Ramin Talaie/Getty Images News

In the media and news space, few companies are as iconic and widespread as The New York Times (NYSE:NYT). Despite fears that developed several years ago that the internet would kill the newspaper industry, businesses like this not only survived; they thrived. With a shift to digital, The New York Times has turned from a once beleaguered relic of the past into a modern business that is demonstrating attractive growth on both its top and bottom lines. Though shares of the company are expensive relative to similar players, and shares are not exactly cheap on an absolute basis, the rapid growth and strong margins generated by management have turned this into a growth machine. Moving forward, I do not expect upside for shareholders to be tremendous. But I do believe the value proposition here is strong enough to warrant this being a ‘buy’ prospect at this time.

I underestimated its potential

Back in January of this year, I wrote a bullish piece about The New York Times. At that time, I acknowledged the company’s success in transitioning to a digital subscription model. I lauded the company’s recent acquisition of The Athletic, despite the uncertainty in that business’ fundamentals. Ultimately, I concluded that the company offers attractive long-term upside. Having said that, I would say a bit short-sighted in my assessment. I mentioned how the company was trading at a high price and I believed that would limit the firm’s upside in the near term. Boy, was I wrong. At the end of the day, I did rate the company a ‘buy’, but I didn’t understand then just how strong the upside of the company would be in the span of just a few months. While the S&P 500 has experienced an increase of just 2.8%, The New York Times has generated a return for investors of 16.5%.

This strong return for what is one of America’s most trusted and widespread news sources, has not been without merit. In the final quarter of the company’s 2021 fiscal year, the only quarter for which data is now available that was not available when I last wrote about the business, management revealed revenue of $594.23 million. That represents an increase of 16.7% compared to the $509.36 million the company generated one year earlier. As a result of this, sales for the 2021 fiscal year came in at $2.08 billion. That was 16.3% above the $1.78 billion the company generated in 2020.

For years, The New York Times had been fighting an internal struggle, pitting its legacy, but declining operations against the rapidly growing digital subscription portions of the business. It seems that now the digital subscription side of the business has finally grown enough, while the older portions of the firm have finally declined enough, to allow the company to break out of a three-year time frame in which revenue was stuck in a fairly narrow range. Of course, it doesn’t help that, in this time frame, the company was also, like many others, stuck in a pandemic. So it stands to reason that some of the troubles during this time frame were caused by that. But I digress.

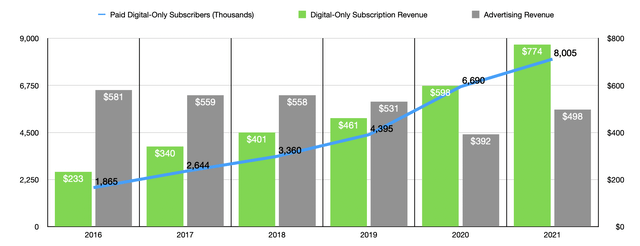

To illustrate just how the company has changed, consider the number of digital-only subscribers on his platform. As of the end of the latest quarter, the company had 8.01 million subscribers. This compares to the 6.73 million the business had at the end of its 2020 fiscal year. In recent years, the company has embraced the digital-only subscription model, as evidenced by the fact that, as recently as 2016, the firm had just 1.87 million subscribers on this platform. This implies an annualized growth rate of 33.8%. As a result of this initiative, digital-only subscription revenue has grown to represent $773.88 million of the company’s revenue for its latest fiscal year. That means it represents 37.3% of overall sales for the business. By comparison, back in 2016, digital-only subscription revenue was just $232.8 million, or 15% of sales.

Another bright spot for the company in the latest fiscal year was advertising revenue. For 2021, this figure came in at $497.54 million. This compares to the $392.42 million generated just one year earlier, but is still down from the $530.68 million reported for the company’s 2019 fiscal year. It is worth noting that both print and digital advertising revenue increased from 2020 to 2021, with some of this rise being attributable to an economic rebound following the COVID-19 pandemic. This is not to say that the print portion of the business is doing any better. Print subscriptions as of the end of the latest quarter came in at 784,000. That compares to the 833,000 the company reported at the end of 2020.

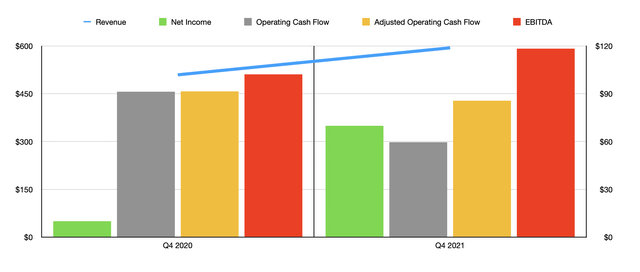

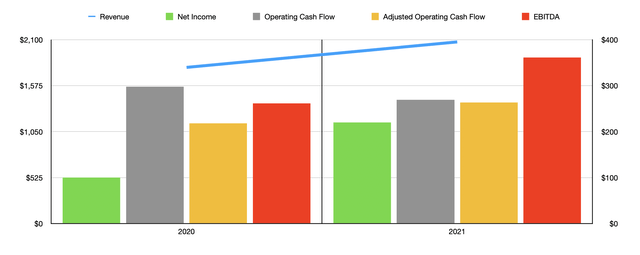

As revenue has risen, so too has profitability. Net income of $69.89 million in the final quarter of 2021 dwarfed the $10.01 million generated the same quarter one year earlier. This pushed overall net profits for 2021 up to $219.97 million. This compares to the $100.10 million generated in 2020. Operating cash flow for the year came in at $269.10 million. That is slightly below the $297.93 million generated in 2020. But if we adjust for changes in working capital, cash flow would have risen from $217.82 million to $263.60 million. That’s the highest the company reported for at least the past six years. More likely than not, it’s the highest the company ever reported. Another metric to consider is EBITDA. According to my estimates, this metric came in at $361.07 million. That is 38.1% above the $261.40 million generated just one year earlier.

This increase was not just a one-time thing. It seems as though management is forecasting strong results moving forward. Current guidance only covers the first quarter of the company’s 2022 fiscal year. However, they currently anticipate digital-only subscription revenue, excluding the company’s acquisition of The Athletic, growing by between 18% and 21% year over year. Including the aforementioned acquisition, digital-only subscription revenue should rise by between 23% and 28%. Combined with digital advertising revenue forecasted to grow by between 20% and 24%, this should result in total revenue for the company climbing at a rate that is in the mid to upper single digits. Excluding the aforementioned acquisition, this figure should still be around the mid-single-digit range, if not higher. After all, The Athletic only generated revenue of $65 million during its 2021 fiscal year. So its overall impact on the enterprise today is rather marginal.

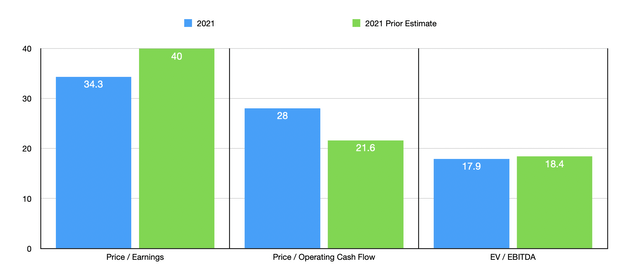

Unfortunately, management has not provided any other guidance that would be relevant for determining the company’s bottom line. So our best bet is to value the company with the results achieved in 2021. At present, the company’s price to earnings multiple is 34.3. This is actually lower than the 40 multiple that I calculated using forecast and earnings when I last wrote about the business. The price to operating cash flow multiple should be 28. This is higher than the 21.6 multiple I previously calculated with my own estimates. But the EV to EBITDA multiple for the company has dropped, declining from 18.4 to 17.9. The reason why this multiple is so much lower is because the company has no debt on hand but has cash, cash equivalents, and various marketable securities totaling $1.07 billion.

In two of the three ways I looked at, shares of the company have actually gotten cheaper despite rising in price. Having said that, the company is in no way the cheapest prospect on the market. To determine this, I looked at four similar firms. On a price to operating cash flow basis, three of these firms had a positive multiple, with the range for these multiples stretching from 8.2 to 17.5. Meanwhile, the EV to EBITDA multiple of these four companies ranged from 8.4 to 9.3. In both of these cases, The New York Times was the most expensive of the group. Meanwhile, using the price to earnings approach, the multiples ranged from 20.3 to 35.4. Three of the four companies were cheaper than our prospect.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| The New York Times | 34.3 | 28.0 | 17.9 |

| News Corporation (NWS) (NWSA) | 25.8 | 10.9 | 9.3 |

| Pearson plc (PSO) | 35.4 | 17.5 | 8.5 |

| John Wiley & Sons (WLY) | 20.3 | 8.2 | 8.4 |

| BuzzFeed (BZFD) | 22.0 | N/A | 8.9 |

Takeaway

Relative to similar players in the market, there is no denying that The New York Times is a pricey business. Having said that, recent performance, combined with management’s own expectations moving forward, shows that there is a reason for these high multiples. Management continues to create significant value for its investors. And because of that, combined with the company’s long-term business plans, I believe that further upside is warranted. At the risk of being wrong in the near term, I do still think that upside over the next few months is probably rather limited. But for investors who focus on long-term investing, it may make sense to pay a premium to participate in the prospects of this firm for the years to come.

Be the first to comment