Editor’s note: Seeking Alpha is proud to welcome Nick Cartier as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

stockcam

Netflix (NASDAQ:NFLX) execs have vehemently denied the incorporation of ads into the Netflix user experience for years, saying the company had “zero interest” as recent as last year. That narrative is over, as Reed Hastings indicated during the company’s last earnings call that Netflix is open to entering the advertising business in a major way.

Why the pivot? Advertisers are salivating over CTV (connected TV) inventory, and it’s a clear opportunity to increase Netflix’s total addressable market (TAM) to include more price-sensitive households. There’s no doubt that Netflix’s subscriber growth trajectory has made them into a darling on Wall Street for the past decade. However, last quarter is really the first sign of slowing growth that struck fear into some investors (NFLX has been trading down 37% since earnings).

I always believed Netflix had two major tricks up its sleeve to stave off saturation: 1) crack down on password sharing, and 2) subsidizing the base retail price with ads. Both are highly effective tools to expand their TAM overnight. Reed Hastings has swiftly deployed both to combat the negative press stemming from their recent subscriber woes.

I’m not sure both bombs needed to be dropped simultaneously… but the cat is out of the bag now so there’s no turning back. Netflix is poised to become an advertising behemoth.

Why is CTV advertising so hot?

Unlike social media, CTV is largely not user-generated content, so it’s inventory that combines brand safety with advanced digital targeting. However, the one major thing CTV is lacking still is scale, and Netflix can help fill that void in the market. I’m bullish that Netflix will enter this business aggressively, and advertisers will be willing to pay hefty CPMs (costs per thousand, also called costs per mille) for Netflix’s premium audience. That could ultimately increase their total addressable market without sacrificing total ARPU for the base plan.

It’s no secret that the future of advertising is programmatic, which means that computers are buying and selling ads via auction-based systems in real time. I operate a programmatic advertising business today and I can say from experience that the tech stack is quite complex. Netflix will need to lean into licensing programmatic advertising technology to effectively enter this market, and building it themselves is out of the question.

Rumor mill: buy, build, partner?

Before they dive in headfirst into this business, I think Netflix needs to make a critical decision. They need to decide if they want to sell their ad inventory via open real time bidding (in other words, “the open market”) or via a “closed” walled garden ecosystem. This decision will impact the degree to which third-party sell-side-platforms (e.g., Magnite (MGNI), Freewheel (CMCSA), Google (GOOGL), Tremor (TRMR), Xander (MSFT), etc.) and operating systems (e.g., Roku (ROKU), Amazon Fire TV (AMZN), Vizio (VZIO), etc.) will benefit from Netflix’s tailwinds.

No platform (not even Hulu) has enough scale today in CTV to effectively build out a walled garden. However, history shows that there’s a lot of power in cutting out middlemen (e.g., sell-side platforms) and controlling 100% of your inventory firsthand – just ask Google and Facebook (META).

My hunch is that Netflix will probably partner and sell inventory via the open market route (with some private marketplace deals) because it’s a quicker pathway to market. Details of Netflix’s partnership with Microsoft still haven’t surfaced, but the driver behind that deal is likely Xander’s sell-side platform (SSP) representation of Netflix’s ad inventory (this announcement doesn’t exactly mean it’s exclusive representation, so don’t count Magnite and Tremor out from participating as an SSP well). If Netflix wants to create a walled garden experience, they’re going to need to buy their way into this market.

Roku has already built out a major programmatic ad sales capability (through acquiring Dataxu). Netflix has a ton of historical ties to Roku and they are already sharing first-party data with them, so that makes sense. However, the core value behind Roku’s business is adoption of its operating system, and publisher relations is critical to that. Complex publisher relations in a Netflix/Roku world could dramatically devalue Roku’s core business in the long run, so I think this isn’t a match made in heaven.

I’m scratching my head at the Comcast and Google rumors. Sure, both of companies know a ton about selling ads, but Netflix’s difference maker is rich viewer engagement data and an ad tech partnership that will inherently open Netflix up to sharing its secret sauce with YouTube and NBCUniversal. I think there are less risky companies out in the ethos (like Magnite, Microsoft, Tremor, Xander, etc.) that Netflix can directly partner with (or potentially buy). I also think ancillary players like LiveRamp (RAMP), Neustar (TRU), IAS (IAS), and DoubleVerify (DV) could benefit as measurement and/or verification plays. Lastly, The Trade Desk will surely benefit if Netflix goes the “open market” route.

Monetizing ads won’t be easy money, but at the end of the day I think increased optionality is always better for the consumer. Hulu pioneered the hybrid ad-light and ad-free model over a decade ago with great success, and I can say that if it’s built right an ad-light model can inject a new revenue stream that has the potential to improve average revenue per user (ARPU) for their base plan, while expanding the TAM to include more price-conscious households. I think the upside from increasing their TAM (after recent price hikes likely scared off a sizable chunk of subs) outweighs the risk of cannibalizing from subscribers downsizing.

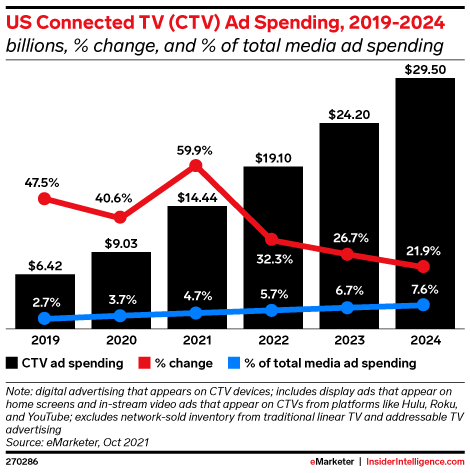

Let’s not forget that HBO Max (WBD), Peacock, Discovery+, and Disney+ (DIS) are integrating ads into their pricing and packaging this year, so it’s quickly becoming the market standard. The advertising market for CTV is also drastically different than it was two years ago. It’s a $20B+ market today and growing YoY. Advertisers are starting to see results on CTV and there’s a litany of market headwinds pushing ad dollars into CTV over the next decade.

CTV ad revenue projections (US) (eMarketer)

Recommendations (long-term value)

I believe that Netflix is a buy. The company (along with CTV as whole) is positioned to eat into two distinct advertising markets: 1) traditional TV, and 2) digital video (which combined represent a $118B+ market in the U.S. today). I anticipate this revenue stream will take two years to become fully functional, but I see tremendous long-term value in Netflix’s market positioning in the CTV and mobile ad sector.

Netflix’s market entrance could be a rising tide that lifts all ships, and I’m bullish that Microsoft (through its Xander acquisition), Magnite, Roku, LiveRamp, and The Trade Desk (TTD) are best positioned to receive ancillary benefits from Netflix’s announcement.

Netflix has a lot of work to do to get the job done right, but in the long run I think they will be a major power player in digital advertising. I have a ton of faith in their management team, which continues to defy the odds. Keep an eye on their M&A strategy and hiring in the coming months as a transformational deal isn’t out of the question.

Who is going to be their Peter Naylor (Hulu’s former ad sales chief)? This will provide valuable clues as to how they plan to position themselves in the market. The main decision you need to watch for is whether they launch via the open market or pursue the walled garden approach. The latter has more upside, but will require the right people and capabilities to properly execute.

Be the first to comment