Sundry Photography

Preamble

These days, high-growth companies that have double-digit revenue growth and positive operating cash flow but with no GAAP earnings like Zscaler (NASDAQ: ZS) and CrowdStrike (NASDAQ: CRWD) and those that have both high growth and earnings but are valued richly in price-to-earnings terms like STAAR Surgical (NASDAQ: STAA), are often shunned by investment communities.

To these risk-averse investors who want to own technology stocks with some growth but are unwilling to overpay (and rightfully they should not) for growth or invest in companies with no earnings, NetApp (NASDAQ:NTAP) sounds like a fantastic deal that checks all the boxes – cheap valuation, profitable business, pays a sizable dividend that grows at a double-digit CAGR. An industry leader in the business for three decades, NetApp is as established as it gets so no meme stock there.

However, one needs to look deeper into these data points, and look beyond them, to better understand if NTAP is a value stock or a value trap. In addition, NTAP does face real risks that investors need to be cognizant of.

This article examines the bull and bear case for NTAP.

Business Overview

A little background for those new to NetApp. If you are familiar with the story, you can skip to the section “The Business Is Backed By Strong Tailwinds”.

This is a company that has been continually undergoing transformation, from a legacy-type storage provider to a self-proclaimed “cloud-led, data-centric software company”. According to the latest 10Q (Q2 2023, page 28),

NetApp is a global cloud-led, data-centric software company that gives organizations the freedom to put data to work in the applications that elevate their business. We help our customers get the most out of their data with industry-leading public cloud services, and hybrid cloud solutions. Building on a rich history of innovation, we give customers the freedom to manage applications and data across hybrid multicloud environments. No matter where a customer’s data is or how the business uses it, NetApp helps to bring it together in a data fabric. For nearly three decades, NetApp has supported customers to accelerate their unique data fabrics and extend their workflows into a hybrid cloud environment with the right tools and right capabilities.

To better monitor the progress of the business transformation, the company presented its revenue in two parts in the most recent 10Q – the Hybrid Cloud and the Public Cloud.

The Hybrid Cloud segment offers clients software, hardware, and service components. It offers a portfolio of storage management and infrastructure solutions designed to operate with public clouds to unlock the potential of hybrid, multi-cloud operations. The portfolio includes cloud-connected all-flash, hybrid-flash, and object storage systems, powered by intelligent data management software.

The Public Cloud segment offers a portfolio of products delivered primarily as-a-service, including related support. This portfolio includes cloud storage and data services, and cloud operations services. Our enterprise-class solutions and services enable customers to control and manage storage in the cloud, consume high-performance storage services for primary workloads, and optimize cloud environments for cost and efficiency.

However, NTAP did not always report its revenue this way. It definitely did not always describe its business as “cloud-led”. In 2016 10K, NetApp’s described itself as a provider of “software, systems and services to manage and store customer data” so it can “enable enterprises, service providers, governmental organizations, and partners to envision, deploy and evolve their IT environments.”

Back in 2015, the then-new CEO George Kurian in his first conference call as CEO said,

As customers transform their IT environments, they are reducing their spend on traditional storage, which has put pressure on our ONTAP 7-Mode business. The 7-Mode storage operating system was shipped in only 35% of FAS units in the quarter, down from roughly 75% a year ago.

Customers are also slowing investment in the capacity expansion of their traditional storage environments. Both of these dynamics lowered new unit shipments off and lower incremental capacity in ONTAP 7-Mode systems put downward pressure on our product revenue, despite strong growth in other parts of our business.

We are migrating our installed based customers to Clustered ONTAP and gaining new customers in competitive environments. The number of customers using Clustered ONTAP grew by more than 130% in Q1 from Q1 a year ago. The fastest growth was in new to NetApp customers, which grew 225%.

He recognized that the company’s traditional business was losing steam and the company had to head in a different direction. The storage market did not experience growth in calendar years 2013, 2014, or 2015 due to a combination of customers delaying purchases in the face of technology transitions, increased storage efficiency and changing economic and business environments. In that same earnings call, CEO George highlighted the future potential of NTAP’s investments,

Our hybrid cloud solutions are important in positioning us ahead of the market, but do not contribute meaningfully to revenue today.

That is foresight, investing for the long term while disregarding short-term pain. His strategy was to maximize efficiencies in the declining but still profitable traditional business while growing in new areas aggressively through acquisitions. It was an unpleasant 2016 for the new CEO filled with pain, fear, uncertainty and doubt. His CFO left. Many analysts downgraded NTAP. Some believed that NTAP would struggle with its image of being technologically backward compared to new-guard storage startups like Pure Storage (NYSE: PSTG).

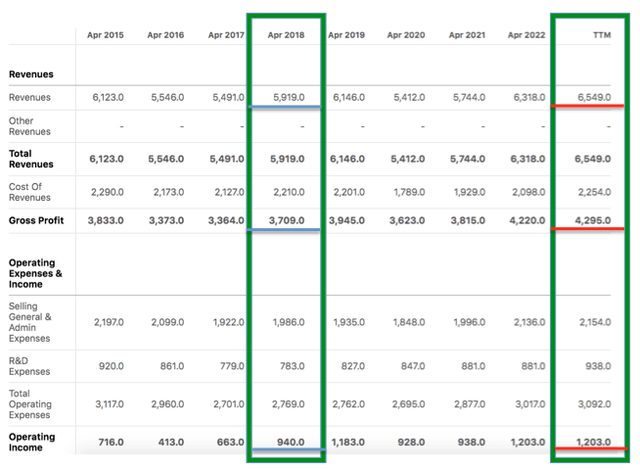

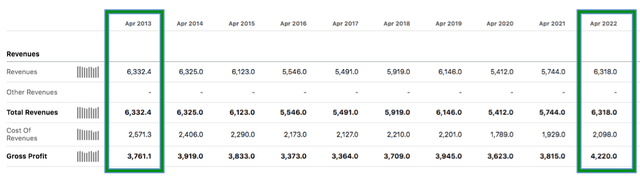

The company’s transformation picked up steam in 2018, reverting a few years of declining revenues. In fact, NTAP is bringing in more revenue now (based on TTM figures) than it has ever been in any of the past 10 years.

Seeking Alpha Financials page for NTAP

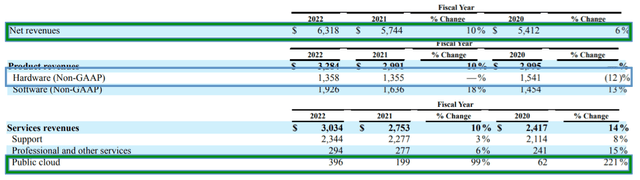

It took a while but I believe the CEO’s acquisition strategy worked. Many of these acquisitions have gone on to become new services or products that NTAP could offer. For instance, NTAP acquired Spot in 2020 and CloudCheckr in 2021, and within a year of acquiring them, they have already become part of a wide range of services (Spot Elastigroup, Spot Ocean Kubernetes Suite, SpotSecurity, Spot Eco, Spot CloudCheckr) that NetApp is offering. It is acquisitions such as these that boosted Services revenues from the Public Cloud segment by 99% year-on-year even while Product revenue was flat due to various supply chain delays.

Of course, we all knew what happened in 2020. Fast-forward to today. It is clear that since the pandemic, growth in revenue, profit, and operating income are all back on track and trending in the right direction.

It is no wonder this CEO is highly regarded, scoring an impressive 94% approval rating on Glassdoor.

The Business Is Backed By Strong Tailwinds

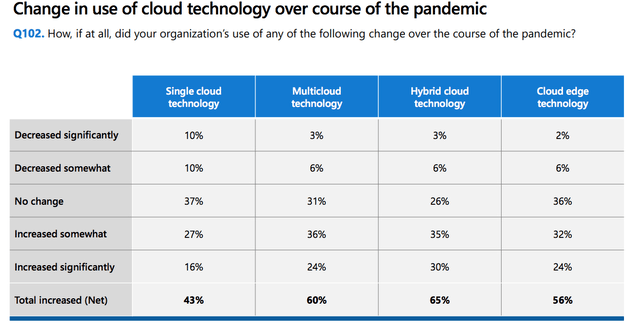

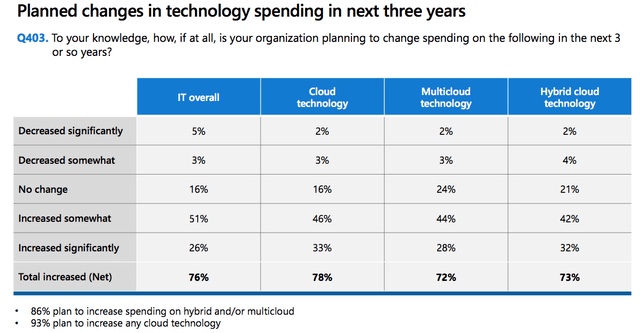

If anything, the pandemic helped NTAP by accelerating customers’ transformation to the cloud. In a recent Harris Poll survey, there is certainly no ambiguity regarding the rapid shift to cloud technology.

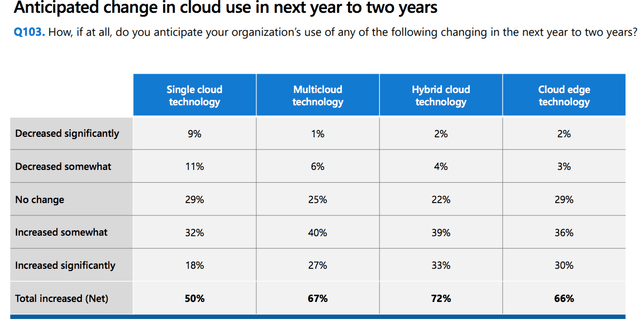

Furthermore, this digital transformation is not slowing down. When asked, about their anticipated change in cloud use in the next one to two years, the responses were overwhelmingly positive, with 72% of the respondents – the most – indicating plans to increase usage (and spending) in hybrid cloud technology. And Hybrid Cloud is NetApp’s strong suit.

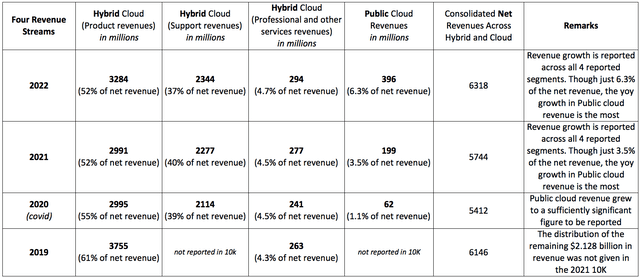

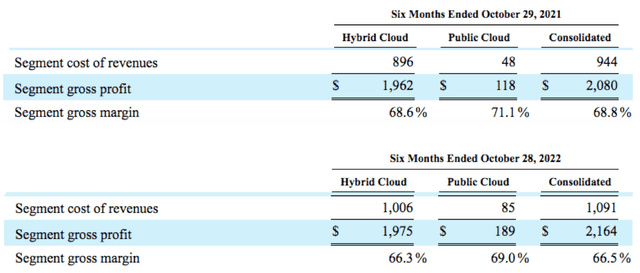

Diving deeper into NetApps’ four different revenue segments from Hybrid Cloud and Public Cloud, growth is observed in all of them.

Data extracted from NTAP’s 2021 and 2022 10Ks

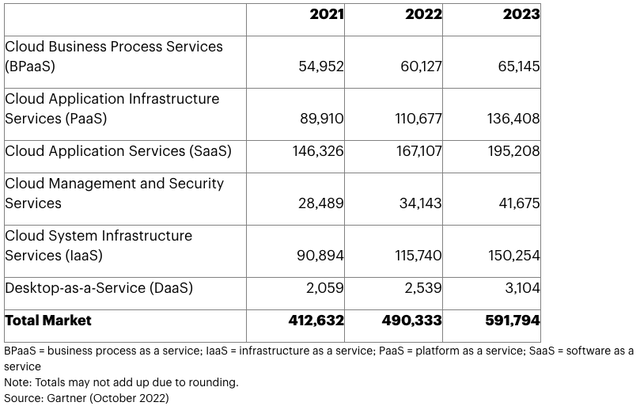

According to Gartner, worldwide end-user spending on public cloud services is forecast to grow 20.7% from $490.3 billion in 2022 to $591.8 billion in 2023.

Gartner Forecasts Worldwide Public Cloud End-User Spending Oct 2022 (figures in millions)

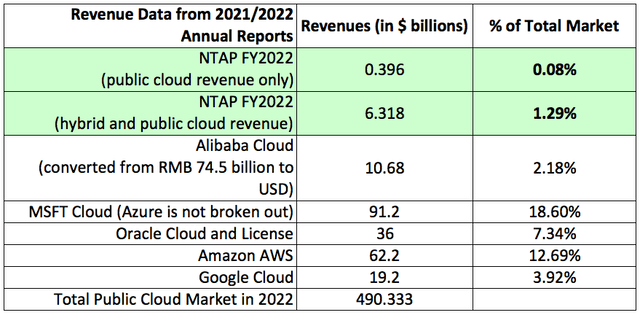

This table below is not a fair comparison as (1) only NTAP broke out its revenue according to public cloud and hybrid cloud and (2) the “total market” figure of $490 billion from Gartner represents only the Public Cloud market while companies lumped their cloud-generated earnings as a whole, I believe it still gives a rough sense of where the major industry players stand. According to my table, although the industry behemoths like Google (GOOG) (GOOGL), Amazon (AMZN), Microsoft (MSFT) and Oracle (ORCL) could have dominated 42% of the total Public Cloud market share (according to CRN it is more than 65%), this still leaves the remaining market up for grabs among the remaining players who are much smaller.

Data extracted from the latest annual report from these companies

Considering NTAP’s $396 million revenue from its Public Cloud segment is just 0.08% of the total Public Cloud End-User spending forecast for 2022, how fast that segment has been growing (grew 99% y-o-y from FY 2021 to 2022), and that this Public Cloud is still expected to grow at 20.7% in 2023, there are plenty opportunities for this hypergrowth segment of NTAP.

Other than the successful (in my opinion) and still ongoing cloud business transformation, the legacy side of the business, though declining, remains stubbornly profitable. One must realize that after companies had already invested millions to establish their own on-prem data management solutions, and with an approximately four to eight years refresh cycle (longer if businesses are on a tight budget), these companies would not be in a hurry to transit to a full cloud solution. And NTAP helps its customers transit from the existing on-prem 7-mode to Clustered ONTAP.

In addition, industries with highly complex compliance requirements, like banking, military, healthcare, and insurance, will find it more acceptable transiting to a hybrid cloud solution and while keeping mission-critical infrastructure on-prem. The complexity of compliance increases when considering compliance across multiple states and globally across different jurisdictions. Organizations in these industries will be moving to the cloud at an even slower pace, and even when they do move they would not be going full public cloud. Take for instance the banking industry. For many banks, a hybrid approach works best as it allows banks to enjoy both the security and the control of the private cloud and the flexibility and scalability of the public cloud. For example, banks can manage issues related to security and data privacy by building a hybrid cloud infrastructure where important data is stored on private cloud and computing power resides in the public cloud. Enter NTAP’s hybrid cloud solutions.

In addition, NTAP’s native cloud storage service is integrated with VMware. And as NTAP is the only certified and supported third-party cloud storage solution for VMware Cloud, that creates significant new opportunities for NTAP to help customers. As those VMware environments move to the cloud, NTAP can capture the data that resides on their competitors’ on-premises systems, helping these customers quickly, easily, and cost-effectively migrate their enterprise workloads to the cloud.

Fundamentals Show That Business Is Solid

NetApp’s pluses have been highlighted by many analysts in Seeking Alpha so I will just mention them briefly:

- It is cheap (P/E GAAP TTM 9.89)

- It has a solid balance sheet with a BBB+ credit rating

- It is profitable (received an A grade on Seeking Alpha backed by 65% gross margins and 22% net margins)

- It pays a well-supported dividend (30% payout ratio) that yields 3.09% which is greater than S&P 500’s 1.82%

- It is a dividend growth stock, growing dividends at a 5-year CAGR of 20.72%

- It is forecasted to grow sales and earnings between 5.85% to 8.26% in the next few years

So why did the share price fall by 12.2% after the latest earnings call on 29 November, from $71.79 to $62.98 as of 7 December?

Why Did The Stock Fall: Fear From Near-Term Issues

Investors were mainly worried about the softer guidance and the lower gross margins.

Firstly, FY 2023 Q3 guidance of between $1.525 billion to $1.675 billion was lower than analysts’ consensus of $1.71 billion. Revenue is expected to grow just between 2% to 4% in FY 2023.

During the conference call, the CEO acknowledged that growth has slowed as customers look to “optimize cloud spending”. This creates an interesting dynamic. NTAP is the only company to offer native first-party consumption cloud services which is more susceptible to near-term changes in usage than the subscription business. Customers like the benefits of consumption as they can turn it on and off when they want to optimize spending, so while more customers sign up for Spot to save them money, revenue growth may also suffer as Spot works on a consumption model.

I think investors should look at the longer term to determine if this is a real concern that justifies selling the shares or if is it just a bump in the road.

According to Harris Polls conducted in October 2022, 72% to 78% of the respondents said that their respective organization expects to increase spending on cloud-related technologies, so this reduction in growth is very likely to be temporary. When asked about demand returning, CFO Mike Barry was cautiously optimistic, projecting an uptick in demand in the second half of the fiscal year.

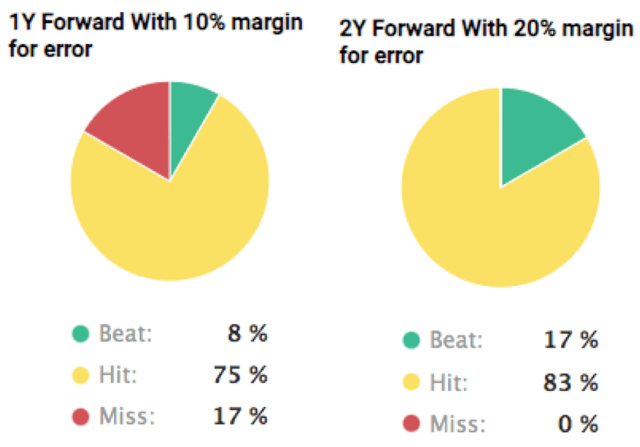

Finally, if the company is confident that it will continue to grow albeit at a lower rate of 2% to 4%, that translates into gaining market share. Considering NTAP’s excellent Analyst Scorecard, meeting 75% of analysts’ 1-year forecast and missing only 17%, I will say the odds of NTAP’s growth projections coming true are good.

Secondly, investors were concerned that gross margins fell year on year. CFO Mike Berry projects FY 2023 gross margins to fall between 66% and 67% due to elevated component costs weighing on product margins. As you can see from the table below, a 66%-67% range is below the range of 68.6%-71.1% reported in the same quarter for FY 2022.

I believe that the underlying reasons that gave rise to these concerns around the reduced margins are already in the process of being resolved. The supply chain constraints led to higher product component and freight costs that should be resolved in the second half of FY 2023. The Baltic Dry Index, which measures the cost of shipping goods worldwide, has already fallen 58% year-to-date, and is currently priced around 2018 to 2019 levels, so freight costs should be normalized.

Is NTAP Good Value?

It is fair to question if NTAP is a good investment for the long term.

One may point to NTAP’s stagnant revenue. The reported revenue of $6.318 in 2022 was even lower than the reported revenue of $6.332 in 2013. Is NTAP a value trap?

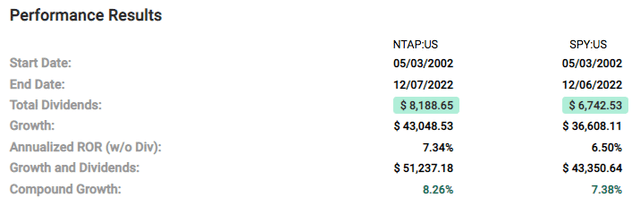

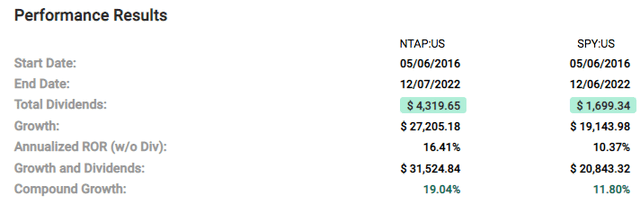

Another may point to NTAP’s dismal annualized rate of return over the last 20 years of 8.26% which barely beat the S&P 500’s 7.38%, even with dividends reinvested. The less than 1% beat is not exactly a stellar achievement.

Let’s address each of these in turn.

On the matter of stagnant revenue, it is important to remember that NTAP’s legacy was in constant decline. It was thanks to the continual and successful transformation to a cloud-led company that boosted the company’s revenue, evident from the growing revenues across all four reported cloud segments.

With regards to the comparison of NTAP’s annualized rate of return, I believe it is only fair to consider NTAP’s performance from the time CEO George Kurian took over in 2016.

In that period from 2016 to 2022, NTAP performed very well. With dividends reinvested, NTAP’s compound annual growth rate of 19.04% would have beaten S&P 500’s 11.8% by more than 7%. In that same period, NTAP also bested some of its competitors like IBM’s 2.04% (NYSE: IBM), Oracle’s 12.65%, Amazon’s 14.89%, and Google’s 13.74%.

Conclusion

A great comment on one of the many NTAP articles got me interested in the company. The author of that comment wrote,

To me, NTAP is the perfect example of why you don’t invest in what you know little about. While for financial people just based on company fundamentals NTAP looks like a great value equity in an attractive growth sector that for some bizarre and irrational reason got beaten down anyone working in IT or DevOps can see beyond the fundamentals and understand that besides dividend harvesting this company is uninvestable.

As a “financial person” – guilty as charged – I was indeed impressed by NTAP’s fundamentals. It was after understanding the company’s history, its challeng es as a legacy company, and its successes in facing those challenges, that helped me better appreciate the company for what it has become today. It is this understanding that allowed me to disregard the stagnant revenue growth and dismal compound annual growth rate as reasons to label it as a value trap. The growth in all four reported cloud segments is proof that NTAP’s transformation into a cloud-led company is not just a vision statement but a reality.

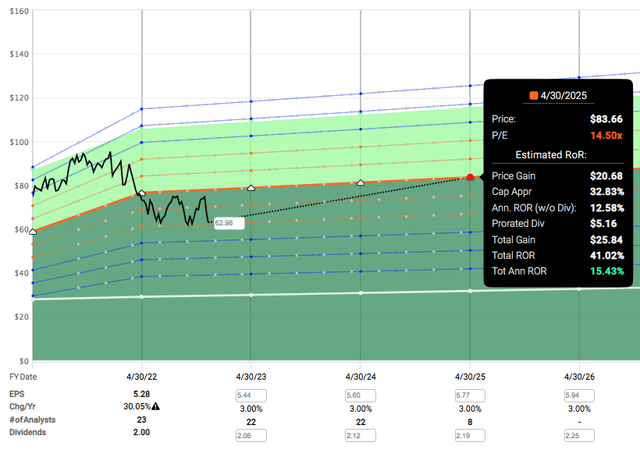

And say I assume a low adjusted earnings growth rate of just 3% for the next 3 years, and say NTAP trades up slightly to a P/E of 14.5 which is lower than its 5-year average of 15.96, NTAP can still potentially offer a 15.43% total annualized rate of return.

No matter how I see it, NTAP appears to be of great value at the current price. Investors seeking to derisk their portfolio yet keep a foot in a cloud-related technology stock should find NTAP appealing.

Past achievements are never indicative of future performance. However, these past results provide insights from which we can extrapolate the future with some caveats, and mine is this: So long as George Kurian continues to serve as the CEO, I will have confidence in his ability to steer the ship through the storms. The recent issues like softer guidance and compressed margins are nothing compared to the challenges he and his team had to go through in the initial years of NTAP’s digital transformation into a cloud-led company.

Be the first to comment