Andy Feng

Thesis

We highlighted in our previous article on NIO Inc. (NYSE:NIO) urging investors to capitalize on the broad selloff in Chinese equities as Chinese President Xi Jinping secured his third term. We argued that the market has likely used the panic selling to force weak holders to capitulate, including investors who added at its March/May lows.

Accordingly, NIO has significantly outperformed the S&P 500 (SPX) (SP500) since our previous update, as it posted a gain of 20.4% (vs. SPX’s 3.7% gain). Coupled with China’s “refinement” of its zero COVID policies last week, we believe the prognosis for Chinese equities is looking increasingly positive.

Furthermore, NIO was battered to levels that looked incredibly cheap before it released its Q3’22 earnings. As such, we postulated significant pessimism had already been baked into its valuation.

Therefore, the critical question for investors is whether the reward/risk profile still looks attractive despite a mixed Q3 result coupled with a weaker-than-expected Q4 guidance.

We assess that NIO’s valuation and price action remain constructive. We also deduce that it remains configured in a medium-term downtrend. Despite that, the opportunity for a mean-reversion rally against its bearish bias still looks attractive.

Furthermore, our analysis suggests that NIO’s operating performance should continue to improve through FY23 as it ramps up its production with its new product launches.

Coupled with constructive price action, refinement of zero COVID policy, and a battered valuation, we maintain our Speculative Buy rating with a medium-term price target (PT) of $19.

NIO: Weaker Q4 Guidance But Likely Reflected In Its Valuation

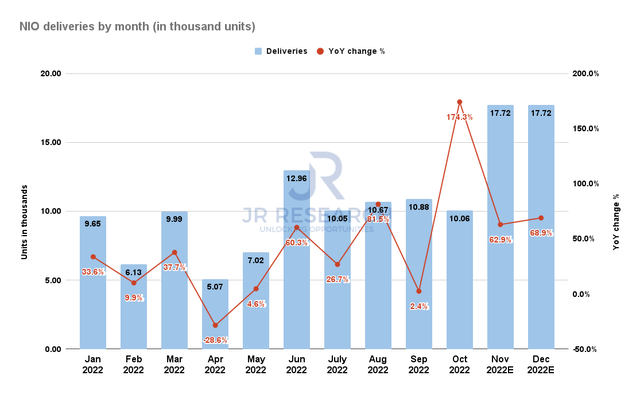

NIO Deliveries by month (Company filings)

Management highlighted that it expected to post Q4 deliveries of 45.5K units (midpoint). Given that NIO had announced 10.06K deliveries for October, its guidance suggests an average of 17.7K each for November and December.

Accordingly, NIO could post deliveries growth of 63% YoY in November, or 76% MoM. Notwithstanding, its Q4 guidance came in well below the previous consensus estimates of 55.61K units.

Despite that, the positive post-earnings reaction from the market suggests that it’s already looking ahead (given its battered valuation) as NIO is ramping up its production meaningfully.

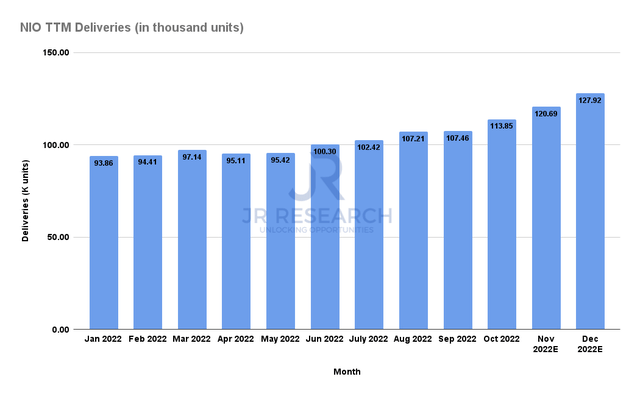

NIO TTM Deliveries by month (Company filings)

As such, the company’s TTM deliveries are expected to reach nearly 128K by December 2022. Therefore, it demonstrates that NIO has been ramping up its production well despite the zero COVID disruptions. Furthermore, the company highlighted its 600K capacity (on double shift) to meet its production requirements if necessary.

Also, it doesn’t expect to face significant demand challenges despite Tesla’s (TSLA) price cuts in China. However, we believe it’s still too early to determine the impact of the heightened competition between NIO and its EV peers. Obviously, NIO’s primary strategy is still to target the premium ICE segment in China. Even though the company has made progress as it attempts to diversify into Europe, the opportunity is still too nascent to assess its likely impact.

Hence, we postulate that the NIO’s momentum in China remains critical for the market to determine its directional bias moving ahead, despite its battering.

China’s Zero COVID Policy Refinement Is A Constructive Driver

China’s NEV market has largely defied China’s economic malaise and its zero COVID restrictions in 2022. Accordingly, recent data showed that China’s October NEV sales increased by 75% YoY. As such, China Passenger Car Association (CPCA) revised its forecasts for China NEV sales to 6.5M by the end of 2022 (up from 5M at the start of 2022).

Hence, it’s clear that NIO and its EV peers were mainly hobbled by COVID restrictions, given the supply chain disruptions to its production. Management also highlighted its concerns, as CEO William Li articulated:

It’s quite difficult for us to make [an] estimation regarding the impact of the COVID control and prevention measures on the operation of the company. But if we talk about the supply chain and the vehicle production, I believe the vehicle production capabilities should be able to meet the delivery target with that for next year. For 2023, I believe, for vehicle production, we will have a relatively sufficient production capacity to meet the demand. And if we can achieve 150,000 production capacity in 1 shift, I believe the production of the vehicle will be carried out in a very smooth manner. (NIO FQ3’22 earnings call)

Hence, we are pleased to know that China has decided to refine its zero COVID policy. While the government has emphasized that it doesn’t indicate an exit from zero COVID, we believe it implies positive progress in the correct direction for NIO.

It could also help alleviate significant production challenges moving ahead due to unforeseen COVID lockdowns. Hence, investors willing to bet on further progress should find NIO’s valuation appealing at the current levels, given its high-growth algorithm.

If investors wait till China fully reopens (of course, a big if for now), we are confident NIO wouldn’t be trading at where it’s, as the market is forward-looking.

Is NIO Stock A Buy, Sell, Or Hold?

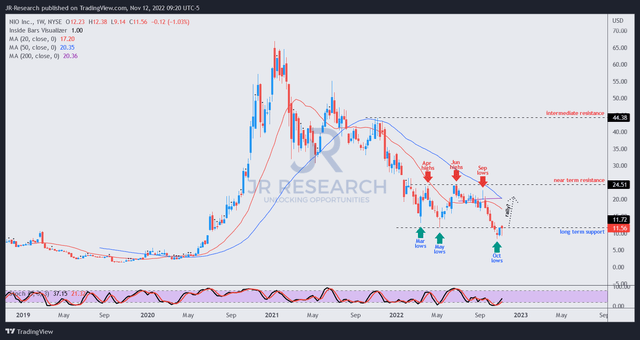

NIO price chart (weekly) (TradingView)

NIO held its October lows robustly after forcing an incredibly steep panic selloff from its September highs. Consequently, it also pulled the rug on dip buyers in March/May.

However, the recovery from its October lows could see NIO retake its long-term support, which is highly constructive.

Coupled with a battered valuation with an FY24 Revenue multiple of 0.89x, we see significant re-rating potential from these levels.

Maintain Speculative Buy with a medium-term PT of $19.

Be the first to comment