Torsten Asmus

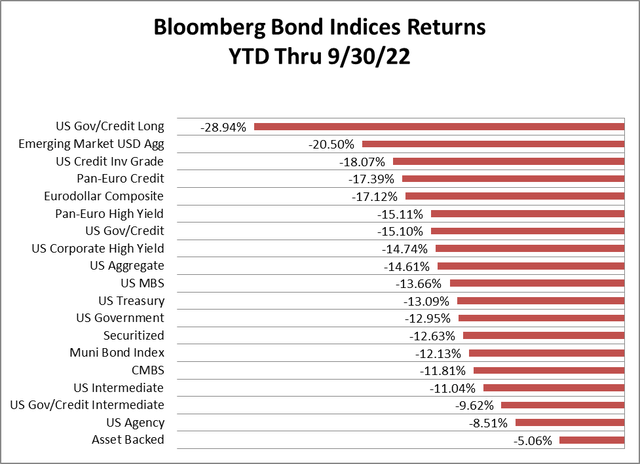

2022 has proven to be a tough year for bond investors. The broadest measure of the bond market, the Bloomberg US Aggregate Index, has returned -14.61% through the end of the third quarter. There has been no place to hide, as all segments of the bond market have experienced negative returns year to date. Asset Backed Securities (ABS) have had the best performance with a return of -5.06%, while the US Govt/Credit Long segment has had the worst performance with a return of -28.94%.

These results are not surprising, as ABS represent the shortest component of the Aggregate Index, with a duration of 2.16 years, while the US Govt/Credit Long segment represents the longest component of the Aggregate Index with a duration of 14.30 years.

This is shaping up to be the worst performance year in the 45-year history of the Aggregate Index. The previous most significant decline was -2.92 in 1994. Using a broader data series compiled by NYU, 2022 looks to be the worst year since 1931.

Bloomberg

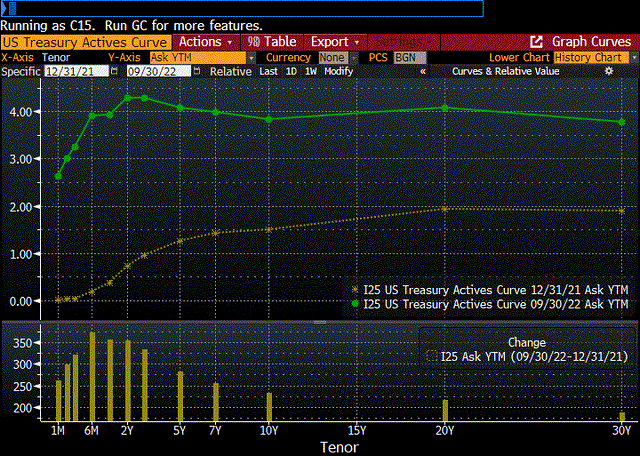

The reason why bonds have performed so poorly is due to the sharp rise in interest rates in 2022.

Rates have risen across the yield curve, as the biggest jump occurred the 6-month T-Bill, with the yield increasing 372 basis points (bps) to 3.90%. The smallest gain occurred in the long end of the curve with the 30-year US Treasury Bond rising 187 bps to 3.78%.

Bloomberg

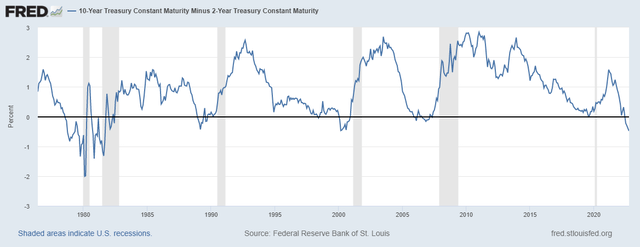

The larger gains in the front end of the curve have caused the yield curve to invert, with the highest point on the curve being the 2-year US Treasury Note at 4.28%.

The yield curve is often a good predictor of an economic recession. When the curve, as measured by the spread between the 2-year US Treasury Note and the 10-year US Treasury Note, inverts, recession often follows. At quarter end the 2-10 year curve was inverted by 45 bps. Yield curve inversion has preceded every recession since 1980.

Typically though, there is a lag of 12 to 24 months between yield curve inversion and the onset of a recession.

FRED

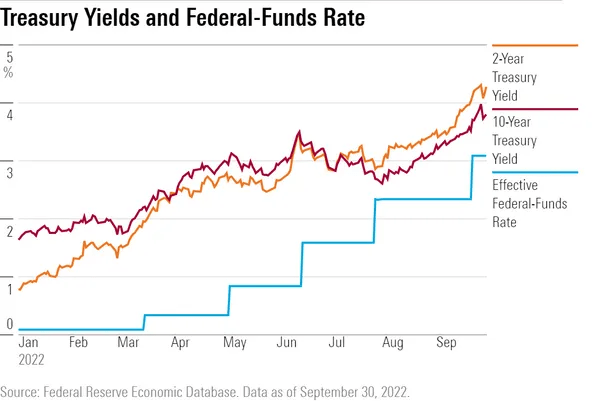

Rates have risen dramatically this year as the Fed tightened monetary policy in an attempt to rein in the highest inflation rate in 40 years. Since the beginning of the year the Fed has increased their benchmark Fed Funds rate 5 times by a total of 300 bps to the current range of 3.00 – 3.25%. This tightening is expected to continue.

FRED

The Fed is faced with the tough job of trying to bring inflation back to their long-term target of 2% without causing a recession. Fed Chairman Jay Powell has acknowledged that this will be a difficult task. He is willing to tolerate a modest increase in unemployment until there is clear evidence that inflation is moving back down to their target.

In addition to increasing their benchmark rate the Fed is also embarking on their previously announced balance sheet reduction, otherwise known as Quantitative Tightening (QT). This is another step in their post-pandemic policy normalization. Although first announced in November 2021, the balance sheet reduction has been rolled out gradually. In January 2022, the FOMC published that they intended to reduce the Fed’s securities holdings over time in a predictable manner. Beginning in June 2022 maturities of both Treasury securities and MBS held in the Fed’s SOMA portfolio were allowed to roll off subject to a cap of $47.5 billion per month. In September 2022, this cap was increased to the full amount of $95 billion per month.

Currently the Fed is the largest owner in the world of both US Treasury securities and MBS, holding $5.7 trillion and $2.7 trillion, respectively. They have been the marginal bid for these bonds over the past two years, and their absence will continue to put pressure on the markets in the future.

While many are seeing signs that perhaps inflation has peaked and are projecting that the Fed may soon change course, Powell has insisted “history cautions strongly against prematurely loosening policy.”

According to Rick Rieder, the CIO of Global Fixed Income at BlackRock, in a recent Barron’s interview “buy the dip doesn’t work during QT; you just keep getting new dips.”

There is one consolation to the rising rates since the Fed began tightening. Cash, which has offered virtually no return for several years, now is attractive. Money Market Fund yields are approaching 3%, the highest level in 14 years, and one year US Treasury Bills are yielding over 4%. These are safe alternatives for sitting out the volatility in bonds.

Be the first to comment