Pgiam/iStock via Getty Images

New offerings summary:

CDX3Investor.com

State of the preferred stock market

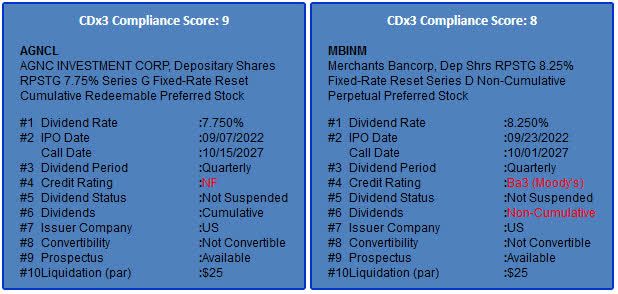

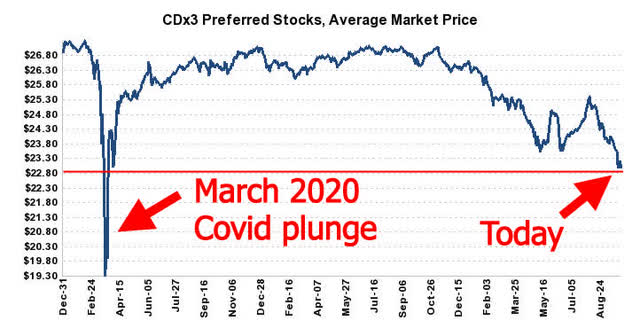

Whereas August saw a resurgence of new issuances, September slammed the proverbial door, with early September’s AGNCL offering diving to 20% below the offering price, and late-September’s offering from Merchants Bancorp (MBIN) requiring an initial 8.25% dividend rate to attract buyers. Meanwhile, past offerings of high-quality preferreds with CDx3 Compliance Score rankings of 10 out of 10 fell as a group by $1.07/share to a current discount to par value of approximately 8.1%, and offer a current yield of 6.12% at today’s average price of $22.98.

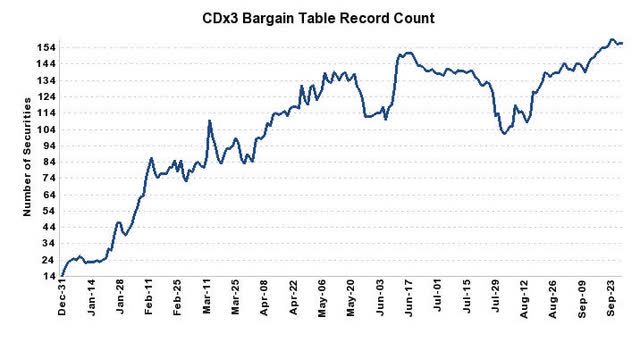

Our internal CDx3 “bargain table” count broke out to a new all-time-high of 157 since we began tracking the metric in 2015. Here is a YTD chart of our bargain table count:

The average “CDx3-compliant” preferred stock (10 out of 10 CDx3 Compliance Score) saw its market price fall to levels not seen since the March 2020 Covid-driven plunge; below is a chart from 12/31/2019 through today:

About the new issues

AGNC Investment Corp. (AGNC) completed an offering of 6 million shares of new Series G “fixed-rate reset” cumulative preferred shares, offering an initial dividend rate of 7.75% until October 2027, after which the dividend rate resets to the then-current five-year US Treasury rate plus a spread of 4.39%. The new shares trade on the Nasdaq under symbol AGNCL where they recently traded two pennies north of $20/share.

And Merchants Bancorp completed an offering of 5.2 million shares of new Series D “fixed-rate reset” non-cumulative preferred shares, offering an initial dividend rate of 8.25% until October 2027, after which the dividend rate resets to the then-current five-year US Treasury rate plus a spread of 4.34%. The new shares were rated Ba3 by Moody’s and traded temporarily on the OTC under symbol MBIPL before moving to permanent symbol MBINM on the Nasdaq.

On deck: Reinsurance Group of America (RGA) priced an offering of $700 million of 7.125% “fixed-rate reset” subordinated debentures due 2052. The 7.125% rate will be paid until October 2027, after which the interest rate resets to the then-current five-year US Treasury rate plus a spread of 3.456%. The new debentures were rated Baa2 and BBB+ by Moody’s and S&P respectively, and are expected to trade on the New York Stock Exchange within 30 days of issuance under symbol RZC.

SEC filings: AGNCL, MBINM, RZC

Buying new shares for wholesale

In the IPO review above, you may have noticed we referenced temporary OTC trading symbols. Preferred stock IPOs often involve a temporary period during which these OTC trading symbols are assigned until these securities move to their retail exchange, at which time they will receive their permanent symbols.

But there is no need to wait. Individual investors, armed with a web browser and an online trading account, can often purchase newly introduced preferred stock shares at wholesale prices just like the big guys (see “Preferred Stock Buyers Change Tactics For Double-Digit Returns” for an explanation of how the OTC can be used to purchase shares for discounted prices).

Those who have been following this strategy of using the wholesale OTC exchange to buy newly introduced shares for less than $25 are more able to avoid a capital loss if prices drop (if they choose to sell).

Your broker will automatically update the trading symbols of any shares you purchase on the OTC, once they move to their permanent symbols. A special note regarding preferred stock trading symbols: Annoyingly, unlike common stock trading symbols, the format used by exchanges, brokers and other online quoting services for preferred stock symbols is not standardized.

For example, a given Series A preferred stock might have a symbol ending in “-A” at TD Ameritrade, Google Finance and several others, but this same security may end in “PR.A” at E*Trade and “.PA” at Seeking Alpha. For a cross-reference table of how preferred stock symbols are denoted by sixteen popular brokers and other online quoting services, see “Preferred Stock Trading Symbol Cross-Reference Table.”

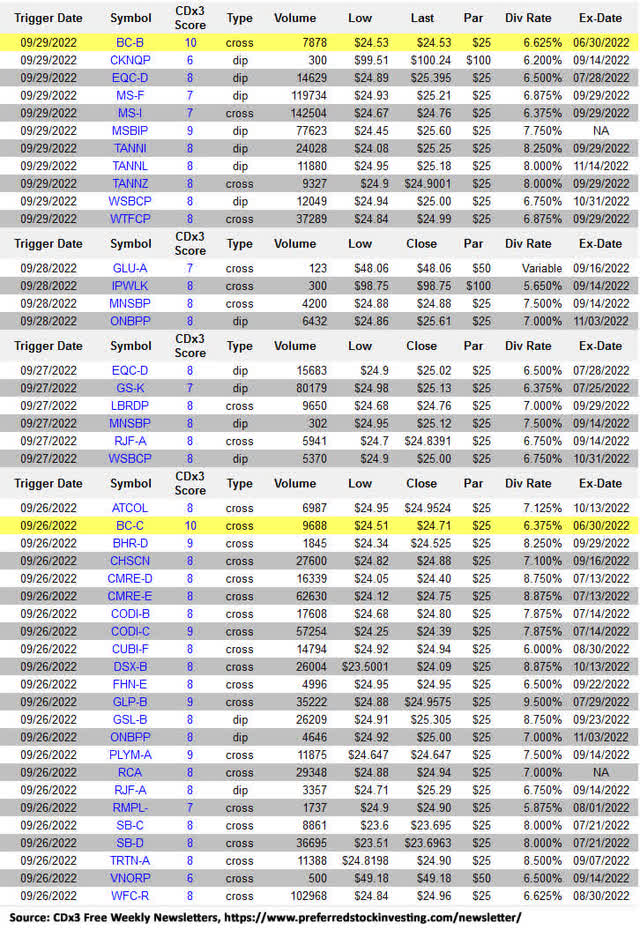

Past preferred stock IPOs below par

In addition to covering new preferred stock and ETD offerings, here at CDx3 Notification Service we also track past offerings, with alerts when securities fall below their par values. Here are some of the recent dips/crosses below par we observed:

Note: Any yellow highlighted entries indicate eligibility for the “CDx3 Bargain Table.”

Until Next Time…

Here at CDx3, our typical articles will provide month-end preferred stock (and ETD) IPO summaries, plus a look at selected past preferred stock IPOs that are now trading below par. Often the reward on offer for “imperfect” preferred stocks is very high relative to the fully CDx3-compliant professionally credit-rated securities.

Whether you are the kind of investor who sticks with preferred stocks with a CDx3 Compliance Score rated 10 out of 10, or whether your portfolio has room for 9-score-and-lower securities, stay tuned for future articles recapping new IPOs and interesting preferred stock activity that we notice here at the CDx3 Notification Service. Thanks for reading!

Be the first to comment