Ljupco

NETSTREIT Corp. (NYSE:NTST) is an “interesting” real estate investment trust (“REIT”).

What else can you call a REIT that managed to hold onto a 100% occupancy ratio throughout the horrid periods of 2020 and 2021, while maintaining a $100M+ quarterly investment rate throughout the entire pandemic?

NTST has a very convincing investment thesis in terms of its customers and tenants, and this high tenant quality creates a near-bond type leasing contract with high rent collections – that are not likely to be impacted by general disruptions in macro.

This makes NETSTREIT a superb prospect – and if you’re thinking this sounds good, you’re not alone.

Let’s look closer at the company.

NETSTREIT – The REIT

Now, first things first.

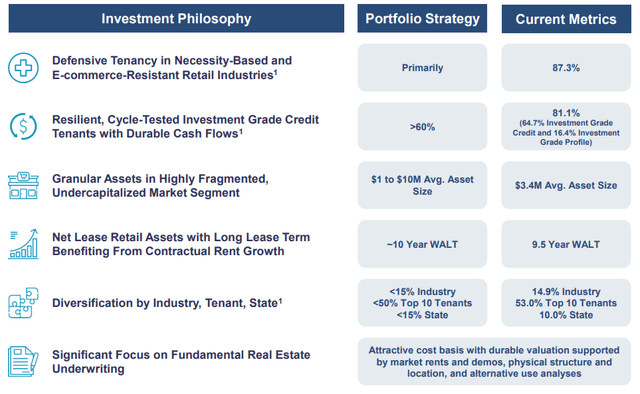

NETSTREIT lacks a credit rating – we need to look at tenant credit ratings here, which are arguably as important for a net lease REIT such as this one. The company works with conservative underwriting, active asset management, and deep industry relationships to achieve alpha and scale.

As mentioned, NETSTREIT is one of the very, very few REITs with a 100% occupancy ratio. This also isn’t any sort of a fluke – it’s maintained this for over 2.5 years at this point.

The company’s main focus is defensive industries – clients are in necessity and discount-oriented retailers with e-commerce resistant company strategies and approaches.

NETSTREIT is very picky about who it lets into its properties and leases.

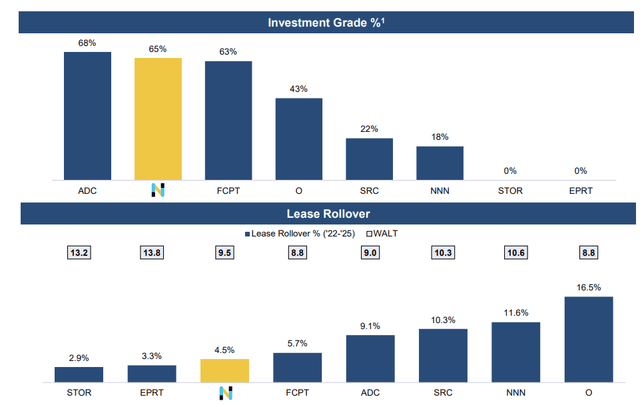

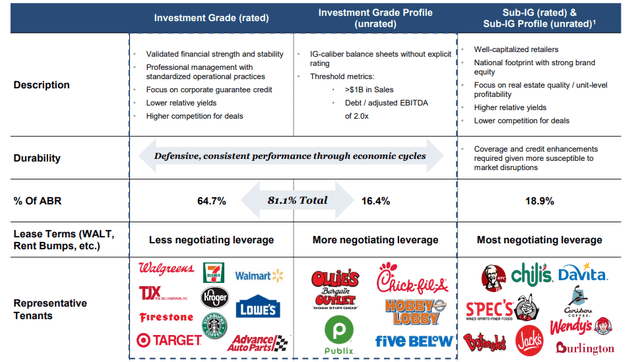

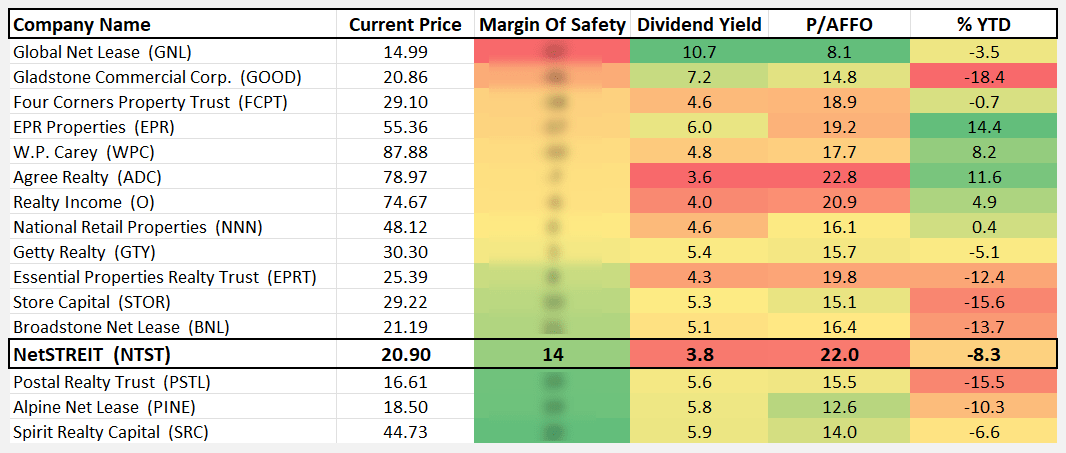

The Texas-based REIT has the industry’s and segments’ second-best investment-grade tenancy ratings. Only Agree Realty (ADC) has better at 68%. NTST is better than O here, with O “only” at 43%.

Quality really is one of the biggest arguments for this REIT. Only STORE Capital (STOR) and Essential Properties (EPRT) have lower lease rollovers than this company. Quality, quality, and more quality (the 3 Qs in the title).

NTST Investor Presentation

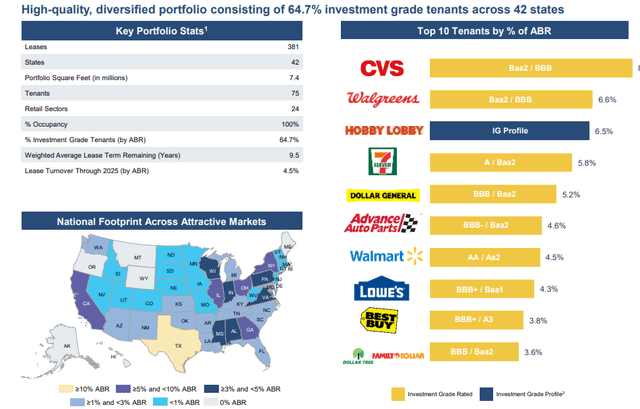

Let’s talk about NETSTREIT’s portfolio since we’re so focused on quality here. And there’s plenty to like here.

The top 10 companies by ABR have a collective ABR of just over 45% – which is high – but when you look at who these companies are and where the company’s properties are located, I believe you will view this as favorable. We certainly do.

Note: (ABR = Average Base Rent)

NTST Investor Presentation

The company does have some portfolio-wide diversification in terms of its industries and tenants. 54.5% of the portfolio is leased to necessity businesses like Walgreens (WBA), Walmart (WMT), Target (TGT), Lowe’s (LOW), Kroger (KR), CVS (CVS). 18.1% discount, such as Big Lots (BIG), TJX (TJX) and 14.8% service, such as Taco Bell, 7-11, Wawa, or KFC.

The top industries are Drug Store/pharma with ~15%, 13.7% home improvement, and 9.3% discount retail, among other things.

NTST’s portfolio diversification has changed significantly since its Pre-IPO back in 2019. Back then, the company had 93 leases in 28 states, 12% of which were CVS. Now the company is 8.2% CVS with 381 leases in 42 states. The company has expanded massively.

All of these leases generate $84.2M in ABR, which is more than 4x the ABR of 2019 and it manages 7.4M Square feet. In simple terms, the company has improved its portfolio qualities significantly.

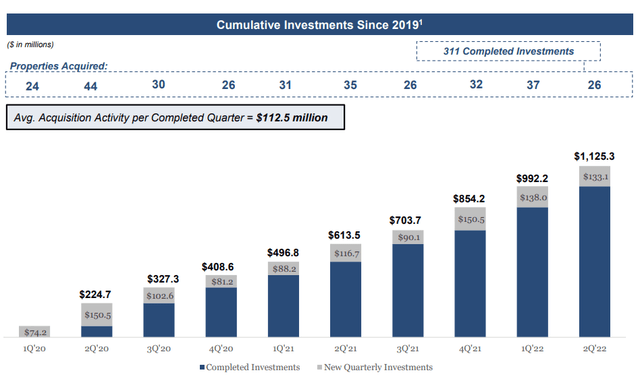

Growth is the second argument for NTST. Take a look at the average M&A activity.

NTST Investor Presentation

NTST is one of the more active asset managers in the net lease industry. The company combines active monitoring of every single one of its properties with identification and strategic recycling.

Now, this is not unique – all REITS to some degree do this, but the company’s activity relative to its portfolio size tells us that the company really is very active in this perspective. NTST’s demands for its properties are high.

That’s something we really like to see. We also like to see the company’s strong focus on its three underwriting parts – Tenant credit underwriting – real estate valuation – Unit level profitability.

It’s the company’s focus here, and its expertise that creates consistent performance through economic cycles. Now, it’s hard to talk seriously about this with a company that really hasn’t seen that many years in a listed state – NETSTREIT is, after all, only IPO’d in 2020. That’s not even 2 years yet.

Doubting the company is understandable.

That’s also likely why the company is trading cheaply – at least in part – but we at iREIT on Alpha look at company quality. And the quality of this particular business is outshining many others of its kind.

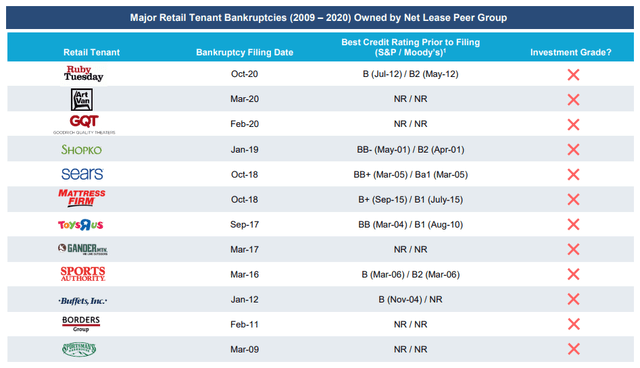

Its focus on investment-grade tenants is based on sound reasoning – namely that every major retail tenant bankruptcy over the past 2009-2020 period was seen by tenants or companies, owned by peers, and the tenants had no IG.

NTST Investor Presentation

In assessing credit quality, real estate quality, and unit level profitability, the company uses and focuses on mission-critical or resilient tenants as well as properties resulting in strong rent coverage and higher variability in operating costs.

NTST wants at least 2.0x Rent coverage and that the property ranks in the top half of the tenants’ store portfolio. Unless this is the case, NTST is not interested in the property or might seek to dispose of it.

The company’s focus is furthermore on “inefficiently” priced assets, with a typical transaction characteristic that has a smaller deal size, not very highly marketed, may involve transactional structuring limits further limiting the pool of interested buyers, and doesn’t allow for financing flexibility.

If NTST achieves this, it results in the company buying inefficiently priced assets at great prices, delivering significant shareholder value – and for the time being, the company has actually managed this.

This has resulted in extremely strong fundamental metrics for NETSTREIT.

NTST Investor Presentation

With fundamentals great, a word about the leadership.

Mark Manheimer, CEO, and President of NETSTREIT, has experience from Realty Income as the director of underwriting, experience from Spirit Realty (SRC), and other net lease peers. The same set of experiences from similar peers such as Federal Realty (FRT) is true for the CFO of the company.

We have interviewed him often at iREIT on Alpha (June 2022, March 2022, December 2021, and August 2021).

NTST markets itself as a “growth” REIT, and I view this as being an accurate description. Its tenants provide it with defensive cash flows and proven resiliency overall, and the company is led by a seasoned team with decades of experience in the business.

It’s a disciplined underwriter with experience, and it has a platform that’s positioned for scale and has proven to be able to grow its cash flows massively over a short time – it’s only been IPO’d for 2 years.

Despite this, the company hasn’t received the love or trust of the market this year, dropping 8.25% YTD and currently trading at what is a historical cheap valuation.

Risks to NETSTREIT do exist – but they’re modest.

We’ve already covered that they lack any credit rating. The company also focuses on very small transactions to be able to garner attractive cap rates. This makes sense – high-quality tenant properties are usually very expensive, and outside this REITs ability to handle. However, transactions continue.

We acquired 34 properties for $90 million at an initial cash capitalization rate of 6.3% and a weighted average lease term of 8.2 years. In addition, rent has commenced on two development projects that had a total cost of $7.6 million and had a weighted average investment yield of 7.6%.

(Source: Mark Manheimer, 1Q22 Earnings Call)

One could even argue that NETSTREIT learned from the mistake many other REITs made during the pandemic when they faced dropping rent collections as many tenants struggled.

Their response was to make sure that only the best, albeit small, properties are allowed to be part of the REIT. For now, this has worked out extremely well for the business.

Let’s look at what this has done to the valuation, and why we view this company as attractive.

NTST Stock Valuation

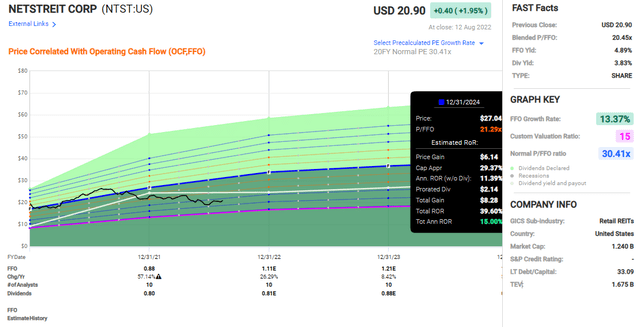

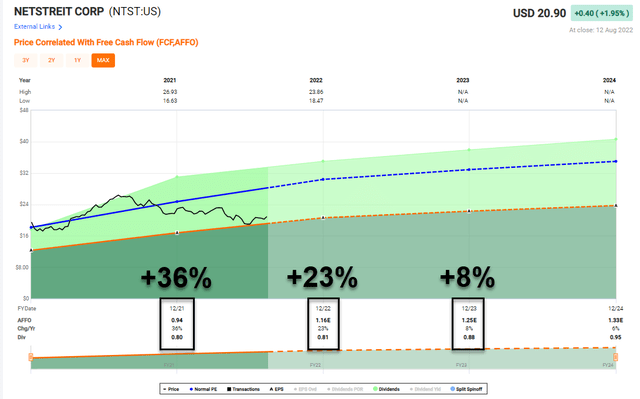

A company that has been able to grow as NETSTREIT has, naturally is bound to trade at some fairly impressive multiples. This is the case for the company, which since its inception and IPO has traded at around 30x P/FFO. This might seem high, of course.

But you have to remember that NETSTREIT has averaged annual funds from operations (“FFO”) growth of almost 100% annually over the past 2 years, and is expected to grow by double-digits going forward as well. When consider this, 30x doesn’t sound like that insane any longer.

Still, future growth rates are different than past growth rates. NTST is expected to grow at around 13.3% on average until 2024 on a per-year basis (based on FFO per share).

Now, to be clear, analysts don’t know what to make of this company. Analyst missed its only 2021 forecast, which gives these estimates somewhat of a “zero” confidence rate. The company is very new on the markets, after all.

Still, despite its small size, its followed by 9 S&P Global analysts. All of these analysts have a “BUY” or “Outperform” rating, with an average price target of $24.69, from a range of $20 low to $32 high.

That denotes an upside of 18.2% at the current valuation. We at iREIT on Alpha would view this target with favor, as our target is around $24.3 for the company, a similar level.

Future growth is nowhere near as historical growth.

We don’t expect FFO to double in 2 years again. However, this is a quality company that grows the “right way.” On the basis of that, we can allow the company to trade at a 15-22x P/FFO multiple, because it has the potential for high double digit FFO growth going forward.

This would give us an upside range of at least positive at 20x.4 current P/FFO, and a high upside of 15-18% per year on the basis of a 2024E forecast.

FAST Graphs

This is one of the, and the only actual REIT I know of today with a 100.00% occupancy rate, based on extremely qualitative tenants. The company’s occupancy has never dipped – not in both years of the pandemic.

It’s clearly a “young” REIT.

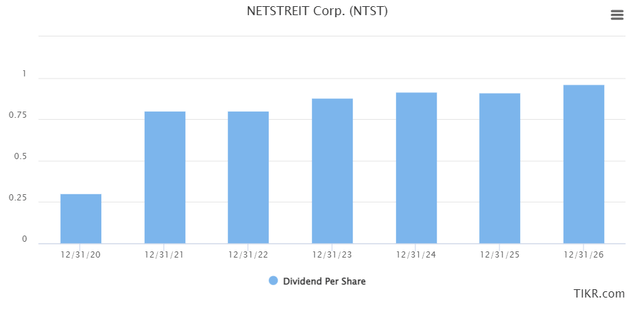

The yield is modest – under 4% even after the drop – but there is potential to raise it further with increased FFO, expected to come in at $1.11 today and another $0.1/share in the next year. Based on current dividend growth forecasts, we would be looking at an above 4% yield on today’s price for the 2023E dividend.

FAST Graphs

The company has improved its portfolio – and now trades with a solid set of fundamentals at an increasingly cheap price for what it offers. That said, other REITs are higher on the quality meter and come with IG-rating, as well as higher yields.

Avoid the 3 Ts

I’m sure you’ve heard me talking about the 3 Ts before, that stands for:

You see, when I owned dozens of duplexes, I was always frustrated over these landlord expenses. I paid the property taxes on all of my rentals in addition to the trash collection and broken toilets. Remember that rental properties are extremely high maintenance.

Alternatively, Net Lease landlords pay none of these costs, all expenses (including taxes, insurance, and maintenance) are paid by the tenant.

Thus, instead of the 3 Ts… I get the 3 Qs (quality, quality, quality) with NETSTREIT.

If you’re not invested in some of these REITs, then you might be better off investing into investments with a higher credit quality and yield – because the upsides for these are also great.

However, if you’re already heavily invested in REITs and have space for one more – a great one – then NETSTREIT is an alternative for you. There is a lot to like about this company.

NTST Investor Presentation

So – we at iREIT on Alpha consider this one a “BUY.”

iREIT

Be the first to comment