Chun han/iStock via Getty Images

Chinese education giant New Oriental (NYSE:EDU) is recovering strongly after the Chinese government’s crackdown on the education sector last year. They expect to return to the black in FY 2023, and their new business initiatives are promising. Competitive risks cloud their outlook however.

Solid recovery

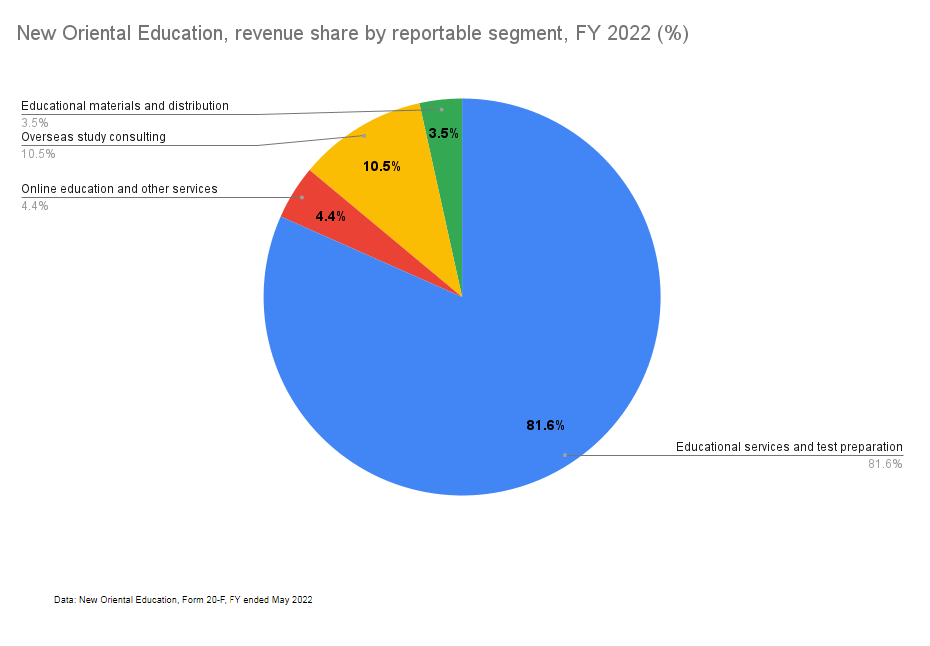

After going through a roller coaster year triggered by the Chinese government’s ‘Double Reduction’ policy which prevented education providers from providing K-12 academic tutoring services on a for-profit basis, China’s education sector is getting off to a fresh start and one of the leading players, New Oriental Education, is seeing positive early signs in their restructuring efforts. Forced to shut down their K-12 tutoring services business, the restructured company now focuses on four operating segments: (i) educational services and test preparation services; (ii) online education and other services; (iii) overseas study consulting services; and (iv) educational materials and distribution.

Author

For the quarter ended August 2022, revenues were down 43% YoY to USD 744.8 million, driven by the cessation of its K-12 after-school tutoring services business. The total number of schools and learning centers dropped to 54% YoY to 706 by the end of August 2022, from 1,556 the same period last year.

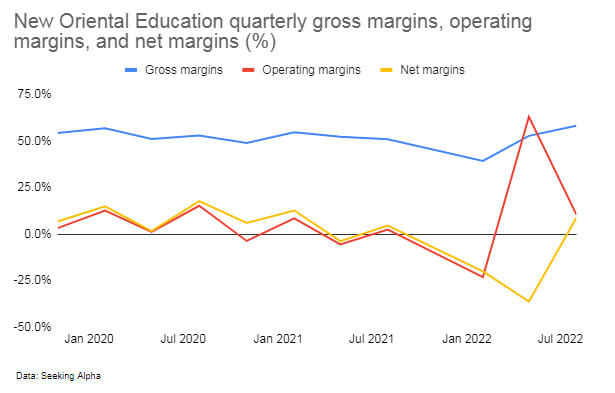

Profitability improved significantly however; operating income rose 140.5% YoY to USD 77.9 million, and margins improved as well partly helped by school closures and employee layoffs which led to a reduction in fixed costs; gross margins expanded to 58.1% in the August 2022 quarter compared to 50.9% in the August 2021 quarter while operating margins jumped to 10.4% during the August 2022 quarter compared to 2.4% the same quarter a year earlier.

Author

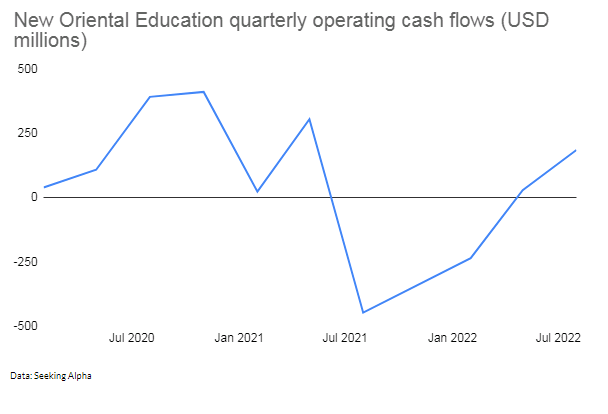

Cash flows also improved, with operating cash flows staying positive for the second consecutive quarter, a turnaround from the same quarter last year when operating cash flows were negative.

Author

With financials on the mend, the company authorized a USD 400 million share repurchase program between July 28, 2022 through May 31, 2023.

Looking ahead, the company is optimistic about its prospects. After suffering a USD 1.2 billion loss in FY May 2022, company management is expecting a return to the black in FY 2023. This is likely to be achieved through further shrinkage of their offline K-12 education business while expanding their new business segments, notably overseas study consulting which is currently the only major profitable segment and is seeing strong growth with revenues up 21% YoY during the August 2022 quarter and up 16% YoY the previous quarter. Their online education business segment which includes their Koolearn platform is loss-making, and given Koolearn’s sketchy track record in generating profits (the company has been lossmaking since 2019 but was profitable in years prior), this segment is likely to remain loss making although rapid growth in their higher margin eCommerce business could help offset segment losses near term.

The company is working on a few long term strategic new business initiatives which as of now are showing positive traction.

Expanding non K-12 academic services

The Chinese government’s ‘Double Reduction’ policy, which aimed to reduce excessive burdens placed on both school children (whose schedules were packed with after-school tutoring classes), as well as parents (who spent exorbitant amounts on their children’s after-school education), was also partly driven by a need to overhaul their education system from one based on scores and books, to one based on “rounded” development whereby academic education was balanced with extra curricular activities. The result has unlocked demand for enrichment programs in areas such as singing, music, nature education, art, calligraphy, coding, history, sports, soft skills (such as public speaking) and games (such as chess). Leveraging on their existing education infrastructure and resources, New Oriental expanded their non K-12 education programs in 2021 and has generated positive traction with courses already being rolled out in more than 60 cities in China, and 270,000 students enrolled as of the August 2022 quarter.

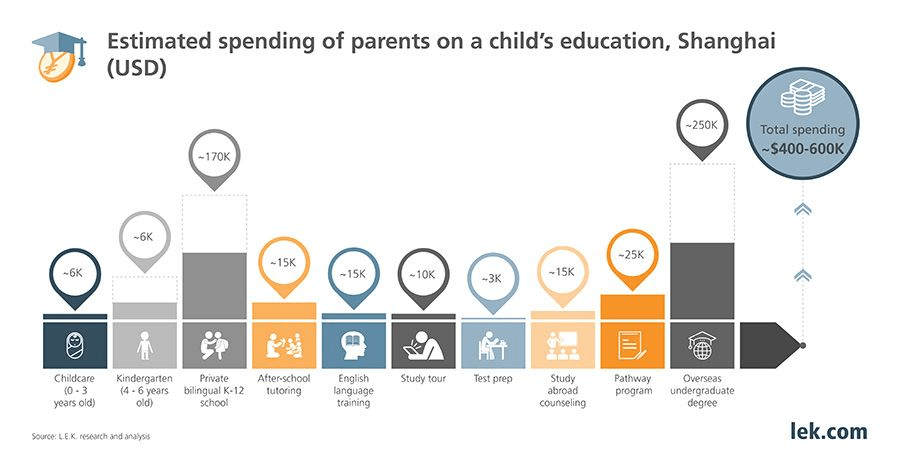

Meanwhile the company continues to focus on overseas study consulting services (which currently accounts for about 10% of revenues as of May 2022), exam preparation courses, as well as their intelligent learning system and devices business which is seeing strong traction with 131,000 active paid users in the August 2022 quarter. Demand for overseas study opportunities among Chinese students is strong, and likely to remain so in the longer term as incomes rise and an increasing proportion of parents can afford overseas study costs, opening opportunities in consulting services and exam preparation courses which New Oriental is positioned to benefit from.

Consultancy.asia

Koolearn ventures into high margin eCommerce

Leveraging their existing live broadcast technology (originally developed for their live-broadcast classrooms) and existing human resources, New Oriental’s online education subsidiary Koolearn branched out into eCommerce as part of its restructuring effort, with the company launching an eCommerce platform “Dongfang Zhenxuan” focused on selling agricultural products through livestream shows on video platforms such as Douyin. After seeing enormous success, they launched their own private label products as well as a supply chain management system. Going forward, with Koolearn growing at a rapid clip, it is likely to drive growth and account for a greater share of New Oriental’s revenue mix.

Part of their success may have to do with their differentiation amid China’s highly competitive eCommerce space; their livestream videos often feature highly knowledgeable teachers mixing educational information (such as bilingual hosts combining English lessons with Chinese, nutritional values, historical significance etc) with their sales pitches, boosting their shows’ utility and appeal, and thereby helping them stand out in China’s sea of livestreamers.

Although agriculture eCommerce is extremely challenging particularly in terms of logistics, going forward, there is reason to be optimistic; China’s eCommerce boom has largely overlooked online retail of fresh produce and consequently rural communities have so far not fully participated in China’s eCommerce growth story. That is changing however; China’s Common Prosperity Program aims to promote rural development and increase farmer incomes among other targets, and eCommerce is viewed as a solution to drive this ambition with the country’s 14th Five Year Plan (2021-2025) envisaging the expansion of eCommerce into rural China. A favorable regulatory environment and a relatively low eCommerce penetration for agricultural goods suggests a long runway for growth in China’s fresh produce eCommerce space, an opportunity Koolearn is aiming to profit from.

Risks

Competitive risks

Competitive risks may limit New Oriental Education’s growth prospects. Established edtech rivals such as GaotuTechedu and TAL Education have also been expanding their enrichment programs as part of their pivoting strategy, and some such as TAL Education have also followed New Oriental in venturing into eCommerce. Meanwhile new entrants are looking to capture a share as well, with around 33,000 new enrichment education enterprises sprouting up (a 99% YoY growth) in less than two months after the Chinese government’s Double Reduction policy was put forward.

Delisting risks

Last month, the SEC named New Oriental Education as a stock that could be delisted under the Holding Foreign Companies Accountable Act (HFCAA). This risk could be eliminated by investing in New Oriental’s Hong Kong shares.

Summary

New Oriental Education is rapidly recovering after a disastrous year in 2021 driven by China’s overhaul of its education sector. The company expects to return to the black in FY 2023 and their new strategic business initiatives, notably their expansion into non-academic subjects, and agriculture eCommerce are promising. Although the long term success of these new businesses remains uncertain and competitive risks remain with a slew of new competitors entering the space, New Oriental does have a slight edge as one of the leading education players with quite a strong brand name, as well a relatively strong financial position; the company has a net cash position of USD 2 billion as of August 2022, (USD 4.25 billion in cash and cash equivalents and short term investments, and USD 2.2 billion in total liabilities). Net cash and short term investments accounts for nearly half of New Oriental’s USD 4.25 billion market capitalization which may make the stock attractive for some. A P/E of 19 for a company with an as yet uncertain future is not really attractive however and investors with a low risk threshold may opt to wait for an opportunity with a better risk/reward.

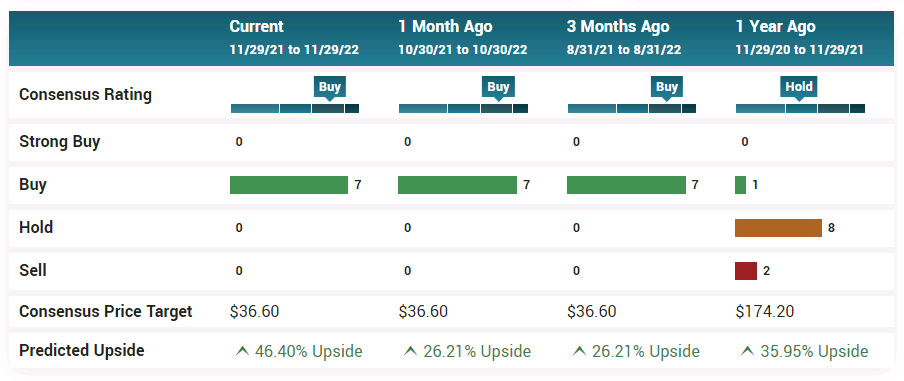

Analysts are mostly bullish on the stock.

Marketbeat.com

Be the first to comment