Björn Forenius/iStock Editorial via Getty Images

Investment Thesis: Norwegian Air Shuttle has the potential for longer-term upside, but investors are likely to be cautious in the short to medium term.

Norwegian Air Shuttle (OTCPK:NWARF) has endured a difficult few years – having only recently emerged from bankruptcy protection to safeguard its business during the COVID-19 pandemic.

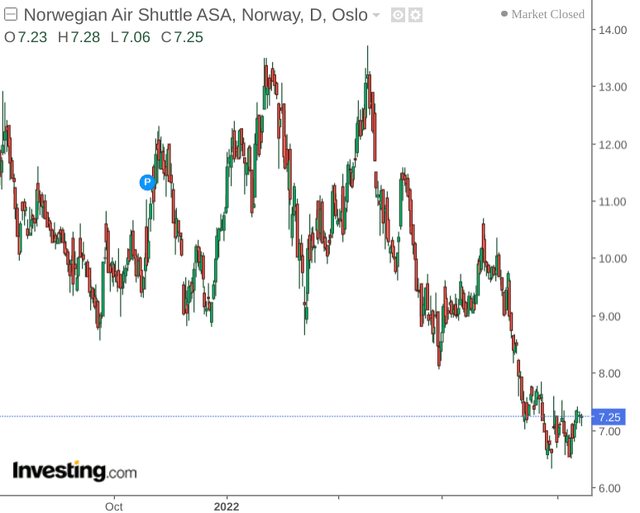

As such, while the company is showing some signs of recovery – price has still continued to decline throughout this year:

investing.com

The purpose of this article is to assess whether Norwegian Air Shuttle could see a rebound in upside going forward as the airline attempts to further recover post-restructuring.

Performance

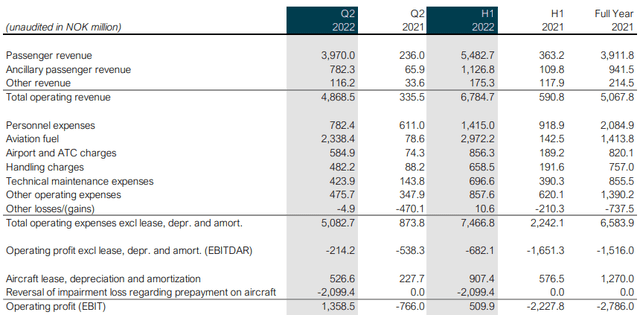

From a performance standpoint, the recovery in revenues and operating profit has been quite impressive.

When comparing H1 2021 and H1 2022 performance, we can clearly see that revenues are up sharply for the first half of this year – with H1 2022 revenues exceeding revenues for the full year of 2021. It is also noteworthy that operating profit (EBIT) has also rebounded into positive territory.

Norwegian Air Shuttle ASA: Second quarter 2022 financial report

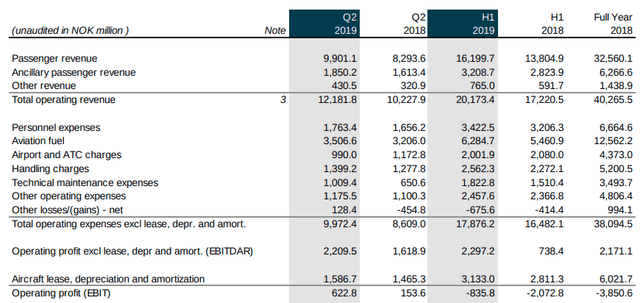

To put the revenue and earnings figures into a broader context, here are the passenger revenue and EBIT figures for H1 2018 and H1 2019:

Interim report: Norwegian Air Shuttle ASA – second quarter and first half 2019

We can see that total operating revenue for H1 2022 is still well below that seen in H1 2019. With that being said, we can also observe that total operating expenses are also significantly lower – and thus the company showed an operating profit for H1 2022 whereas operating profit was negative for H1 2019.

From this standpoint, while Norwegian Air Shuttle has endured significant hardship as a company up until now – there may be a case for arguing that Norwegian Air Shuttle now has a significant opportunity to become a leaner, more profit-driven company going forward.

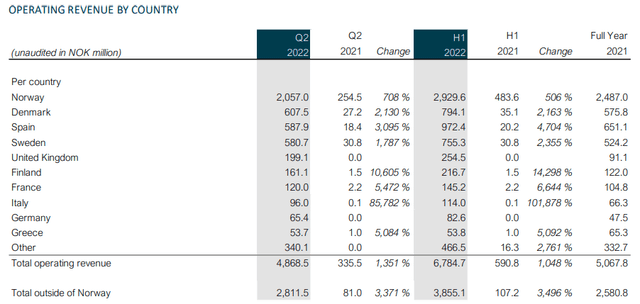

It is also noteworthy that the operating revenue by country mix has also changed significantly. For instance, the company’s home market of Norway accounted for just over 20% of revenues in H1 2019, whereas this had increased greatly to just over 43% in H1 2022.

Moreover, while United States revenue accounted for just over 20% in H1 2019, Norwegian Air Shuttle has since ended all long-haul routes, including those departing from the United States. As a result, the company is now entirely focused on short-haul routes across the European market:

Norwegian Air Shuttle ASA: Second quarter 2022 financial report

From a balance sheet standpoint, we can see that the company’s quick ratio has improved significantly – from 0.51 in June 2019 to 1.20 in June 2022:

| June 2019 | June 2022 | |

| Current Assets | 16576.2 | 11947.5 |

| Inventory | 162.4 | 74.2 |

| Current Liabilities | 31892.9 | 9860.5 |

| Quick Ratio | 0.51 | 1.20 |

Source: Figures sourced from Norwegian Air Shuttle ASA Q2 2019 and Q2 2022 Financial Results. Figures provided unaudited in NOK million (except quick ratio). Quick ratio calculated by author.

A quick ratio above 1 indicates that Norwegian Air Shuttle holds significant liquid assets to cover its current liabilities.

Additionally, the company’s non-current debt is down from 51.389 billion NOK in June 2019 to 8.973 billion NOK in June 2022.

Holistically, I take the view that Norwegian Air Shuttle could be in a good position to grow if the company can continue to maintain a healthy balance sheet and control expenses given its leaner business model.

Looking Forward

Going forward, Norwegian Air Shuttle will be competing with a fundamentally different business model focused on short-haul flights across the European market – with more of a focus on domestic revenue. In this regard, this could allow the company to carve out a further competitive advantage domestically.

For instance, the company may come under significant pressure in Europe when competing against larger rivals such as Ryanair Holdings plc (RYAAY), but could be in a good position to cement their existing competitive advantage in their home market.

As it stands, the company’s post-restructuring phase could see investors tread quite carefully on Norwegian Air Shuttle, at least in the short to medium-term. As the company has had to undergo a process of bankruptcy protection and restructuring – investors are quite likely to tread carefully until the company has built a strong track record of growth in revenue and earnings once again.

One of the main risks to Norwegian Air Shuttle – as with the industry as a whole – is rising fuel prices and inflationary pressures putting pressure on profitability. From this standpoint, investors are likely to tread cautiously and ensure that the company is in a good position to control its expenses and maintain profitability before we see meaningful upside in the stock.

Conclusion

To conclude, Norwegian Air Shuttle has seen a significant rebound in revenues and earnings, and given the company’s leaner short-haul business model – Norwegian Air Shuttle could be in a position to see longer-term upside if revenues and earnings continue to show signs of growth.

However, I take the view that Norwegian Air Shuttle will need to show clear signs that long-term growth is possible, and thus the stock might see limited upside in the short to medium term.

Be the first to comment