sanches812/iStock via Getty Images

The Macroeconomic Environment is Not Developing Favorably for Metals

As the US Federal Reserve raises interest rates amid persistently high inflation, fears of a recession are growing among investors.

If the hawkish stance convinces consumers to rein in their spending, a recession is inevitable. A recession would weigh on many markets, with base metals leading the way. A slowdown in consumption that triggers a recession affects demand for base metals as these commodities are used to manufacture a wide range of products.

A decline in the demand for these commodities will put downward pressure on prices.

Analysts predict that within a year zinc will fall 11% from its current $2,905.50 a ton, copper will fall 7% from its current $3.64 a pound, and lead will fall 9% from its current $2,005.55 per ton.

Gold and silver are also forecast lower a year from now, with the yellow metal down 4% from the current $1,677.72 an ounce and the gray metal down more than 8% from the current $20,720 an ounce.

Not the Time for a Bullish Approach to US-Listed Metal Miners

As such, investors should reconsider their holdings in US-traded metal mining stocks given the macroeconomic picture that is gradually unfolding for the value of their production.

Among those stocks that investors should consider changing their stance from buy to hold is Nexa Resources S.A. (NYSE:NEXA).

In addition to expectations of lower commodity prices, some underperforming mining operations are contributing to the current downside risk to Nexa Resources S.A. stock.

Nexa Resources S.A.

Based in Luxembourg, Nexa Resources produces zinc (main production) and other base and precious metals (secondary production) from five underground mineral deposits located in South America as follows:

3 Productions are in the Peruvian Central Andes: Cerro Lindo, El Porvenir and Atacocha

Cerro Lindo is an underground polymetallic mine in the Peruvian province of Chincha (about 270 km southeast of Lima). It has been mining base metals such as zinc, copper, lead, and silver since 2007. Cerro Lindo is one of the world’s largest zinc producers. Nexa Resources owns and operates the mine through its subsidiary in Peru. Currently, Cerro Lindo has reserves that are estimated to be able to support mining activities until at least 2029.

As of late 2021 estimates, the Cerro Lindo mineral deposit contained 44.04 million tons of proven and probable mineral reserves grading 1.43% zinc, 0.2% lead, 0.62% copper, and 22.3 grams of silver per tonne of ore (g /t).

In the first 9 months of 2022, Cerro Lindo sold 66,000 tons of zinc, down almost 17% year-on-year. This was mainly the result of an 18% year-over-year decline in zinc output to 77,600 tons.

Looking ahead to the full year 2022, Cerro Lindo is expected to produce between 81,000 and 86,000 tons of zinc, between 26,000 and 33,000 tons of copper, between 11,000 and 12,000 tons of lead, and between 3.9 million and 4.1 million ounces of silver.

Compared to 2021, zinc production will be 16-21% lower, copper production will be 11-12% lower, lead production will be 6.3-14% lower and silver production will be 2.6-7.3% lower.

These declines in metal production are expected as miners are currently dealing with reduced ore throughput that is delivered at the processing plant, while the concentration of the metal in the ore is also currently trending unfavorably.

This situation, coupled with anticipated lower metal prices, should not allow the company to increase the profitability of its operations. This could impact the stock price as the stock market doesn’t welcome lower sales and lower profit margins. Margins could also shrink if lower production means higher costs.

El Porvenir is an underground polymetallic mine owned and operated by Nexa Resources S.A., through its subsidiary in Peru. El Porvenir is located in the central Andean region of Peru, more precisely in the Peruvian province of Pasco, about 13 km from the city of Cerro de Pasco.

The miner currently produces zinc as the main product and lead, copper, and precious metals such as gold and silver as by-products. The mine has been in operation since 1949 and is expected to produce metals over the next few years through 2028.

As of December 31, 2021, El Porvenir hosted 15.32 million tons of minerals in Proven and Probable Reserves grading 3.57% zinc, 1.04% lead, 0.2% copper, and 69.5 g/t silver.

In the first 9 months of 2022, El Porvenir sold 39,900 tons of zinc, a slight increase of 5% over the previous year. Lower zinc sales may have been impacted by the company’s decision to focus mining activities in certain areas of the mine deposit in order to exploit a higher concentration of lead and especially silver in the mineral.

As for the expected production of the metals for 2022, these should not be very exciting for the market as they foresee the following deviations from 2021 levels. Zinc production should fluctuate between -4.7% and +3% to 49,000 to 53,000 tons, copper production should fall 0.4% to 300 tons, lead production should fluctuate between -15.3% and +1.7% to 15,000 to 18,000 tons, while silver production should fluctuate between -11.4% and +2.9% to 3.1 million to 3.6 million ounces.

This expected production combined with a lower price for the metal will certainly not help El Porvenir increase the profitability of the mine.

Atacocha is a polymetallic mine where metals are extracted using underground and open-pit mining techniques. The mine is owned by Nexa Resources S.A. and is operated by its Peruvian subsidiary. The mineral asset is located in the Peruvian province of Pasco.

The mine has been producing zinc, copper, lead, silver, and gold since 1939 and has a mine life of 3 years to 2025.

The Atacocha open pit deposit contained 3.28 million tons of Measured Mineral Reserves grading 1.1% zinc, 0.81% lead, 28.9 g/t silver, and 0.21 g/t gold as of late 2021.

The Atacocha underground deposit contained 3.28 million tons of Measured Mineral Reserves grading 1.1% zinc, 1.98% lead, and 101.1 g/t silver as of late 2021.

In the first 9 months of 2022, Atacocha sold 6,700 tons of zinc, a 37.6% increase over the previous year. However, Atacocha currently accounts for less than 3% of the company’s total sales of zinc.

Zinc production was 8,500 tons in 2021 and is expected to be 8,500 to 9,400 tons in 2022. Lead production was 8,700 tons in 2021 and is expected to range between 10,000 and 11,000 tons in 2022. Silver production was one million ounces in 2021 and is expected to be 1-1.1 million ounces in 2022.

However, Atacocha is a good contributor to gold production as its production accounts for between 45% and 50% of the company’s total production. However, for this to translate into a benefit to corporate profitability, the price of gold must trade higher, and analysts instead expect it to fall in the coming period, as outlined above.

2 Productions are in the Brazilian State of Minas Gerais: Vazante and Morro Agudo

Vazante is a mineral deposit for the production of zinc, lead, and silver through underground techniques. The mineral occurrence is located very close to the municipality of Vazante in the Brazilian state of Minas Gerais. The mine is owned by Nexa Resources S.A. and is operated by its Brazilian subsidiary.

The mine began mining the metals in 1969 and based on the company’s mineral resource data below, operations will continue for many years to 2032.

As of December 31, 2021, Vazante hosted 15.91 million tons of minerals in proven and probable reserves grading 8.77% zinc, 0.22% lead, and 13.7 g/t silver.

In the first 9 months of 2022, Vazante sold 97,900 tons of zinc, a 6.7% decline over the previous year. Vazante is currently experiencing a downward trend in mining performance in terms of both treated throughput and average grade. Additionally, there could be some disruption to mine activity in the coming months due to some maintenance work already planned.

Thus, metal production is expected for this year at least to be lower than 2021 levels. The reductions will be dramatic: -16% to -9.6% to 118,000 to 127,000 tonnes of zinc; -37.5% to -25% to 1,000 to 1,200 tonnes of lead and -40% to -20% to 300,000 to 400,000 ounces of silver expected in 2022.

Morro Agudo is an underground and open pit zinc, lead, and silver mineral deposit 100% owned by Nexa and operated through its Brazilian subsidiary, located in Minas Gerais State, Brazil. It is actually a mining complex as it also includes 3 other mineral deposits forming The Ambrosia Trend. This is located no more than 20 km from the municipality of Paracatu in the state of Minas Gerais.

The Morro Agudo has been a metal production site since 1988 and it is estimated that it will remain so at least until 2028.

On a measured and indicated basis, the mineral resources of Morro Agudo are estimated at the end of 2021 to be 13.92 million tonnes of ore grading 3.39% zinc and 0.59% lead.

In the first 9 months of 2022, Morro Agudo sold 14,100 tonnes of zinc, an increase of almost 12% over the previous year. Morro Agudo is the only zinc mine that is performing well thanks to several initiatives implemented over the past year. Now, in addition to more flexible management of mining activities, it allows for higher underground production. However, Morro Agudo accounts for less than 7% of the company’s total production and produces no precious metals.

Morro Agudo is projected to produce between 16,000 and 19,000 tonnes of zinc in 2022 versus 17,300 tonnes in 2021 and between 4,300 and 4,800 tonnes of lead in 2022 versus 4,700 tonnes in 2021.

A Risk of Delay in the Construction of the Third Mine in Brazil

Overall lower metal production and prices coupled with a likely continued strengthening of the US dollar against local currencies could negatively impact cash flow, which was $282.3 million for the 12 months ended Q3 2022. If this happens, it could potentially cause the company to reassess its capital allocation strategy, which would pose a risk to the timing of the project to construct the Aripuanã multi-metal manufacturing facility in Mato Grosso state, Central-West region of Brazil.

The company anticipates that commercial production activities for zinc and other metals should begin before the end of 2022. Should the start-up of the new mine be delayed, negative effects on the share price cannot be ruled out.

Aripuanã will absorb approximately 80% of the total $75 million that Nexa Resources S.A. intends to provide for expansion projects in 2022. For non-expansion projects, the company will spend approximately $310 million.

In addition to cash flow from operations, the company had approximately $538 million in cash on hand and short-term investments as of September 30, 2022.

Not just cash for Nexa Resources S.A. as its balance sheet was encumbered with debt totaling $1.7 billion resulting in a yearly interest expense of $135.8 million. This among other things was totally offset by a 12-month operating profit of $489.7 million.

The Stock Valuation: The Stock Price is Low, but Not Enough to Support a Bullish Stance

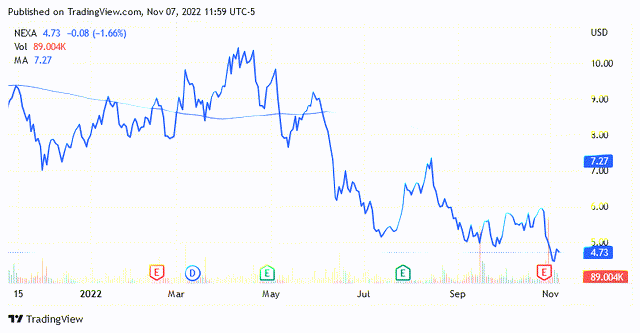

As of this writing, shares are trading at $4.73 per unit with a market cap of $637.03 million and a 52-week range of $4.27 to $10.54.

After falling more than 35% over the past year, shares are trading well below the median of $7.405 in the 52-week range and well below the long-term trend of the 200-day moving average of $7.27.

These low valuations compared to recent historical ones are not enough, in my opinion, to justify a bullish stance on this stock.

The stock price has more chance of continuing the decline than reversing course due to the occurrence of two factors.

The first factor is an expected decline in production and prices of base and precious metals.

The second factor is the risk of a recession due to the US Federal Reserve’s policy of tightening interest rates. A recession, which some analysts are forecasting for occurring in the second half of 2023, would affect demand for most of the products that use base materials, such as electronics, vehicles, furniture, medical devices, chemicals, etc.

In addition, the Nexa Resources S.A. share price could continue to be weighed down by the more direct impact of fears of an ineffective US Federal Reserve amid persistently high inflation and fears of the risk of a potential economic slowdown.

Therefore, it would be wise not to increase the position for the time being, as the next upward trend in base metal prices seems a long way off given the current situation.

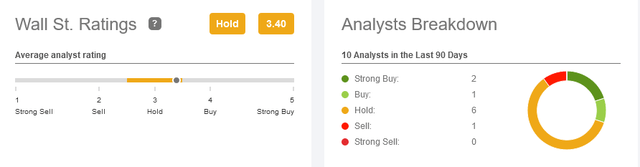

Wall Street Recommendations and Average Price Target

Wall Street analysts recommended 2 Strong Buys, one Buy, 6 Holds, and one Sell rating, resulting in a medium rating of Hold.

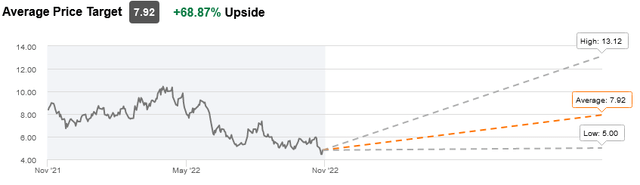

Wall Street analysts recommended an average target price of $7.92, reflecting a 68.87% upside potential.

Conclusion – Significant Downside Risk Weighing on the Stock

The stock price has fallen sharply over the year and is low today from a technical analysis perspective. However, a low price does not mean cheap stock. Operations do not appear to be in good shape, which may indicate lower metal production in the near term.

In addition, metal prices are expected to trade lower rather than higher in the coming months. So, buying shares of this stock now, as some on Wall Street suggest, might be too early. The share price may still fall.

Be the first to comment