If you’re still holding onto Annaly Capital Management, you’re not seeking alpha. You’re seeking a dumpster fire. Get out before the market comes to grips with the magnitude of the losses in Q1 2022. It’s time to close out positions. No need to be a bag holder. The market isn’t reflecting the severe damage from Q1 2022 yet.

Baloncici/iStock via Getty Images

Annaly Capital Management (NYSE:NLY) has achieved an impressive premium to book value. It looks like a discount to you? I understand that a share price of $7.43 would appear to be a discount to the Q4 2021 book value of $7.97. However, we’re projecting a substantial decrease in book value per share during Q1 2022. Scott Kennedy provides all the premiums/discounts, projected book values, ratings, and highlights the change in rating in his weekly series on The REIT Forum.

Opinion

I believe the substantial majority of NLY’s shareholders are significantly underestimating the damage to book value. I believe bigger investors will become more aware over the next week or two as other analysts update their models and start warning clients.

So why would we think NLY’s book value would be down significantly? There are two ways to answer that. I could provide a long detailed reconciliation of projected accounting adjustments. However, Scott already does that. So I’ll break it down into simpler terms.

Basis Points

For this discussion to make sense, I need investors to understand the term “basis points.” A basis point is .01%. So why don’t we use .01%? Because it isn’t clear enough. If interest rates increase from 1% to 2%, then rates “doubled.” Some investors would claim this is a 100% increase (since it doubled) while others would say it’s a 1% increase since the yield is 1% higher.

We don’t want to have that confusion, so we need to use the term basis points. If rates increased from 1% to 2%, that is a 100 basis point increase. There’s no argument. Anyone who says otherwise is simply wrong. This is a precise term. Having precise definitions improves communication.

We’re also going to use the term “MBS” to refer to “Mortgage-Backed Securities.” Further, when I use the term “Interest Rates” in this article, it will refer to Treasury rates in the range of 1 year to 10 years (unless otherwise specified).

Finally, I need to mention that for Annaly Capital Management we can use the terms BV (book value) and NAV (net asset value) interchangeably. There are REITs where those terms are not interchangeable, but they’re here.

Now that we are speaking the same language, we can move on.

Interest Rate Sensitivity

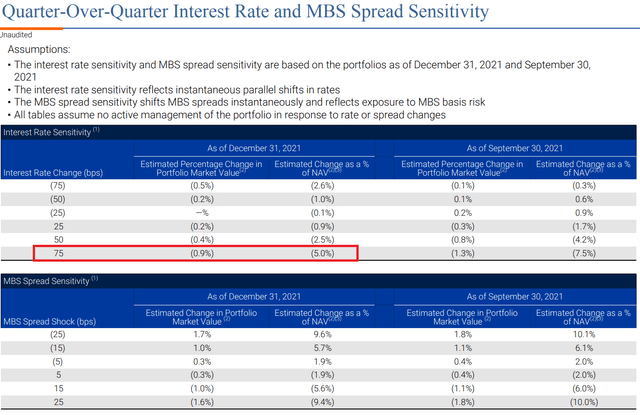

Annaly Capital Management now provides two presentations for their quarterly results. They have a combined length of just over 60 pages. The one we want is page 18 of Annaly’s Q4 2021 supplemental presentation. It looks like this:

NLY Q4 2021 Supplemental Presentation

Sorry, you’ll have to zoom in on the image. There’s no way to scale that without distorting the text. I added the red box for the part I want investors to focus on.

Annaly’s presentation indicates:

- If interest rates across the yield curve were 75 basis points higher, it would create a 5% reduction in book value per share.

- The drop in book value from an increase of 75 basis points is twice the drop created by an increase of 50 basis points (2.5%).

- The drop in book value from a 50 basis point increase is more than twice the drop created by an increase of 25 basis points (0.9%).

Note: Interest rates won’t move by the exact same amount across the curve. The table is designed to be a simplified presentation. So far, the five-year Treasury yield increased by 123 basis points and the 10-year Treasury yield increased by 88 basis points. Both of those numbers are bigger than 75, so you should probably guess that the impact of interest rates alone drove a reduction in book value greater than 5%.

So why does a larger increase in rates result in book value falling at such a fast rate? Why does a 75 basis point increase reduce book value by more than 3 times the loss from a 25 basis point increase?

Because as rates increase further, it results in a larger decrease in the value of the MBS. Why can’t a mortgage REIT just hedge out all of that risk?

If rates fall significantly, the hedges would lose a significant amount of money. However, lower rates don’t result in a huge gain for MBS. When rates fall substantially lower, people refinance more often. When rates move higher, they refinance far less. Consequently, mortgage will be outstanding longer if rates move higher but be paid off sooner if rates move lower.

When interest rates only move slightly, this isn’t a big deal. When rates move substantially, it becomes a big deal.

This is a concept we call “negative convexity.” It should be called “concavity,” but math majors didn’t determine how finance spreadsheets were set up. So we end up with negative convexity instead.

MBS Spread Sensitivity

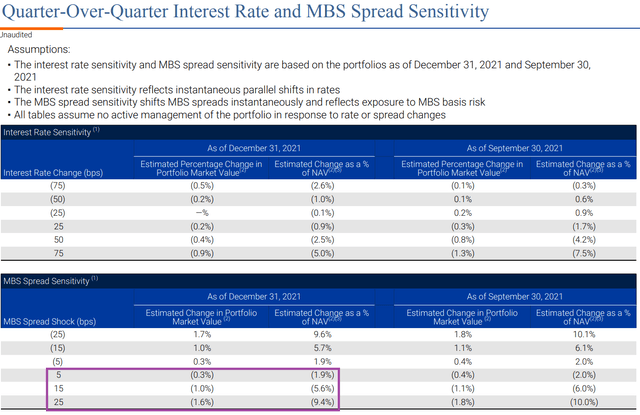

The next factor to consider comes from the same slide, but I’ve moved the highlighting. This time, we’re going to discuss the purple box:

NLY Q4 2021 Supplemental Presentation

When MBS spreads increase, it reduces NAV rapidly. This topic can be a bit more complex because there are multiple ways to measure MBS spreads. Those different measurement techniques will usually point investors in the same direction, but not to the exact same value. The best technique by a large margin is to actually model out every position in the portfolio. I used to do that, but Scott handles it all now and I’m very confident in his estimates.

Note: This is actually how I became so confident in Scott’s work. I had years of comparing our estimates and seeing the actual results for the REITs, which demonstrated the success of our models.

Investors can argue about how much MBS spreads increased, but I think most will agree that they did increase. The rate on a 30-year mortgage increased materially more than most Treasury rates. That’s enough to suggest that spreads widened. Therefore, we should expect that spread widening will also contribute to a decline in book value.

Combining Those Factors

Our (referring to the REIT Forum) estimates for Annaly Capital Management’s book value in Q1 2022 suggest a very material decrease. We have Scott’s estimates from the end of last week (linked at the top of the article) and he will produce another set of estimates for 3/31/2021. Of course, those estimates can’t be created until after we’ve seen the actual changes in MBS and Treasury rates (not to mention LIBOR swaps).

Historical Price to Trailing Book Ratios

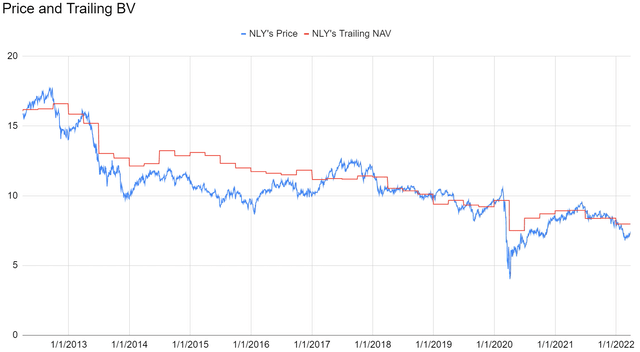

Using “Trailing Book” refers to the value from the prior quarter. It can be a bit confusing for investors at times since the mortgage REIT doesn’t release earnings on the same day the quarter ends. However, we built a chart showing how it would look if we contrasted NLY’s daily share price with the trailing book value. In this chart, book value is updated as of the date the quarter ends (though it is not announced until a few weeks later):

The REIT Forum

Using that chart, you would be inclined to think that NLY still has a moderate discount. Today’s share price of $7.43 is lower than $7.97. However, if we believe book value has already fallen significantly, then we are expecting the red line to drop. If the red line drops significantly, then that share price stops looking like a nice discount.

What About Other Factors?

I don’t need to demonstrate other factors. I could. Scott calculates more than book value. We could go into factors like earnings and dividends, but we don’t need to right now. The price-to-book ratio is sending an extremely strong signal.

It’s like seeing flames in your living room. You could dig into other factors to determine if there’s actually a fire, but you don’t need to do that if you can see the flames.

Conclusion

We’re projecting a loss so far this quarter materially greater than 10%. In that context, the share price stops appearing so “low.” When investors recognize the loss, they may become far more concerned and could send the price lower. This is a great time for investors to sell their position in Annaly Capital Management’s common shares and reallocate. We have several choices which are still trading at attractive valuations. There are even a few mortgage REIT common shares offering some upside. However you spin it, there are plenty of opportunities with a better risk/reward profile.

Rating: Bearish on NLY. No change to the preferred shares. Some of NLY’s preferred shares are still attractively valued. While book value per share got crushed, preferred equity is completely fine.

Be the first to comment