TT/iStock via Getty Images

Since my previous article on the energy-heavy Global X MSCI Norway ETF (NYSEARCA:NORW) was published more than three months ago, the update is certainly overdue. Today’s note is supposed to provide a fresh look at the Norway thesis, paying due attention to the monetary policy direction, and also briefly reviewing the main holdings of this investment vehicle, especially considering they have presented their Q3 results just recently, so by looking inside, we could find clues on whether it is worth finally upgrading NORW to a Buy.

In short, NORW is a passively managed fund that is supposed to represent the performance of Scandinavian companies comprising the MSCI Norway IMI 25/50 Index. At this juncture, the portfolio includes 67 equities, with the top ten accounting for around 65% of the net assets. NORW is heavily weighted toward large-caps, and with exposure to the mega-cap universe via Equinor ASA (EQNR), a Stavanger-based state-controlled energy heavyweight with a market cap around ~$118 billion and almost 23% weight in NORW. Meanwhile, Volue ASA, a software company delivering solutions for the energy, power grid, and infrastructure end-markets, is the smallest holding in this mix, with a measly weight of just 0.08% and a market cap of approximately $394 million.

Overall, the fund is focused on energy (35.4%) and financials (19.7%), reflecting a natural tilt of Norway’s hydrocarbon-rich economy (owing to the Norwegian continental shelf’s massive reserves and resources) toward the petroleum-focused players.

In July, I elaborated on a few risk factors that could send the already embattled fund even lower, namely inflation in the U.S. and the urgent necessity to increase interest rates to bring surging prices under control expeditiously, which created challenging conditions for the krone.

So the Fed’s hawkishness has been a strong headwind for the NOK this year. Paradoxically, the inflation problem in Norway and interest rate increases from Norges Bank did little to keep it afloat. In the previous article, I also added that oddly enough, the crude price rally had only marginally contributed to NORW’s and NOK’s performance, even though it bolstered the financial results of the ETF’s holdings and boosted the total government cash flow from the petroleum industry, which is forecast to touch NOK 1,169 billion, NOK 881 billion higher than in 2021.

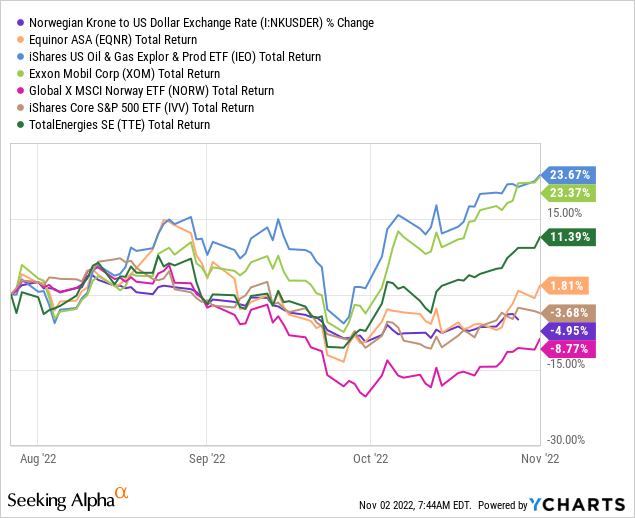

Since then, the fund’s price has declined by around 8.8%, underperforming the iShares Core S&P 500 ETF (IVV), which has also not been unscathed, yet dropped by just 3.7% defying sluggish tech earnings.

Interestingly, Equinor not only underperformed the U.S.-centered iShares U.S. Oil & Gas Exploration & Production ETF (IEO) and Exxon Mobil (XOM), which barely needs a lengthy introduction, but also its European peer TotalEnergies (TTE).

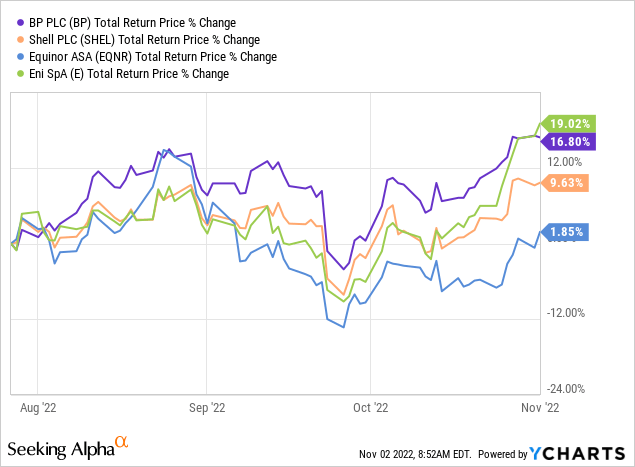

Other supermajors BP (BP), Shell (SHEL), and Eni (E) also did much better. So the only factor I see as a possible downside catalyst was its decision to consider selling a 28% stake in the Statfjord field. I would welcome my dear readers’ thoughts on other possible catalysts in the comments section.

Rate increases to continue slowly, offering little support for the krone

So, NORW’s performance has been merely lackluster. Have the fundamental conditions changed in favor of the NOK? Let us discuss this.

Obviously, monetary policy is one of the essential factors to consider. In September, Norges Bank predictably increased the policy rate by 50 bps to 2.25%, the level previously seen in 2011. The regulator cited a slew of reasons behind the move, with inflation close to a 34-year-high being the key one. Specifically, the 12-month rise in consumer prices in August touched 6.5%, materially exceeding a forecast rate from the June report.

However, as November 3 approaches, when the central bank is due to announce its new policy rate decision, my view is that it would opt for a smaller increase (a Norges Bank pivot, if you please), more likely of 25 bps instead of 50 bps. In my opinion, this is consistent with what was said by the officials in the September monetary policy report, which is worth quoting at some length:

The policy rate has been raised from a very low level over the past year and monetary policy is starting to have a tightening effect on the Norwegian economy. This may suggest a more gradual approach to policy rate setting ahead. The projections in this Report are based on a rise in the policy rate to around 3% in the course of winter.

What does this mean for the NOK? This is barely bullish, to say the least.

Does the krone look attractive with the policy rate in the country peaking at around 3% in winter? Unlikely. For better context, the possibility of another 75 bps rate hike from the Fed anticipated this week is comparatively high, while there is an opinion that the rate could peak at 5.5% in 2023.

At the same time, the 10-year Norway government bond yield is not at approximately 3.44%, while the U.S. 10-year yield (US10Y) is at ~4%, which makes it obvious why the NOK performance has been so sluggish this year even despite tailwinds from surging oil and gas prices.

A closer look at main holdings

Regarding NORW’s holdings, let us briefly return to Equinor ASA, an energy supermajor that is its principal allocation. EQNR will most likely remain the #1 holding in the near future even if its market cap inches lower should oil and gas prices change direction.

EQNR is an incredible company that has been reaping all the benefits from the Brent price rally and the European efforts to resolve its energy crisis by diversifying its natural gas supply. EQNR has recently released its Q3 2022 results, which are worth touching upon briefly. Specifically, its revenues rose by a staggering 84.9% while net operating income surged 2.7x as the group’s average liquids price increased 34% vs. Q3 2021. Nine-month FCF was up 32% and its cash and cash equivalents exceeded its net worth, representing a 4.5x increase from the December 2019 (pre-pandemic) level.

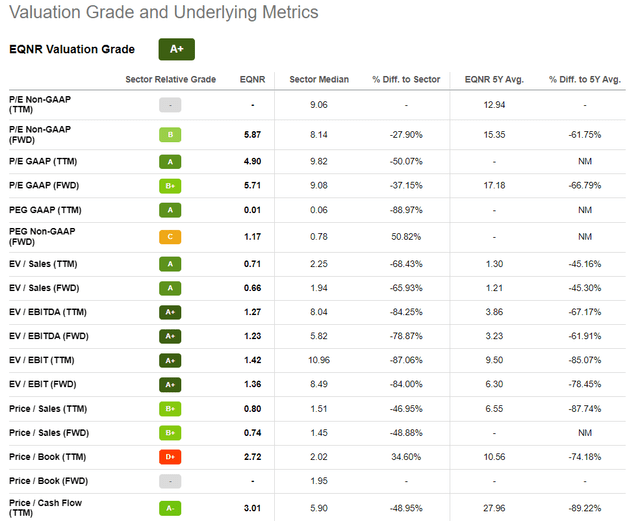

At the same time, EQNR is deeply undervalued. The Stavanger-based energy giant sports an A+ Quant Valuation grade owing to its ultra-low EV/EBITDA, EV/Sales, P/Cash flow, and other multiples even by the traditionally modest energy sector standards. I maintain a positive long-term view of this heavyweight, partly because of its footprint in renewable energy.

DNB ASA (OTCPK:DNBBY), Norway’s leading financial services group and NORW’s holding with a 10.4% weight, has been one of the key beneficiaries of robust economic activity in Norway despite rising interest rates. Tighter credit conditions also have been a potent tailwind for DNB’s earnings as its net interest income was up 25.5% from 3Q21 and 6.3% from 2Q22. Still, amid global softness in equities, the stock is down ~9.6% in Oslo YTD.

Final thoughts

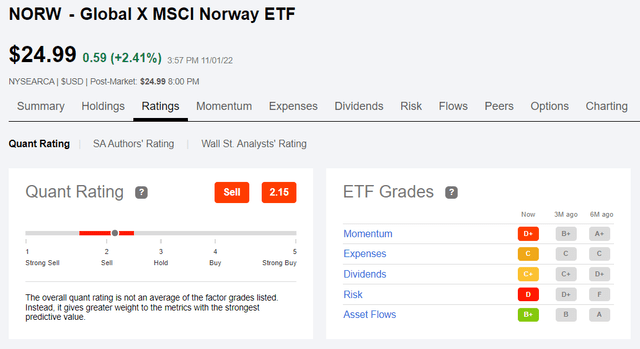

With lackluster momentum and elevated risk, NORW has a Sell Quant rating.

However, I would refrain from creating a bearish thesis here, highlighting the overall resilience of the Norwegian economy, especially compared to its Nordic peers and the eurozone, and a presence of a few robust companies in the NORW portfolio I fairly love to see, chiefly Equinor.

After all, the GDP growth outlook for this Nordic nation is way stronger compared to its neighbors. According to the October forecast from the International Monetary Fund, Sweden will face a 0.1% real GDP contraction in 2023, with Denmark delivering tepid 0.6% growth, while Norway will achieve a healthy 2.6% expansion.

Also, NORW has just an 8.53x P/E (vs. 15.15x in 2021), pointing to the overall inexpensiveness of the holdings. On a side note, when looking at the P/Es of Norway’s energy players, please do remember that hefty petroleum taxes take their toll on earnings, so it is also worth paying attention to before-tax metrics like EV/EBITDA. For instance, EQNR’s nine-month 2022 effective tax rate was ~67.5% ($64.1 billion in IFRS income before tax and only $20.85 billion in net income), so it has a 4.9x P/E and a phenomenal 1.2x EV/EBITDA.

Nevertheless, I see the weakness in the NOK as likely in Q4 and probably in early 2023, with uncertainty regarding the oil price direction and Norges Bank becoming less hawkish, so NORW does not deserve a Buy rating at the moment.

Be the first to comment