Mario Tama/Getty Images News

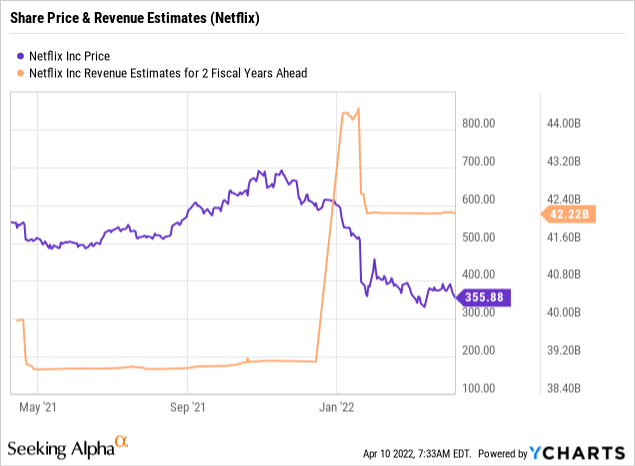

Netflix, Inc.’s (NASDAQ:NFLX) share price has declined an eye watering 47% from its highs, in November 2021. The firm has faced an intense battle in the streaming wars, which has resulted in their market share being eaten up, going from 51.4% in Q12020 to 43.6% in Q42021. Despite this the firm is still the market leader, with the lowest churn in the industry, top management, increasing margins and a large growth runway ahead. Is this stock worth tuning in for? Let’s dive into the business performance, market opportunity, financials & valuation in more detail.

Market Opportunity

As of 2021, there were 780 million broadband internet subscriptions globally, excluding China. In addition, there are approximately 650 to 700 million paid TV subscriptions as of 2021, outside of China.

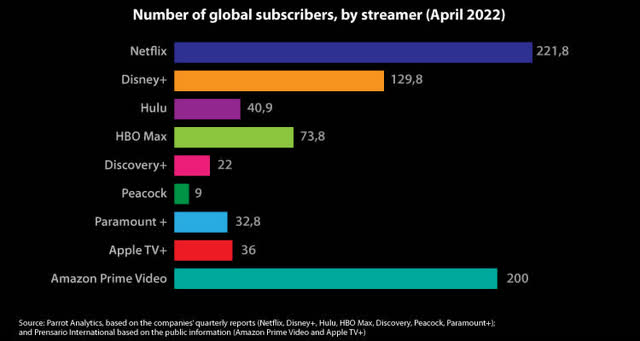

Netflix has a staggering 222 million paid subscriptions globally, but the total address market is 700 million subscriptions. Thus, the firm has a market penetration of 31.7% or to put it another way approximately 70% of the market is left to fight for.

Streaming Provider Subscriptions (Digital-Content)

The streaming market size is forecasted to continue to grow by an 18.3% CAGR up until 2026. While Pay TV subscriptions were 100 million in 2014 and are expected to decline by 40% to just 60 million by 2026. Netflix is poised to benefit from this simultaneous growth in the streaming market & the decline in Pay TV.

Business Performance

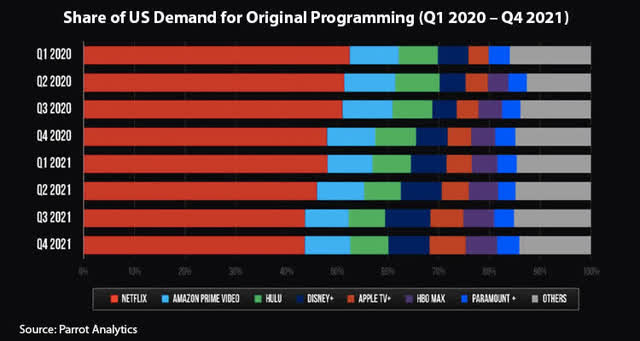

Netflix is facing intense competition from rivals and has seen their market share decline from 51.4% in Q12020 to 43.6% in Q42021. While the firm’s rivals such as Apple TV, HBO Max and Disney+ have grown their market share from 13.5% to 21.4%.

Content Market share (Parrot-Analytics)

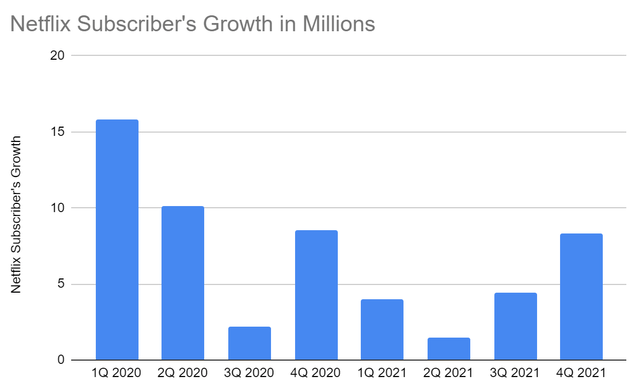

Netflix has also seen slowing user growth with a net increase of 8.28 million subscribers reported in Q42021, which was mainly driven by markets outside of the US. However, this was below the company’s prior guidance of 8.5 million paid subscribers and even analyst expectations of 8.3 million. (Source: FactSet)

Netflix Subscriber Growth (Bloomberg data)

The demand for original content is a key indicator of new subscriber growth. Original programming such as Squid Game and La Casa De Papel proved to be very popular with non-English speaking audiences and thus helped to slow down the firm’s subscriber losses, compared to prior quarters in 2021.

Netflix launched the widely popular The Witcher and Cobra Kai at the end of Q42021 and thus this should boost demand for Q12022. New episodes of Stranger Things are also coming in 2022 which should help with demand.

Netflix is currently releasing between 150 to 200 episodes of original content each more, which is more than competitors such as Disney+, Hulu, HBO Max and Prime Video. This gives Netflix a vast variety of content which appeals to everyone and makes the firm the “anchor” of the streaming industry with other services being viewed as “add-ons”.

Pricing Power

Netflix offers one of the lowest cost forms of high value entertainment and their service is still 80% cheaper than the average Pay TV package in the US, with a 30 cent cost per engagement hour. Now although, the “Streaming Wars” is a commonly used phrase, is this really a war? According to Parks Associates 61% of US households with broadband subscribe to 2+ streaming services as of 2020 up from 48% the previous year. This makes complete sense given the average Pay TV subscription is $80, that could be transferred over to multiple streaming providers and still be cheaper!

Netflix has also shown themselves to have “pricing power” in the industry and has recently increased prices, but they are still cost effective.

-

Netflix at $15.99 (after recent price increase).

-

HBO Max $14.99

-

Amazon Prime Video ($12.99 incl. Prime)

-

Disney plus at $7.99

Given, the average US median family income is $79,900 for the year 2021, a price rise doesn’t seem an issue to average person, but this puts substantial profits directly to Netflix’s bottom line.

Strong Financials

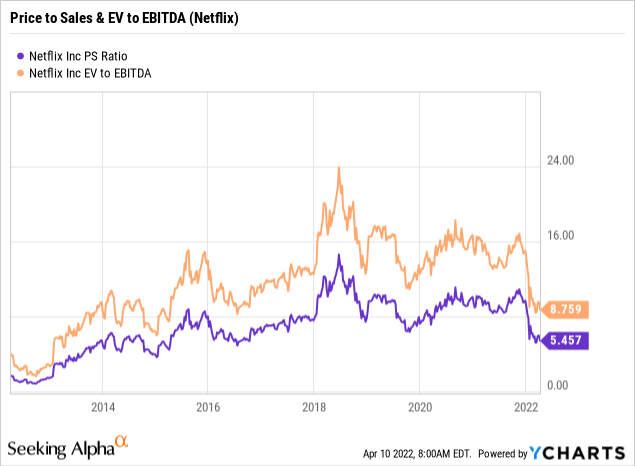

Netflix generated $29.7 billion in revenue as of FY2021, up a substantial 18% year over year. While gross profit has increased a substantial 26% from $9.7 billion in 2020 to $12.3 billion in 2021.

Netflix Revenue (created by author)

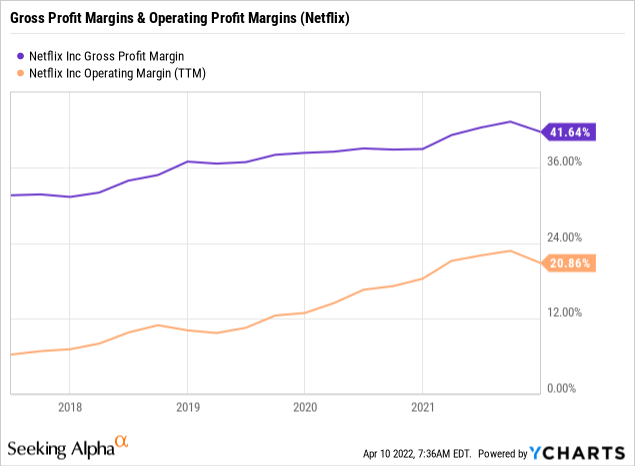

Price increases for the firm’s service has helped to increase Gross Profit margins from a healthy 38% in 2020 to 40% in 2021. While operating profit margins have been on an upward trend increasing from ~12% to 20.86%.

Netflix Margins (created by author)

Content is the biggest expense for Netflix but the good news is the firm has held content spend per subscriber constant, with overall content spend growing by 23% per annum. As of FY2021, Netflix has $6 billion in cash & cash equivalents with current debt of just $699 million. I noticed their long-term debt of $14.6 billion which could be an issue if interest rates rise.

Attractive Valuation

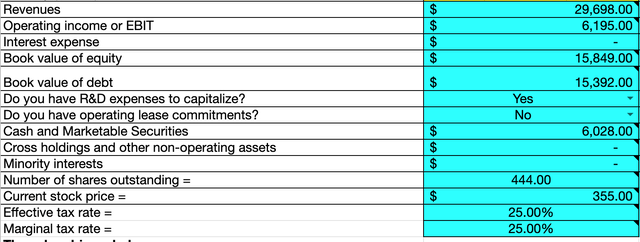

In order to value Netflix, I have plugged the latest financial information into my discounted cash flow model. In addition, I have capitalized R&D expenses to increase the accuracy of the valuation.

Netflix Valuation Model 1 (created by author Ben at Motivation 2 Invest)

I have estimated a 17% revenue growth for the Netflix 5 years, in line with analyst estimates and conservatively estimated the firm’s operating margin to hold steady at 24%, although a slight increase may occur if the firm increases their prices again.

Netflix valuation model (created by author Ben at Motivation 2 Invest)

Given these factors I get a fair value of $384/share at the time of writing this the stock trades at $355 and is thus ~8% undervalued.

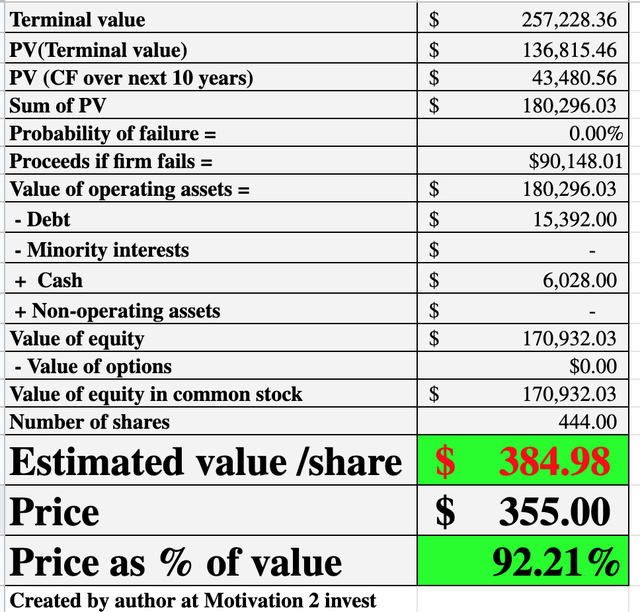

In terms of relative valuation, the stock is trading at the lowest Price to sales multiple (5.4) and lowest EV to EBITDA multiple (8.7) since 2016.

Netflix relative valuation (created by author at Motivation 2 Invest)

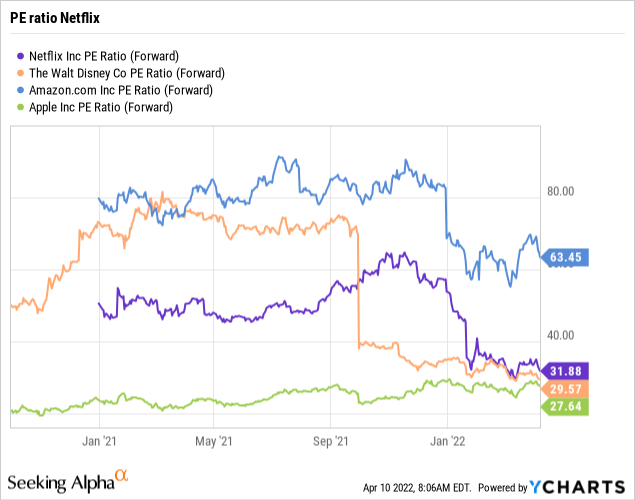

Just for extra information I have included a PE ratio (forward) against a variety of firms involved with streaming. Now although this is not a fair industry comparison as Netflix, is a pure play streaming provider while for the other larger companies it is a complementary service, it is still useful to see the levels. Netflix trades at a forward PE of 30, which isn’t exactly cheap, but is roughly in line with the larger tech giants that have less growth potential on a percentage basis due to their large size.

Netflix Multiples (created by author at Motivation 2 Invest)

Insider Buying

From my investigation I noticed the founder & CEO of Netflix Reed Hastings bought $20 million worth of shares on Jan 22nd 2022. Hastings paid an average price of $393/share and owns approximately 1% of the firm. This is great to see and does show a positive signal to Wall Street.

Risks

Streaming Wars

As discussed at the start of this article, Netflix is facing tremendous competition from a variety of players and many have large capital bases to back them up such as Apple and Amazon. This is a risk moving forward and they could continue to see market share declines and declining subscriber growth.

Content Treadmill

Netflix and all streaming providers are on what I call a “content treadmill”, their subscriber growth depends vastly on original content, which resonates with the audience. This means continual investment is needed to sustain this long term.

Subscription Fatigue

Subscription Fatigue is the phenomenon of multiple subscriptions, overwhelming the customer. According to Deloitte, in 2022, at least 150 million paid subscriptions to streaming video-on-demand (SVOD) services will be canceled globally, this is a staggering churn rate of up to 30% per market. However, they do caveat this bold prediction with “overall, more subscriptions will be added than canceled” and “the average number of subscriptions per person will rise”. The prediction is mainly a sign of a competitive market and people succumbing to “subscription fatigue”

Russian Subscribers

Netflix has direct exposure to Russia and could lose between 1 and 2 million subscribers in 2022 as the firm has suspended services in the region. Although this is less than 1% of the firm’s subscriber base it still doesn’t help the overall growth story.

Final Thoughts

Netflix is a fantastic company and despite the increasing competition they are still the market leader in streaming and their service acts as an “anchor” for the rest of the market. Netflix’s competitors are pouring huge sums into the “streaming wars” but they are not profitable on a standalone basis. Thus, if they don’t start generating a significant return they may redirect their funds to other bets in the future, which is an optimistic outlook for Netflix. The company is currently undervalued intrinsically and earnings per share is expected to grow by up to 20% per year. I do expect volatility moving forward and Netflix has to prove they can still grow subscribers, but long term this stock is worth tuning in for.

Be the first to comment