Spencer Platt/Getty Images News

One sizable and interesting multimedia company that investors should be wise to take a close look at is News Corporation (NASDAQ:NWS) (NASDAQ:NWSA). Recent performance by the company, while not all strong, has been generally positive. Management continues to create value for its investors and the company’s share price is rewarding those same investors as a result. Long term, it is impossible to know what the future holds. But given how cheap shares are priced today, investors should view the company as a favorable prospect moving forward.

An update on News Corporation

Back in November of 2021, I wrote an article about News Corporation wherein I described the company’s bumpy operating history. Even though financial performance in prior years had been somewhat volatile, I also stressed that shares of the company were trading at pretty cheap levels on an absolute basis. At the end of the day, I rated the company a ‘buy’ prospect, indicating to my readers that I felt that investors buying in could experience some nice upside in the years to come. Though only a short time has passed, things are off to a good start. Even as the S&P 500 has generated a loss of 1.8%, buying into News Corporation would have resulted in a profit of 2.3% over the same window of time.

This return disparity, though not necessarily large, has been backed by continued strong performance by the business. At the time of my last article on the firm, data existed only for the first quarter of the company’s 2022 fiscal year and earlier. Since then, we have seen another quarter worth of data come out. And the results are promising. Revenue during that timeframe totaled $2.72 billion. That represents an increase of 12.6% year over year compared to the $2.41 billion management reported for the second quarter of the company’s 2021 fiscal year. Even though revenue growth was significantly positive during this time frame, bringing total revenue up from $4.53 billion in the first six months of 2021 to $5.22 billion the same time this year, not every part of the company performed well.

For instance, revenue associated with the Subscription Video Services portion of the business declined, falling from $511 million to $498 million in the most recent quarter. But beyond that, most other parts of the business fared quite well. The strongest growth, not surprisingly, came from the Digital Real Estate Services unit, which consists of the company’s 61.4% ownership over REA Group (OTCPK:RPGRF) (OTC:RPGRY) and its 80% ownership over Move (with the remaining 20% owned by REA). Sales there came in at $456 million for the quarter, representing a year-over-year increase of 34.5%. Thanks to that, revenue in the first six months of the firm’s 2022 fiscal year was up 40.2% compared to the same time last year. It’s also worth noting that some legacy parts of the business have been performing exceptionally well this year. Book Publishing revenue is up 16.1% and News Media revenue is up 14.5%. Meanwhile, the Dow Jones segment of the company also posted attractive growth, with revenue climbing 14.4% year over year.

With revenue rising, profits have also been steadily improving. For the first six months of the company’s 2022 fiscal year, net income totaled $431 million. That compares to the $265 million reported one year earlier. Operating cash flow did decline, dropping from $483 million to $430 million. But if we adjust for changes in working capital, it would have actually risen from $664 million to $888 million. Meanwhile, EBITDA for the company grew from $765 million to $996 million. In addition to all of this, the company also continues to focus on other ways to grow. In December of last year, for instance, management announced the acquisition of Base Chemicals, a provider of data and analysis on the chemicals markets. That cost the company $295 million and follows its announced purchase in July of that year of Oil Price Information Service for an even larger $1.15 billion.

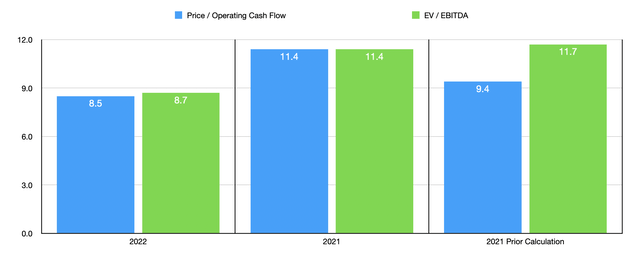

When it comes to valuing the company, the process is fairly simple. Using the company’s 2021 results, I calculated that the firm is trading at a price to adjusted operating cash flow multiple of 11.4. However, if we annualize results experience for the 2022 fiscal year, this number would drop further to 8.5. The last time I wrote about the firm, using 2021 estimates, I calculated a price 2 adjusted operating cash flow multiple for the company of 9.4. Another way to look at the company is through the lens of the EV to EBITDA multiple. For 2021, this number came out to 11.4 as well. This drops to 8.7 if we rely on 2022 estimates and it was 11.7 in my last article.

To put the pricing of the company into perspective, I did decide to compare it to five similar firms. Unfortunately, only four of these had positive results. On a price to operating cash flow basis, these four firms ranged from a low of 6.7 to a high of 28.8. In this case, using our 2021 figures, two of the five companies were cheaper than News Corporation. On an EV to EBITDA basis, the range was from 6.9 to 19.6. Once again, three of the four firms were cheaper than our target.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| News Corporation | 11.4 | 11.4 |

| John Wiley & Sons (JW.A) (JW.B) | 8.3 | 8.5 |

| Gannett Co. (GCI) | 6.7 | 6.9 |

| The New York Times (NYT) | 28.8 | 19.6 |

| Pearson (PSO) | 17.3 | 8.5 |

As other authors at Seeking Alpha would rightly point out, there are different ways to value the business. One of these is to look at the company from the perspective of its individual components. Perhaps the easiest asset to use to illustrate this exercise is the firm’s aforementioned ownership of REA Group. The reason why this is simple is because REA Group is also a publicly-traded company. At present, the company has a market capitalization of $13.40 billion. Given the 61.4% ownership that News Corporation has over the entity, that implies an equity value to the business of $8.23 billion. Stripping that out alone from News Corporation would leave just $5.20 billion from News Corporation’s $13.43 billion market capitalization. In short, this one asset alone accounts for 61.3% of the company’s overall equity value despite making up only 32.9% of its profits (when including the Move ownership as well). This is not to say, of course, that other assets are worth as much on a pro-rata basis.

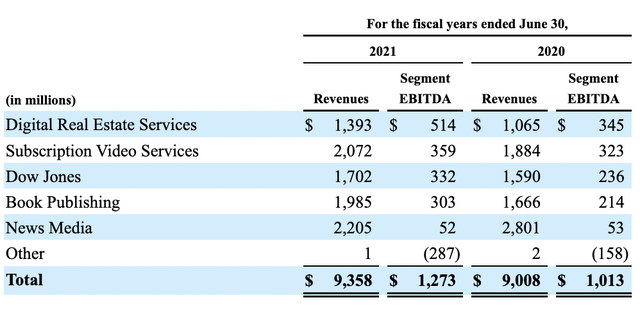

Revenue associated with Digital Real Estate Services, the segment that REA Group and Move are included in, has been growing at a faster pace than the rest of the business. Of the growth portions of the business, excluding this unit, revenue growth from 2020 to 2021, for instance, came in at 12%, while profit growth was 28.6%. But for Digital Real Estate Services, these numbers were 30.8% and 49%, respectively. What this does mean, however, is that my assessment of the company indicates shares that, while perhaps fairly valued relative to similar firms, are underpriced, but perhaps not as underpriced as what might actually be the case. The value of the company’s other assets could very well be worth far more than what the company is trading for today. Take, as an example, the Dow Jones segment of the company. Assigning it a pro-rata share of corporate costs, we end up with EBITDA in 2021 of $270.9 million. That unit, I would argue, is comparable to The New York Times. At present, The New York Times is trading at an EV to EBITDA multiple of 18.4. Using that same multiple would imply a total value for Dow Jones of $4.98 billion. That, combined with the REA Group ownership, already gets us up to $13.21 billion, which is remarkably close to both the market capitalization and enterprise value of News Corporation.

Takeaway

Based on the data provided, it seems to me as though News Corporation continues to perform well for investors. Long term, the company could very well create a lot of value for these shareholders. My own analysis is a more conservative approach to looking at the company. And it illustrates that shares likely have some upside even though they might be fairly priced compared to similar firms. Once you start talking about a sum of the parts analysis, however, it becomes clear just how cheap the company actually is. Even so, I would prefer to err on the side of caution. Regardless, I can understand why investors would be drawn to this enterprise.

Be the first to comment