Scharfsinn86/iStock via Getty Images

After the founder resigned from his Executive Chairman position back in 2020 due to fraud allegations, Nikola (NASDAQ:NKLA) appeared in a dire situation. At the time, the EV trucking company faced allegations their truck didn’t even drive. My investment thesis is turning more Bullish on this survivor in the burgeoning EV trucking sector after previously warning to wait nearly a year for better prices.

Truck Production

At the Analysts Day event on March 24, analysts were able to confirm that Nikola had officially started production on battery-electric commercial trucks. The company confirmed a goal of producing 300 to 500 Tre BEV trucks this year after officially announcing a week ago the completion of construction at the Coolidge, AZ, plant with annual capacity of 2,500 trucks.

In quick order, Nikola has hit some huge millstones finally pushing the EV tuck manufacturer out of the pre-revenue phase. The original plans were for production to start in 2021 with the delivery of 600 BEV trucks, so the company is only ~1 year behind the original schedule despite the disruptions.

The news is important due the plans to expand into hydrogen EVs, or FCEVs, in 2023. Nikola is far more differentiated in the fuel cell market with even Tesla (TSLA) looking to manufacture EV trucks along with a whole list of other competitors.

Even the alpha FCEV units have already accumulated 8,000 miles and hauled 1.5 million pounds of product for Anheuser-Busch in Southern California. In other words, the market should have limited concerns about the real opportunity for Nikola to sell production units of the BEV this year and FCEV next year. What really appeared like a pipe dream after the founder resigned has turned into a legitimate business.

Similar to Tesla in the early days, Nikola has made impressive progress on building production capacity and vehicle development, but the company doesn’t exactly hit internal targets. The Phase 2 production expansion project will add another 20,000 truck capacity in 2023, but investors should hold the target with a grain of salt with the goal of progress over perfection.

Investors should expect more targets to slip leading to the major issue now facing the stock at $10 and a market cap of $4 billion.

Liquidity Is The Problem Now

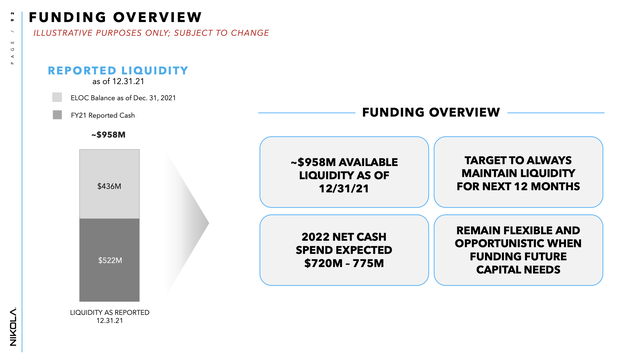

Nikola reported an end of 2021 cash balance of $497 million, down from $841 million in the prior year. The company is reporting a total liquidity position of ~$958 million based on $522 million in borrowing capacity.

Source: Nikola Q4’21 presentation

The company forecasts spending ~$750 million in cash this year leaving the year ending liquidity at an extremely low level, possibly below $200 million. Nikola will need to raise a substantial amount of money during 2022 in order to maintain liquidity targets for the next 12 months.

With the company producing Tre BEVs and working on pilot programs for the Tre FCEV, Nikola isn’t going to have a difficulty raising cash. The only real question is the cost of capital.

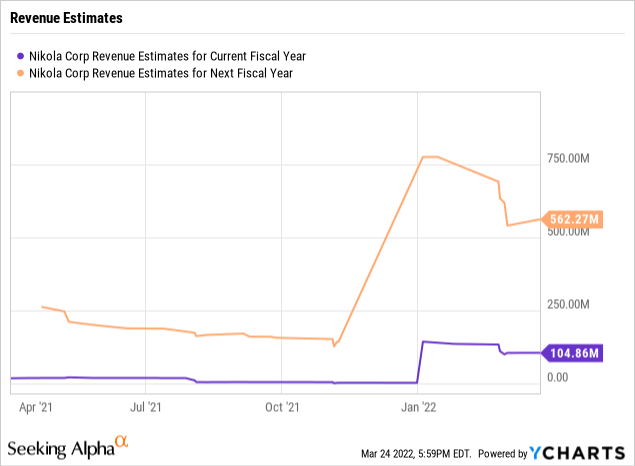

Investors following Nikola can now focus on a better question regarding the level of revenues as the production ramp becomes apparent. Analysts forecast 2022 revenues topping $100 million. At $300K a truck, the forecast is for Nikola to hit the low end of deliveries this year at only 333 BEVs.

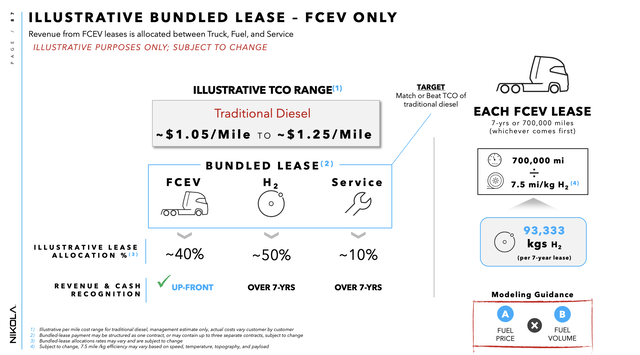

The FCEV trucks have a far more promising business model with Nikola set to generate revenues off hydrogen fuel and services. The company is working on a bundled lease where only 40% of the revenues come from the actual truck.

Source: Nikola Q4’21 presentation

The key here is that the business model really becomes intriguing in 2023 heading into 2024 as revenues ramp and the company approaches break-even levels while the liquidity position is improved. In fact, investors are probably looking at an ideal scenario where the stock is de-risked via both production ramping and Nikola raising additional funds out of the way.

A patient investor should wait for this signal.

Takeaway

The key investor takeaway is that Nikola still has to produce production units to generate sales and ramp-up production significantly to generate profits. At best, the company will burn the remaining cash and need to raise a substantial amount of funds. Under such a scenario, investors should keep the stock on the investment screen, but the best time to invest is after production units reach customers and the company has raised additional funds de-risking the investment.

Be the first to comment