monsitj

By Jill Mislinski

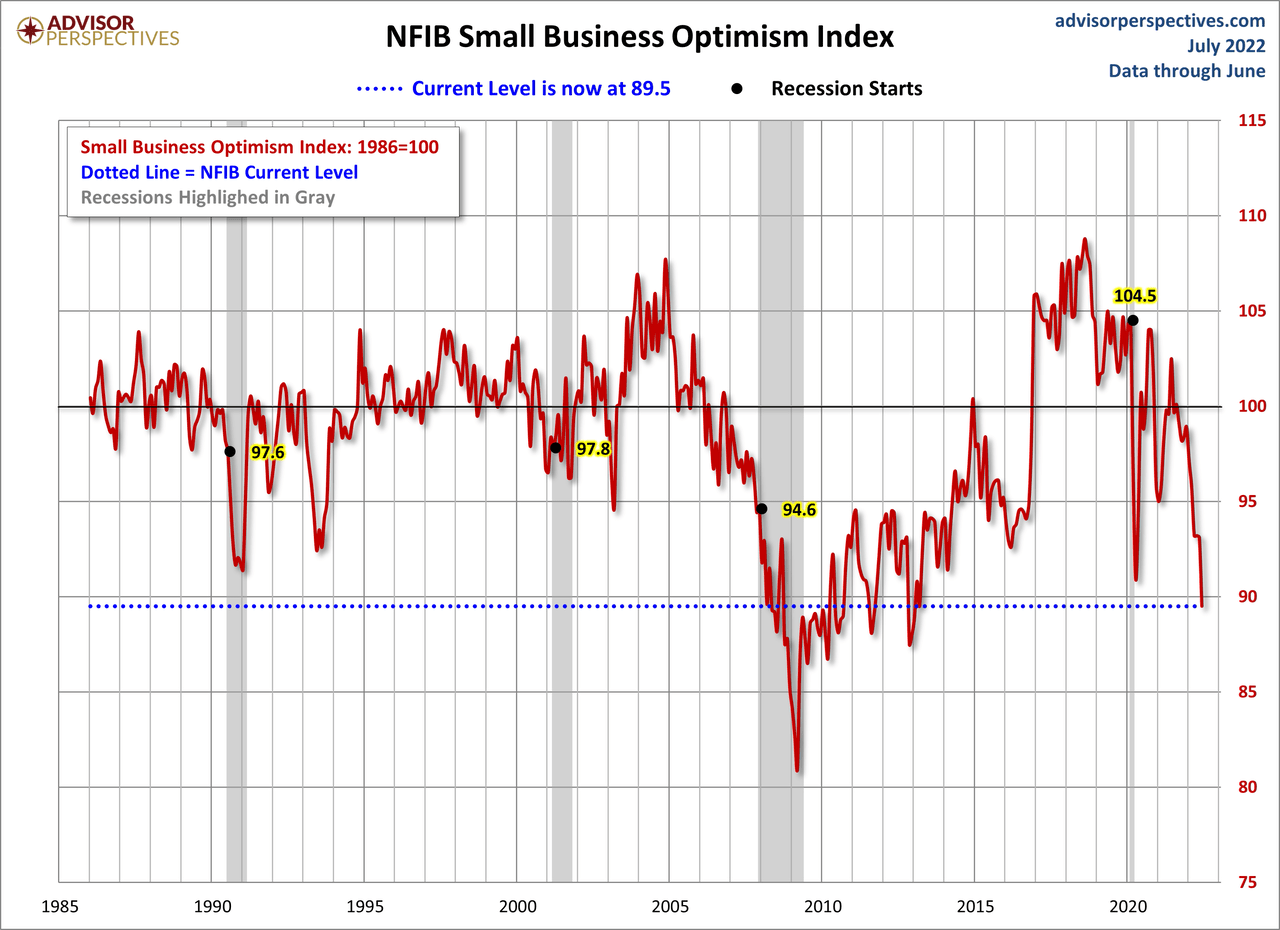

The latest issue of the NFIB Small Business Economic Trends came out this morning. The headline number for June came in at 89.5, down 3.6 from the previous month. The index is at the 7th percentile in this series.

Here is an excerpt from the opening summary of the news release.

The NFIB Small Business Optimism Index dropped 3.6 points in June to 89.5, marking the sixth consecutive month below the 48-year average of 98. Small business owners expecting better business conditions over the next six months decreased seven points to a net negative 61%, the lowest level recorded in the 48-year survey. Expectations for better conditions have worsened every month this year.

Inflation continues to be a top problem for small businesses with 34% of owners reporting it was their single most important problem in operating their business, an increase of six points from May and the highest level since quarter four in 1980.

The first chart below highlights the 1986 baseline level of 100 and includes some labels to help us visualize that dramatic change in small-business sentiment that accompanied the Great Financial Crisis and now the COVID-19 pandemic. Compare, for example, the relative resilience of the index during the 2000-2003 collapse of the Tech Bubble with the far weaker readings following the Great Recession that ended in June 2009 and today’s figures.

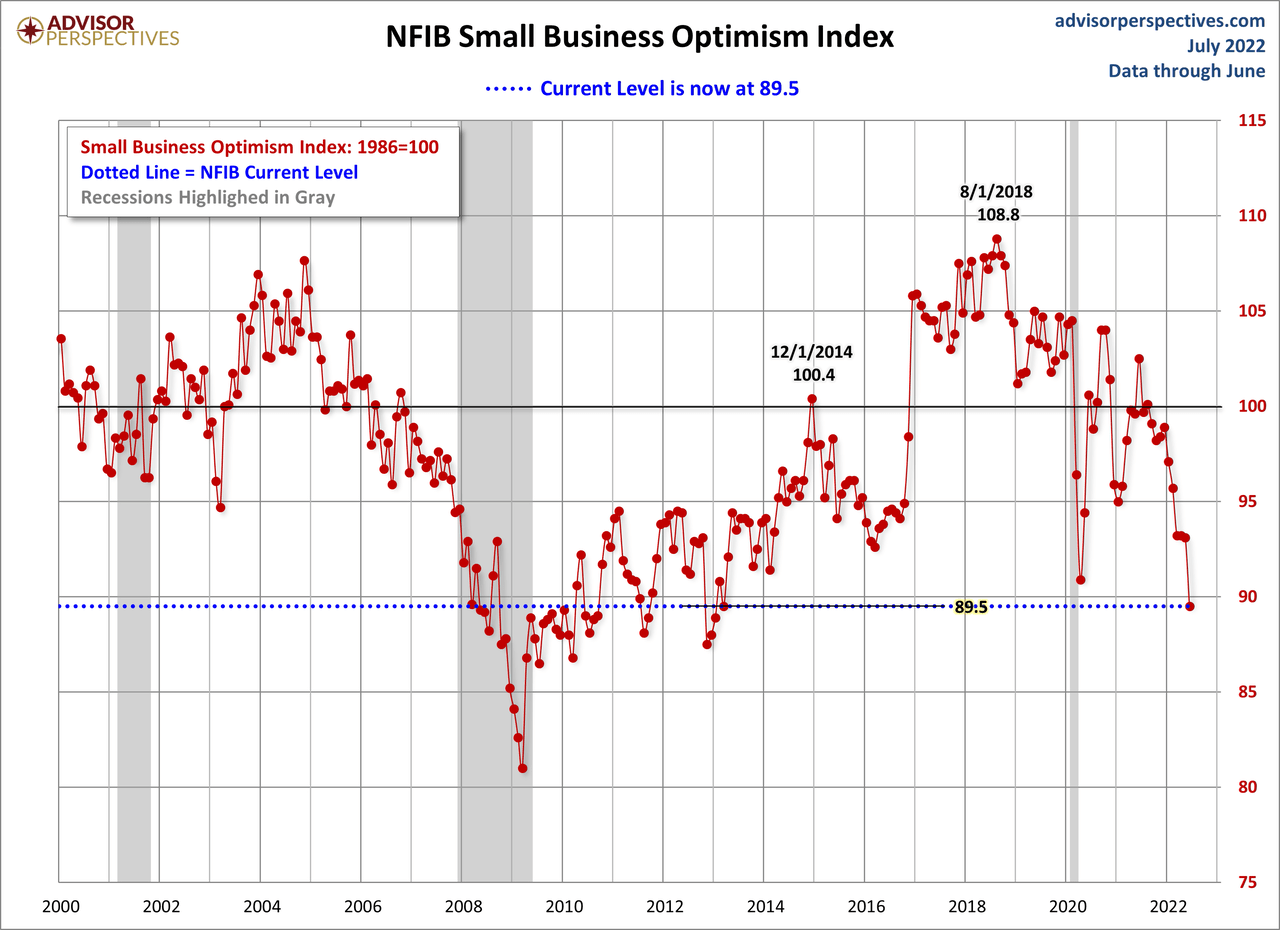

Here is a closer look at the indicator since the turn of the century.

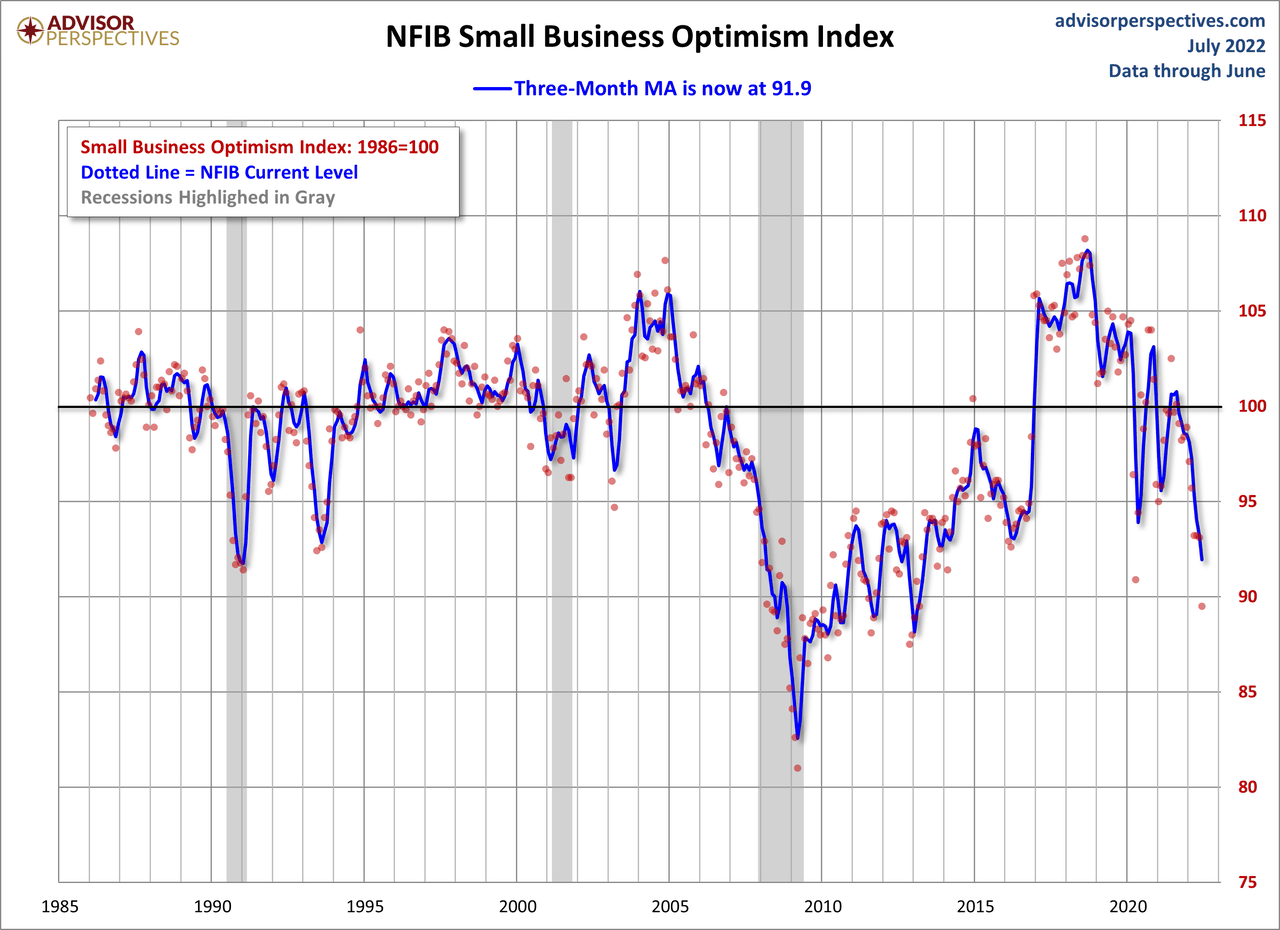

The average monthly change in this indicator is 1.4 points. To smooth out the noise of volatility, here is a 3-month moving average of the Optimism Index along with the monthly values, shown as dots.

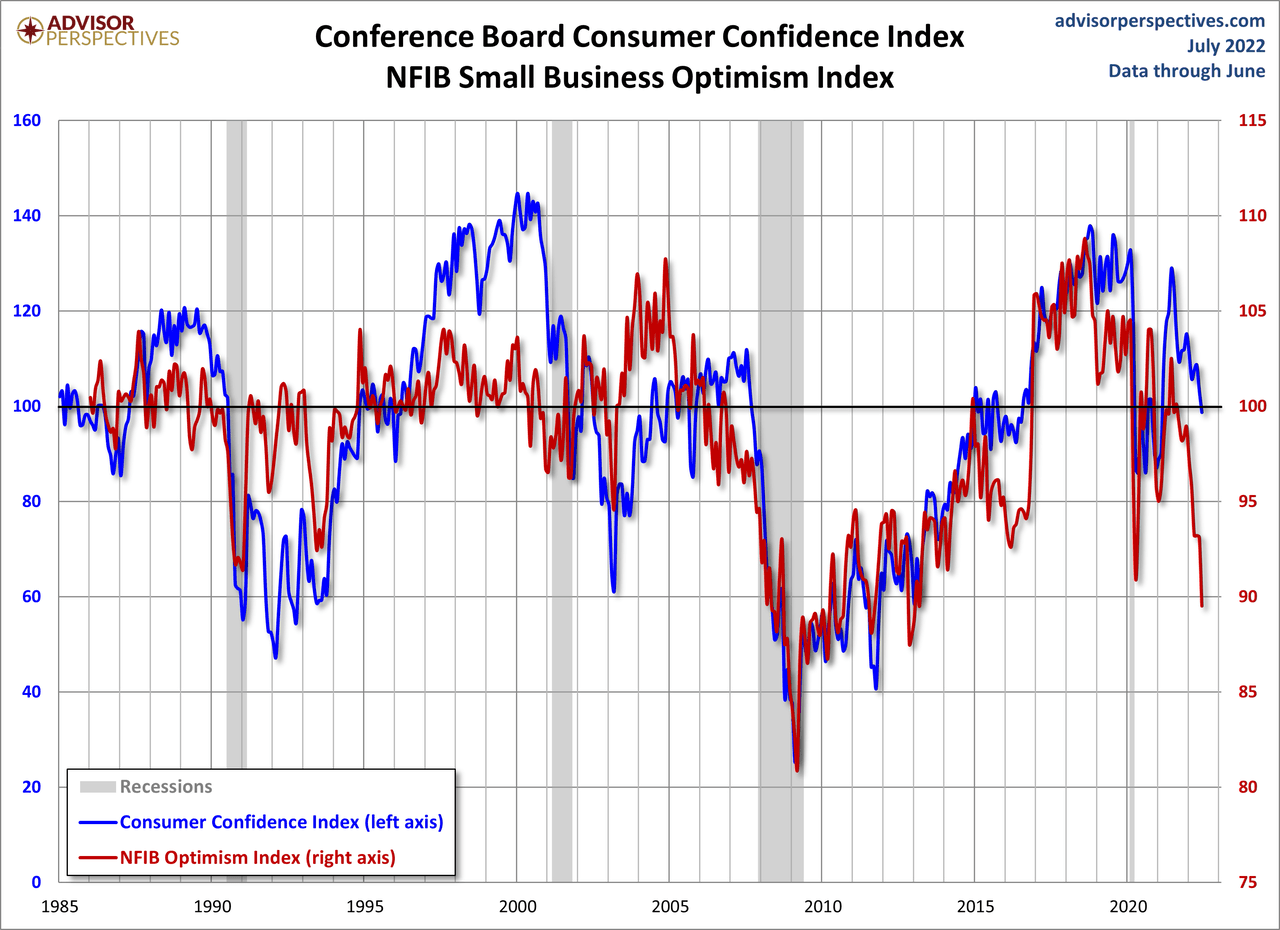

Business Optimism and Consumer Confidence

The next chart is an overlay of the Business Optimism Index and the Conference Board Consumer Confidence Index. The consumer measure is the more volatile of the two, so it is plotted on a separate axis to give a better comparison of the two series from the common baseline of 100.

These two measures of mood have been highly correlated since the early days of the Great Recession. The two diverged after their previous interim peaks, but have recently resumed their correlation. A decline in Small Business Sentiment was a long leading indicator for the previous two recessions (but clearly not for the Covid-19 recession).

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment