Grim Berge/iStock via Getty Images

The Global X MSCI Norway ETF (NYSEARCA:NORW) is a relatively narrow bet as far as ETFs go. The Norwegian economy itself is quite one-dimensional. It’s all about oil and salmon. Both of these commodities actually make for an attractive bet, and also take FX risk out of investing in the earnings of Norwegian companies. Moreover, the Norwegian economy is highly stable and protected by reserves of wealth. Ultimately, for a pretty low multiple and a decent yield, the ETF is probably worth considering if ETF investors want to enhance oil exposures while also shoring up risk in their portfolios.

The NORW Breakdown

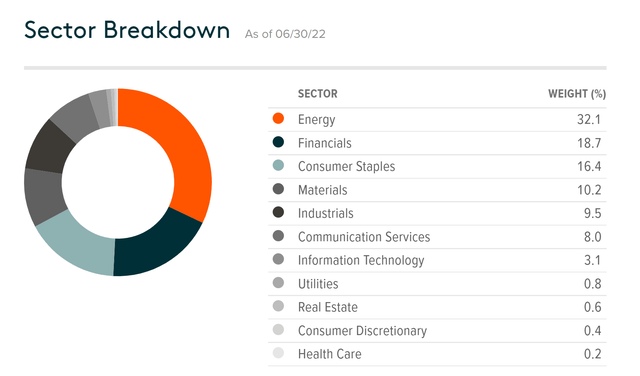

Let’s have a quick look at what constitutes the NORW. Primarily, it’s exposed to energy. Stocks like Equinor (EQNR) and Aker BP (OTCPK:DETNF) both have important interests in reserves like Johan Sverdrup and others on the Norwegian continental shelf, which has some of the lowest breakeven costs in the world barring the Saudis.

Other major exposures are financials, meaning Norwegian banks. These are very safe companies as they are going to be de facto backed by the state. DNB (OTCPK:DNBHF) is owned 34% by the state, and this is their main banking holding. The Oil Fund would be used to shore up deposits of a bank like this if something really bad were to happen, which it probably won’t. DNB will probably benefit from the current environment.

Other major exposures are consumer staples. Some of this will be salmon, probably most. Companies like Mowi (OTCPK:MHGVY) represent salmon from the Norwegian economy. They are also benefiting durably from the current environment, more on that later.

Sector Breakdwon (GlobalXEtfs.com)

Drivers of Return

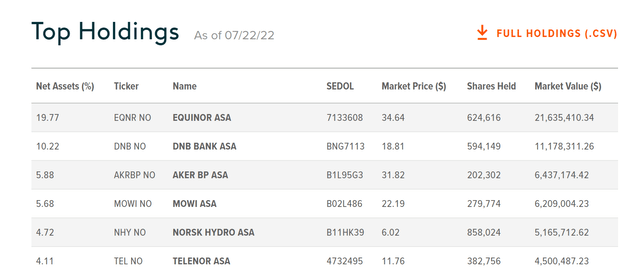

The main holdings are the following, and they will be responsible for the direction of returns in large part.

NORW Holdings (GlobalXEtfs.com)

Equinor and Aker BP are both major oil exposures. With durable trends supporting the price of oil, including speculation and geopolitical conflict, the margins of these companies should remain high. These companies are responsible for the low ETF multiple, where oil is trading at late-cycle multiples. Moreover, these companies earn in USD primarily, so FX risks for foreign investors are somewhat limited. This is a bit important since despite being connected to the price of oil, the NOK is a pretty small currency and is relatively risky for emerging market standards.

DNB Bank is supported by the Norwegian government and by rising rates as a retail bank. The Norwegian Oil Fund which is the fund collected by the government by direct taxes on oil companies is meant for shoring up the wealth of Norwegians, including guaranteeing a pension as well as covering major public utilities. Banks in Norway benefit from a backstop as its deposits are very likely to be protected were the bank to suffer massively. This hard limit on the downside is of value to investors especially as a recession comes and unemployment spiraling becomes a concern in the global economy. Moreover, rate increases in Norway in line with most monetary authorities should benefit the interest income at DNB offsetting fee declines elsewhere.

Mowi is a stock we like. It is vertically integrated into feed while feed prices are rising on account of pressure from Ukraine grain prices. Moreover, with grain products rising in price, protein that depends on cheaper meal is going to be relatively economical. Being a cheaper substitute should raise salmon demand in volume and price, which is ideal for the company while being able to stay ahead of input costs.

Norsk Hydro (OTCQX:NHYDY) is another stock we cover frequently and is also well positioned for the current environment. They are vertically integrated into energy in order to produce aluminium. Energy is not a problem for the company, but the issue is that aluminium is coming off highs due to slowdowns in industry. Moreover, they have specific extrusion businesses that are even more exposed to homebuilding and other markets that might be a little bit more at risk given the recession. Nonetheless, they have the lowest cost assets in the aluminium business all powered by hydropower, and with competitor capacity at risk with rising energy prices and falling aluminium prices they might be the last ones standing so to speak.

Conclusions

Overall, the NORW ETF pays a 2.26% yield, which is not insignificant and trades at an 8.8x PE multiple. This value is driven by the energy exposure, but also by financials, where low multiples indicating late-cycle exposures are driving yields up. However, we think there are durable supports to energy prices that make this late-cycle assumption pessimistic. Moreover, financials in Norway are particularly safe. Overall, you get risk reduction from government guarantees through financial exposures while making an energy bet without FX risk for USD denominated accounts. If you want to make a narrow bet on these things while avoiding too many company idiosyncrasies, NORW looks like a solid choice.

Be the first to comment