fotoslavt/iStock via Getty Images

On April 19, 2022, Netflix’ (NASDAQ:NFLX) management shocked investors with a significant miss on the number of new subscribers added. Previously, the company guided to approximately 224.3 million global paid streaming memberships, whereas it only reported 221.6 million at the end of Q1 2022. The deviation is in part attributable to the suspension of the company’s service in Russia and winding-down of all Russian paid memberships (approximately 700,000). However, as Netflix CFO Spencer Neumann acknowledged, the company fell short of the 2 million subscribers it had previously announced, excluding the impact of the Russia-Ukraine conflict. I see this as a major sign of the slowdown in the company’s business and increasing competition. I would go so far as to suggest that we are beginning to see evidence of the content streaming business becoming a commoditized industry.

Netflix – Priced for (Slowing) Growth?

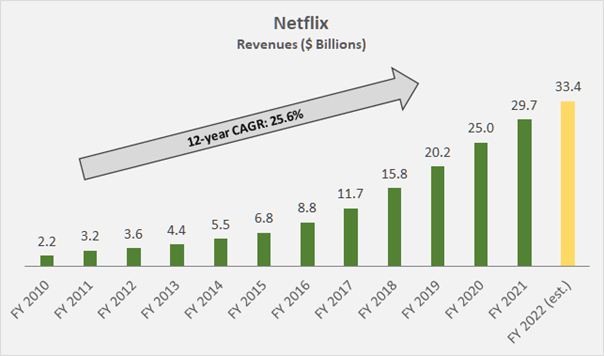

Netflix has rightly performed like a growth stock over the last decade, with its top-line compound annual growth rate (CAGR) of 25.6% (Figure 1). However, growth has slowed in recent years as the company and its service grew more mature and competition intensified. For example, growth in fiscal 2021 was only 19%, compared to 35% three years earlier. For 2022, analysts expect Netflix to grow its top-line by 12%.

Figure 1: Development of Netflix’ revenues over the last decade (own work, based on the company’s 2010 to 2021 10-Ks)

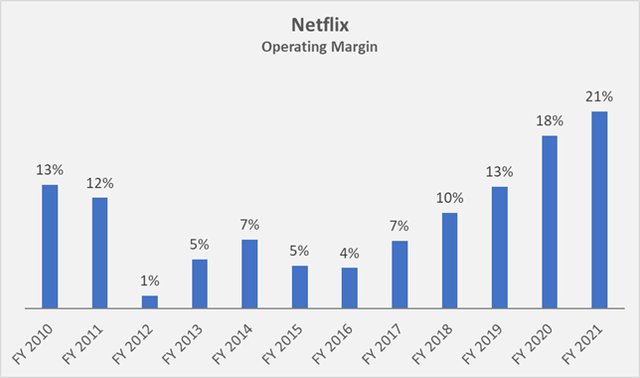

As Netflix grows larger and more mature, it doesn’t need as much marketing spend as it used to. While the company spent 14% of its revenues on marketing in 2010, this expenditure fell to just 9% in fiscal 2020 and 2021. As NFLX’s “input costs” remained relatively stable, as shown by the gross margin of 34% ± 5%, the operating margin increased significantly, as shown in Figure 2.

Figure 2: Development of Netflix’ operating margin over the last decade (own work, based on the company’s 2010 to 2021 10-Ks)

Another, less positive sign that Netflix is becoming a mature company is the onset of saturation in its largest markets, and this already became evident in the Q4 2021 earnings call. The company must come up with a solid plan to expand its subscription base beyond markets such as the U.S. or Western Europe. Netflix is eyeing India and other global markets, looking at 500 million subscribers. However, these markets are considered less profitable (cable subscriptions in India are around $3 per month), underscored by the company’s significant price cuts across all plans in December 2021.

Account sharing has been and continues to be a major problem for Netflix. During the Q1 2022 earnings call, CEO Reed Hastings mentioned around 100 million households using Netflix without paying for it. Compared to the 222 million paid streaming memberships, this is certainly a lot, and one could argue that Netflix should continue to allow users to share accounts, much like Microsoft (MSFT) did on its way to success with its Windows operating system when it more or less tolerated pirated use. However, there is a distinct difference between an operating system and a streaming service, in that the former is used by private and commercial users likewise. Netflix’s service is discretionary, and I see no reason why continuing account sharing practices would benefit the company going forward. In fact, I would go so far as to suspect that the company is refraining from cracking down on account sharing because management fears a catastrophic impact on paid memberships. During the Q1 2022 earnings call, management once again did not come up with tangible evidence of a plan of monetizing account sharing:

[…] we’re working on how to monetize sharing. We’ve been thinking about that for a couple of years. But when we were growing fast, it wasn’t the high priority to work on. And now, we’re working super hard on it.

Reed Hastings, CEO of Netflix

It looks like management’s solution to this problem is to raise subscription prices further, as the company will likely ask “[…] members to pay a bit more to share the service with folks outside their home”. Only recently, Netflix raised prices of their subscription plans in the United States and Canada by approximately 11%. A continuation of aggressive price increases against the backdrop of the current inflationary environment and increasing consumer perception that services are too expensive suggests that the streaming industry is becoming increasingly commoditized and Netflix’s content-based moat is eroding.

On a positive note, the survey cited above shows that Netflix is the first choice of streaming service if the more cost-conscious consumers would choose a single service (i.e., 41% of respondents). However, 90% of the respondents found HBO Max as the most satisfactory service. My impression is that Netflix’s ability to continue to capture a growing share of the streaming market is slowly fading and this is also underscored by the following statements during the Q1 2022 call and the lack of concrete plans to outsmart the competition.

[…] it’s really — we got great competition. And what we’ve got to do is take it up a notch.

Reed Hastings, CEO of Netflix

Even with this heightened levels of competition, our engagement — our viewing has been very, very steady, holding on to our market share in the space.

Theodore Sarandos, Co-CEO of Netflix

Netflix Will Likely Adopt Legacy TV Practices

During the conference call, the CFO pointed to the company’s plans to increase revenues by adding ads to lower-cost memberships. This may prove necessary, as a continuation of outright price increases is only possible in line with competitors. However, the fact that NFLX is starting to adopt old TV practices may also backfire, especially when comparing the streaming service to the YouTube’s premium service, which is run by a much more financially flexible company, Alphabet (GOOG, GOOGL).

During the call, it was also hinted that the company intends to stagger the release of new episodes, i.e. weekly or bi-weekly, to increase user engagement at a given time and potentially drive ad-related revenues. I see this very critically, as the only reason to subscribe in the first place is to use the service regardless of the time.

Conclusion – Is NFLX Rightly Still Valued As A Growth Stock?

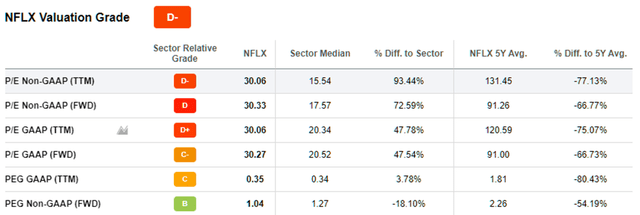

NFLX’ price-earnings and PEG ratios have fallen significantly below their five-year average valuations (Figure 3), but I believe that a comparison is flawed for several reasons. For one, we are still in the midst of a roaring bull market. Then investors became increasingly exuberant about technology-related stocks, and the COVID-19 pandemic only added fuel to the fire. Certainly, NFLX benefitted handsomely from the measures imposed by governments around the world to contain the spread of SARS-CoV-2. However, I contend that we are in a time of change and that this trend will reverse as the world moves past the pandemic. Finally, competition will intensify further, and the multiples paid today for streaming providers will gradually approach a level more in line with that of conventional industries.

Figure 3: Selected valuation metrics for NFLX (obtained from Seeking Alpha’s stock page)

Taken together, I fail to acknowledge why Netflix should trade at the lofty multiples it still trades at. My regular readers know that I only buy where I see tangible value, and Netflix does not fall into that category, even after the recent sell-off. The increasingly obvious commoditization of the streaming business and management’s continued cluelessness about monetizing shared accounts without breaking the company’s growth record leave me uninspired and I will gladly put my capital to work elsewhere.

Thank you very much for taking the time to read my article. In case of any questions or comments, I’m very happy to read from you in the comments section below.

Be the first to comment