da-kuk/E+ via Getty Images

This article was first released to Systematic Income subscribers and free trials on Apr. 14

Recent sharp changes in interest rates have opened up opportunity as well as confusion within the capital structure of some issuers, specifically those with multiple preferreds outstanding. In this article, we take a look at the New Residential Investment Corp. (NYSE:NRZ) series of four preferreds and discuss how investors can think about allocating within the suite.

New Residential Investment Corp. is an unusual mREIT for the breadth of its underlying portfolio. Its focus lies in the more common investments such as agency MBS and mortgage servicing rights also used by (TWO), (PMT) and others, due to their offsetting interest rate risk profile. In addition, the company has an origination business as well as a single family rental portfolio among others.

A Quick Look At The Bigger Picture

Before taking a look at the preferreds, we quickly review some of the erroneous beliefs we have come across in the investor community with regard to NRZ and the broader mREIT sector.

One misconception is that the negative convexity of agency MBS securities (due to the mortgage borrowers’ inclination to refinance when rates fall) prevents mREITs from being able to hedge against changes in interest rates.

Negative convexity is a way of referring to the non-linear duration dynamics of agency securities whose duration increases when rates increase (because mortgages are less likely to be prepaid) and decreases when rates fall (because mortgages are more likely to be prepaid). Holders of agency MBS, in effect, see their risk exposure increase in the bad scenario (when rates increase, their agency portfolio drops in value and becomes even more sensitive to interest rates) and see their exposure decrease in the good scenario (when rates fall, their agency portfolio gains in value but their agency MBS portfolio sensitivity to rates falls too).

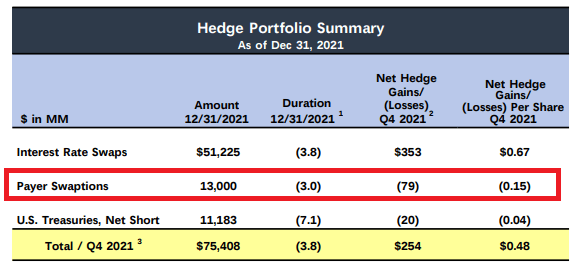

Not being able to hedge against this negative convexity of agency, MBS would come as a big surprise to mREITs themselves who use interest-rate derivatives, primarily swaptions, which feature positive convexity (if bought). The hedge composition of NRZ is shown below.

NRZ

Another table in the same Q4 presentation clearly shows how the positive convexity of the swaption position significantly cuts the negative convexity of its mortgage holdings. If it wanted to, the company could easily fully hedge out the negative convexity of its position.

The second misconception is that this negative convexity is the reason why mREIT book values are dropping. This view doesn’t make a ton of sense. Convexity is a second derivative of price (i.e., the first derivative or the rate of change of duration) so it doesn’t immediately drive price change. Saying negative convexity causes prices to fall is like saying you are moving left (first derivative of position) because you are decelerating (second derivative of your position). An agency MBS portfolio would still lose money in the current environment even if its convexity were positive.

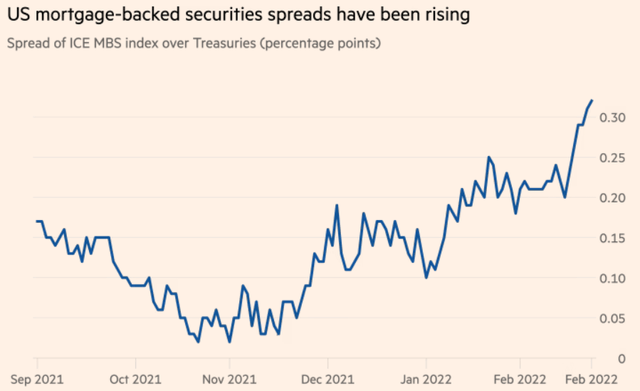

The real reason that some mREIT book values are dropping is because agency valuations relative to Treasuries are cheapening. This has been happening because Fed TBA buying during the market meltdown in 2020 caused agencies to richen relative to Treasuries. However, as the market has been pricing in a coming unwind of the Fed’s balance sheet, agencies have duly reversed their richening.

We can see this below which plots the yield differential between agencies and Treasuries. This so-called MBS basis is a risk that agency mREITs have to carry by virtue of the fact that the instruments they use as hedges (primarily interest rate swaps and Treasury futures) don’t move in sync with Agencies.

Most mREITs maintain a relatively duration-neutral portfolio so they are not much affected by changes in interest rates. However, when Agencies cheapen relative to their hedges, as is happening now, they will underperform.

It also goes without saying that far from all mREITs are seeing their book values drop. We have been highlighting hybrid mREITs for many months now whose preferreds remain attractive options in the current environment. These mREITs typically hold whole loans at a lower level of leverage and so haven’t been hurt by the difficult price dynamics of agencies.

A Look At The NRZ Preferreds

In this section, we take a look at the NRZ suite of preferreds and walk through how investors can think about allocating within it.

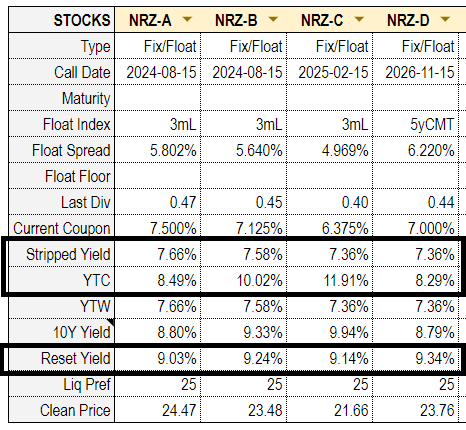

The table below is an extract from our investor Preferreds Tool and shows the key features and metrics of the four NRZ preferreds.

Systematic Income Preferreds Tool

A quick glance at the relevant yields of the suite tells us the following. First, the four stocks are trading in a relatively narrow window of stripped yields of 7.36% to 7.66%. Second, unlike the stripped yield range of 0.30%, the yield-to-call or YTC range is very wide from 8.29% to 11.91% or a range of 3.62%.

The intuitive conclusion from these numbers is to go for Series C (NYSE:NRZ.PC) which boasts the highest YTC of 11.91%. The idea is that, yes, it has a modestly lower stripped yield but a much higher YTC. So you lose a little now but gain a ton when the stock is redeemed.

Most preferred investors will see the obvious problem with this reasoning, which is that it makes the flawed assumption that NRZ.PC is actually going to be redeemed. A security trading at a price of $21.66 is not exactly sending a strong signal to the issuer to redeem. This is because the market is explicitly telling the issuer that if it wants to redeem and refinance the preferred by issuing a new $25 series, it will have to substantially increase its coupon.

The stock’s stripped yield of 7.36% tells us that the issuer would have to issue the new preferred at around this level. In short, this implies that not only would the issuer have to pay a coupon that is 1% more than it is paying now, it would also have to dish out significant fees to the underwriter for the issuance of the new stock. It doesn’t take a PhD in Finance to realize that the issuer is not going to just burn money in order to do a favor to investors who may be foolishly expecting NRZ.PC to be redeemed just so they can make a mint.

It’s also important to highlight that NRZ.PC has the lowest coupon of the four series which means it is the least likely to be redeemed even if it manages to trade up to a level where a redemption makes sense. Three of the preferreds have redemption dates within a 6-month period.

All four of the NRZ preferreds are Fix/Float so they are only going to feature their current stripped yields until the first call date. If they are not redeemed, their coupons will switch to a floating-rate regime with three series featuring a LIBOR+ spread coupon which resets every 3 months and (NYSE:NRZ.PD) featuring a 5-year Treasury yield + spread coupon, which resets every 5 years. Investors curious what is going to happen to LIBOR should have a look at our recent weekly on this topic.

The key point is that just looking at stripped yield and yield-to-call isn’t going to give investors enough insight as to which security in the suite is the most attractive, particularly when redemption likelihood is not very high as it is across most preferreds. For that, we also need to consider reset yield. Reset yield, also highlighted in the table above, shows what the stock’s stripped yield will be on the first call date – when the coupon switches to a floating rate.

At this point, unless you are Rain Man, it’s going to get pretty difficult to keep three different types of yield across four series in your head. Add to this the fact that different series have first call dates at different times and that LIBOR is also expected to shift widely over the next few years.

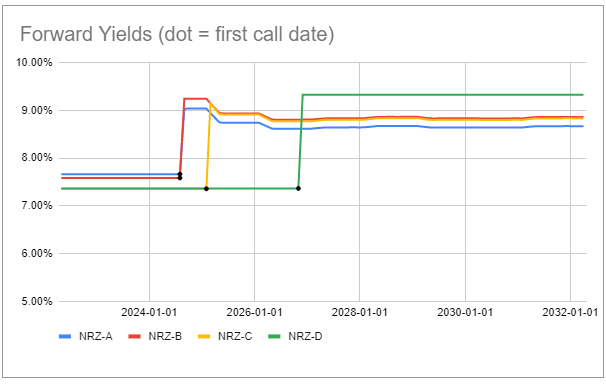

To cut through this, we show an extract of what we call Forward Yields from our Preferreds Tool, which summarizes the expected path of stripped yields of the four series over the next decade based on LIBOR forwards (and current 5Y Treasury yield for NRZ.PD).

Systematic Income Preferreds Tool

What we see here is that the stripped yield of NRZ.PC (yellow line) goes from sharing the lowest level prior to redemption to being the second lowest after redemption. However, if we average out the coupons across these two periods, NRZ.PC comes out the lowest by a good margin (this is because NRZ.PD which shares the lowest stripped yield prior to the first call date zooms up to the highest after the first call date).

In short, NRZ.PC is very clearly the lowest-yielding security prior-to and after the first call date. This is very relevant because at its current price, it is pretty unlikely to be redeemed if NRZ is at all a rational economic agent.

Investors banking on its very high YTC have to make an argument that the stock will be redeemed or, put another way, that its price will head back above $25. A clear prerequisite for this is for Treasury yields to reverse their sharp spike this year. And, arguably, the easiest way for this to happen is for the economy to enter a recession. It also requires, in our view, for inflation to come off.

Though it may seem fairly probable for some investors, we also need to consider that what typically happens in a recession is that credit spreads rise sharply on the back of expectations of increased defaults. When this happens, yields of credit securities such as corporate bonds and preferreds don’t fall as much as Treasury yields. What this means is that the yield of NRZ preferreds will struggle to fall significantly in a recession because, even if somehow Treasury yields fall back lower, wider credit spreads will keep NRZ preferred yields high and, hence, the price of NRZ.PC well below $25.

This suggests that the right way to think about NRZ.PC is to combine a small probability of large outperformance (i.e., having NRZ.PC redeemed and enjoying its high yield-to-call) and a high probability of small underperformance (i.e., earning its lowest stripped yield over time).

So, the right conclusion here isn’t to say that NRZ.PC offers an amazing mispricing opportunity but to say that it offers investors with specific views a trading opportunity. Investors who think that preferred yields are going to collapse back lower will want to hold NRZ.PC, because in that case all the series are likely to be eventually called. They will also want to hold NRZ.PC because NRZ.PC has the lowest coupon and, hence, the highest duration so it will bounce the hardest if / when rates collapse. And those investors who think that rates are going to remain stable or keep rising should continue to avoid NRZ.PC because of its lowest stripped yield (before and after the first call date) as well as the longest duration in the suite.

NRZ Preferreds And Rising Rates

Given the focus that many investors have on rising interest rates, it is worth highlighting how the NRZ preferred suite may be impacted.

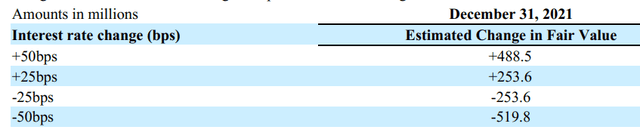

NRZ preferreds benefit in two ways from rising rates. First, the company’s book value is expected to rise substantially, given the rise in interest rates since the end of last year. As of Q4, the company had equity of $6.6bn. A 0.5% parallel rise in interest rates increases its equity by $490m. With the 5y Treasury yield having risen by 1.4% or close to 3x that number, the increase in equity is likely very substantial. We don’t know it with any certainty because the interest rate curve also flattened considerably over the same period i.e., the move was not parallel as assumed by the company’s calculation. The increase in book value also increases the equity / preferred coverage, which makes preferreds more defensive.

The second way the NRZ preferreds benefit from rising interest rates is that all 4 of the are Fix/Float (one with LIBOR as the base index and one with the 5-year Treasury rate i.e., 5-year CMT). The higher these rates go, the higher will be the floating coupons of these securities past their first call date. And even though they may be redeemed before investors will enjoy it, the rise in their post-first-call coupons will allow these stocks to be more resilient. We discussed this phenomenon in an earlier weekly.

Finally, the preferreds also feature relatively high coupons which shortens up their duration relative to the average preferred, making them more resilient in periods of rising rates. They also feature relatively high yields in the preferred space which helps as well as since a higher level of carry can more quickly offset drops in price.

In our view, these dynamics have allowed the NRZ suite to outperform not only its mREIT preferred sector but the broader sector as well. The average NRZ preferred has a year-to-date total return of -3.4% vs. -5.2% for the average mREIT preferred vs. -6.0% total return for the average preferred.

Takeaways

In our view, there are two key takeaways for investors. One is that different kinds of preferred yields (whether stripped, yield-to-call, yield-to-maturity, reset yield etc.) matter more or less at different times. The yield-to-call matters very little for a low dollar-priced stock and matters a great deal for a high dollar-priced stock (i.e., trading significantly above its liquidation preference or “par”).

Second, investors shouldn’t make investment decisions based solely on bottom-up “mispricings” whether real or not. It’s also very important to gauge how attractive the company’s sector is in the current environment, how the company stacks up within its sector and what part of the capital structure (i.e., common shares vs. preferred shares vs. debt, etc.) looks most attractive at present.

Third, investors who take the view that preferreds yields are very likely to retrace lower are better off allocating to very low coupon bank preferreds such as (JPM.PM) or (COF.PN) among others which have 20%+ of potential upside in case of a full retracement.

Within the NRZ suite, we continue to like NRZ.PD as one of the few preferreds with a 5-year Treasury yield base rate after the first call date. If Treasury yields remain at currently elevated levels or rise even further, it offers the most attractive reset yield profile in our view in the suite.

Be the first to comment