image/iStock via Getty Images

Investment Thesis

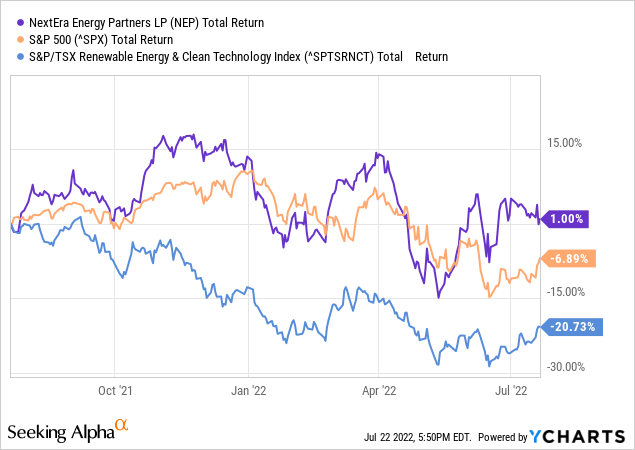

NextEra Energy Partners, LP (NYSE:NEP) is a dividend-paying clean energy stock that has outperformed the market in the previous 52 weeks and YTD, trading at all-time highs during 2021. Going back 3, 5, or 10 years, the company has completely outmatched the market in total returns.

Wind and solar energy production have a robust growth opportunity with accelerating decarbonization initiatives across the globe with higher consumer preferences toward clean energy. This continues to drive the US wind and solar generation sector to attract bipartisan support, leading to a possible Federal Clean Energy Standard. If this goes through, the Solar and Wind development sector in the US will turn into a gold mine of investment, solidifying NEP’s position as a top performer in a growing industry.

The company’s longstanding and reliable distributions make a vital part of the bull case for the stock. These distributions are characterized as a return of capital up to the investors’ basis for at least the next eight years, firmly secured through solid liquidity, contracted revenue, and above-average growth, making NEP a great yield and growth play.

The Company

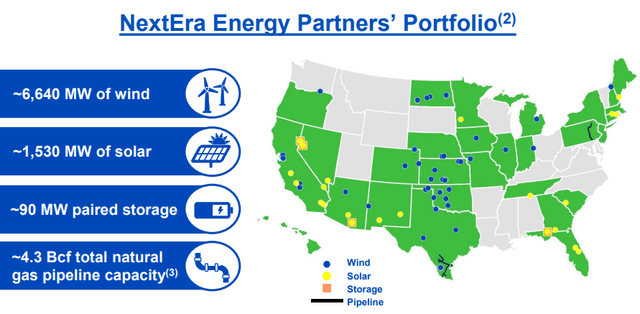

NEP acquires and operates contracted clean energy projects, including wind, solar and solar-plus-storage projects and a portfolio of contracted natural gas pipeline assets.

It is a part of NextEra Energy Inc. (NEE), a $155 billion company that operates 61 GW energy production, controlling the largest electric utility interest in the United States by retail MWh sales and the number of customers, Florida Power & Light Company and it is a market leader in wind & sun and battery storage electricity.

The company owns a 45.3% interest in NextEra Energy Operating Partners, LP (NEP OpCo) and NextEra Energy Equity Partners, LP (NEE Equity). The financial results of NEP, NEP OpCo, and NEE are presented on a consolidated basis.

In 2021, NEP acquired multiple wind and solar generation facilities, including battery storage facilities, with a combined net generating capacity of about 2,342 MW and a net storage capacity of 58 MW. These acquisitions drove a major portion of the YoY revenue and EBITDA growth in the MRQ.

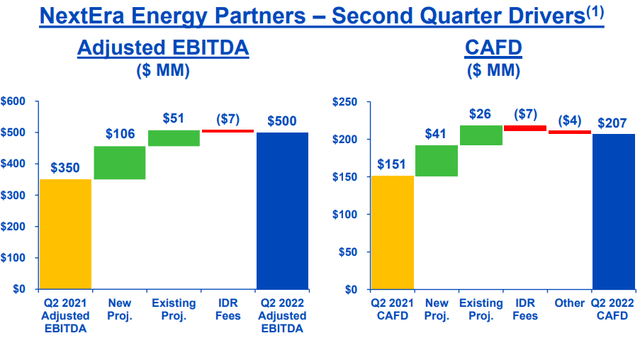

NEP Q2 2022 Investors Presentation

In 2022, NEP agreed to acquire 67% of a battery storage facility under construction in California with a storage capacity of about 230 MW from NextEra Energy Resources (NEER), a part of NextEra Energy Group, for a base price of $191 million. The company claims that this acquisition is expected to contribute about $32.5 million of run-rate adjusted EBITDA and about $15 million of run-rate cash available for distribution (CAFD).

In Q2 2022, the company also divested its ownership interests in a 156-mile Texas gas pipeline for $203 million to invest in accretive renewable energy assets. This accounted for about 40% of its pre-disposal 386-mile gas pipeline ownership.

Reliable Distributions

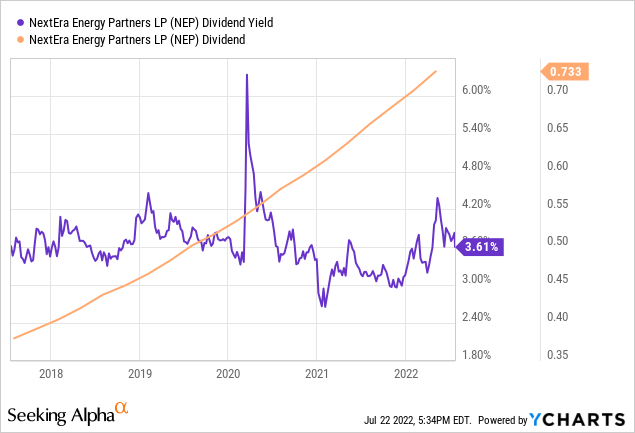

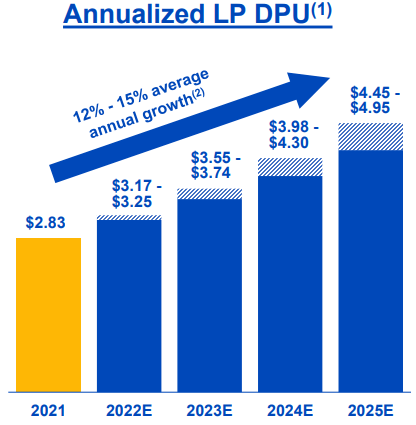

One of the major things the company prides itself on is its more than 300% distribution growth since its IPO in 2014. The distributions have a forward annual payout of $3.05, yield about 4% per annum, and have a 5-year annual growth rate of about 15%, with a consecutive growth for the past 7 years. NEP will continue this growth through robust diversification and expansion via its M&A strategy. S&P Global expects the company to make acquisitions of about $1.6 billion in 2022, $2.3 billion in 2023, and $5.7 billion in 2024.

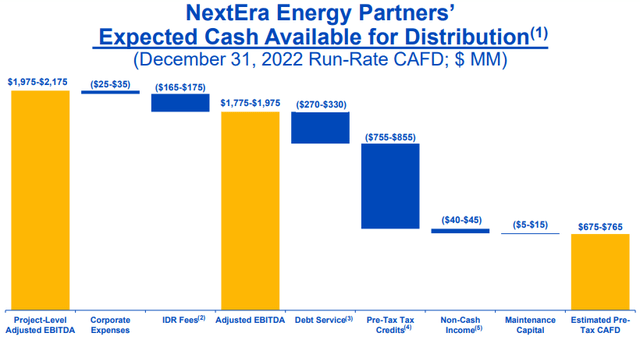

NEP expects between $685 and $775 million CAFD for the whole year, and the $376 million CAFD earned in the first half of 2022 demonstrates the company’s ability to stay on track. Even though the disposal of its pipeline might affect NEP’s financial performance to a certain extent, the redeployment of its proceeds into new projects and assets will lead to the successful delivery of its recently upped guidance.

The company’s diversification strategy through its M&A transactions has worked well since its IPO, expanding from 15 to 29 states since mid-2019 and increasing the net capacity by over 55%, from 5,325 MW to 8,260 MW. Additionally, it has exploded its portfolio expansion from under 1 GW in 2014 to over 8 GW in 2022. Accordingly, about 30% of its previous year’s CAFD is attributable to third-party acquisitions.

The company has also taken other measures to secure its CAFD, such as the recent structural modification to its Incentive Distribution Rights (IDR) fees, which caps the IDR fee paid to NextEra Energy Management Partners, LP (NEMP) at $157 million per annum ($39.5 million per quarter), given that the distributions to unitholders are above $0.7624 per unit per quarter, which the company has already achieved through the current quarter distribution declaration. This has the immediate effect of reducing the IDR fees for 2022, which has been reflected in the revised guidance, and a perpetual effect in the long term.

This incentivizes the company to keep growing its distributions above this threshold to maximize unitholder value appreciation and keep its cash flows at optimal levels. In effect, the company will have a higher CAFD per dollar of investment.

The company’s revenue streams are contracted with mostly investment grade off-takers, have a weighted-average remaining contract life of 14 years, and are not exposed to volumetric or commodity price fluctuations, de-risking the topline growth and its translation to CAFD.

NEP Investor Presentation

This predictable cash flow generation through contracted streams is crucial in safeguarding the company’s distributions and securing long-term stability.

Valuation

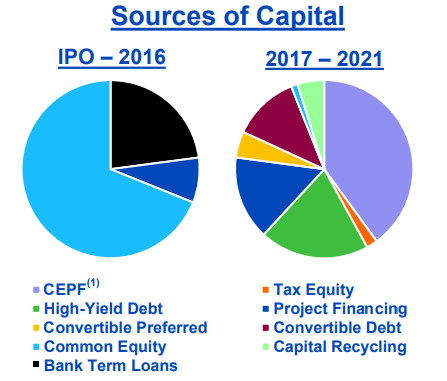

The company’s leverage plays an important part in its long-term strategy and is a crucial factor in valuing the stock. NEP has substantially modified its capital structure in the previous 5 years, adding a lot of flexibility through its Convertible equity portfolio financing (CEPF), Convertible Debt, and High yield debt. This allows the company to achieve high growth through a relatively lower cost of capital, resulting in a unitholder value accumulation over time.

NEP Investor Presentation

If the company achieves its Adjusted EBITDA target for 2022 of $1875 million at the midpoint, $912 million of which has already been achieved through the first half of 2022, it will have a reasonable Debt to Adjusted EBITDA ratio of around 3x. The reasonable valuation goes well with its 60-month beta of 0.85, indicating lower volatility than the market, which is an especially positive attribute in current market conditions.

Conclusion

The company is poised to generate about $720 million at the midpoint in CAFD during 2022, sports about $167 million in cash on its balance sheet, generated gross proceeds of over $200 million from the sale of its pipeline, and has access to a substantial revolving credit facility, making the company highly liquid. This level of liquidity can easily cover its expected CAPEX, working capital needs, and distribution growth, resulting in substantial unitholder value appreciation.

The company enjoys the benefits of being backed by one of the largest renewable energy players in the market. As such, I expect it to endure through the current recessionary pressures easily, as is evident by its streamlined operation through the pandemic.

I am bullish on the stock because NEP is a distribution-yielding growth stock with a proven track record, fair valuation, and above-peer growth prospects.

Be the first to comment