Cucurudza

Another month, another step towards financial freedom.

It never gets old writing that.

I never tire of seeing my passive income stream increase.

Honestly, taking the time to tally up my monthly dividends is probably my favorite market-related activity that I perform each month as a part of my portfolio management process.

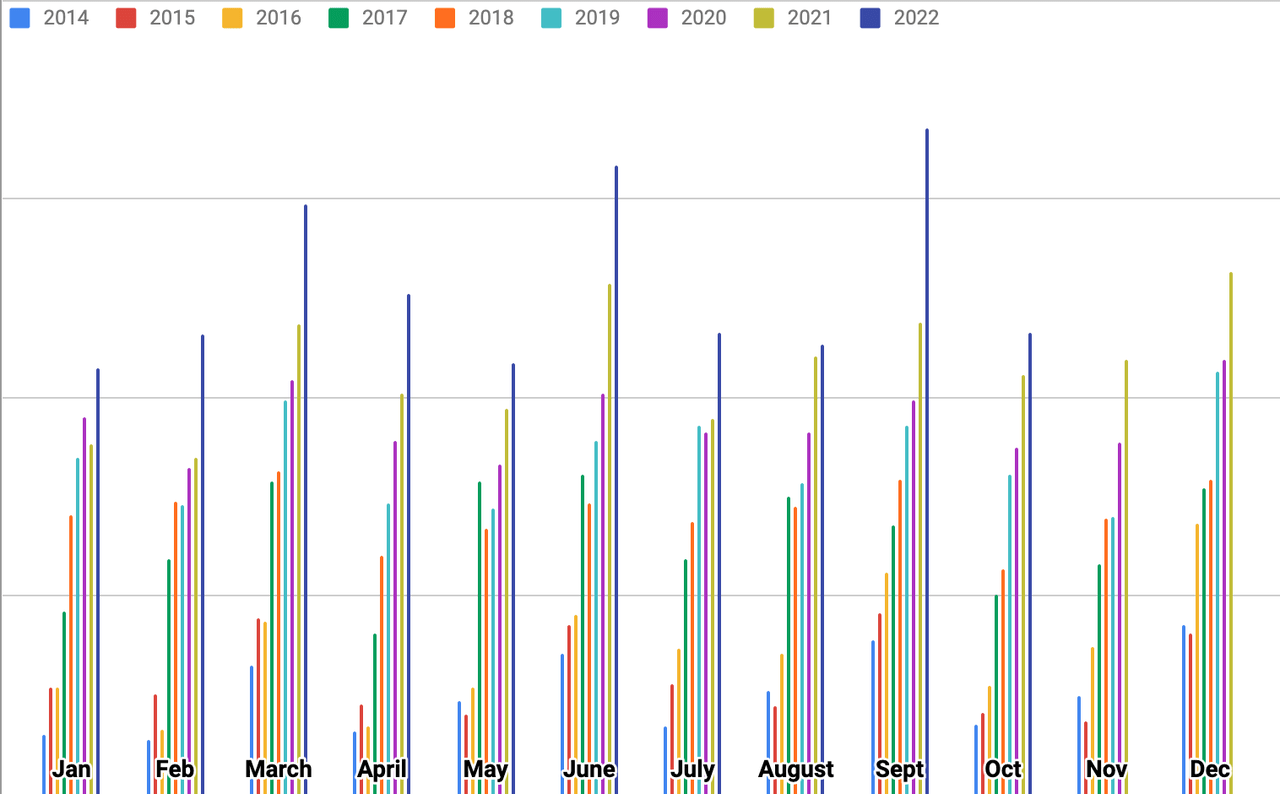

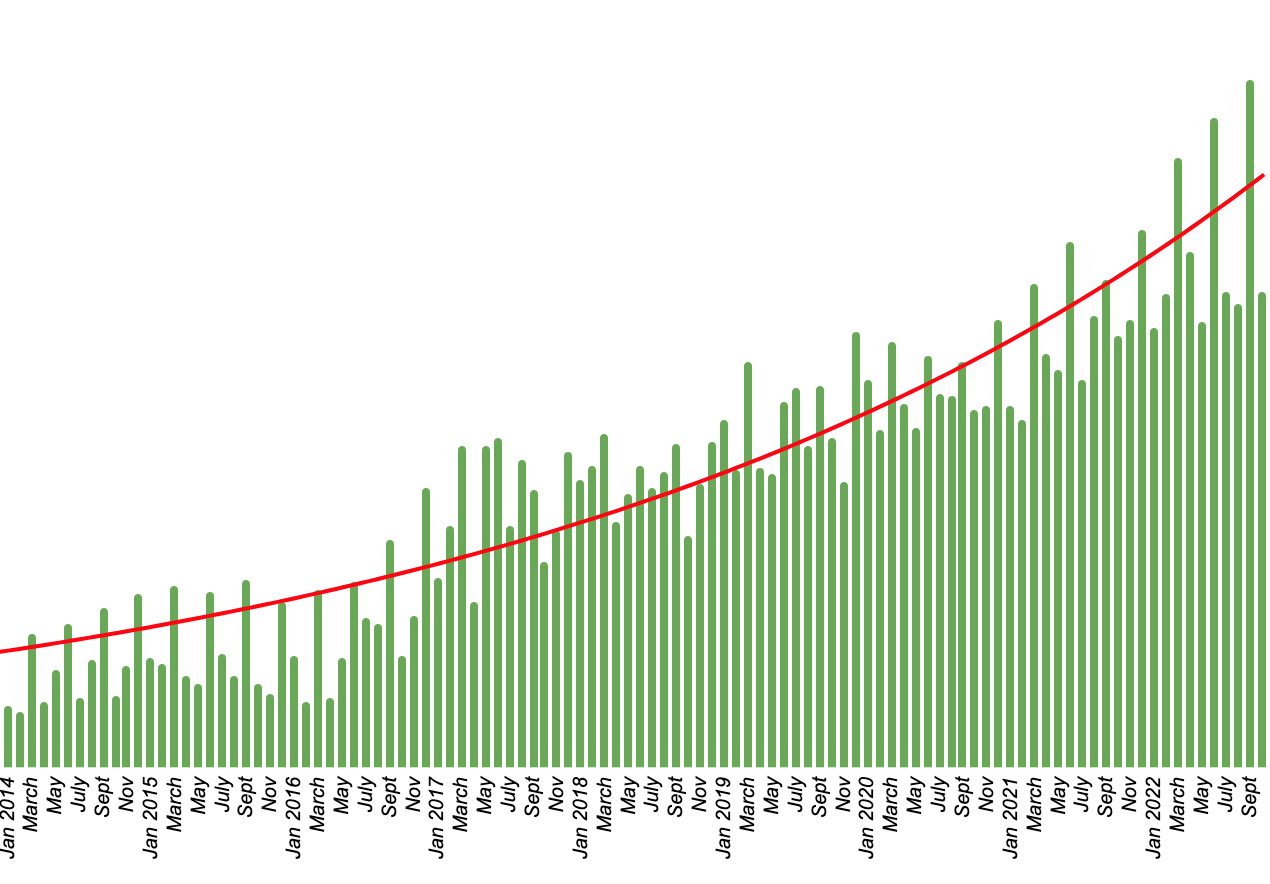

In October of 2022 my passive income stream posted 10.16% year-over-year growth.

Nick’s Dividends (Nick’s data )

Throughout the first 10 months of 2022 my passive income was up by 22.10% compared to the first 10 months of 2021.

And during a year like 2022, where the markets are down 20%+, it doesn’t get much better than being able to sit back and watch my passive income stream compound because frankly, short-term share price movement doesn’t matter to me.

You see, I’m basing my retirement plans off of sustainably growing dividends and with that in mind, I’ve been able to sleep well at night throughout this very volatile market environment seeing my dividends continually increase.

What’s more, the 20%+ dividend growth that I’ve generated throughout 2022 thus far (largely due to increased investments rather than organic raises) is well ahead of my annual goal.

In general, I’m targeting 10-12% annual dividend growth over the long-term.

Every year that I’m able to post results which exceed that level accelerates my journey towards financial freedom.

The weakness in the market has really hammered home the importance of passive income to me.

Lower share prices have allowed me to buy shares of beaten down blue chips with historically high yields.

In the past I’ve dabbled a bit in speculative growth stocks and/or non-dividend paying deep value picks; however, over time I’ve realized that I’ve come to regret those decisions more often than not.

Maybe it’s just a personality thing.

I know that others can be highly successful with investing strategies that involve those types of selections.

But, as for me, I receive a great deal of solace from the fact that the vast majority of my holdings pay me reliably increasing dividends, regardless of the type of sentiment surrounding markets or the broader economy’s near-term direction.

Monthly Dividends (Nick’s Data)

Believe me, after the disasters that we’ve seen from the big-tech earnings in recent weeks, it’s been hard to avoid the temptation to add shares of the beaten down F.A.N.G. names to my portfolio.

I really like the wide moats, strong balance sheets, and secular growth prospects that several of these companies offer (later on in this piece you’ll notice that I have significant positions in both Alphabet (GOOGL) and Amazon (AMZN) which are down 39% and 49%, on a year-to-date basis, respectively).

I’ve strongly considered piling shares of those companies up even higher; however, now – more than ever – I find myself focused on compounding my passive income stream as I notice this snowballing process pushing me closer and closer to my ultimate goal.

This is why I’ve become increasingly concentrated on accumulating blue chip dividend growth stocks throughout 2022 – this is why nearly every stock that I purchased during October pays a reliably increasing dividend.

October Trades

To start off, let’s discuss the selective re-investments that I made when I put my September dividends to work on 10/3/2022.

Here’s the trade alert that I sent out to Dividend Kings subscribers when I made my October re-investments:

“Everyone, I just put my September dividends to work. As I said over the weekend, September was my best month ever, in terms of dividend income. My passive income was up 41.1% on a y/y basis. Therefore, I had a lot of cash to put to work and I did so adding to a slew of existing positions. I added to MasterCard at $289.32, SPGI at $313.97, BAM at $42.26, ENB at $38.31, SHW at $212.34, QCOM at $116.44, ECL at $148.96, and NKE at $84.67. All of these companies are blue chips. They’re all undervalued (IMHO). The yields are mainly lower, but there is high dividend growth potential involved. And, ENB obviously bolsters the overall yield of the bucket. I’m so pleased with how the compounding process is working out for me…the market is down 25% and my passive income is at all-time highs. I’m looking forward to the dividends from the final quarter of the year. After September’s big y/y growth result, it’s looking like 24-25% overall dividend growth for 2022 is possible.”

In general, the focus here was on quality. I was pleased to take advantage of the recent sell-offs in names like MA, NKE, and BAM, specifically. Over the last month or so those stocks have experienced strong rallies…obviously, with the benefit of hindsight, I wish I had accumulated more shares near their recent lows, but at the end of the day, I’m also grateful to have had the opportunity to buy at such attractive prices.

Remember, when it comes to building wealth over the long-term it’s time in the market that matters, not trying to time the market, which is exactly why the regularly scheduled selective re-investment strategy works so well.

By re-investing my dividends on the first trading day of each month I know that I’m taking steps to increase my share counts of blue chips, regardless of what the market is doing. Re-investing on a schedule like this removes emotion (fear/greed) for the equation and guarantees that my dividend income stream is always marching higher.

Tax Loss Harvesting Trades:

With tax season just around the corner, I made 3 notable tax-loss harvesting moves during October: selling Block (SQ), Netflix (NFLX), and Prudential (PRU) at losses.

In general, I hate locking in losses.

I’m generally very averse to doing so, which is why, from time to time, you’ve seen me happily hold onto dividend payers when they’re underwater for long periods of time (companies like AT&T and Scotts Miracle-Gro come to mind here).

I don’t like the idea of selling strong companies when I believe that they’re undervalued.

In these situations, I’m usually content to stay patient and collect my dividends while I wait for a rebound to occur (historically speaking, the vast majority of blue chip stocks have bounced back from weakness). And, even if that doesn’t occur (honestly, I have my doubts about T/SMG climbing back up towards my cost basis anytime soon), I still strongly believe in the broader buy and hold strategy which has allowed me to hold onto winners whose gains have greatly outweighed any potential losses taken by stubbornly holding onto dogs.

Looking at long-term investing strategies, the data clearly shows that buying and holding blue chips leads towards strong performance over time.

As you can see by my cost basis data below, patience has rewarded me with a lot of significant gains by doing nothing but buying blue chips and sitting on my hands as their management teams compound my wealth.

But, with that being said, I am happy to talk with my CPA and use tax-loss harvesting to pull double duty by rectifying past investment mistakes and lowering my tax burden by taking strategic losses.

Here’s the trade alert that I posted to Dividend Kings subscribers regarding my first tax-loss harvesting trade which was made on 10/4/2022:

“All, I just made a trade…starting to think about taxes for the year and wanted to take advantage of the recent dip from a tax loss selling perspective. So, I sold my positions in SQ at $60.75 (total disaster, down like 62%…got a bit out of my lane with that one; lesson learned) and PRU at $92.82 (down slightly, like 7%) to offset some prior gains and give myself losses for the year. I immediately used the proceeds to buy O at $60.86 (I wanted to grab some shares while the yields were still around 5%), LMT at $405.04 (solid, SWAN type stock which yields roughly 3% and recently raised its dividend by 7%), and DIS at $99.93 (this is my first Disney purchase in years, but the stock looks very cheap if the company hits earnings growth estimates in the coming years, plus analysts are starting to predict the return of a dividend, which would be really nice). Overall, my passive income here was a break even. if Disney initiates its dividend, that would push it to positive, from a passive income standpoint. But, overall, I think I’ve increased the quality of my portfolio here and achieved my goals from a tax-loss perspective. Now I’m just going to sit back and see what happens with this rally…very happy to have put so much cash to work in recent weeks at the -25% threshold.”

Furthermore, I admitted to subscribers that I fell prey to greed and overpaid for SQ during the crypto boom of 2020/2021 and discussed my desire to reduce exposure to speculative growth stocks and reallocate those funds towards dividend growth stocks.

Unfortunately, I hold PayPal (PYPL) in a retirement account so there are no tax-related benefits to locking in those losses,, so I’ve decided to hold my PYPL stake (analysts are calling for strong EPS growth in the coming years). But, since SQ was held in a taxable account, I saw a chance to use this mistake to my advantage.

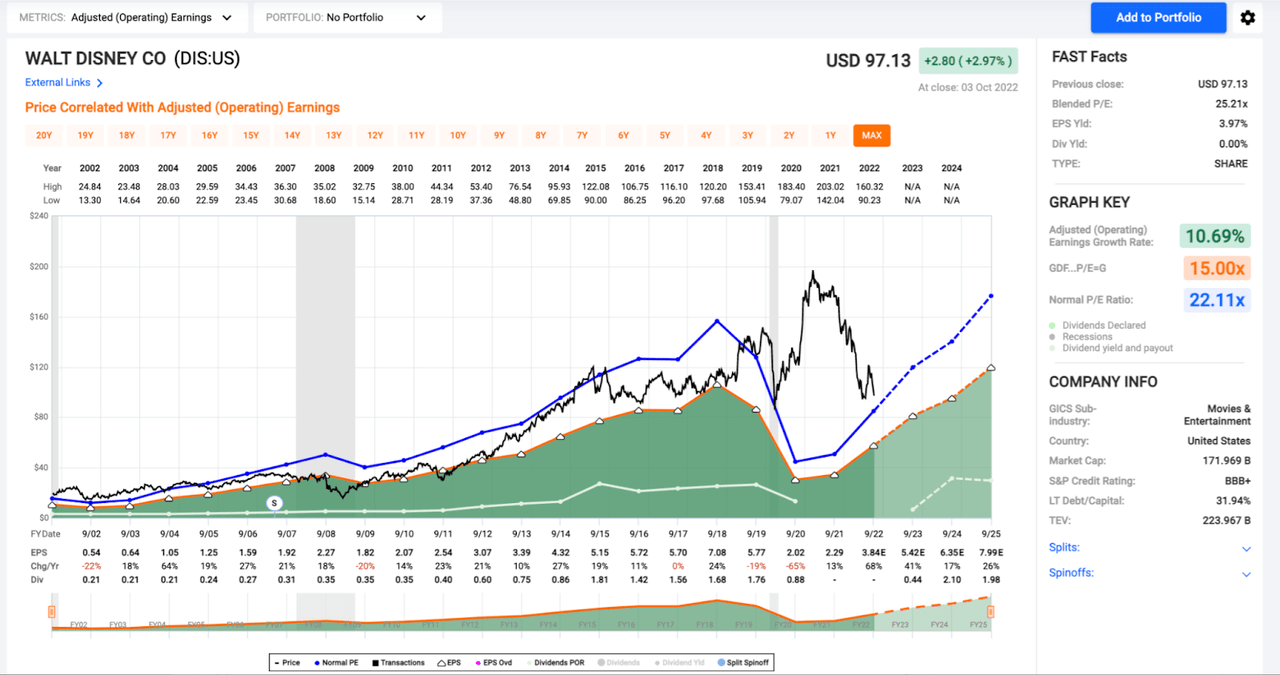

I should also note that since adding to my DIS stake the company posted pretty disappointing earnings.

When I added to my DIS stake I said, “It’s been a tough few years for DIS during the pandemic, but if they’re able to hit that ~$5.50 EPS estimate for the current fiscal year, we’re talking about a forward P/E of ~18.5x. And, if DIS meets analyst estimates looking out to fiscal 24 and 25, the forward P/Es are just 15.7x and 12x.”

Yet, things have changed, with regard to DIS’s forward fundamental guidance/consensus outlook.

Here’s the F.A.S.T. Graph chart that I posted on the day of that trade. As I said to subscribers, if DIS is able to hit that ~$8.00/share EPS figure in fiscal 2025 then shares were trading for less than 12.5x forward earnings just a few fiscal years down the road. I have a long time horizon and therefore, I thought the long-term upside was great. I still do…but I admit, the company’s recent Q4 earnings weren’t pretty and the analyst consensus for 2025 has already fallen from $7.99/share to $6.36/share.

F.A.S.T. Graphs (F.A.S.T. Graphs)

Therefore, my 12.5x forward multiple has already risen to 15.5x (looking at those 2025 estimates). That’s not good and it’s clear that the margin of safety here has diminished. But, long-term, I still really like DIS (though, at this point in time, the unexpectedly high ongoing streaming expenses do lead me to believe that Disney’s dividend isn’t likely to come back anytime soon).

Though, I suppose there is still hope in that regard with Wall Street consensus calling for dividend payments to begin again in fiscal 2024.

Either way (Disney dividend in the near-term, or not), I’m very pleased with the O and LMT additions as well.

In short, replacing PRU and SQ with LMT, O, and DIS is a trade that I’d make any day of the week and I’m definitely sleeping even better than usual at night after having increased the quality of my holdings.

Speaking of increasing the quality of my holdings, I also took advantage of the recent rally that Netflix (NFLX) shares experienced to exit that position at a slight loss, giving myself the flexibility to use those proceeds to bolster my portfolio’s quality and passive income stream.

Here’s the trade alert that I posted at Dividend Kings regarding my 10/25/2022 NFLX sale:

“All, I have meetings throughout the rest of the afternoon so I won’t be at my CPU. Before I leave, I decided to make a trade…liquidating my NFLX position at $291.79. In doing so, I locked in a 4.18% loss. That’s a bummer, but the more I thought about it, the more I wanted to go ahead and take advantage of the 26%+ rally that NFLX has seen during the last month. Initially, I bought shares of NFLX back in Jan of 2022 at $407 (when the shares dropped 20%+ in an AH post-earnings trade). I thought that was too far, too fast, in terms of a sell-off; however, it appears the market was correct, because NFLX’s fundamentals have deteriorated since (when I bought shares, NFLX was expected to post roughly $13 in earnings this year…well, now that’s a 2024 estimate). With that in mind, the value that I thought I was locking in disappeared. Thankfully, I averaged down throughout the sell-off, most recently doubling down at $217.15. My cost basis prior to the trade was $304.54. I was thinking about waiting to see profits, but ultimately, I didn’t want to lose out on the opportunity to raise cash and get rid of a disappointing position. I was able to add some tax losses here, so that’s nice too I suppose. In other words, I didn’t want to be greedy and miss out on the opportunity to basically rectify what I now view as a mistake. Since NFLX doesn’t pay a dividend, there is no lost passive income with this trade. Therefore, I’m not in a hurry to put this cash to work. But, with so many big earnings deals in the coming days, I wouldn’t be surprised to see outsized volatility. Admittedly, it feels nice to have extra cash on hand during a market like this…and looking back to my NFLX journey throughout 2022 on the whole, I take solace, knowing that my -4% performance here was actually much better than the broader markets. I plan to put this cash to work in a dividend grower.”

Admittedly, I got lucky here, from a tax loss perspective, because the original $407.00 purchase that I made was in a taxable account but my most recent $217.15 double down was in a retirement account, so when I sold my entire stake, I was able to lock in heavy losses on my initial stake (good for tax losses) while avoiding taxes on the large gains that I had on my most recently purchased shares.

In the weeks since 10/25 I used the proceeds from my NFLX sale to buy shares of EcoLab (ECL) at $131.17 and Hershey (HSY) at $213.40.

Both of these trades were made in November so I’ll discuss them during next month’s portfolio review, but once again, I feel confident that I’ve increased the quality of my holdings with these moves and although both ECL and HSY have relatively low dividend yields, the passive income that they provide is much higher than NFLX’s $0.00/share dividend and therefore, these trades are examples of using active management to increase my passive income stream.

A Tobacco Trade

In response to a handful of headlines impacting the tobacco space that I saw during October (namely, Philip Morris buying the US IQOS rights from Altria) I made a series of rebalancing trades…

Here’s the trade alert that I posted on 10/20/2022 to Dividend Kings regarding that matter:

“All – in light of the MO/PM news this morning, I’ve decided to shift around my tobacco basket to better reflect future return profiles (Looking at data, I agree with DS that BTI has the best future growth profile, followed by MO, with PM bringing up the rear, in terms of the big tobacco players). Prior to this morning’s trade, I owned a basket of all 3 stocks, which made up roughly 2.3% of my portfolio. I didn’t change that overall weighting with this morning’s trade…but I did move around my holdings. When thinking about making these moves, I wanted to ensure that I didn’t reduce my passive income stream. So, since PM had the lowest dividend yield of the 3…as well as the lowest return potential (plus, I’m not a big fan of them dishing out so much money for assets in this environment) I decided to liquidate my PM position at an average cost of $85.48. I also trimmed my MO position, which was previously overweight, back down to the 1% level of my portfolio…so now it’s full. I sold those MO shares at $43.92. Then, I used the proceeds of all of these sales to buy BTI…at an overall cost basis of $37.32. And, by making these trades, not only was I able to better align my weightings with my forward looking potential estimates, but I was able to slightly increase the size of my passive income stream (the new BTI shares generate roughly 2.95% more passive income than the PM/MO shares that I sold (thanks to BTI’s yield being much higher than PM’s). In conclusion, now I have an overweight BTI position, a full MO position, and zero PM shares…and a few more dividend $$.”

This one was just about moving around assets to maintain my exposure to reduced risk produced without damaging my dividend income stream.

Monthly Cash Savings:

And finally, with all of that out of the way, we arrive at the trades that I made with my monthly savings during the month of October.

I used my monthly savings to add to two existing positions: Texas Instruments (TXN) and Essex Property Trust (ESS). I also initiated a new stake in an industrial REIT: Rexford Industrial (REXR). All 3 of these companies are dividend growth blue chips, in my estimation.

The first trade of the month was TXN; on 10/18/2022 I bought shares at $151.45.

Here’s the trade alert that I sent out regarding these shares to Dividend Kings members:

“All, I just started putting my October savings to work…I used approximately 30% of my funds to add to my TXN position at $151.45. I think TXN is cheap here at roughly 17.2x next year’s earnings (which are expected to be down ~6% on a y/y basis)…yes, there are short-term growth headwinds at play (largely due to high capex). But, TXN recently raised their dividend by 8%, showing some confidence. And, since I’m overweight QCOM and AVGO, I’m happy to diversify a bit within the semiconductor space. TXN yields 3.27% here. And it goes ex-dividend in about a week. So, happy to lock in this next dividend payment, further compounding my passive income stream. Now…looking forward to putting the rest of the monthly savings to work in the coming days/weeks.”

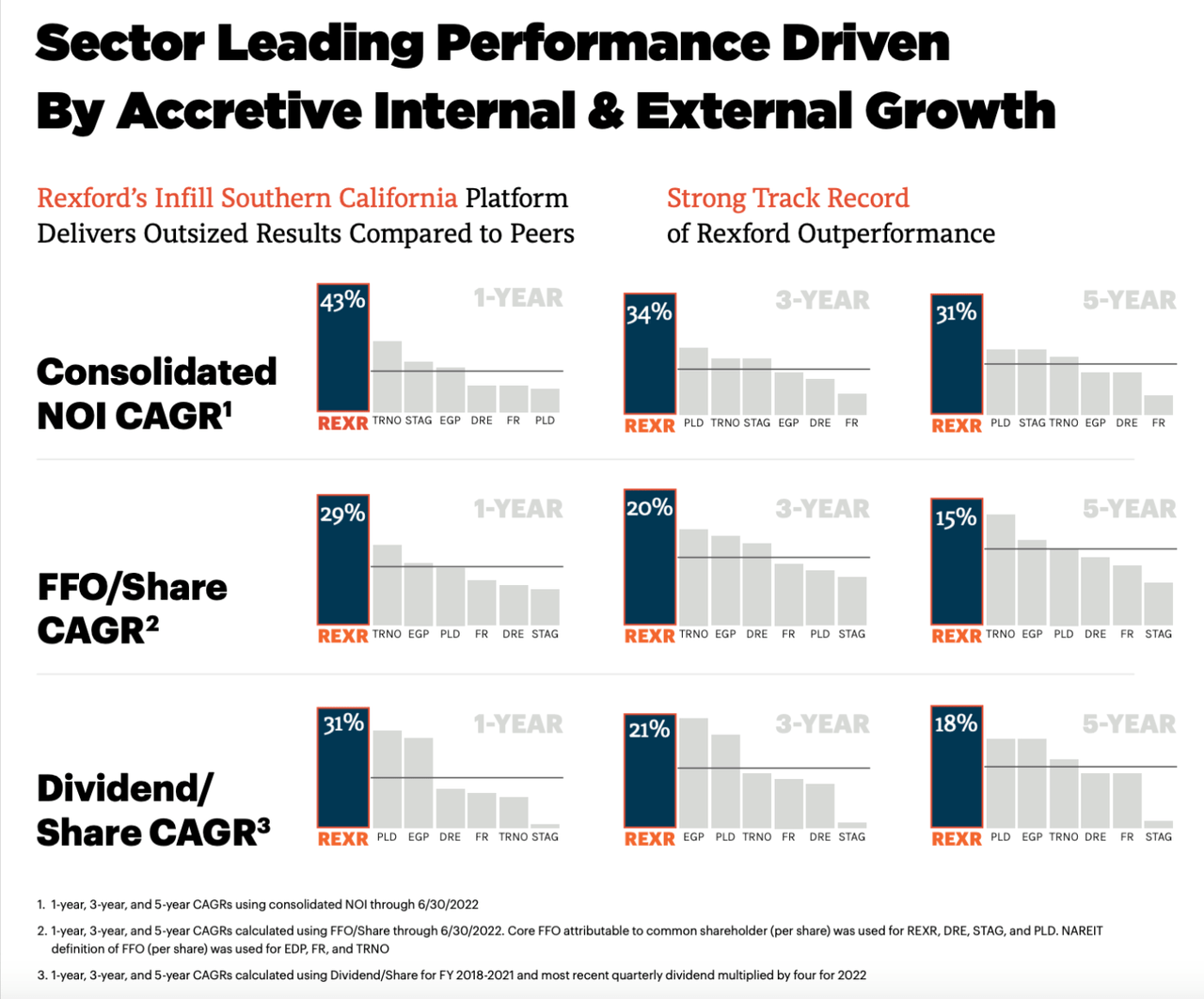

Up next, on 10/19/2022 I bought REXR at $51.00.

Here’s the trade alert that I provided to Dividend Kings subscribers:

“All, I just made another trade using my October savings…I initiated a position in REXR at $51.00/share. This is a blue chip industrial REIT (arguably the best-in-class name, though I’m sure Prologis – another company that I’m long – would beg to differ). At $51.00, REXR is trading for 31.5x my expectations for 2022 AFFO. And, at $51.00, REXR is trading for just 27.5x my expectations for 2023 AFFO. Those might not seem like low valuations, but if you look at the chart below, you’ll see that REXR hasn’t traded at these levels since the sell-off in late 2018. Furthermore, looking back over the last decade, you’ll notice that REXR shares have not fallen below the 30x AFFO range since mid-2016. In other words, I like the fundamental support here. I like the nearly 2.5% dividend yield. And I expect to see REXR continue to post double digit dividend increases moving forward. After this trade I will have put 70% of my monthly savings to work. I have room for another purchase or two before the month is over, so I will continue to look for blue chips trading at fair (or better) value. *graphics in the thread below.”

I continued, “REXR posts earnings tonight after the bell…my plan is to buy some now at a price that I like and then if the stock falls, I can buy more. But…if it rallies, well then at least I have a starter position.”

And lastly, I highlighted the company’s quality with this chart from a recent REXR investor presentation…

REXR October Investor Presentation (REXR IR)

As far as performance goes within the industrial space, it doesn’t get better than REXR over the last 5 years.

Speaking of high quality REITs focused on west coast properties, I also added to my ESS position last month, buying more shares at $222.97 on 10/27/2022.

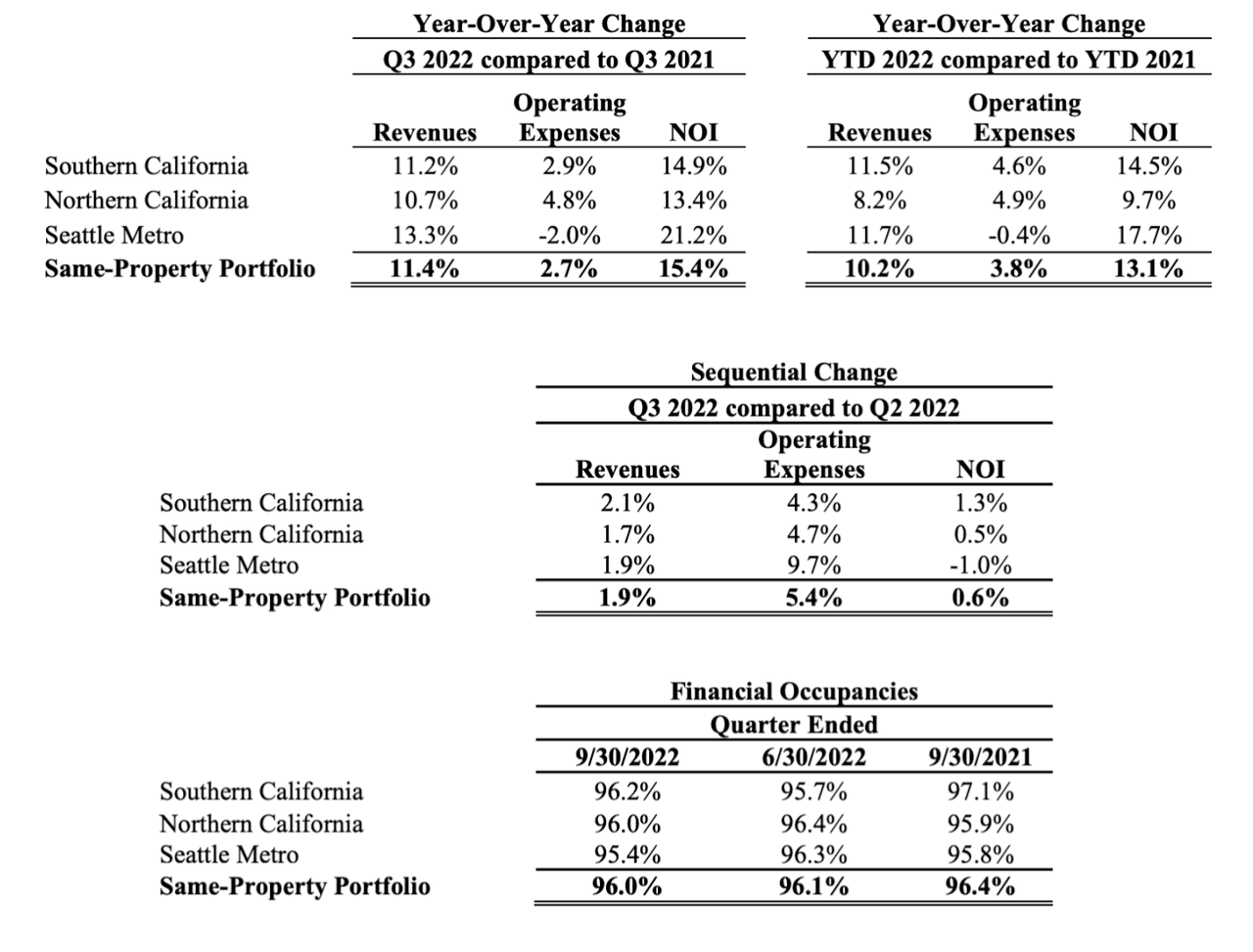

Here’s that trade alert: “All, I just put the rest of my monthly savings to work, adding to my ESS position at $222.97. At this level the stock yields 3.95%. ESS trades for just 15.4x the midpoint of new full-year FFO guidance (well below ESS’s 5, 10, and 20-year P/FFO averages of 20.75x, 21.5x, and 20.5x, respectively. At this price point, ESS shares are trading close to their 2020 COVID-19 crash valuation lows. And yet, the stock is expected to post 15%+ FFO growth this year and mid-single digit FFO growth in 2023 and 2024 as well. The stock’s same-store NOI continues to grow nicely. And while I expect to see that slow down next year too (due to tough comps) the fact is, I really like ESS’s properties in the supply constrained west coast markets. ESS doesn’t have the same sort of growth prospects as a MAA/CPT in the near-term; however, its valuation is much more attractive and I like the nearly 4% yield here. No matter how you slice it, this stock is historically cheap and I love buying blue chips like ESS when they have a wide margin of safety attached. I still have my NFLX proceeds to put to work. I’m hoping to allocate those towards another DGI stock or two in the relatively near-term. analysis/charts in the comment thread below.”

I continued, “As you can see, strong operational results in all of its major markets.”

ESS Q3 Data (ESS IR )

Nicholas Ward’s Dividend Growth Portfolio

|

Core Dividend Growth |

60.99% | ||

| Company name | Ticker | Cost basis | Portfolio Weighting |

| Apple | AAPL | $24.26 | 13.53% |

| Microsoft | MSFT | $72.84 | 4.14% |

| Broadcom | AVGO | $234.30 | 2.78% |

| BlackRock | BLK | $413.84 | 2.44% |

| Qualcomm | QCOM | $76.44 | 2.12% |

| Starbucks | SBUX | $48.10 | 2.09% |

| Johnson and Johnson | JNJ | $114.02 | 2.06% |

| Cummins | CMI | $217.77 | 1.69% |

| Cisco | CSCO | $32.67 | 1.68% |

| Lockheed Martin | LMT | $354.14 | 1.58% |

| Bristol Myers Squibb | BMY | $49.47 | 1.58% |

| Raytheon Technologies | RTX | $80.22 | 1.57% |

| Merck | MRK | $73.71 | 1.50% |

| Comcast | CMCSA | $38.54 | 1.45% |

| PepsiCo | PEP | $94.75 | 1.44% |

| Deere & Co. | DE | $347.85 | 1.26% |

| Honeywell | HON | $126.18 | 1.21% |

| Amgen | AMGN | $136.07 | 1.21% |

| Texas Instruments | TXN | $106.72 | 1.17% |

| Coca-Cola | KO | $40.25 | 1.08% |

| Brookfield Asset Management | BAM | $35.70 | 1.06% |

| Brookfield Renewables | BEPC | $33.49 | 1.04% |

| Parker-Hannifin | PH | $255.96 | 0.98% |

| Illinois Tool Works | ITW | $130.90 | 0.87% |

| Brookfield Infrastructure | BIPC | $39.19 | 0.87% |

| Pfizer | PFE | $30.48 | 0.81% |

| L3Harris Technologies | LHX | $185.82 | 0.71% |

| Ecolab Inc. | ECL | $143.27 | 0.65% |

| Northrop Grumman | NOC | $376.97 | 0.64% |

| Essex Property Trust | ESS | $226.97 | 0.62% |

| Air Products and Chemicals | APD | $234.91 | 0.62% |

| Prologis | PLD | $118.30 | 0.51% |

| Alexandria Real Estate | ARE | $130.96 | 0.47% |

| Diageo | DEO | $107.91 | 0.45% |

| AvalonBay Communities | AVB | $156.60 | 0.41% |

| Hormel | HRL | $42.99 | 0.40% |

| Hershey | HSY | $213.40 | 0.40% |

| Medtronic | MDT | $73.94 | 0.37% |

| Digital Realty | DLR | $49.87 | 0.36% |

| Rexford Industrial Realty | REXR | $51.22 | 0.35% |

| Stanley Black & Decker | SWK | $139.75 | 0.34% |

| McCormick | MKC | $35.71 | 0.26% |

| Mid-America Apartments | MAA | $163.02 | 0.22% |

| Automatic Data Processing | ADP | $227.52 | <0.10% |

| McDonalds | MCD | $232.10 | <0.10% |

| Waste Management | WM | $161.37 | <0.10% |

| High Yield | 13.65% | ||

| Realty Income | O | $62.34 | 2.51% |

| British American Tobacco | BTI | $37.59 | 1.75% |

| W.P. Carey | WPC | $65.23 | 1.49% |

| AT&T | T | $28.83 | 1.35% |

| AbbVie | ABBV | $79.08 | 1.35% |

| Agree Realty | ADC | $65.85 | 1.33% |

| Enbridge | ENB | $39.33 | 1.33% |

| Altria | MO | $45.96 | 0.98% |

| Federal Realty Investment Trust | FRT | $115.13 | 0.67% |

| National Retail Properties | NNN | $36.57 | 0.61% |

| Verizon | VZ | $45.20 | 0.28% |

|

High Dividend Growth |

11.07% | ||

| Visa | V | $74.29 | 2.26% |

| Lowe’s | LOW | $148.99 | 1.75% |

| Nike | NKE | $62.68 | 1.44% |

| Home Depot | HD | $250.58 | 1.09% |

| MasterCard | MA | $90.44 | 1.04% |

| Intercontinental Exchange | ICE | $97.23 | 0.69% |

| Domino’s Pizza | DPZ | $355.20 | 0.53% |

| Booz Allen Hamilton | BAH | $75.49 | 0.49% |

| Sherwin Williams | SHW | $219.30 | 0.45% |

| Accenture | ACN | $269.76 | 0.38% |

| S&P 500 Global | SPGI | $332.22 | 0.37% |

| Roper | ROP | $418.69 | 0.35% |

| ASML Holding | ASML | $643.47 | 0.23% |

| Non-Dividend | 7.51% | ||

| Alphabet | GOOGL | $44.34 | 4.07% |

| Amazon | AMZN | $88.19 | 1.81% |

| Adobe | ADBE | $439.36 | 0.66% |

| Salesforce | CRM | $213.13 | 0.29% |

| Meta Platforms | META | $179.21 | 0.28% |

| PayPal | PYPL | $201.72 | 0.20% |

| Chipotle | CMG | $1,298.41 | 0.20% |

| Palantir | PLTR | $15.11 | <0.10% |

|

Special Circumstance |

5.77% | ||

| Walt Disney | DIS | $91.92 | 1.70% |

| Blackstone | BX | $95.86 | 1.39% |

| NVIDIA | NVDA | $37.19 | 1.35% |

| Constellation Brands | STZ | $172.19 | 0.39% |

| Ares Capital Corp. | ARCC | $16.94 | 0.31% |

| Owl Rock Capital | ORCC | $14.23 | 0.31% |

| Carrier | CARR | $20.97 | 0.12% |

| Otis | OTIS | $58.65 | 0.10% |

| Scotts MiracleGro | SMG | $153.56 | <0.10% |

| Crypto | Diversified Basket | n/a | 0.39% |

| Cash | 0.52%* | ||

| Most | Recent | Update: | 11/11 |

*Most of my cash is held in my checking account, not my brokerage accounts, so overall, my investable cash weighting is roughly 6.5%.

Conclusion

Since the end of October we’ve seen a nice rally in the markets. I’ve put a lot of cash to work throughout 2022 and it’s great to see such strong gains on some of those recent investments. But, more than anything, I continue to look forward to totaling up my dividend income during November and December to see the 2022 annual total.

As you know, in retirement, I don’t plan on living off of the proceeds from trades. Frankly, I hate the idea of having to liquidate assets to fund a comfortable retirement. The idea of outliving one’s nest egg is a scary one and therefore, my plan doesn’t involve selling shares at all, but instead, living off of the passive income that my portfolio produces. My heavy allocation towards dividend growth stocks should provide reliably increasing passive income throughout the rest of my life (including retirement).

To me, reaching financial freedom comes when my passive income level exceeds my lifestyle’s expenses. The beauty of the dividend growth strategy is that not only can my equities provide the passive income that I need, but annual increases which protect my purchasing power from being eroded away by inflation. Living entirely off of the dividends provided by this well diversified portfolio remains my goal and therefore, I smile every time that I add shares of a blue chip dividend grower to my holdings…knowing that by doing so, I’m one step closer to my ultimate goal.

Be the first to comment