Drew Angerer/Getty Images News

Price Action Thesis

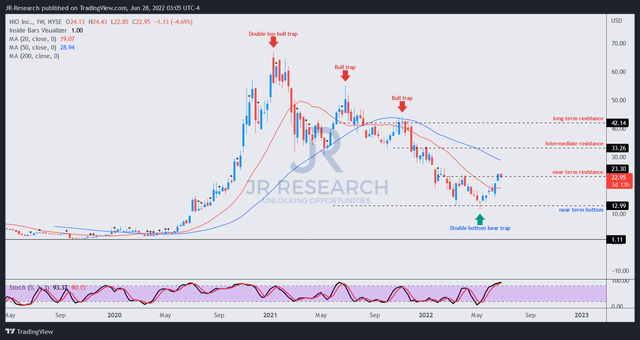

We follow up on our pre-earnings update of NIO Inc. (NYSE:NIO) stock. We have consistently highlighted the stock had bottomed at its March capitulation. A double bottom bear trap (significant rejection in selling momentum) also formed in early May, as the stock has surged almost 97% from its May lows.

Therefore, our recent price action thesis has largely played out, even as the market was highly pessimistic about NIO in the last few months due to the COVID lockdowns and supply chain disruptions.

Accordingly, we urge investors to pay close attention to price structures, as they are forward-looking, offering investors keen insights into the market’s forward intentions.

NIO also reported an FQ1 earnings card that was broadly in line with our expectations. But, given its tremendous surge from its May bottom, we believe the medium-term risk/reward profile seems less attractive at the current levels.

Also, the stock’s massive surge is emblematic of a rapid “flush-up” price action that could precede a potential bull trap. Notwithstanding, we have not observed a bull trap that investors should consider yet.

Our reverse cash flow model indicates that NIO remains a highly speculative play. Even though it’s expected to continue its ramp towards profitability, we urge investors to be wary about its valuation.

Accordingly, we revise our rating on NIO from Buy to Hold. We encourage investors to await the next deep retracement to consider adding exposure.

NIO – Double Bottom Bear Trap Stanched The Bearish Tide

We highlighted in our previous article that a potent double bottom bear trap had formed in early May while the mayhem over China’s COVID lockdowns and supply chain disruptions were in full swing.

Double bottoms are the most formidable bear traps set up by the market to force highly pessimistic investors/traders to liquidate their positions rapidly, with the conviction to create a “false break to the downside.” Notably, double bottoms are highly effective price structures that often provide early signals of a potential reversal of a stock’s bearish bias.

Therefore, investors should not be stunned that the market has prepared for its massive reversal since early May, as price action is always forward-looking. Notwithstanding, NIO remains mired in a bearish flow, as it takes time for the reversal to play out as the market accumulates (recall that double bottoms are early signals).

However, we are confident that it’s unlikely for NIO to break its March or May lows as it moves to regain its medium-term bullish bias.

Still, Near-Term Caution Is Warranted

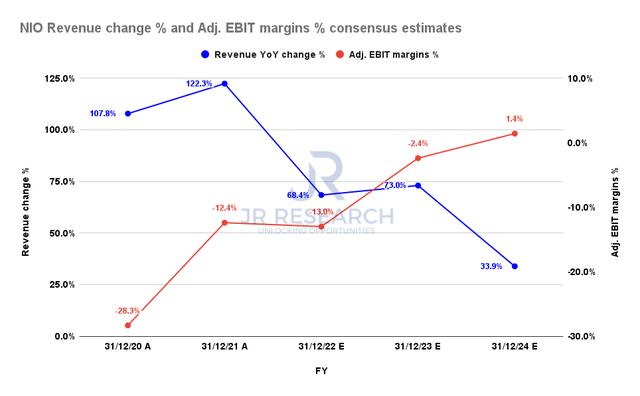

NIO revenue change % and adjusted EBIT margins % consensus estimates (S&P Cap IQ)

NIO reported a decent FQ1 card that was largely in line with our expectations. The company is confident in recovering its gross margins by FQ3, which have been affected by the surge in battery costs, and the recent disruptions.

However, CEO William Li seems confident that we have seen the worst of the surge in battery raw material costs. He articulated (edited):

We can see the raw material costs actually peaked in April, and we started to see some trend of going down, specifically for the lithium carbonate. In China, we have already started to see there are more resources for the lithium and there are some companies trying to mine the lithium to make sure they can supply to the market and meet the demand. And we also have a similar forecast for the nickel material as well. So we believe the general trend is the cost of those battery materials is going down, and it’s not going to go up again. (NIO FQ1’22 earnings call)

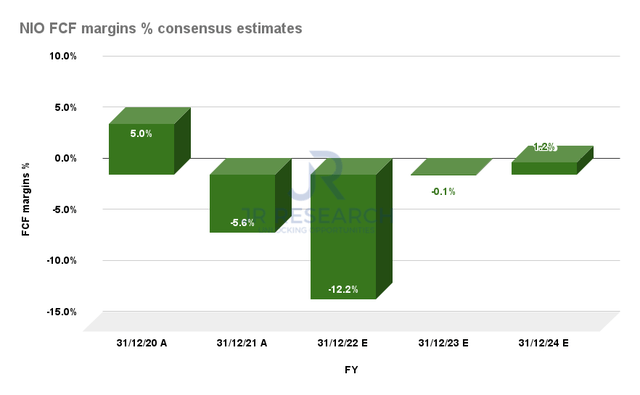

NIO FCF margins % consensus estimates (S&P Cap IQ)

We have often accentuated that exposure in NIO should be considered speculative. As seen above, investors can corral that NIO is not estimated to report FCF profitability until FY24, in line with its adjusted EBIT margins.

Consequently, valuing NIO with a high degree of conviction will be challenging, as it could impact its valuation significantly if its FCF growth cadence were affected moving forward (given its weak FCF profitability).

| Stock | NIO |

| Current market cap | $37.92B |

| Hurdle rate (CAGR) | 25% |

| Projection through | CQ4’26 |

| Required FCF yield in CQ4’26 | 2% |

| Assumed FCF TTM FCF margin in CQ4’26 | 3% |

| Implied TTM revenue by CQ4’26 | $65.05B |

NIO reverse cash flow valuation model. Data source: S&P Cap IQ, author

Based on our reverse cash flow model, we assessed that NIO is unlikely to meet our TTM revenue target of $65.05B by CQ4’26 at its current valuation.

We applied an above-market hurdle rate that we believe is apt for a typical high-growth stock. Using a growth-focused FCF yield of 2%, we also assumed a TTM FCF margin of 3% by CQ4’26.

As highlighted earlier, this is where NIO could either surprise or disappoint us. But, we would rather be more cautious given NIO’s much lower production scale.

Notably, Tesla (TSLA) posted an FCF margin of 4.4% in FY19 on producing 365K vehicles. NIO expects a 20K monthly run rate (240K annualized) in H2’22. Therefore, we believe it’s critical to evaluate the level of scale efficiencies in NIO’s operating model that can lift its FCF margins by the end of FY22.

If NIO can surprise to the upside, it could help the stock re-rate. Otherwise, we believe NIO is expected to prove too much at its current valuation.

Is NIO Stock A Buy, Sell, Or Hold?

We revise our rating on NIO from Buy to Hold. We noted a tremendous surge of close to 97% from its May double bottom. Also, a potential bull trap could form at its near-term resistance level, suggesting caution. However, given its double bottom, we believe the worst seems to be over.

Our valuation model indicates that NIO could underperform at its current valuation. Therefore, unless the company can prove that it can ramp its operating efficiencies tremendously, it’s challenging to justify outperformance at its current valuation.

Therefore, we urge investors to wait patiently for a re-test of its current resistance and let the price action play out first.

Be the first to comment