cyano66

Netflix (NASDAQ:NFLX) is a global streaming entertainment service that offers licensed and original movies, TV series, and games. The bumpiness of recent revenue and customer growth causes some concerns along with macro headwinds. While the company has already been in the streaming business for 15 years with a market cap of $110B, I think there is still a huge runway ahead. I would like to share some of my thoughts about this business in this article.

Price hikes should work well for NFLX

During the recent earnings call, the management talked about the temporary impact of price increases on subscribers. It is expected that a wave of churn will happen right after the price increase. However, people usually rejoin NFLX after new titles are released, and the churn rate will start normalizing. As the call stated:

that’s certainly what we are seeing in the United States, for example, where we’re seeing those like the churn, for example, that you mentioned, returned to pre-price change levels.

As NFLX does more and more price increases and A/B testing, they are definitely smarter on this subject. I think NFLX’s average revenue per member will continue to grow at a faster rate than overall inflation, which protects company profitability. Since 2018, NFLX’s standard plan has grown a lot from $10 to $15. More hikes will come as people continue to do cord-cutting.

NFLX subscribers will show up during the current macro turmoil

NFLX has benefited from the pandemic crisis. It also performed well under economic downturns and high inflation last quarter as revenue grew 9% to $7.9B, and subscriber net losses were only -1M vs. -2M forecasted. Historically, pay TV businesses tend to be more resilient across economic cycles. In-home entertainment’s value proposition is increasing as people don’t go out as much. Subscription businesses like NFLX should be even stickier.

Subscriber growth is not done yet, there are still lots of untapped markets

One concern about NFLX is its slowing subscriber growth. While the US market is already saturated, there are still large unexplored spaces for global expansion. If you believe we will head to an inevitable end of the linear TV era over the next five or ten years, the growth story of NFLX will continue. Even in the US, we still have around 72M pay TV households. Globally, there are 1000M households. This is a huge market opportunity as most of those people will transfer their spending to NFLX somehow in the future.

NFLX is already a global business, with 60% of sales from overseas. Japan + Korea + Taiwan + Australia have 240M+ well-educated and high-income populations. NFLX is just starting its localization efforts in these markets. Not to mention India, NFLX is already gaining momentum with many titles produced from there.

So for NFLX, it is still all about growth, growth, growth. They will continue to invest in content and build a strong brand worldwide.

Don’t underestimate the new Advertising business

Advertisers love eyeballs, and NFLX has those. This past year, NFLX has been viewed for 1.334 billion minutes, which is more than CBS and NBC combined. In the US alone, 7.7% of TV screen time share is for Netflix. This is an enormous asset for advertising. I think there are currently three forms of videos to attract people’s attention: TikTok for short-form videos, YouTube for mid-length videos (5-15mins), and NFLX for long videos (30 mins+). YouTube alone is making 7.5B in ad revenue this quarter. Hulu’s ad revenue will reach 2.7B by 2021.

Currently, NFLX is very careful with ads as they don’t want to compromise anything on customer experiences. But I believe NFLX + Microsoft could come up with an innovative solution than any other platform to embed ads in their shows. Analysts have projected NFLX to make 1.2B in ad revenue by 2025 (I personally think it could be more).

The numbers

Since NFLX’s cash flow accounting on content is front-end loaded, it fluctuates a lot based on the availability of talent, scripts, licenses, etc. I would use earnings power as my valuation estimates.

NFLX revenue is generally very predictable, with around $32B this year. Consider the 19% operational margin that the company targets. Then adding tax and interest expenses around 4% of revenue, we can estimate 15% of net profit margin, which gets around $4.8B earnings. This aligns with Analysts’ 2022 annual target estimates. Given that NFLX is a well-known company, I think it should be a fair estimate.

Then the company spends around $2.5B on RD, which I think should be used on growing the business instead of maintaining business. Adding half of these RD costs back to earnings, the true earnings power should be around $4.8B + $1.25B = $6.05B.

Based on the 12% growth project NFLX released this quarter, I project the next ten years with three scenarios:

1. Good scenario: a growth rate of 17% for the first five years, a growth rate of 12% for the next five years, and 7% as the discount rate. We can expect $16.8B earnings power at year 10. This could equal a market cap of $251B with a 15x multiple, which is 2.5x of the current market cap.

2. Neutral scenario: a growth rate of 14% for the first five years, a growth rate of 9% for the next five years, and 7% as the discount rate. We can expect $9.1B earnings power in year 10. This could equal a market cap of $136.6B with a 15x multiple, which is 1.36x of the current market cap.

3. Bad scenario: a growth rate of 10% for the first five years, a growth rate of 6% for the next five years, and 7% as the discount rate. We can expect $6.6B earnings power at year 10. This could equal a market cap of $99B with a 15x multiple, which is similar to the current market cap.

Bottom line

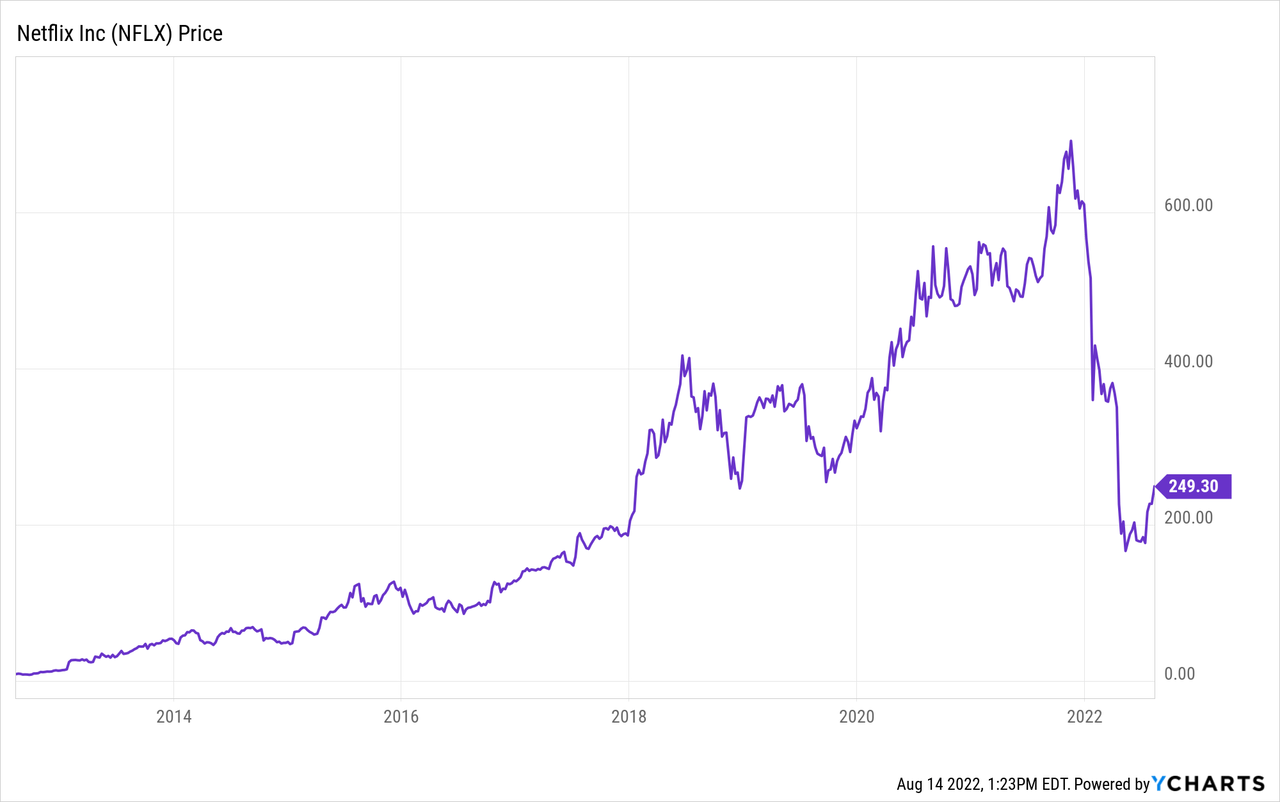

NFLX is a high-quality stock with lots of hidden strengths of its business. As its content portfolio continues to expand, its value proposition to customers will get stronger and stronger. 10 years from now, I think NFLX could replace Disney (DIS) as the most valuable entertainment brand in the world. And its market cap will certainly represent that. The current stock price should rise and align with its earnings growth in the long term from here.

Be the first to comment