In this article, we examine the significant weekly order flow and market structure developments driving NG price action.

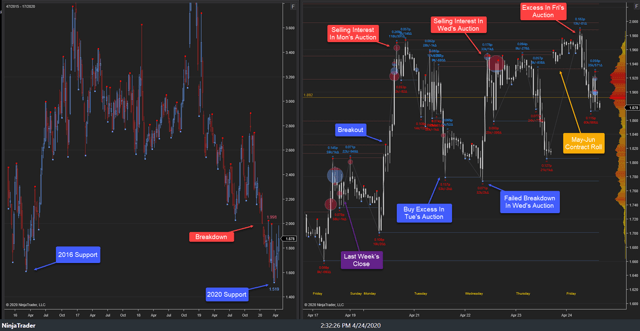

As noted in last week’s NG Weekly, the highest probability path for this week was buy-side barring failure of 1.70s as support. This probability path did play out as a pullback to 1.70s early week resulted in aggressive price discovery higher to 1.97s in Monday’s auction where selling interest emerged. Balance developed there, 1.97s-1.77s, through mid-week before a minor probe higher to 1.98s failed in Friday’s trade amidst the May-Jun contract liquidity roll. A minor pullback developed to 1.87s in Friday’s auction, settling at 1.89s.

19–24 April 2020:

This week’s auction saw a pullback develop in Monday’s trade, achieving the weekly stopping point low, 1.70s. Price discovery higher resumed from there, driving price higher through key resistance, 1.80s, achieving a stopping point, 1.94s, where selling interest emerged into Monday’s NY close. Minor price discovery higher developed to 1.97s following Monday’s Globex re-open. Selling interest emerged there as retracement ensued in Tuesday’s trade, achieving a stopping point, 1.77s, where a buy excess emerged into Tuesday’s NY close.

Narrow balance developed, 1.77s-1.84s, into Wednesday’s trade before a re-test of the pullback low developed. Rotation higher ensued within the developing balance, achieving a stopping point, 1.95s. Buyers trapped there ahead of Wednesday’s NY close. Balance continued in Thursday’s trade through the EIA release (+43 bcf vs. +39 bcf expected) as rotation lower developed to 1.80s into Thursday’s NY close. A contract roll induced gap higher developed upon Thursday’s Globex re-open before minor price discovery higher, achieving the weekly stopping point high, 1.98s, early in Friday’s auction. Minor sell excess developed there as the probe higher failed and price rotated lower 1.87s ahead of Friday’s close, settling at 1.89s.

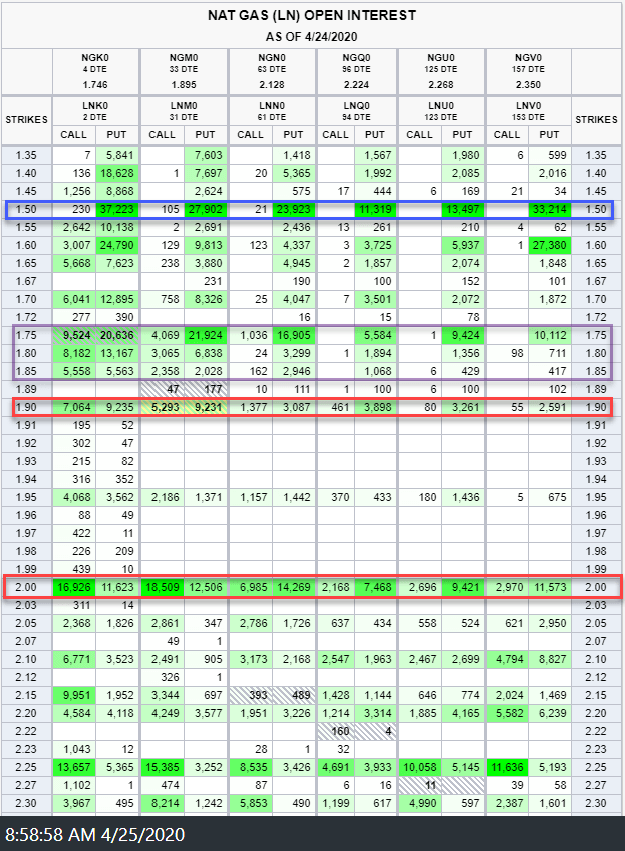

This week’s primary expectation of price discovery higher did unfold as key support, 1.70s, held early week before the rally continued to 1.98s. The rally phase stalled within key supply overhead and a large option “Wall”, 1.80s-1.90s.

Source: CME/QuikStrike

Focus into next week rests upon the market response to the key trade cluster, 1.98s-1.80s. Buy-side failure to drive price higher from this area will target key demand clusters below, 1.73s-1.66s/1.60s-1.55s, respectively. Alternatively, sell-side failure to drive price lower from this area will target key supply clusters above, 2.17s-2.22s/2.23s-2.29s, respectively. The highest probability path, near-term, is sell-side, barring failure of 1.98s as resistance. The four-year demand cluster, 2.20s-1.50s, which we have noted for months and which the market revisited, remains key to the larger structural view. In the intermediate term (3-6 month) context, conditions in the leveraged capital posture reflect signs of potential structural low formation as the market trades to this major demand area.

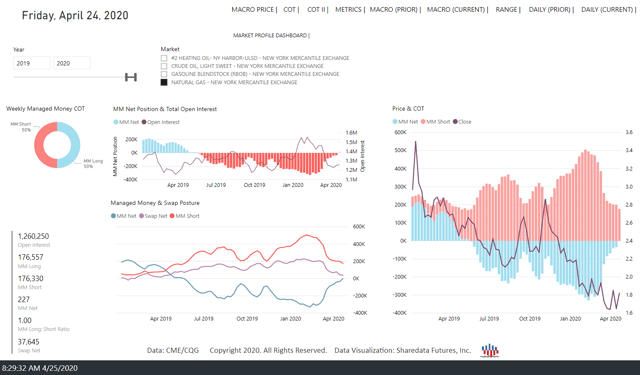

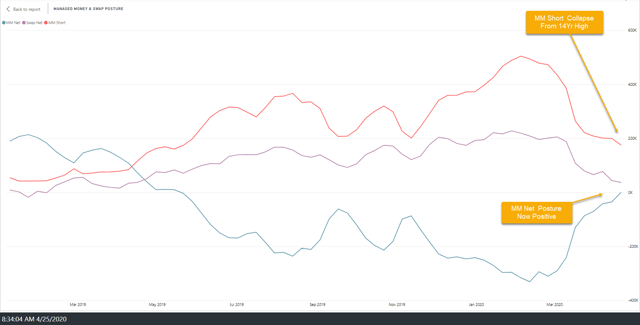

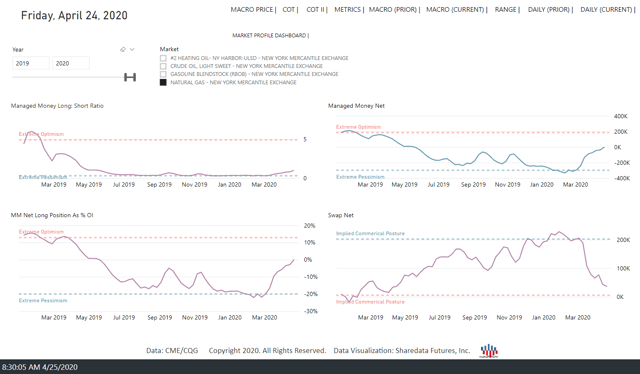

It is worth noting that despite the approximately 59% decline from the November 2018 high to the August 2019 low, only from June through early September 2019 had the Managed Money (MM) short posture begun to reach levels consistent with structural low formation (typically 300-350k contracts). MM short posture peaked the week of 13 August (-367k contracts) declining into mid-November (-201k contracts). This development implied that MM sentiment reached extreme bearishness as price reached lows resulting in the rally from 2.02s to 2.90s. In the last 2 instances of this development (March 2016 and December 2017), NG subsequently rose from 1.70s to 3.25s and 2.65s to 4.5s, respectively. This week’s data shows MM net posture flipped positive (224 contracts), an approximately 330k contract shift, from the fourteen-year low developed on 11 February. This week’s MM net posture is the first positive reading since May 2019.

The MM short posture stands at -176k contracts as the trend lower continues since the 04 February high (-505k contracts).

The MM long:short ratio and MM net long position as % of open interest remain at levels typically consistent with structural low formation. MM posture reached quantity needed to develop structural lows from July-September 2019 and recent levels were more extreme. MM posture is now reflecting the material shift of net posture at/near major lows. This type of development warrants caution on the sell-side as this type of herding behavior generally creates potential for abrupt price movement in the opposite direction. The market has seen such movement of the 1.55 support recently. Based on the market generated data, it is likely a structural low has developed.

The market structure, order flow, and leveraged capital posture provide the empirical evidence needed to observe where asymmetric opportunity resides.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment