mphillips007/iStock Unreleased via Getty Images

Investment Thesis

Netflix’s (NASDAQ:NFLX) Q1 earnings report was full of surprises. However, these were mostly negative surprises.

It’s not only that subscriber numbers are looking light. But it’s also the fact that revenue growth rates are getting impacted by events in Europe starting in March.

I’ve been making the case that tech investors are going into this earnings season blindfolded, like sheep for the slaughter. Netflix is just the first big tech company to report. But as more news starts to percolate, it will only solidify my bearish case.

Consequently, I make the argument that investors would do well to not buy this dip. In fact, the prudent investment strategy would be to exit their position, given that the facts on the ground have changed.

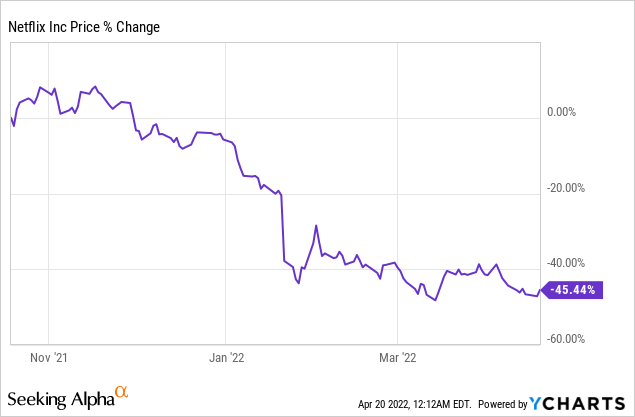

Investor Sentiment Has Turned Negative

Back in January, I wrote a Netflix article titled, This Changes Everything. I said,

[…] [T]he mantra of ”investing for growth” works for as long as the company is reporting revenue growth rates that offer compelling, sustainable, predictable, and close to ”certain” growth prospects.

However, when you are investing for growth and are barely generating any positive free cash flow, and your top-line growth rates are around mid-10s%, that’s a difficult situation to be in and ask investors to pay a premium for your stock.

Along these lines, I’m not convinced that paying 5x this year’s revenues for Netflix, while it’s expected to grow around the mid-teens CAGR is attractive enough.

Along these lines, I’ll continue today.

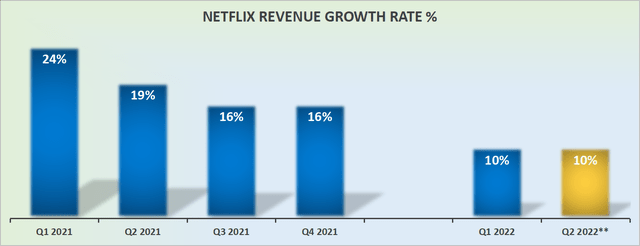

Revenue Growth Rates Start to Fizzle Out

Netflix revenue growth rates

Throughout the whole of 2021, I was bullish on Netflix. But starting in January I became increasingly bearish on tech.

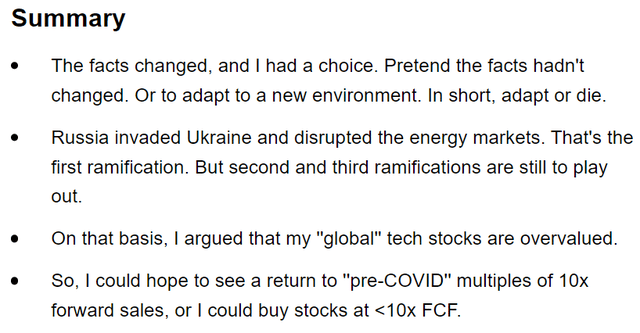

Recently, I wrote a two-part series on why I made a shift from tech to commodities where I explained my rationale:

Why I Went From Tech To Commodities And You Should Too (Part 1)

And for now, tech companies, particularly large-cap names, have acted as if the backdrop of Europe was no concern for large ”US-based” tech companies.

However, this is where I argue the market isn’t thinking through this logically. These companies are not ”US-based”, they are in fact global platforms.

And with Europe slowing down economically and likely to go into a recession, this will have a meaningful effect on large, global tech companies that are priced for never-ending fast growth.

Netflix’s Near-Term Prospects Discussed

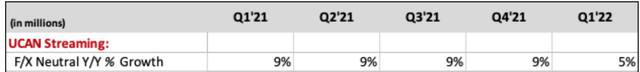

Let’s face reality. Netflix’s oldest market, which accounts for 43% of total revenues has begun to mature.

Netflix Q1 2021 shareholder letter

As you can see above, Q1 2022 saw its UCAN revenues increase by 5% y/y. This is clear evidence that Netflix’s strongest growth days are now in the rearview mirror.

Netflix Q1 2021 shareholder letter

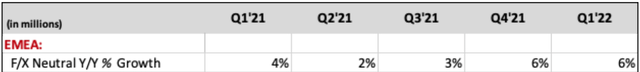

Then, consider this, EMEA makes up 33% of Netflix’s total revenues. Consequently, whether or not Europe goes into a recession will have a meaningful impact on Netflix’s ability to grow its overall revenues.

In fact, before a recession was on the cards, EMEA was already only growing in the mid-single digits. Now with a potential recession, it’s likely that growth rates in EMEA could turn negative over the next quarter or two.

Note that these two regions combined make up 75% of Netflix’s total revenues. Everywhere else is a distraction. Don’t lose focus when investing.

Do Free Cash Flows Matter?

Having followed Netflix for so long, I’ve become accustomed that for Netflix’s shareholders the fact that Netflix is not capable of generating strong free cash flows hasn’t made any difference.

However, now things have changed. Previously, investors were intoxicated by the idea of ”growth at any cost”. Trust me, I know, because I was too!

But in this game, you only have two options on the table. You can either adapt or die. When you understand this, you don’t have to be particularly wise to learn that the obvious answer is to realize your missteps and quickly change course.

What’s more, previously, investors were more than willing to disregard, any notion that Netflix isn’t a strong free cash flow generator because the company was, after all, a ”growth company”.

But what about now? Does eking out 10% CAGR count as a growth company? I’m afraid that it does not.

With that in mind, Netflix has ambitions to be free cash flow positive this year, but it has failed to anchor to investors what its free cash flow could be. On the call Netflix said,

We’ll be positive free cash flow this year, consistent with our expectations going into the year, and we’ll continue to build on that in the years going forward. So that’s our expectation.

Traditionally, Netflix has its strongest free cash flow period in Q1 of each year, with each passing quarter it makes less free cash flow than in Q1.

With that in mind, I’m inclined to believe that Netflix won’t make more than $1 billion of free cash flow this year.

As a reference point, during Q1 2022 it printed $802 million.

On the other hand, Netflix’s GAAP operating margins are still expected to be around 19% to 20% this year. Thus, the spread between Netflix’s GAAP operating margins and free cash flows margins is likely to be around 5,000 basis points in 2022.

So, it naturally begs the question, do free cash flows matter? Can you pay down debt with GAAP operating profits, or do actually need to use free cash flows to pay debt and repurchase shares?

Given that no shares were repurchased in the quarter, I suspect that free cash flows do matter.

NFLX Stock Valuation – Expensive For What’s on Offer

Netflix has never been a cheap company. But as long as subscriber numbers and revenues were going up and up, nobody wanted to get bogged down asking difficult questions.

But when your shares drop more than 20% on the back of earnings results, trust me, people will start to ask difficult questions about their investment.

Here are a few questions that surface:

- Whether paying 17x operating earnings is really something all that appealing when there are question marks looming over your ability to grow at close to 15% CAGR?

- When will Netflix’s free cash flows start to match its GAAP accounting, after all the extension of its library amortization?

- Will Netflix’s ability to monetize against password sharing be an advantage or a hindrance to subscriber growth?

These questions are easy to trigger emotional answers. But emotions have no place in investing.

The Bottom Line

For as long as the share price is going up, nobody is going to be all that troubled to ask tough questions about their Netflix investment. But now that this movie is now about to end, the final credits are coming up.

That’s why I’m sidestepping tech names and investing in commodities. Whatever you decide, good luck and happy investing.

Be the first to comment