial for sure remains on my watch list.

Be the first to comment