Sean Gallup/Getty Images News

While NIO (NYSE:NIO) remains one of the most popular EV brands in China, the upcoming financial headwinds caused by lockdowns are going to make it harder for the company to achieve its initial delivery target in the following months. At the same time, the growth of competitors along with the uncertain future of its stock on the American exchanges are also creating more pressure on the share price. On a positive note, though, there are signs that Beijing won’t interfere in the EV business at this stage and will help automakers weather the current challenges by keeping the tax cuts, which will make it easier for NIO to increase its market share in the biggest EV market in the world in the long run. Therefore, I continue to have a long position in NIO, which gives me exposure to the Chinese EV market, but the position itself doesn’t have a major significance in the overall portfolio due to external factors that are outside of the company’s control.

Prepare For An Ugly Performance

NIO undoubtedly has a bad second quarter. The lockdowns in the Chinese cities such as Shanghai made it harder for the company to exceed expectations in recent months. In my latest article on Alibaba (BABA), I have noted how Chinese lockdowns negatively affected even the country’s tech sector, as all revenue forecasts have been downgraded recently. Only less than a week ago Shanghai officials reported no cases in the city after months of strict movement restrictions. However, CCP has committed to the zero-Covid policy, and there was a document flowing from the Communist officials in which it was stated that travel restrictions could once again be implemented in the following years. As a result, it would be too premature to say that the lockdown risk has disappeared forever.

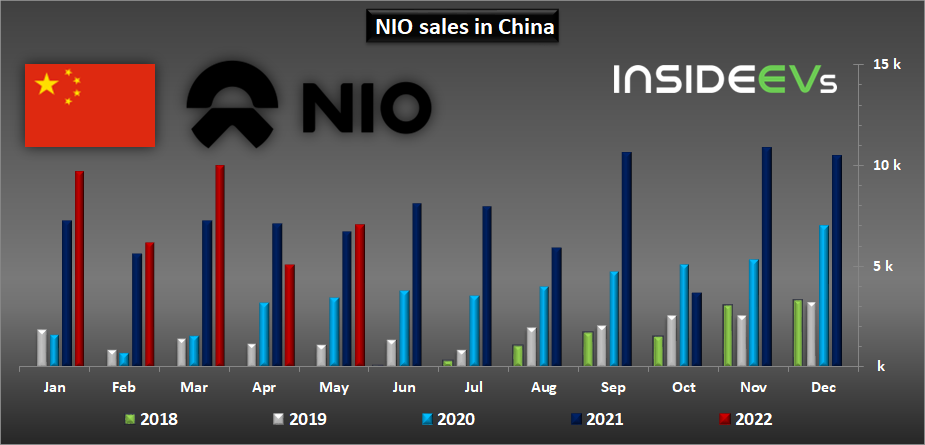

In April alone, NIO delivered only 5074 vehicles, down from nearly 10k in March. In May, the business started to slowly rebound from the effects of lockdowns as during that month NIO delivered 7024 vehicles up 4.7% Y/Y but still below the initial delivery targets. In Q2, NIO expects to deliver only 23,000 to 25,000 vehicles, down 3% Q/Q to 11% Q/Q. At the same time, the research agency Mizuho decreased its full-year estimates target from 142k to 138k.

NIO Sales in China (InsideEvs)

Another problem for NIO is the rise of competitors, who managed to more efficiently deal with the negative effects of the lockdown. In May, another Chinese EV maker XPeng (XPEV) increased its deliveries by 78% Y/Y to 10,125 vehicles, while one of NIO’s main competitors Li Auto (LI) grew its deliveries by 165.9% Y/Y to 11,496 vehicles in May. One of the main advantages of both XPeng and Li Auto is the fact that both of them have their own manufacturing plants and don’t rely on third parties for production, which makes it easier for them to minimize their downside during turbulent times. This is not the case with NIO, which outsources the production to its partner JAC.

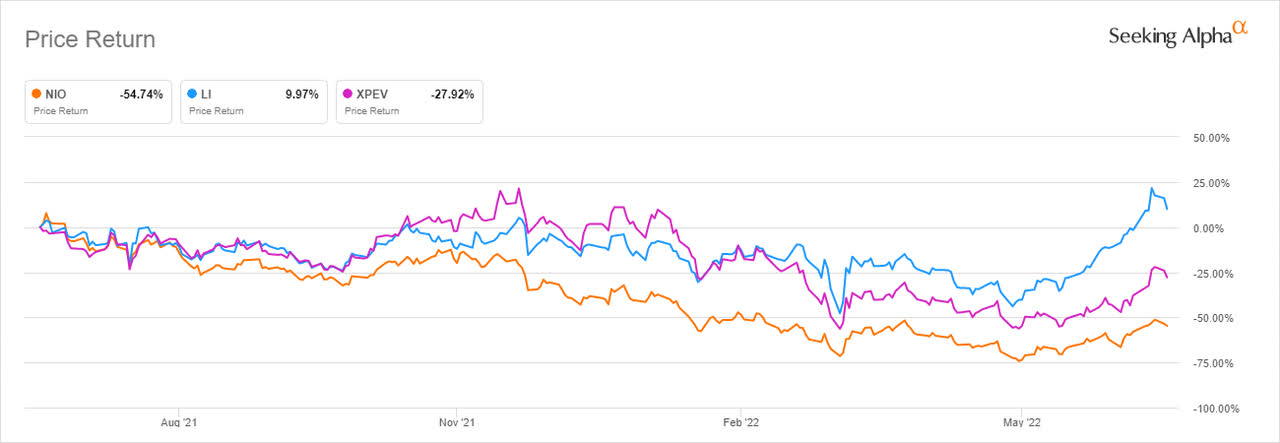

That’s probably one of the main reasons why NIO’s stock has also underperformed in the last 12 months in comparison to the stocks of both of its close competitors. What’s worse is that both of those companies are also about to enter NIO’s turf by launching their own electric SUVs in the following months. XPeng expects to release its electric SUV called G9 in Q3, while Li Auto plans to launch NIO’s direct competitor called L9 later this August. If successful, both XPeng and Li Auto could make it harder for NIO to accelerate its expansion, as the electric SUV market in China slowly becomes more saturated.

1Y Stock Performance of NIO, XPEV and LI (Seeking Alpha)

NIO’s third main downside comes from outside of China. In one of my latest articles on the company, I have already said that it’s unlikely that NIO will be able to significantly expand in Europe and the United States due to local competition and geopolitical reasons. On top of that, there’s a risk that its stock will continue to be under selling pressure until the regulators from both sides of the Pacific reach an audit deal. Last year a significant portion of institutional selling occurred due to fears that the company could be delisted from the American exchanges. Then just a month ago, NIO has once again been added to the PCAOB’s list of companies that operate in jurisdictions where international auditors couldn’t access the accounting books of public companies. In late May, the SEC officials stated that significant issues in reaching a deal with Chinese officials remain, and in my article on Alibaba, I noted why an audit deal needs to be reached before the end of this year in order to decrease the probability of delisting of Chinese shares from the US exchanges.

There’s Still Hope Left

Despite all of those downsides, there’s still some hope left for NIO. One of its main growth catalysts comes directly from Beijing. One of the main concerns that investors had in the past was whether the Chinese government decides to interfere in the EV business after its talks about the consolidation of the industry last year. Beijing’s interference in the tech sector has destroyed billions in shareholder value, so the fear was justified. However, in an effort to boost its economy and reach its carbon-neutral goal by 2060, the Chinese government will likely keep the tax cuts for the industry, which should spur consumer spending after the negative impact of the lockdowns and lead to nearly $30 billion in spending on EVs. Let’s not forget that Beijing aims to reach a GDP growth rate of 5.5% Y/Y in 2022, and it would be hard to do given the negative effects of the lockdowns in Q2. That’s why a new set of policies could be presented this year to reach that target, which should be viewed as a positive thing for NIO.

In addition, we shouldn’t ignore that China has the greatest adoption rate of EVs across the globe. In May alone, Chinese EV sales accounted for 31% of all car sales, while the country itself leads in global plug-in registrations as well. At the current pace, it’s believed that battery EVs will dominate the car market in China by 2025, so the CAGR estimates for the Chinese EV market of nearly 30% are close to reality. That’s also one of the main reasons why legacy automakers such as BMW are eager to manufacture and sell electric vehicles in the region as well.

To tackle the competition and prevent XPeng and Li Auto from taking over the electric SUV market, two weeks ago NIO revealed its mid-range SUV ES7, which could drive up to 300 miles on one charge and has a price point similar to Li’s upcoming L9. In addition, just like Li’s L9, NIO’s ES7 is also expected to start selling this August. On top of that, NIO is also interested in getting some portion of China’s electric sedan market and forcing XPeng and Li Auto to engage in a price war in that niche. That’s why in Q3 it expects to launch its sedan called ET5.

The good news in all of this is that it’s safe to say that the demand for EVs in China is still there despite the economic downturn caused by lockdowns. On top of that, China has all the rare earth elements needed to create batteries for electric vehicles. This helps local brands such as NIO to shorten their supply chains and minimize the geopolitical risks in case of trade wars. This is something that the European and American manufacturers, who rely on China for batteries and manufacturing tools, don’t have.

Another good thing is that the downside for NIO’s stock appears to be priced in at the current levels. For Q2, NIO’s management expects the company’s revenues to be in the range of $1.47 billion to $1.59 billion, still up 10.6% Y/Y to 19.4% Y/Y, but below the initial consensus street estimates of $1.79 billion. The weak guidance has negatively affected NIO’s shares earlier this month, but it also helped to decrease the overall expectations. The street has already updated its guidance and expects NIO to generate only $1.44 billion in revenues in Q2, which is below the management’s forecast. Considering that the management gave their outlook for the quarter in early June after the slow quarterly rebound in May, the company has a fairly good chance to beat the Q2 street estimates, which should positively affect its share price later on.

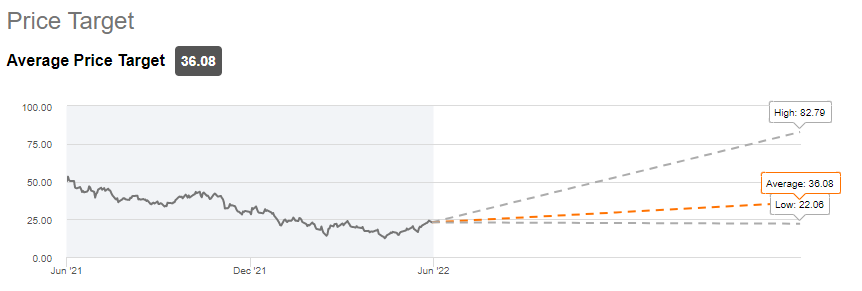

On top of all of this, the street still expects the annual revenue growth rate of 60% Y/Y with more growth by the end of the year when new models are launched and headwinds from the recent lockdowns disappear. At these estimates, NIO trades at a forward P/S rate of only 4x, which is a fairly justified multiple, especially since it already prices most of the downsides that are highlighted in this article. Considering this, the street gives NIO a consensus price of ~$36 per share, which represents an upside of ~70% from the current market price.

NIO’s Street Consensus Price Target (Seeking Alpha)

The Bottom Line

NIO enters an ugly period of less growth than initially expected and more competition on the horizon. The growth of its deliveries in May has been weaker in comparison to the growth rates of XPeng and Li Auto, which also suffered from Chinese lockdowns. As those two are entering the EV SUV market, it could be even harder for NIO to accelerate its expansion within the market in the following quarters. On top of that, there’s no guarantee that NIO along with XPeng and Li Auto won’t be delisted in the foreseeable future. As long as regulators from both sides of the Pacific don’t reach an audit deal, investors shouldn’t expect a rapid appreciation of stocks of those companies anytime soon.

On the other hand, it’s safe to say that NIO’s stock has priced in all those downsides, as it already depreciated by over 50% YTD and recently found a bottom. The main question now is whether the growth of the Chinese EV market will outweigh all the main risks that are associated with NIO. We should not ignore the fact that China will remain the biggest EV market in the world, which grows aggressively each year, and that opens new opportunities for NIO to create additional shareholder value despite all the challenges that it faces.

Therefore, I still think that NIO offers good exposure to the Chinese EV sector and that’s why I still own a small long position in the company, which doesn’t have a big exposure in comparison to other positions in the overall portfolio. That way I won’t lose much if the stock tumbles, but at the same time if China manages to recover its economy this year – an EV boom could follow, which will likely push NIO’s shares higher in the long run.

Mark Your Calendars For July 7

I’m happy to announce that on July 7, I’ll be launching my own marketplace service here on Seeking Alpha called BlackSquare Capital. As we’re entering a new geopolitical reality, the goal of the service will be to assist you in building an event-driven portfolio, which can weather any storm and thrive in volatile environments. There will be a very special introductory price for a limited number of the first subscribers, so stay tuned!

Be the first to comment