Vivien Killilea/Getty Images Entertainment

Investment Thesis

As of 20 April 2022, Netflix, Inc (NASDAQ:NFLX) has lost 62% of its value since 2022 started. In its previous FQ4’21 earnings call, NFLX lost 21% of its value from $508.25 on 20 Jan to $397.50 on 21 Jan, when it reported lower-than-expected subscriber growth with even lower guidance for FQ1’22. Three months later, it is déjà vu time, when the stock bled by a further 35%, from $348.61 on 19 April to $226.19 on 20 April 2022. With a trading volume of over 26 folds the usual on 20 April, it is evident that many institutional and retail investors lost faith and ran away with whatever capital they had left.

We will discuss what the future holds for NFLX now.

What Happened To Netflix’s Subscriptions?

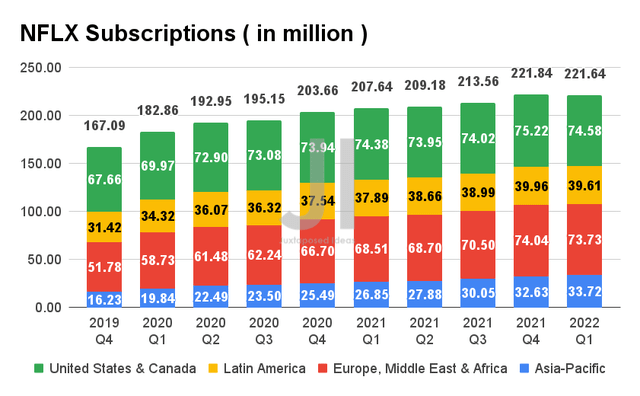

NFLX Subscriptions

The only reason why NFLX fell so hard and so fast was that the company missed its own guidance again for the subscription growth in FQ1’22. The company had previously guided an increase of 2.5M subscribers for the quarter, while the reality hits hard with a 200K decline instead. Demand for the streaming service fell most in the UCAN region at -640K, with LATAM and EMEA reporting declines of -350K and -310K, respectively. Despite reporting a remarkable growth of 1.09M in subscribers in the APAC region, it was obviously not enough to cover the shortfall from other regions. Though the suspension of its service in Russia accounts for a decline of -700K subscribers, a net increase of 500K is still way lesser than its guidance.

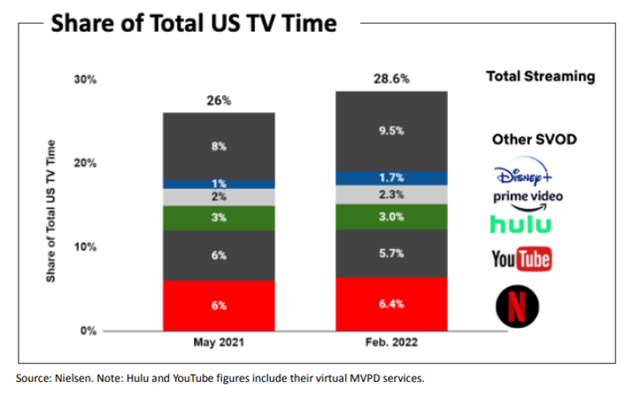

Intense Competition For Streaming Service

NFLX had attributed the slowing growth to multiple factors, notably intense competition from other streaming services, macro factors including inflation and rising interest rates, freeloaders at over 100M households, accounting for almost half of its existing subscriptions of 221.64M on FQ1’22. In the UCAN region alone, the company reported over 30M non-monetized users, representing 40% of its current subscriptions there. Based on an average of $11.83 revenue per membership, NFLX had lost at least $3.54B of revenue in FQ1’22, accounting for over $14B of annual revenues. It is no wonder that the company had decided to double down on monetizing the freeloaders moving forward.

As a result, it would make sense for NFLX to adopt an ad-supported plan, which would help to re-attract the churn, partly attributed to its price hikes. The new plan would help to reduce the friction for those concerned with inflation and rising interest rates. Furthermore, an ad-supported plan would help boost its penetration in lower-income countries with lower spending power, such as its current trial in Chile, Costa Rica, and Peru. NFLX’s competitors, such as Disney (DIS) and HBO Max (WBD), had already iterated their goal to release ad-supported tiers. However, given that the plan would only be fully rolled out in the next few years, its incremental contribution to both revenue and subscription growth would be slow.

Though NFLX had also penetrated the gaming market, its contribution would still be minimal, given that most of its subscribers are here for the streaming service. As a result, its stock recovery would take quite a while, though we may expect some uptick from its loaded content slate in H2’22.

Netflix Is Still Somewhat Profitable, For Now

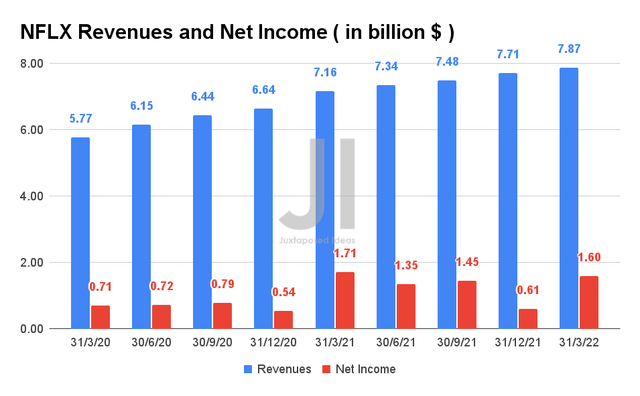

NFLX Revenue and Net Income

In the past five years, NFLX grew its revenues at a CAGR of 28.05%. In the last twelve months (LTM), the company reported revenues of $30.4B and net incomes of $5B, representing excellent YoY increases of 21.6% and 81.2%, respectively. For FQ1’22, NFLX reported revenues of $7.87B, representing an increase of 2% QoQ and 9.9% YoY. The growth was mainly attributed to the recent price plan increases. Nonetheless, its net income is comparatively lower at $1.6B in FQ1’22 than $1.71B in FQ1’21, given its increased operating and R&D expenses for the quarter.

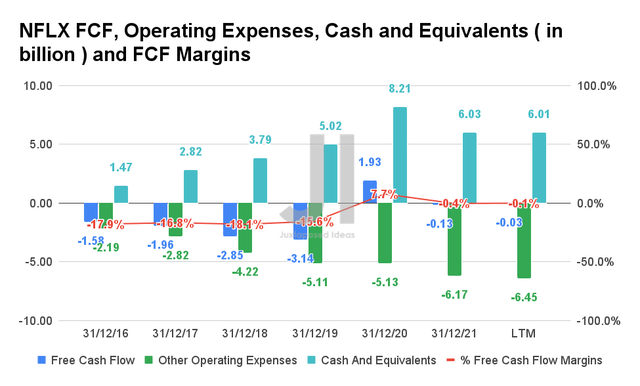

NFLX FCF, Operating Expenses, Cash and Equivalents, and FCF Margins

However, if we were to study further, we would realize that NFLX’s financials are not quite healthy yet. In the past five years, the company has yet to report sustained positive Free Cash Flow (FCF) and margins yet. NFLX reported an FCF of -$0.03B and FCF margins of -0.1% in the LTM, while spending over $6.45B in operating expenses. It comprised $2.4B of R&D, $2.58B of Selling and Marketing expenses, and $1.45B of General and Admin expenses. The company has also been increasing its operating expenses over the years, at a CAGR of 24.11% since FY2016. In addition, NFLX does not seem to be slowing down its operating expenses, given that it needs to constantly produce new content to attract new subscribers. Nonetheless, the company still has a substantial cash and equivalents of $6.01B as of FQ1’22. NFLX co-CEO and content chief Ted Sarandos says:

While we were not happy with the top-line subscriber growth, we definitely saw that the new season of Ozark, Inventing Anna, The Adam Project and certainly, the biggest of them all, the new season of Bridgerton, delivered exactly as expected – actually a little bit bigger than expected with fans. Now of course, we think we’ve got to do that, and we have to have an Adam Project and a Bridgerton every month and to make sure that that’s the expectation of the service constantly. (Seeking Alpha)

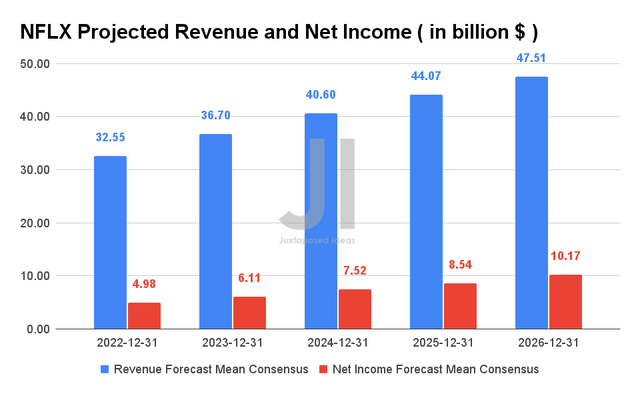

NFLX Projected Revenue and Net Income

For the next five years, NFLX is expected to report revenue growth at a CAGR of 9.86%. Though it represents an evident deceleration in revenue growth, the company is expected to double its net income profitability within the next five years, from $5.11B in FY2021 to $10.17B in FY2026. For FY2022, consensus estimates that NFLX will report revenues of $32.55B and a net income of $4.98B, representing YoY growth of 9.6% and a decline of -2.5%, respectively. Nonetheless, the company guided revenues of $8.05B and net incomes of $1.35B for FQ2’22, representing a YoY increase of 9.6% and in line with FQ2’21 net incomes, respectively.

So, Is NFLX Stock A Buy, Sell, or Hold?

NFLX is currently trading at an EV/NTM Revenue of 3.38x, lower than its 3Y mean of 7.5x. It is evident that the stock was previously overvalued as a high-growth stock during the pandemic, due to its massive growth in subscriptions and revenues then. Despite its relative undervaluation, consensus estimates have downgraded the stock to a hold, due to the apparent decline in its subscription growth.

The way we look at it, NFLX has finally been brought down to earth, after sky-high valuations in the past three years. As it stands now, the stock is finally in line with its peers, such as Disney (DIS) at EV/NTM Revenue of 3.18x, though still comparatively elevated compared to Warner Bros. Discovery (WBD) at 1.42x. Given its lack of economic and IP moat compared to Disney’s theme parks, Marvel Studios, Pixar, and Lucas Film franchises, we expect NFLX’s valuation to decline potentially by half.

Since it will take NFLX some time to recapture the freeloaders and advertising market, we also expect the stock to further retrace for the next few quarters. As a result, tech investors looking for bottom prices may have to wait longer. In contrast, we advise existing NFLX investors to cut losses and run first, before potentially adding once the stock hits rock bottom.

Therefore, we rate NFLX stock as a Sell for now.

Be the first to comment