Feverpitched

As expected, Newell Brands (NASDAQ:NWL) reported very weak results for the latest quarter and the outlook for the next 18 months looks even worse than I expected. The market pushed the stock down about 4% while the rest of the market soared on Friday and was dropping sharply on Monday morning. Their inventory level is way too high, especially if the economy heads into a recession and with continued inflation, consumers are buying necessities, such as food, instead of Newell’s products which are not necessities. In addition, their debt level remains too high, and I expect S&P will reduce their credit rating early next year. The dividend yield of over 6.5% may get even more attractive at lower stock price levels.

Third Quarter Results

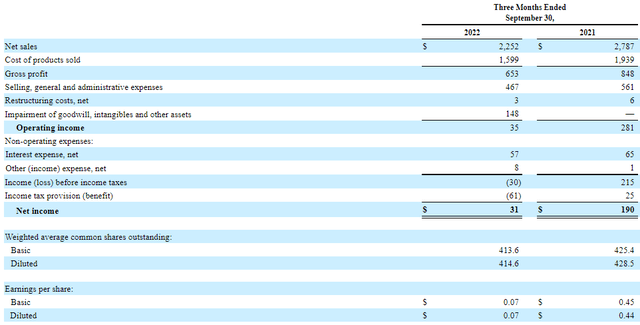

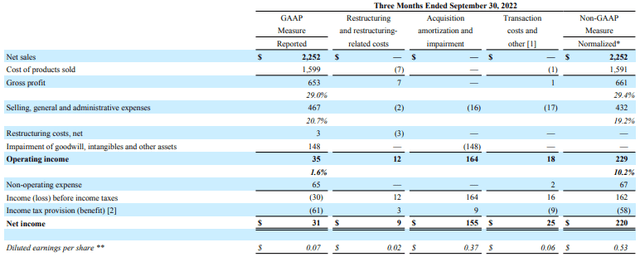

Newell Brands had a $30 million pre-tax GAAP loss for 3Q, but after factoring a $61 million tax benefit they had a GAAP EPS of $0.07. Their “normalized” non-GAAP EPS was $0.53. Most of the difference was because of a $148 million impairment charge.

A major reason for the poor 3Q results was that stores ordered/purchased merchandise in the 2Q instead of 3Q because they did not want to risk not having the products to sell. They were still worried that Newell might have supply chain issues, so they stocked up on merchandise. These stores are now liquidating that merchandise and did not order/purchase as much in 3Q as they usually did in prior years.

3Q GAAP Income Statements 2022 and 2021

3Q GAAP Income Statements 2022 and 2021 (sec.gov)

3Q Non-GAAP Normalized Earnings

3Q Normalized Earnings (ir.newellbrands.com)

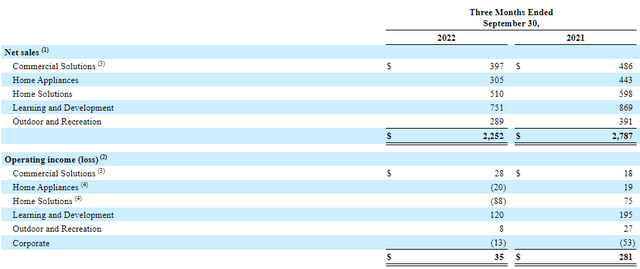

All but one segment had from weak to terrible results for 3Q. While for some consumers the increased prices this year is just an inconvenience, to other consumers it means making critical choices on how to spend their disposable income. Since most of Newell’s products are not considered necessities, they are not near the top of the list for purchases.

3Q Segment Results

3Q Segment Results for 2022 and 2021 (sec.gov)

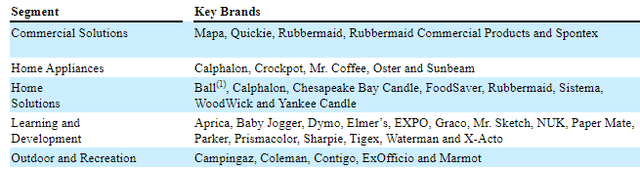

Segments and Major Brands

Segments and Brand Names (sec.gov)

The current problem facing Newell is that their inventory level is way too high, especially heading into a likely recession. The finished goods inventory was $2.012 billion at the end of 3Q compared to $1.625 billion in 3Q 2021. While higher prices account for some of this increase, relative to decreasing sales, this inventory issue is a major negative. In addition, the 2021 inventory figures include their Connected Home & Security business that was sold earlier this year. They had to tie-up cash carrying this excessive inventory instead of paying down debt with that cash to improve their leverage ratio.

With their guidance of revenue for 4Q of $2.18-$2.26 billion, they should be able to get this inventory lower, but that will also mean a lower level of production at their factories over the next few months. Operating at lower capacity results in lower profit margins as fixed costs become a higher percentage of revenue. Because of weak sales and lower margins, their latest guidance of 4Q normalized EPS is only $0.09-$0.14. (Their full year 2022 revenue guidance was reduced from $9.37-$9.58 billion to $9.35-$9.43 billion and non-GAAP normalized EPS was reduced from $1.56-$1.70 to $1.56-$1.61.)

This is a problem that is not unique to just Newell. There are many other companies that are scaling back production going forward to adjust inventory levels compared to forecasted sales. This is one of the reasons why I am expecting a recession.

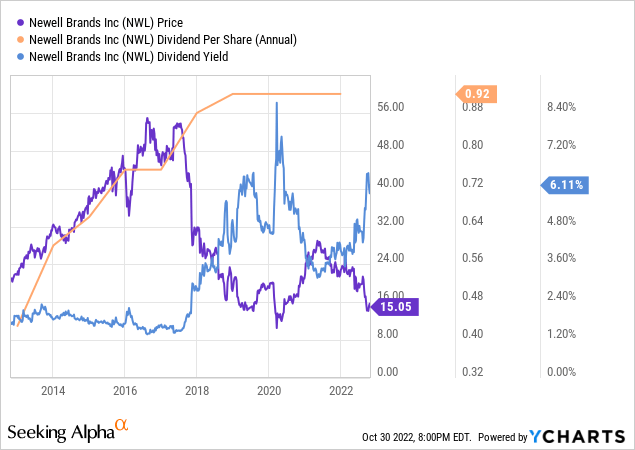

Current 6.5% Dividend Yield

Many investors are buying NWL stock because the dividend yield is currently 6.5% based on the latest stock price. While this is an attractive yield, it is not really a safe yield because of their high leverage and near-term poor cash-flow. CFO Chris Peterson did state in the recent conference call that “we pay a dividend that I think we have been relatively clear that we expect to maintain as flat. We continue to expect that. There has been no change in our outlook on the dividend.” Using their low end 2022 guidance for non-GAAP normalized EPS for 2022 of $1.56, the $0.92 annual dividend implies a 59% payout rate.

Stock Price, Dividend, and Yield for Last 10 Years

Increasing Financial Leverage Problem

Newell Brands is highly leveraged with a current 3.9x debt to EBITDA ratio. While this is better than 5.6x in 2018, it is expected to get worse going forward. S&P placed their debt on a negative outlook in September. S&P currently has a BBB- rating, which most likely will be lowered to BB+ after 4Q results are released in early 2023. S&P is expecting 4.2x leverage ratio for 2023, which is higher than the 4.0x needed to keep their current rating. I am actually expecting an even higher ratio because I am expecting a fairly steep recession next year.

Newell recently issued new debt of $500 million 6.375% ’27 and $500 million 6.675% ’29 notes. The proceeds were used to redeem their 3.85%’23 notes (the interest rate was actually 4.10% because Moody’s lowered their rating a few years ago). These transactions will result in an annual increase in interest expenses of about $24 million.

While the negative covenants in their credit agreement are not currently an issue, they might become problematic if there is a deep recession and revenue/income suffer. There is a 3.5x trailing 12-month EBITDA interest coverage covenant. If earnings and cash flow drop, they may need to borrow more to operate, which will increase interest expenses and lower the coverage ratio. Their recent long-term debt transactions that increased interest expenses by $24 million will require a $84 million higher EBITDA to keep within the 3.5x covenant, for example.

There is also an end of quarter “total indebtedness to total capital” covenant of 60%. If shareholder equity declines because of any losses during a recession and borrowings increase to maintain operations because of cash flow issues, this also could become a problem. While Newell is not actually expected to default, it may need to amend the agreement or get temporary waivers, but this may result in having to pay a fee/higher rate on their credit agreement.

A recession could also impact Newell financially because some of their customers may go into Ch.11 bankruptcy, such as Bed Bath & Beyond (BBBY), which was listed in their 10-K as one of their top ten customers. Newell may get stuck with unpaid accounts receivables. I covered the vendor bankruptcy issues in great detail in my fairly recent BBBY article.

I believe there are still about 257 Yankee Candle stores. They have closed many stores over the years and I would not be surprised if a lot more stores, if not all, are closed over the next two years, which could result in negative charges on their income statement. These stores often rely on nearby stores to generate foot traffic into the store because Yankee Candle stores are not usually a primary “magnet” shopping destination.

Some of these current debt issues would be less of a problem if Newell did not repurchase $275 million worth of stock at $25.86 per share from Carl Icahn back in February. This may have helped unitholders of Icahn Enterprise (IEP), but it has been a negative for other NWL shareholders. It will be interesting to see if this $275 million cash was used instead to reduce debt would have resulted in keeping their debt to EBITDA leverage ratio below the critical 4.0x rating level going forward. (Brett Icahn recently also sold a total of 381,304 NWL shares from his own account and his foundation.)

Conclusion

The reason why I have kept Newell Brands on my watch list is because I really like some of their products, such as their Marmot ski jackets. Their problem is that they have too much financial leverage. The dividend yield of over 6% is attractive, but it is not completely safe even if management states they don’t plan any changes because a deep recession might cause the board to reconsider their payout.

With high inflation and a recession, consumers are less likely to buy non-necessity products, such as candles or blenders. I may consider buying NWL stock if it gets close to $12 per share as a potential economic turnaround and yield play. I currently rate NWL stock a neutral/hold.

Be the first to comment