Vadzim Kushniarou/iStock via Getty Images

Many investors, including myself, love dividends, especially when companies provide annual increases. Who can say they wouldn’t want to get a raise for simply investing in a company? When a company implements a dividend plan, it’s usually an indication of its financial stability. When companies pay dividends, they are returning a portion of their earnings back to their shareholders in the form of a cash payment. To have a successful dividend program, a company must have a great understanding of its business and be able to forecast where its earnings will be several years into the future. A healthy dividend program illustrates a company’s ability to grow and expand profits. From an investor’s perspective, dividends can provide an additional income stream while reducing risk and volatility during periods of uncertainty.

There are two prestigious categories that companies can find themselves in if they provide enough consecutive dividend increases, becoming a Dividend Aristocrat or a Dividend King. These categories represent members of the S&P 500 who have raised their dividends for 25 or 50 consecutive years. The Dividend Aristocrat club marks the 25-year milestone, while 50 years mark the Dividend King accomplishment. Members within these categories must have a market cap of $3 billion and have a minimum of $5 million in average daily trading volume. Dividend programs come and go, while high yields don’t mean much if they are at risk of being reduced or eliminated. Being a member of the Dividend Aristocrat or King clubs illustrates a level of sustainability that’s a cut above the rest. Companies in these categories can also fall on hard times, but there is an established track record of paying their dividend throughout periods of economic uncertainty.

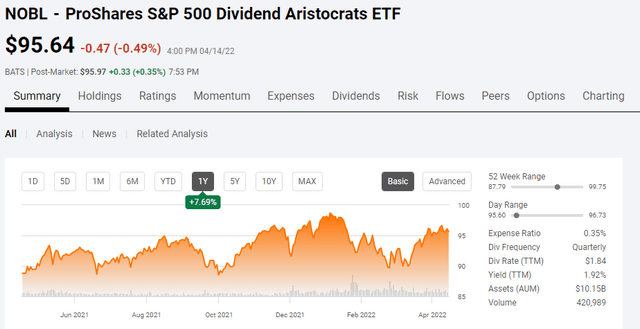

ProShares created the ProShares S&P 500 Dividend Aristocrats ETF (BATS:NOBL), which focuses exclusively on Dividend Aristocrats. This may sound like a phenomenal idea, having an ETF that invests in the companies with the longest string of dividend increases, but it’s not. The same way no two people are the same holds true for companies. At the same time, there are many great companies within this ETF, some drag down the qualities of this fund. Ask yourself, why are you investing in dividend-producing assets? For me, it’s to establish a long-term stream of cash flow that can be reinvested until I am ready to use the income to live off. NOBL currently pays a $1.84 dividend, a forward yield of 1.92%. If you want to own all of the Dividend Aristocrats, NOBL is a great investment option and will generate capital appreciation while producing income. NOBL’s yield and appreciation compared to other dividend ETFs aren’t enticing to me, and I have no plans to add NOBL to my portfolio. If I had to invest in a dividend ETF, NOBL would not be on the list.

The S&P 500 Dividend Aristocrats ETF, NOBL, and my problem with it

NOBL is the only ETF that I am familiar with that exclusively invests in Dividend Aristocrats, which can be viewed as high-quality companies that have increased their dividends for at least 25 years. There are currently 64 companies within NOBL’s portfolio; NOBL charges a 0.35% expense ratio and has $10.1 billion in assets under management. NOBL is a solid fund, but the yield doesn’t get me excited.

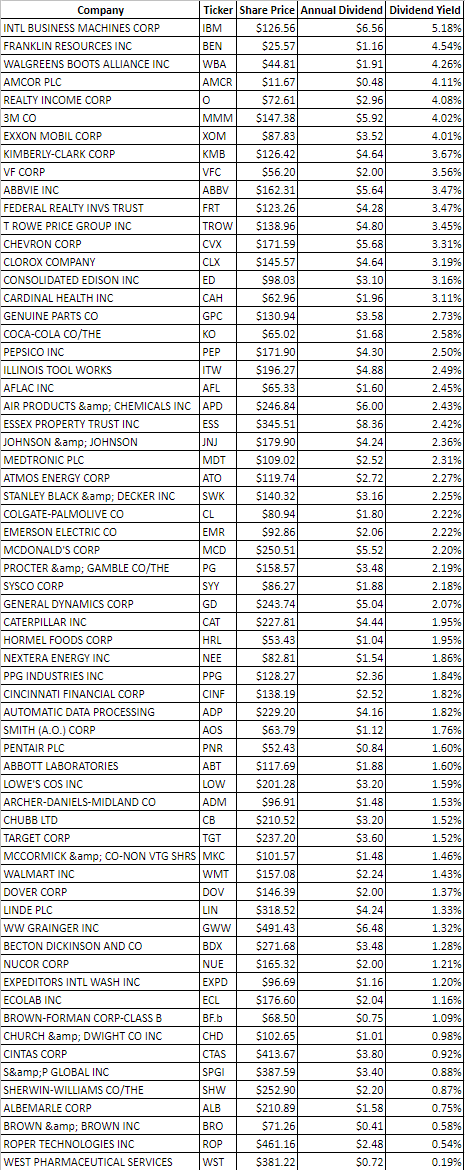

ProShares, Seeking Alpha, Steven Fiorillo

I went through NOBL’s holdings and categorized them by current dividend yield. The average yield from NOBL’s holdings is 2.21%, yet NOBL is only generating 1.92% from its ETF. A handful of companies yield less than 1% within NOBL’s holdings. It would be very interesting if NOBL restructured its holds to yield closer to 3%. When I invest in dividend-producing assets, my main priority is income, with a secondary priority of capital appreciation. The 25-year string of dividend increases creates peace of mind, but the 1.92% is too low, and I am leaving too much yield on the table.

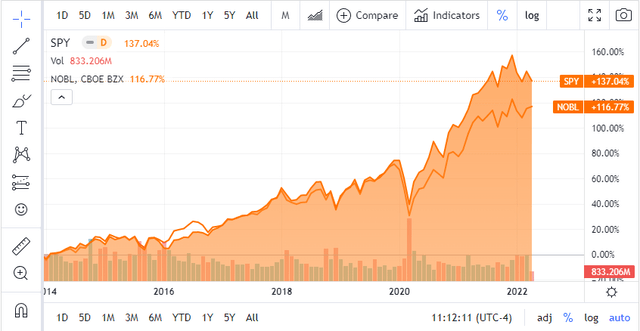

Instead of investing in NOBL and getting a 1.92% yield, I would rather invest in the SPDR S&P 500 Trust ETF (SPY) and just own all the companies in the S&P. If I am going to leave yield on the table, I might as well be compensated with additional appreciation. SPY generates a 1.33% yield on its dividend. Since NOBL’s inception, it has trailed SPY, which is to be expected as NOBL doesn’t have exposure to big tech. The extra 0.59% of yield I can squeeze out of NOBL compared to SPY isn’t worth sacrificing the additional capital appreciation that SPY would generate.

My investment style when it comes to dividends and why NOBL doesn’t have a spot at the table

My investments outside of my retirement accounts are broken into several categories: dividend-producing assets, big tech, growth, and speculation. The money I am investing in my retirement account is 100% allocated to a low-cost S&P index fund. I have decades until I can collect social security or Medicare, so I want to safely maximize my returns for the foreseeable future prior to reallocating to an investment mix that is more stable in my retirement years.

On the dividend side of my personal assets, I am building an income stream to offset the loss of income from my salary when I retire. The goal is to generate enough income from my assets to replicate my salary in retirement. There are other dividend ETF funds that are appreciating while generating larger yields than NOBL. This doesn’t even include individual companies, REITs, MLPs, CEFs, covered call ETFs, or writing covered calls on my positions. I could probably pick a stock within NOBL’s holdings, buy 100 shares, write monthly covered calls on the position and generate a larger yield than NOBL. I started a Dividend Harvesting series on Seeking Alpha because I was asked so many similar questions about dividend investing that I started an account with $100 and documented the series. I added $100 a week and have done so for 58 consecutive weeks so far. In that account, my total projected annual dividend income has grown to $411.24, which is a 6.67% portfolio yield. Overall, the account is in the black by $366.13 (5.94%) and generates 50 weeks of dividend income from 63 positions.

I look at the dividend side of my portfolio as a cash-generating machine. I want to generate the largest yield possible while mitigating my downside risk. I don’t need capital appreciation; that’s what my other investments are for. I just need the account to trade sideways and churn out large dividends. The Dividend Harvesting portfolio I created is a perfect example of this. NOBL has appreciated by 7.69% over the past year, and when I go back 58 weeks, it’s roughly 9%. NOBL’s 9% is larger than my 5.94%, but I am generating 6.67% on the dividend with 50 weeks of income compared to NOBL’s 1.92% paid quarterly. The Dividend Harvesting portfolio is just a separate account I created for a Seeking Alpha series, and it’s accomplishing its objective. My overall goal of generating income from dividend-producing assets is focused on income, not capital appreciation. To mitigate my downside, I can get more yield and aggregate it across many different investments. Sure, NOBL has appreciated well over the years, but with the low yield, you might as well just put your money in SPY and generate a 1.33% dividend yield compared to NOBL’s 1.92%.

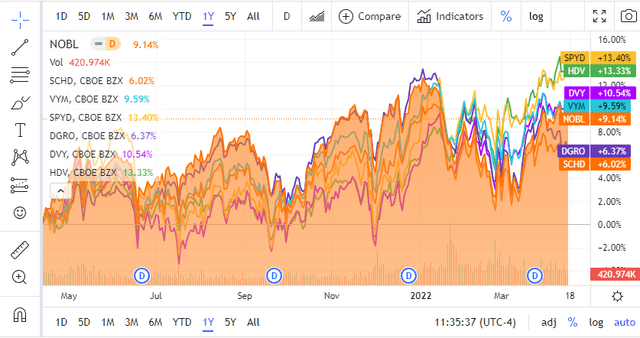

Many investment firms have put out dividend-focused ETFs and some of the most popular are:

- SPDR Portfolio S&P 500 High Dividend ETF (SPYD)

- iShares Core High Dividend ETF (HDV)

- iShares Select Dividend ETF (DVY)

- Vanguard High Dividend Yield ETF (VYM)

- ProShares S&P 500 Dividend Aristocrats ETF (NOBL)

- iShares Core Dividend Growth ETF (DGRO)

- Schwab U.S. Dividend Equity ETF (SCHD)

Over the previous year, SPHD, HDV, DVY, and VYM have all appreciated more than NOBL while generating a more enticing yield. SPYD more than doubles the yield generated by NOBL and has appreciated by an additional 4.26%. It’s not that NOBL is a bad product; it’s a quality ETF; the problem is that it doesn’t cut it for an income product.

|

Company |

Ticker |

Share Price |

Annual Dividend |

Dividend Yield |

1-Year Appreciation |

|

SPDR Portfolio S&P 500 High Dividend ETF |

$44.50 |

$2.07 |

4.65% |

13.40% |

|

|

iShares Core High Dividend ETF |

$108.32 |

$3.86 |

3.56% |

13.33% |

|

|

iShares Select Dividend ETF |

$128.84 |

$3.85 |

2.99% |

10.54% |

|

|

Vanguard High Dividend Yield ETF |

$112.36 |

$3.13 |

2.79% |

9.59% |

|

|

ProShares S&P 500 Dividend Aristocrats ETF |

$95.64 |

$1.86 |

1.94% |

9.14% |

|

|

iShares Core Dividend Growth ETF |

$52.58 |

$1.05 |

2.00% |

6.37% |

|

|

Schwab U.S. Dividend Equity ETF |

$78.70 |

$2.27 |

2.88% |

6.02% |

Conclusion

In theory, NOBL is an interesting idea and may capture the interest of dividend investors as it strictly invests in Dividend Aristocrats. NOBL grabbed my attention until I looked through the fund and couldn’t get past the yield. Overall, NOBL is a good product that generates consistent dividends and appreciation. The problem I have with NOBL is it’s not superior in any category. This isn’t a benefit to investing in NOBL over SPY for appreciation or when you look at appreciation plus the yield. SPY generates 1.33% on its yield and will appreciate more due to the tech sector. NOBL also isn’t that enticing from the income side as there are other ETFs that are generating 3% on the yield and have outperformed NOBL in the past year. There are also other ways to generate a much more lucrative yield than investing in NOBL. If you want to own all the Dividend Aristocrats, NOBL is a good fund that you can’t go wrong with. For me, it doesn’t fit into my investment mix on the capital appreciation side or the income side. If you own it, just hold it, but there are better options if you’re looking for income or appreciation.

Be the first to comment