imaginima

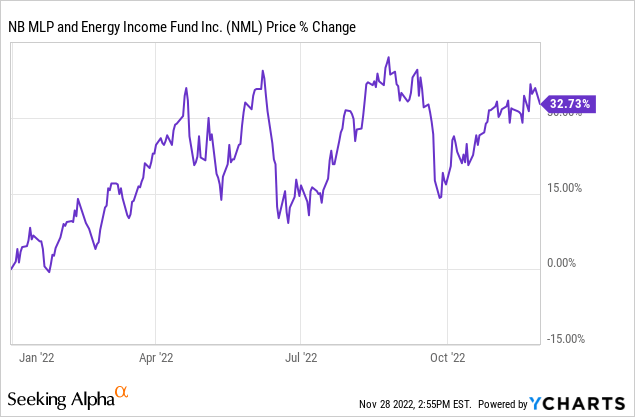

We are nearing the end of 2022, and that’s always a great time to look for interesting closed-end funds (“CEFs”) to add to a portfolio. These funds tend to go on sale near the end of the year, and sometimes discounts close early in the new year. Neuberger Berman MLP Income Fund Inc. (NYSE:NML) is focused on midstream MLP investments and energy companies with an attractive risk/return profile and (interestingly enough) have a low correlation to interest rate fluctuations. Year-to-date, the fund has been doing really well:

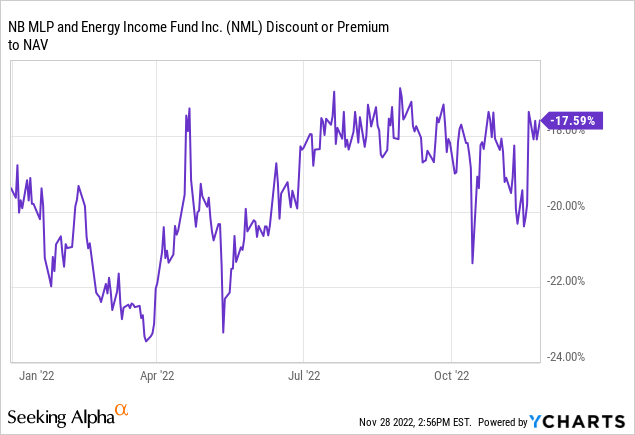

But it still trades at a sizeable discount to net asset value:

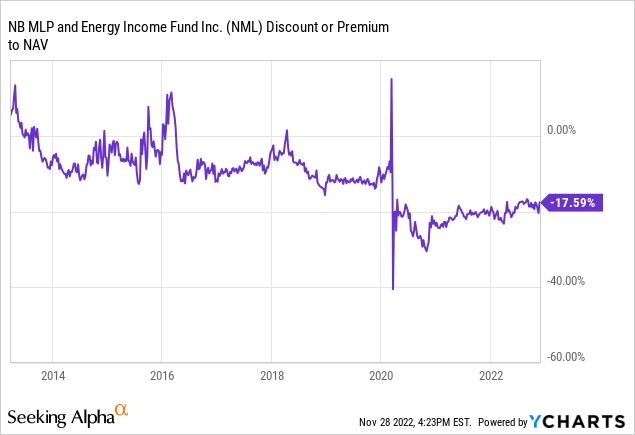

It currently trades at a 17.5% discount. The 6-month average (during a really good year) is around 18.5%, and the 3-year average is over 20%. The fund uses a bit of leverage. It leverage ratio stands at 15.33%. Meanwhile, the distribution rate at the current share price is close to 10% at 9.84%.

I like CEFs with huge discounts, and this is a very high discount for a U.S.-traded closed-end fund. You can find discounts like this more easily in the U.K., but in the U.S. it is currently among the 10 most heavily discounted CEFs.

When I potentially want to buy a CEF, I always glance over the portfolio. Not to second guess the managers, but: 1) this shows whether the management is closet-indexing (I don’t want to pay heavy fees for an index-like portfolio); 2) the portfolio gives clues whether management could be highly skilled (better managers tend to have very creative portfolios); and 3) There could be interesting ideas in the portfolio I may want to look into further.

After buying, I try to hang on to CEFs until the discount to NAV narrows to around ~5% or less for a bond fund or ~10% for an equity fund. What I like here is that the good performance is accompanied by good momentum on the discount. Having said that, the discount is highly volatile, so it’s hard to read too much into it.

The largest 10 positions are:

Targa Resources Corp. (TRGP), Enterprise Product Partners (EPD), Western Midstream Partners (WES), Energy Transfer LP (ET), The Williams Companies (WMB), NextEra Energy Partners (NEE), Antero Resources (AR), ONEOK, Inc. (OKE), and Cheniere Energy (LNG). These make up over half of the portfolio, which means the fund is quite concentrated. A favorable indication the managers are trying to generate alpha.

In my opinion, Neuberger Berman MLP Income Fund Inc. could be an interesting addition to a portfolio. NML is one of the most discounted CEFs in U.S. markets, the distributions are almost 10%, it is managed by a reputable firm, modest leverage is employed, and the portfolio is concentrated towards higher-conviction names.

The two reasons I’m personally going to pass on this one are: 1) the fund has a long history of trading at a very large discount (although it traded a lot better pre-2020); and 2) my portfolio is already fairly heavy on energy picks (where I like to think my edge is slightly larger).

Be the first to comment