Natalia Lagutkina/iStock via Getty Images

After many years of heavy investments (~$8 billion invested in building world-class LNG infrastructure assets around the world over the past 8 years or so), New Fortress Energy (NFE) has started to reap the benefits. Specifically, all eyes are on cash flow generation, as this was the weak point of NFE, until now. The main reason is that it takes quite a bit of time (years) to develop assets (permits, construction, etc.) until they are operational (with all safety measures in place) and reach income generation mode.

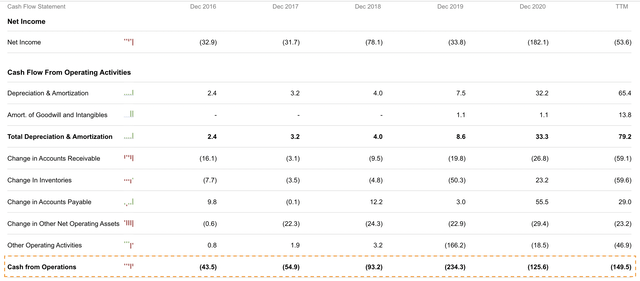

As you can see from the above cash flow statement, cash from operations has been consistently negative over the past few years. In other words, the company was burning cash in its operating activities, and, on top of that, the company had to manage an ~$8 billion investment program, including sourcing capital. As a value investor, I tend to avoid situations of negative operating cash flows. However, the good news is that as of 2022 we are passed the era of negative operating cash flows. But there is even better news. Operating cash flow will not just be positive, it will be significantly positive in FY 2022. And the situation gets even better in FY 2023 and beyond, given the nature of NFE’s contracts, with prudent exposure to commodity risk. In other words, NFE is transforming into a nice cash flow machine, allowing for a significant compounding effect, and this is what I look for as a value investor.

Below we will break down how NFE’s operating margin will translate into free cash flow going forward. Management has guided the following:

- For FY 2022, NFE is on track for an operating margin of at least $1.1 billion.

- For FY 2023, NFE is on track for an operating margin of at least $1.5 billion

As a reminder, operating margin figures do not take into account SG&A (selling, general and administrative), interest and tax expenses, as well as debt amortisation payments (not an expense per se but a cash outflow nonetheless).

Let’s take an operating margin figure of $1.5 billion. From this subtract:

- $100 million for SG&A

- $300 million to $400 million for interest plus amortisation payments

So we are left with a bit more than $1 billion (pre-tax) free cash flow annually. Importantly, NFE will continue with its credit enhancement initiatives and seek investment grade rating (note S&P recently upgraded NFE’s issuer credit rating to ‘BB-‘/Stable Outlook from ‘B+’), which can free up more than $200 million of annual cash flow through simplifying and refinancing the capital structure. During the Q3 20201 earnings call, NFE’s CFO, Christopher Guinta, breaks down the $200 million cash flow ‘savings’ as follows:

We expect we can refinance our $2.75 billion of high-yield notes at rates of approximately 300 basis points lower than current borrowing and reduced interest expense by roughly $80 million a year.

Furthermore, over time, we can refinance $1 billion of asset-level debt, which removes over $120 million of annual amortization. Unlocking these additional cash flows is the next key step in maximizing our cash flow available for reinvestment or for dividends. With that, I’ll turn the call back over to Wes.

These are all steps in the right direction i.e. capitalising on the improved credit rating to reduce the cost of capital and removing annual amortisation requirements to maximize flexibility and invest in higher return opportunities when they present themselves.

What’s more, assuming $200 million for taxes (the net profit will be taxed at varying rates across the business), NFE can generate at least $1 billion in free cash flow annually, after-tax payments. In other words, $1 billion of cash will pile up on the balance sheet every year. Should this base case scenario play out (I see no reason why not), this will provide tremendous optionality either “for reinvestment or for dividends” as the CFO mentioned.

In any event, with $1 billion of high quality free cash flow annually and a current market cap of ~$4.2 billion, NFE appears to be dirt cheap right now with a pro forma free cash flow yield of ~25%. What’s more, we are just getting started in terms of free cash flow growth, as LNG is a booming sector and so is hydrogen (more on this further down). Add into the mix the additional value and incremental cash flows that will be created through reinvesting part of the $1 billion annual free cash flow, NFE’s share price could well increase by more than 4 times from current levels to $80+ per share, and still be reasonably valued.

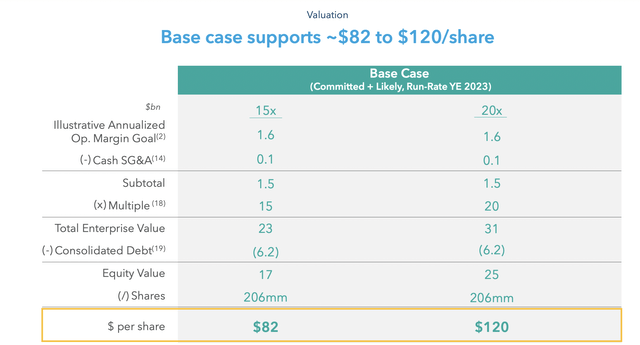

Interestingly, I came across an NFE Annual Investor Update 2021 presentation dated 21 July 2021, and of particular interest is slide 50 which provides analysis supporting a base case valuation of ~$82 to $120 per share.

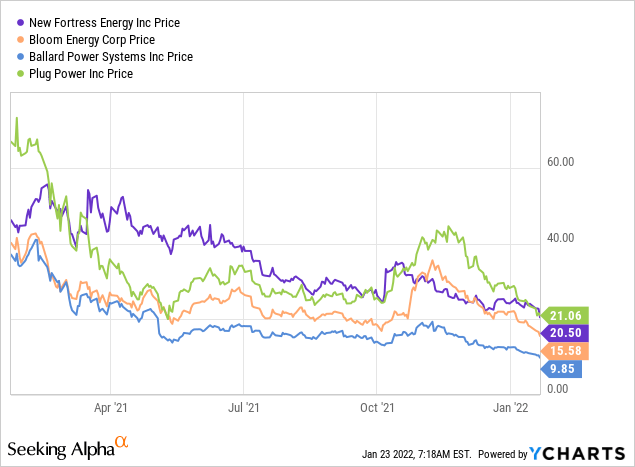

I agree with this thought process and we are off to a promising start. Last year, as well as so far this year, unfortunately NFE’s share prices has performed abysmally. It seems to me that NFE is getting bundled with alternative fuel stocks such as Bloom Energy (BE), Ballard Power Systems (BLDP) and Plug Power (PLUG).

The high correlation is clear. Even though NFE has established a promising and growing division called ZERO, which aims to provide carbon-free power by replacing fossil fuels with affordable zero-emission hydrogen, NFE is predominantly an LNG company, at least right now. It seems that market participants are not really doing their homework, and this has created a great buying opportunity. Sure, NFE will continue making progress through its subsidiary Zero Parks to advance energy transition by investing in blue and green hydrogen, and, in fact, it is very close to launching its first project in the USA.

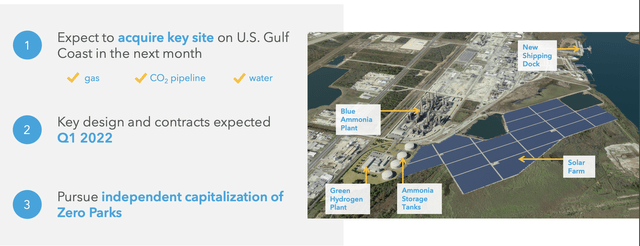

NFE Hydrogen Project on U.S. Gulf Coast

NFE anticipates to acquire a key site on the U.S. Gulf Coast with key design and contracts expected in Q1 2022. In other words, really soon. Importantly, NFE expects to be able to finance the lion’s share of the capital requirements with tax-exempt financing (i.e. high leverage at low interest rates).

Even though I am really excited about the U.S. Gulf Coast project and NFE’s aspirations around hydrogen, I would like to emphasise that from the $1.5+ billion operating margin, which will eventually translate into ~$1 billion in free cash flow annually (as discussed above), pretty much all of it has to do with LNG. In other words, hydrogen and ammonia are future initiatives that will complement NFE’s LNG infrastructure and eventually generate substantial cash flows, but we are still a long way (years) from that point. As such, the market has gotten it completely wrong, at least associating NFE with companies producing negative cash flows that have capitalised on the green hype. NFE is approaching green initiatives in a sensible and conservative manner, enjoying the backbone of the strong cash flows stemming from the core LNG business.

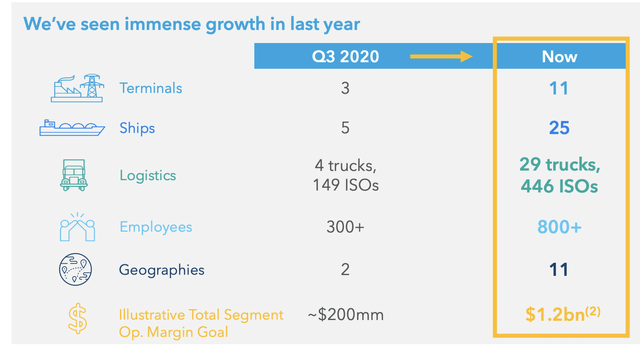

In closing, NFE has reached an important inflection point of generating substantial positive free cash flow. This will be reflected into the financial statements in the coming quarters. However, investors who haven’t done a thorough pro forma analysis on NFE and heavily rely on screeners (which by default have lagged data) will incorrectly assume that NFE is burning cash and has a high debt leverage. In fact, with over $1 billion in operating margin, NFE is on target for 3x debt leverage coverage ratios. Also, it seems that many investors are incorrectly bundling NFE with several green revolution companies that are bleeding cash right now. Even though NFE has a bright green future ahead, it also has a bright future of generating strong free cash flows from its growing LNG business. In the past, a valid risk was NFE’s concentration. But this is no longer the case. NFE has diversified its cash flows, which include volumetric gas and electricity revenues, capacity payments, cargo sales, shipping, etc. In fact, in Q3 2020, NFE had 3 terminals, 37 customers in 2 geographies/markets. Today, NFE has 11 terminals, over 100 customers in 11 different geographies/markets. This massive change in the diversified footprint of NFE’s business is reflected in the following table.

NFE diversification initiatives

This balanced and diversified growth is the key reason why S&P upgraded NFE’s credit rating. Things are heading in the right direction on all fronts expect for the share price, hence the buying opportunity.

Be the first to comment