Andy Feng

Q3 recap and thesis

I’ve been writing a series of articles on NIO (NYSE:NIO) since May 2022 to caution readers of the many headwinds it’s facing. Undoubtedly, I see all the good things that the bulls like about this stock. However, I see even stronger headwinds. For example, in an article published in August 2022, entitled “A Simple Reality Check“, I cautioned readers about its lack of profit and its unsustainable valuation. The stock was still trading at about $21 per share at that time.

Fast forward to now, NIO just released its Q3 earnings report (“ER”). Its Q3 Non-GAAP EPS (i.e., earnings per ADS) came in at -$0.30 and missed consensus estimates by $0.14. Vehicle margin was compressed by another 160 basis points to 16.4% compared with 18.0% a year ago. Its stock prices plunged 12.4% after its Q3 ER into the single-digit range ($9.25 as of this writing, before the market open on Nov 10, 2022).

Now looking ahead, I maintain my bear thesis. And more specifically, in this article, I will argue that NIO’s stock prices would remain in the single digits in the near term (say the next 1~2 year or so). I acknowledge its long-term headwinds, including China’s secular shift towards EVs, its leading branding power, and its aggressive vehicle delivery plans. But I see the negative catalysts to have the upper hand in the near term due to a multitude of strong headwinds, as detailed next.

Strong delivery and top line growth

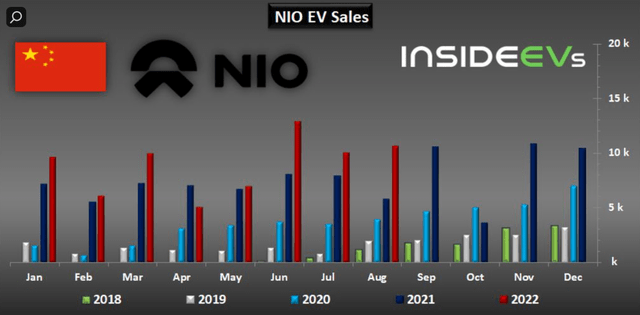

To have a full view, let’s first review the positives before we dive into the headwinds. NIO enjoys leading production and delivery scales among China’s domestic EV players. It has demonstrated a robust ramp-up of production and delivery capacity in the past consistently as you can see from the following chart. specifically, in its September delivery report, it provided the following update for its 2022 Q3 deliveries, boasting another quarter of quarterly deliveries and a nearly 30% YoY growth rate.

- NIO delivered 10,878 vehicles in September 2022

- NIO delivered 31,607 vehicles in the three months ended September 2022, increasing by 29.3% year-over-year and achieving record-high quarterly deliveries

- Cumulative deliveries of NIO vehicles reached 249,504 as of September 30, 2022

In its Q3 ER, it reported a total vehicle delivery exceeding 10k during the October month, translating into a 174.3% YOY (but a slight 7.5% decline MOM). And for its Q4 outlook, it aims at a delivery target in the range of 43k to 48k vehicles, translating into a growth rate of 71.8% to 91.7% YoY. Total revenues are projected to grow in tandem 75.4% to 94.2% YOY.

Source: InsideEVs (NIO)

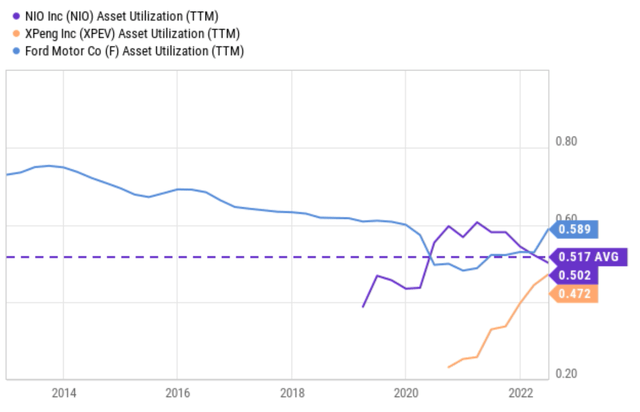

At the same time, its scale helps it to maintain healthy operation efficiency as you can see from the following comparison of its asset utilization (“AU”) against its domestic peer XPeng (XPEV) and U.S. peer Ford (F). NIO’s AU current stands at 0.50x, slightly below its long-term average of 0.517x largely due to the lockdowns in China due to recent COVID case resurgences. Despite the recent decline in its AU, it is still above XPEV’s 0.47x and comparable to F’s long-term average levels.

Margin pressure and lack of profit

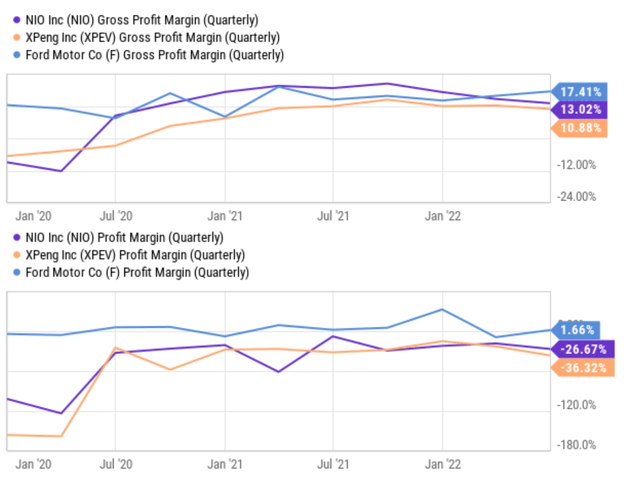

However, the business has been suffering margin pressure on the bottom line and is yet to earn a positive profit. As seen, its gross profit margin (“GPM”) peaked around 18% during 2H of 2021, surpassing Ford. But recently, the GPM has been under pressure and contracted to the current level of 13% by about 500 basis points. Now its GPM is lower than F’s 17.4% by a good gap (although still better than XPEV’s 10.8%). In terms of profit margin, as shown in the bottom panel, the picture is even more concerning. Its net profit margin has always been in the negatives and is -26.7% currently.

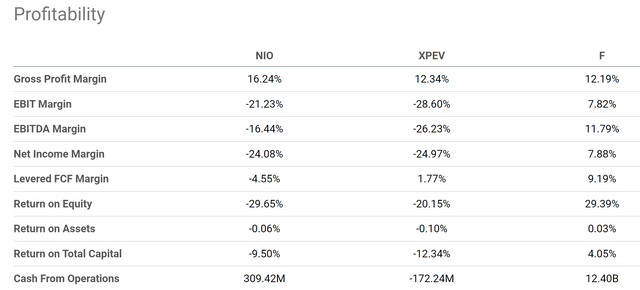

The picture does not improve as we broaden the view to include other metrics as seen in the chart below. Its metrics are negative across the board ranging from EBIT margin, EBITDA margin, and FCF margin.

Looking forward, I see a few key headwinds to keep its profits in the negative besides the macroeconomic factors such as political uncertainties and government policies. First, I expect the capital requirements to continue as it pursues the expansion of charging infrastructures. And note that its cash from operations sat at only $309M, far from being able to meet such requirements. To satisfy customers’ needs, management will need to keep spending on both battery swap stations and also charging stations. Secondly, I expect some of its manufacturing problems and also the global supply chain disruptions to persist. For example, it reported early about an issue involving the low yield rate of its mega-casting parts with its suppliers. This seemingly arcane issue actually can bottleneck its production ramp-up and efficiency, and it will take NIO time to solve its or find alternative suppliers amid supply chain disruptions.

Next, we will see that despite the lack of profit, the stock is still valued at an elevated level despite the large price corrections.

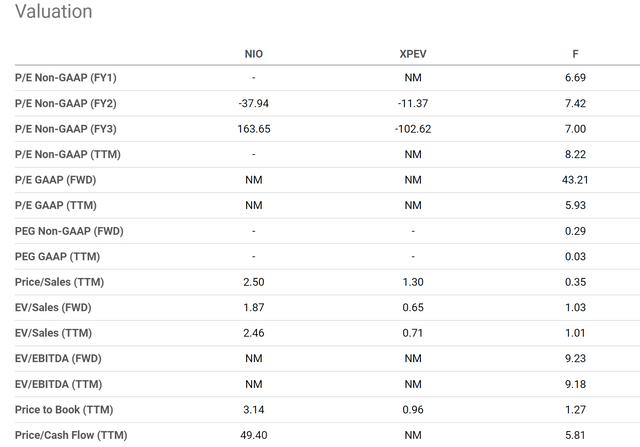

Valuation still too expensive

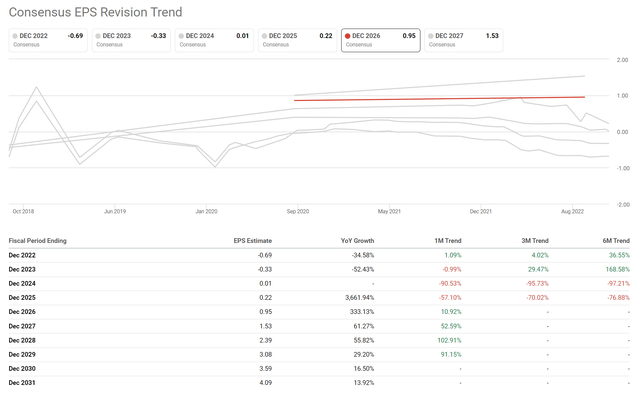

In terms of valuation, NIO is still trading at a large premium both in absolute and relative terms. Its lack of profit makes bottom-line oriented metric meaningless as seen in the chart below. Even FY3 PE stands at 163x, compare to about 6~7x for F. Furthermore, because of the many headwinds as analyzed above and its mixed Q3 results, its earnings outlook is both bleak and highly uncertain as reflected in the consensus estimates in the second chart below. NIO’s earnings revisions for the last 3 months paint a highly pessimistic and uncertain picture. A total of 11 analysts submitted EPS forecasts, and a total of 9 analysts revised the EPS downward by as much as 70% to 95% in 2024.

Using top-line valuation metrics, its P/Sales ratio is still at 2.5x despite the price corrections, on par with the S&P 500 index, about 2x higher than XPEV’s 1.3x, and 7.1x higher than F’s 0.35x. I found such a valuation unjustifiable given its lack of profit and the many headwinds it is facing. And again, its topline growth is highly uncertain too as reflected in the consensus estimates. A total of 21 analysts submitted revenue forecasts, and a total of 17 analysts revised the revenues downward.

Source: Seeking Alpha data Source: Seeking Alpha data

Other risks and final thoughts

To conclude, in the long term, NIO could benefit from the secular shift in China towards EVs, its capacity ramp-up, and its strong branding relative to its domestic peers.

However, I see too many strong forces in the near term to pressure the stock prices into the single-digit range. The stock has yet to report a positive earnings. So far, it has been trapped in the dreaded vicious cycle: the more vehicles it sells, the more money it loses.

The possibilities of lower government subsidies and policies change can also shift the risk calculus dramatically. The combination of elevated valuation and lack of net profit would also keep a lid on the stock prices. China’s Zero Policy on COVID is another uncertainty. NIO had to temporarily suspend production at two of its plants in Hefei during Q3 due to local COVID control requirements. And such suspensions are likely to recur in the near future. And finally, the stock may face the risk of securing new financing as its high CAPEX requirements persist while its organic earnings remain low or negative.

Be the first to comment