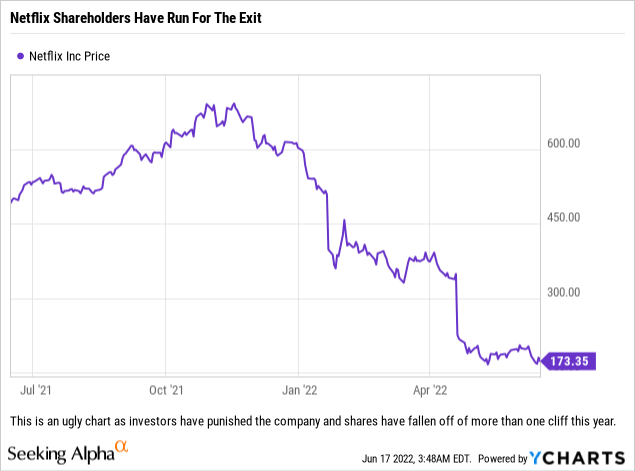

Netflix’s stock has been crushed this year as management was caught off guard after the pandemic and only now seems to be adjusting the business to better compete with other streamers. bennymarty/iStock Editorial via Getty Images

Investors have taken Netflix (NASDAQ:NFLX) shares out to the woodshed, and rightfully so. Netflix’s management team appears to have made some tactical errors due to their belief that their business was great because of the user growth during the pandemic. Management now realizes their mistakes and on their last conference call discussed implementing some plans that they had previously vehemently opposed. We think that some of those proposals have merit, but are disappointed with the timeline provided on the call.

Ending account and password sharing should be an easy fix for Netflix to implement. Ads should be relatively easy as well, but when discussing implementation timelines, management spoke in terms of years, not months. It seems like they are going to take their time to implement some of these plans, but we do think management’s new attitude and openness to address the company’s revenue growth issues moving forward is rather refreshing and a welcome change from years past.

Below we have highlighted five moves we believe management could (and definitely should) implement that could lead to the stock doubling. We state how difficult we think it would be to implement the idea and provide a conservative estimate of the potential impact on revenue.

End Account/Password Sharing

Difficulty To Implement: Easy

Potential Revenue Impact: $2 billion to $4 billion+ annually

Cutting down on piracy, specifically account and password sharing, should be the easiest item to implement as nearly all of Netflix’s competitors already enforce policies to cut down on people using accounts in different households. Disney’s (DIS) Hulu service has for years used your location to verify that you were using their service in your home and not sharing it with someone elsewhere (you have 5 sign-ins from outside your house on a fixed device each year for the Hulu Live service). Warner Bros. Discovery’s (WBD) HBO cracked down on account sharing when it was owned by AT&T (T), forcing quite a few people we knew to sign up for accounts to continue to watch their favorite shows once they no longer had access to accounts belonging to family members.

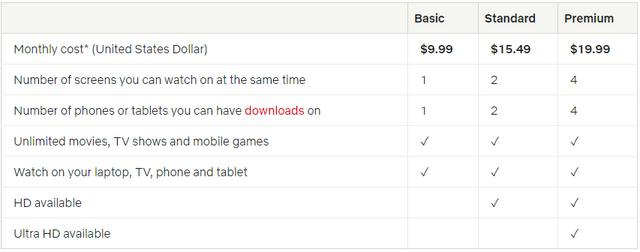

During the company’s Q1 2022 conference call, Netflix executives finally admitted that this issue was having an impact on revenue and subscriber/member growth – estimated to be to the tune of 100 million people globally piggybacking off of a paying customer. In the UCAN region (US and Canada), Netflix estimates that 30 million people are accessing their content without paying. If Netflix ended the ability to share passwords and converted those 30 million to the basic plan, that would create just under $300 million in revenue per month! That is almost $900 million per quarter, or a possible increase of nearly 27% for the company’s UCAN regional revenues. Assume that you only are able to convert 30% of those people and the numbers are still compelling. Keep in mind, these numbers only look at the United States and Canada. The rest of the world has the same issue, and this revenue would basically flow right down to the income statement to profits (meaning it would help the company’s margins and profitability). This is low-hanging fruit. Why the company has previously refused to harvest it is befuddling.

Netflix’s current pricing on the three tiers of service they offer. (Netflix)

Management did announce that they were looking at this item but the plan did not seem complete and it certainly sounded as if they planned to offer access for a small fee. Why management would not just force people onto the basic plan is a headscratcher, especially when it sounds like they will be adding a much cheaper option to convert this group.

Show Ads On A Lower Priced Tier

Difficulty To Implement: Normal

Potential Revenue Impact: between $500 million and $1 billion+ annually

We find this topic to be frustrating because many of Netflix’s competitors already have ad-supported tiers and do quite well with those offerings.

On the company’s conference call, co-CEO Reed Hastings basically signed off on adding an ad-supported tier to Netflix’s offering as it expands the choices for consumers and he feels that is a good thing. While quite a few analysts got excited about this comment, we think all of the energy being spent discussing ads on the service is being wasted because Mr. Hastings went on to say, “that’s something we’re looking at now. We’re trying to figure out over the next year or two.” While it is good news that the company is now interested in including ads on their service, it is a bit frustrating that this is another item which they have recently pivoted on and appear to have done little work to implement the change.

This is more low-hanging fruit for the company, and if one suspects that 10% of current subscribers would switch to an ad supported plan, and those plans can generate early on during implementation just $2.00 extra in ARM (average revenue per member) then those 20 million subs alone could get you to just under $500 million in ad revenues. Due to Netflix’s subscriber base, we suspect that the additional ARM created by including ads would be higher because of Netflix’s large markets in North America and Europe. If Netflix looked to sell a lot of ad content for the ad supported plan, then the revenue generated per household could be significantly higher, with some analysts saying the total potential/addressable market would be worth up to $2 billion in the next few years but with the consensus mostly around $1.2 billion to $1.8 billion. It all boils down to how many ads you are going to force those customers to watch, and until management announces their intentions, we have to be conservative in guesstimating what the revenue generation could be since we have no details or a benchmark reference.

We would point out that in recent days there have been stories coming out regarding Netflix meeting with companies such as Comcast (CMCSA) and Roku (ROKU) about helping roll out ads. Our guess is that this is where the rumors about Netflix buying Roku originated from, so that is good news in that Netflix might not be in the market for a dilutive transaction.

Put Movies Into Theaters

Difficulty To Implement: Easy

Potential Revenue Impact: at least $1-2 billion annually

As Netflix ventures into more expensive productions and spends like the Hollywood studios to make its latest movies, we believe that the company should look at putting its blockbusters, at a minimum, into movie theaters for longer than a week prior to releasing the movies on the Netflix service. This sounds counterintuitive, but we believe that Netflix could use the ‘Suggested For You’ area on the streaming service, or its home screen, to run targeted ads for movies it will show in theaters. This would have the benefit of potentially driving traffic to the movie theater to bring in roughly 4x the revenue (for a family of four) that a monthly sub earns, while also getting people to connect to your movies in a way that could drive more loyalty to the streaming product as people might want to go back and watch that movie later on.

One big movie can generate $1 billion+ from the global box office, and these added revenues can help create more FCF for the company to pay down debt, buy shares, or invest in better content. Also, one big movie in theaters can create a franchise, which can be expensive to create and a reason why Netflix should use movie theaters to help de-risk their high spend on content.

If Netflix ever considered this item seriously, we believe that $1-2 billion in additional revenues would be easily attainable, and most likely a gross underestimate.

Change Release Schedule To Include More Staggered Releases

Difficulty To Implement: Easy

Potential Revenue Impact: TBD, but would lower customer churn rates

Netflix continues to release the vast majority of their content in “binge bundles” – meaning they release all episodes at once in order to allow people to binge the entire package of content quickly (some seasons can easily be done in a day). We suspect that the company learned from releasing seasons in parts, out of necessity due to COVID-19 shutting down production, and will use that data to analyze how to release its biggest franchises in the future in order to keep consumers happy and able to binge while also seeking to cut down on customer churn rates.

Engagement is important, and if the one or two shows someone watches get dropped in back-to-back months, then there are at least 10 months they can cancel their subscription for while waiting until the next season of those shows are released. This used to happen with HBO back in the day, and we think Netflix will have to behave a little more like its competition if it wants to have a comparable churn rate while also not enabling customers to abuse it in that manner.

Competitors Disney, Warner Bros. Discovery and Comcast have all utilized the strategy of releasing shows weekly in order to keep consumers engaged with content over longer periods of time, build up followings weekly if word of the show permeates pop culture and use the weekly content drops to mask the fact that none of these companies tends to drop as many new content items as Netflix. The whole quality vs. quantity argument (which we will avoid for this article).

Engage In Opportunistic M&A Activity For Content

Difficulty To Implement: Hard

Potential Revenue Impact: TBD

This would be the most difficult item for Netflix’s management team to successfully pull off. While the company has announced a couple of acquisitions around gaming, we think that the company might be better suited focusing on purchasing companies that control content, have assets that are complimentary to the Netflix product and provide some synergies that could generate savings through cost cutting after a merger. After all of the M&A activity that has occurred over the last few years within the industry, many of the premier targets have been gobbled up, however, there are some interesting names still out there.

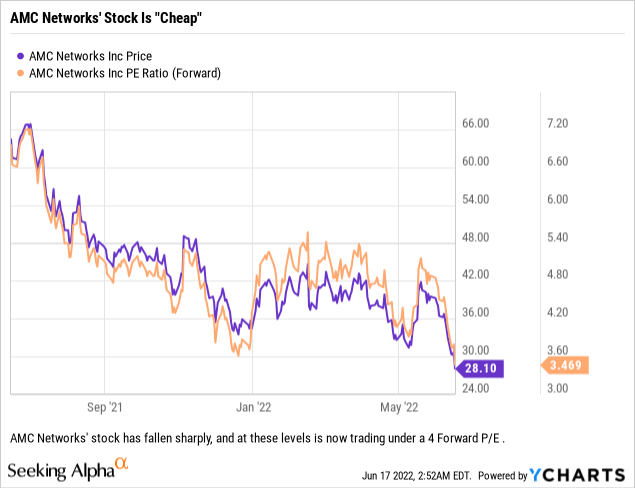

Lionsgate Entertainment (LGF.A) (LGF.B) and AMC Networks (AMCX) would be two interesting names that Netflix could look at. Lionsgate has a library approaching 17,000 titles, and if Netflix were to seriously put their movies in theaters (as we mentioned earlier), then Lionsgate might be a good purchase for its titles which could crank out additional prequels and sequels. In fact, one of Netflix’s big movie releases this year, Knives Out 2 (with a third movie in the series to come out next year), was a title that Netflix stole from Lionsgate. The library and studio are pluses for Netflix, but the company would have to address what to do with Starz and whether it made sense to keep that streaming app separate, roll it into Netflix’s current service, or create a new premium service within the Netflix app.

AMC is dirt cheap but is in the linear TV business, a declining business for sure, but one that generates cash and profits for now. Netflix already has deals for many of the shows that AMC has, but we think this is the type of M&A that could make a lot of sense. First you would have to get the Dolan family to agree to a takeover, but if you could buy the company for less than $3 billion (accounting for a healthy premium and the fact that you would have to purchase the publicly traded A shares as well as the B shares that do not trade) there might be a decent return on your money considering some of their more valuable content properties’ streaming rights are coming up for renewal soon enough and the company is adding new content around ‘The Walking Dead’ to potentially monetize that package in a few years. Throw in the IFC and Sundance Channels and there is some decent content here, but again you have to deal with running a linear TV company unless you can team up with a private equity firm to take over that portion of the business.

Buying companies which control content that your competitors currently have, so that you can own it moving forward would be prudent. Amazon (AMZN) purchased MGM’s studio business from investors for a reason, mostly for the library of content, but also for access to the IP for future content. Netflix has the same opportunity here, and both deals could potentially be accretive to earnings moving forward, depending of course on deal structure, financing and the amount of cash and/or stock used in any transaction.

Summary

If Netflix can implement a few of these ideas over the next few years, and they have committed to addressing two of them, then we think that the stock could be poised to double. The conservative revenue figures we provided could increase revenues by 10-20%, but the big story is how that revenue would flow down the income statement. It is our belief that this low-hanging fruit would benefit Netflix’s margins as a large proportion of the revenues could potentially hit the profit line as none of these ideas dramatically increase the company’s expenses to implement them.

Netflix needs to stop trying to be so different from its competitors in order to better compete against its ‘Old Hollywood’ rival studios, as well as the Big Tech names, and their streaming services. Looking down at multi-billion dollar revenue streams, which all of your competitors partake in by the way, is silly and not at all in the best interest of the company’s shareholders. Now that the company is at least looking to implement 2 out of the 5 items, has us interested in Netflix, however, we are not buyers until we have more clarity on when these items will be implemented. When we have clarity on the timeline, or timelines, then we might very well be buyers. Until then, we wait for Q2 results and the conference call in mid-July.

Be the first to comment