Wachiwit

Investment Thesis

Netflix (NASDAQ:NFLX) had a relatively decent 3Q22 quarter as its overall results came on top of the management’s internal forecast, and market’s expectations. However, I do continue to have my doubts over Netflix’s long term trajectory, given the increasing competition and how well it could execute its ad-supported model to reaccelerate its growth, and fund its operation the long run, and lastly, the impact of churn as a result of the monetization of password sharing. As of now, I’ll continue to remain on the sidelines given the uncertainty of the business.

Overview of Netflix’s Earnings and Past Events

Netflix 10-Q

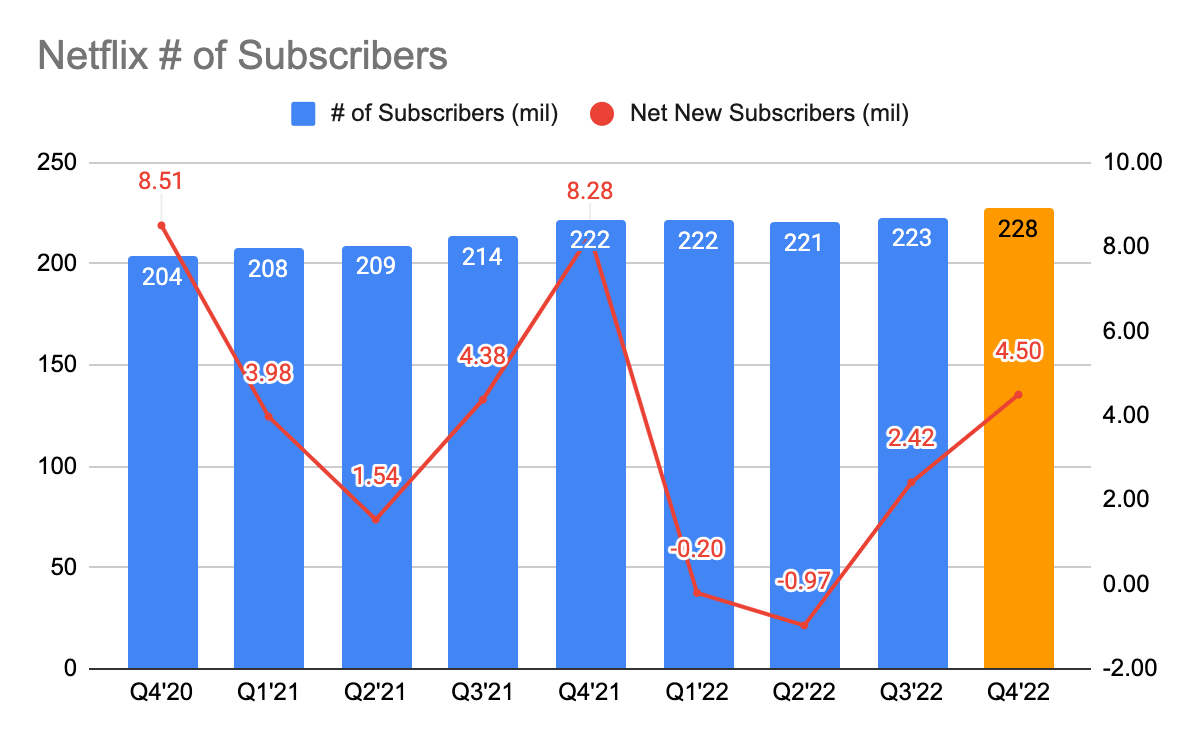

Netflix had a decent 3Q22 quarter as it managed to exceed its previous guidance by adding 2.42 million new subscribers, well above its previous guidance of 1 million. This was primarily driven by its relatively less-penetrated APAC market which added about 1.4 million users. Its operating margin also came in at 19.3%, well in line with its expectations. Excluding the impact of foreign currency exchange, its revenue would have grown 13% Y/Y. This is a decent quarter given that in 1Q22, it experienced its first subscriber loss and its first-ever single-digit growth rate. While that is the case, I do have some concerns over Netflix’s long-term trajectory.

The nature of Netflix’s business is based upon its ability to reinvest in new content to entice new users and retain existing users on its platform. However, as competition heats up and the need to keep up with the rising cost of content, Netflix finds itself struggling to balance between raising prices and keeping its existing plans affordable for its users. Hence, in 1Q22, it embarked on a few key initiatives to reaccelerate its growth rates – (1) the introduction of a lower-price ad-based plan to monetize on ads, (2) crackdown and monetize users who are using password sharing, and (3) focus on reinvesting in new contents to entice and retain users.

My Concerns Over Netflix

Rising Competition

Among its competitors, I believe Netflix has an edge as the largest streaming platform. This is primarily because Netflix is able to tap into customers’ insights to derive the types of content that are more likely to be well-received by viewers. While that is the case, I do think its competitive dynamic has changed drastically due to the rise of multiple new streaming platforms.

This could mean that (1) marketing efficiency may erode as streaming platforms are competing for market share, and (2) there may be more pressure put on the need to reinvest heavily into new content, coupled with the rising cost of content, as mentioned earlier. This raises doubt over whether Netflix can maintain its long-term operating margin of 19%. Furthermore, peers such as Disney (DIS) and Amazon (AMZN) have valuable franchises and strong internal financing to fund their operating losses.

Cannibalizing Existing Subscribers and Execution Risks of Ad-Supported Model

Coming up with a new ad-based plan comes with risks though as price-conscious customers may switch over from existing plans to a lower-priced ad-based plan to save money, causing Netflix to cannibalize its existing subscriber base. During the 3Q22 earnings call, here’s what the management has to say:

“…consumer-facing price will bring in a lot more members then we’re quite confident in the long term that this will lead to a significant incremental revenue and profit stream…we don’t see a lot of member switching plans…But then again the economics and the revenue will be fine as a result even if some of those consumers switch plans.”

As these ad-based plans are yet to be launched, it remains to be seen the extent of how many of its existing subscriber bases may switch over to lower-priced plans. Here’s a survey that was done which indicates that lower-tier subscribers are inclined to switch over to a lower-priced ad plan. According to management, these losses are likely to be offset by new subscribers driven by the new ad plan and high-margin revenue from advertisements. Recently, it was also reported that all of Netflix’s ad inventories were sold out, indicating the robust demand from advertisers to tap into Netflix subscribers.

That being said, it still remains to be seen how well could Netflix run its ad-supported model, and this itself is a huge execution risk. Keep in mind that as there is a limit to its price hike and the ferocious competition, Netflix’s future success is dependent on its execution of its ad-supported model to fund its operation in the long run.

Monetizing Password Sharing is Frustrating Users

As Netflix set to monetize users who are using password sharing, as a step to reaccelerate its growth rates, users have been expressing their frustration online to cancel their subscriptions. Until this is implemented, this raises my other concern on what the churn rate will be like, and therefore, the impact on its bottom line. I do think this is likely to affect the price-conscious and lower-tier subscribers.

Conclusion

This is a relatively short article on Netflix, but I believe to comprise some of the main concerns I have with its long-term growth. However, I do acknowledge that this quarter was a relatively decent quarter for Netflix. In the meantime, I’ll continue to stay on the sidelines.

Be the first to comment